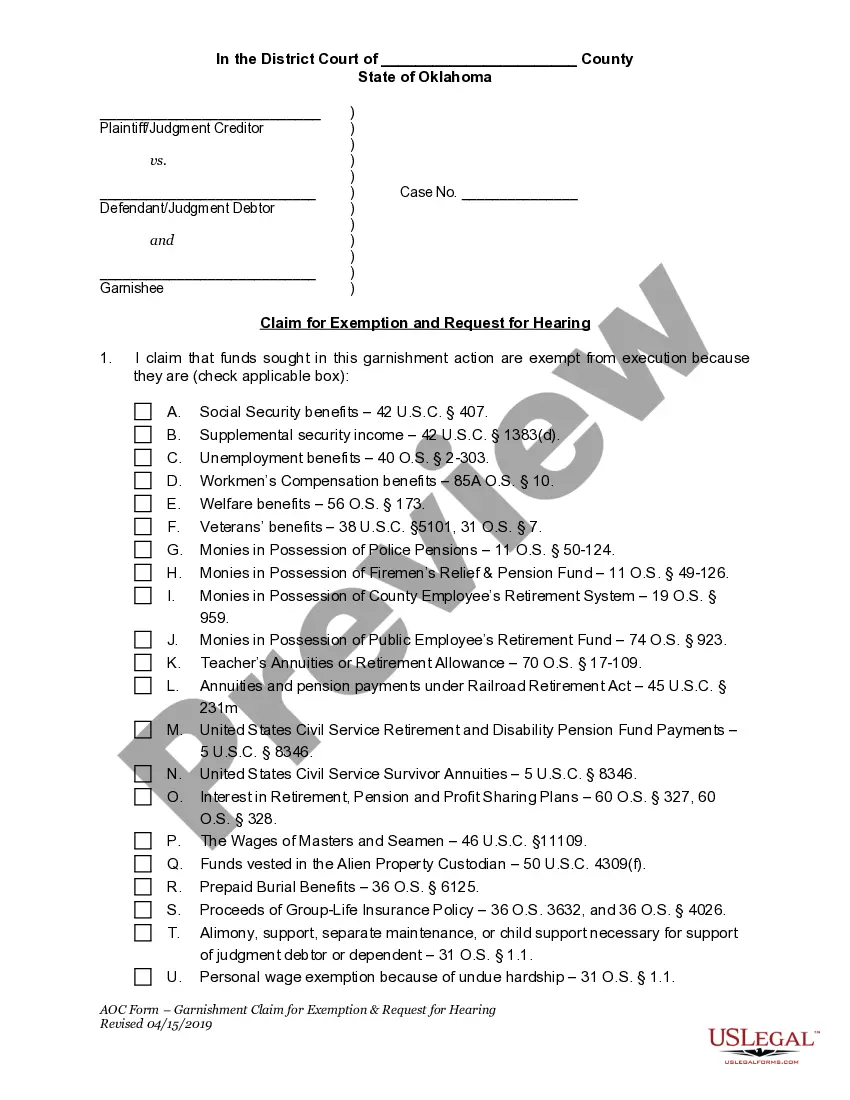

Garnishment Hardship Form Oklahoma For Wage

Description

How to fill out Oklahoma Claim For Exemption And Request For Hearing?

The Garnishment Hardship Document Oklahoma For Wage presented on this page is a reusable official template created by skilled attorneys in accordance with federal and local laws and regulations.

For over 25 years, US Legal Forms has offered individuals, companies, and lawyers more than 85,000 confirmed, state-specific documents for any business and personal situation. It’s the quickest, easiest, and most trustworthy method to secure the paperwork you require, as the service ensures bank-level data security and anti-malware safeguards.

Register for US Legal Forms to have verified legal templates for every life situation readily available.

- Explore the document you require and assess it.

- Examine the sample you looked for and preview it or review the document description to confirm it meets your needs. If it does not, utilize the search function to find the correct one. Click Buy Now once you have found the template you require.

- Register and sign in.

- Choose the payment plan that works for you and set up an account. Use PayPal or a credit card for a swift transaction. If you already possess an account, Log In and verify your subscription to proceed.

- Acquire the fillable document.

- Pick the format you desire for your Garnishment Hardship Document Oklahoma For Wage (PDF, Word, RTF) and download the sample to your device.

- Complete and sign the documents.

- Print the template to fill it out by hand. Alternatively, use an online multi-functional PDF editor to quickly and precisely complete and sign your form with a valid signature.

- Redownload your documents as needed.

- Utilize the same document repeatedly whenever required. Access the My documents tab in your profile to redownload any previously purchased forms.

Form popularity

FAQ

If your wages are garnished, there's a limit to how much of your wages a creditor can take. Usually, that limit is 30% of your net income. However, if the creditor is claiming spousal or child support payments, they can take up to 50%. A garnishing order applies only to wages payable within the next seven days.

Wage garnishments can be stopped through two options: 1) Pay the debt in full with interest and attorney fees. 2) File bankruptcy. You may file for Chapter 7 or Chapter 13 bankruptcy.

Time is VERY IMPORTANT when you ask for a hardship exemption. YOU MUST ASK FOR THE EXEMPTION WITHIN 5 (FIVE) DAYS FROM THE DATE THAT YOU RECEIVE YOUR GARNISHMENT NOTICE!! This is done by filing the Claim for Exemption and Request for Hearing form with the Court Clerk.

Dear Sir/Madam, I am writing to request that you stop the wage garnishment that is currently being imposed on me. I am unable to make the payments at this time due to [insert reason, such as financial hardship]. I have attached documentation that supports my claim.

Employers are typically notified of a wage garnishment via court order or IRS levy. They must comply with the garnishment request and start withholding and remitting payment as soon as the order is received. IRS wage garnishment and levy paperwork will walk you through the steps of completing the wage garnishment.