Garnishment Hardship Form Oklahoma Without Notice

Description

How to fill out Oklahoma Claim For Exemption And Request For Hearing?

Identifying a preferred location to obtain the latest and pertinent legal templates constitutes a significant part of navigating bureaucracy.

Selecting the appropriate legal documents necessitates accuracy and careful consideration, which is why it's crucial to acquire samples of the Garnishment Hardship Form Oklahoma Without Notice solely from trustworthy sources, such as US Legal Forms. An incorrect template can squander your time and prolong the matter at hand. With US Legal Forms, your concerns diminish greatly. You can access and review all the information related to the document’s application and relevance to your situation and in your jurisdiction.

Eliminate the complications associated with your legal documentation. Explore the vast US Legal Forms directory where you can locate legal samples, assess their applicability to your situation, and download them instantly.

- Utilize the library navigation or search function to find your template.

- Examine the form’s description to determine if it meets the criteria of your state and county.

- Preview the form, if available, to confirm that the template aligns with your interests.

- Return to the search to find the appropriate template if the Garnishment Hardship Form Oklahoma Without Notice does not meet your needs.

- If you are confident about the form’s pertinence, proceed to download it.

- For registered users, click Log in to verify your identity and access your selected templates in My documents.

- If you do not have an account yet, click Buy now to acquire the form.

- Choose a pricing option that suits your needs.

- Proceed to registration to complete your purchase.

- Finalize your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading the Garnishment Hardship Form Oklahoma Without Notice.

- Once downloaded, you may edit the form or print it for manual completion.

Form popularity

FAQ

Wage garnishments can be stopped through two options: 1) Pay the debt in full with interest and attorney fees. 2) File bankruptcy. You may file for Chapter 7 or Chapter 13 bankruptcy.

Dear Sir/Madam, I am writing to request that you stop the wage garnishment that is currently being imposed on me. I am unable to make the payments at this time due to [insert reason, such as financial hardship]. I have attached documentation that supports my claim.

Some creditors, though, like those you owe taxes, federal student loans, child support, or alimony, don't have to file a suit to get a wage garnishment. These creditors have a statutory right to take money directly out of your paycheck.

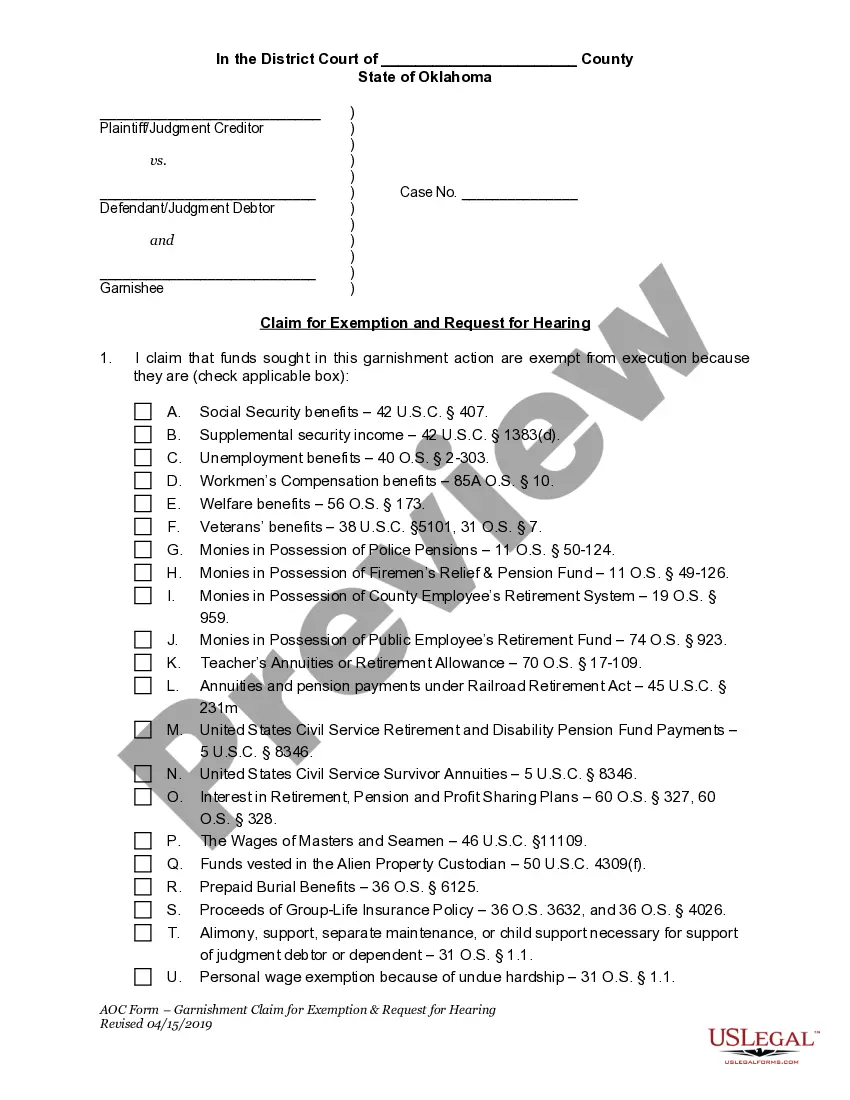

Time is VERY IMPORTANT when you ask for a hardship exemption. YOU MUST ASK FOR THE EXEMPTION WITHIN 5 (FIVE) DAYS FROM THE DATE THAT YOU RECEIVE YOUR GARNISHMENT NOTICE!! This is done by filing the Claim for Exemption and Request for Hearing form with the Court Clerk.

A creditor MUST have a judgment against you before it can get a garnishment. There are two basic limits on the amount creditors can take from your wages. First, they cannot take more than 25% of your take-home pay. Second, a creditor must leave you with at least $217.50 a week or $870 a month in net (take-home) pay.