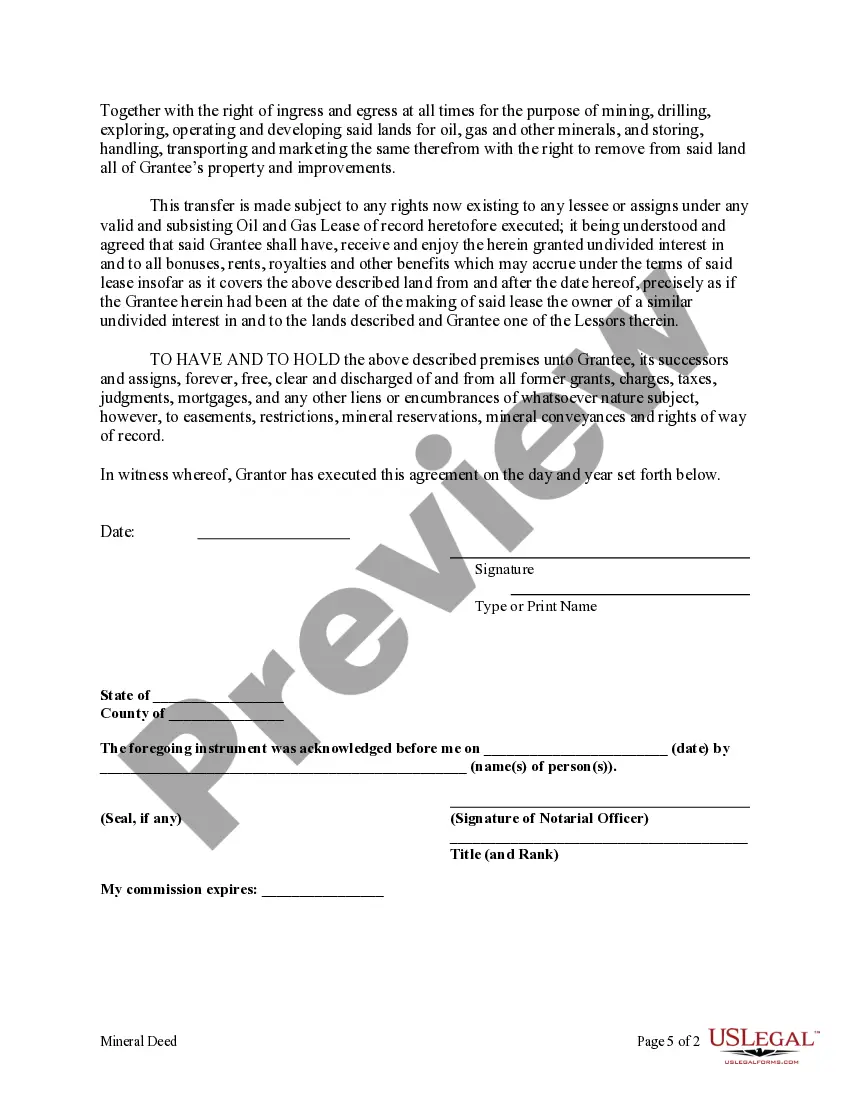

This form is a Warranty Mineral Deed where the Grantor is an Individual and and the Grantee is a Trust. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Ok Mineral Real Forum

Description

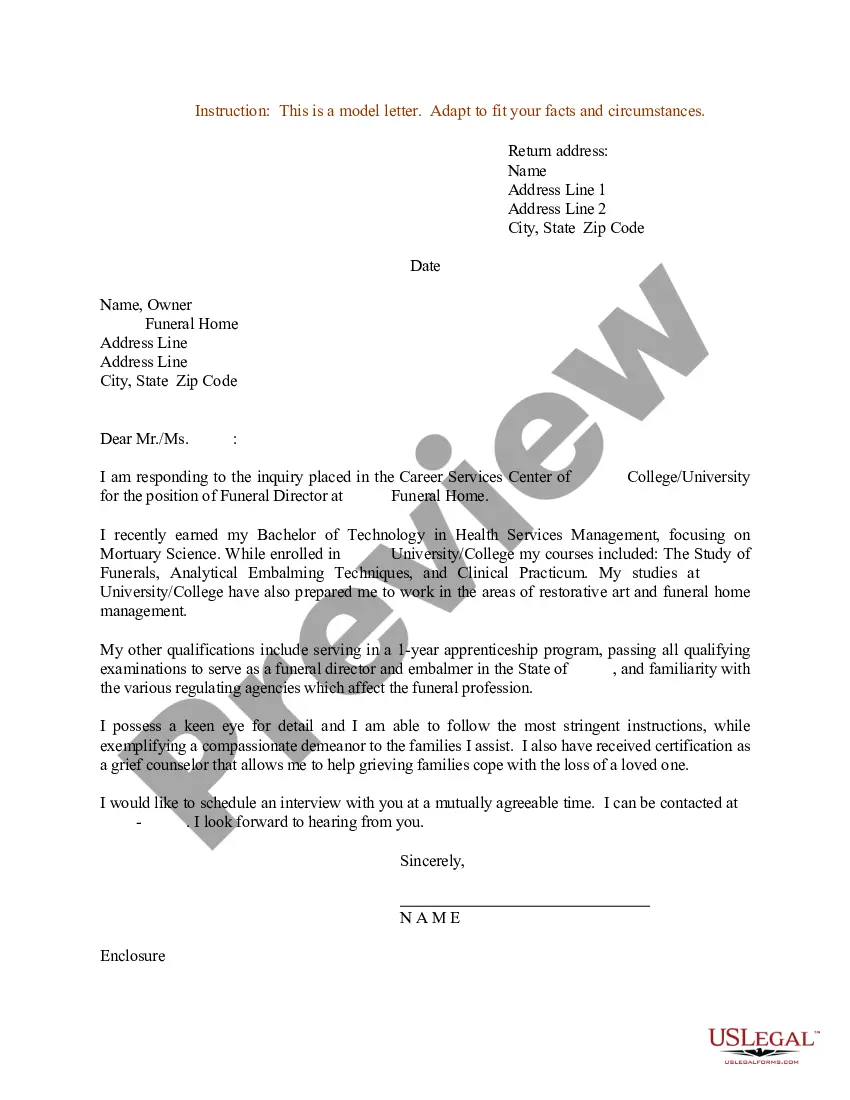

How to fill out Oklahoma Warranty Mineral Deed From An Individual To A Trust?

Legal management can be mind-boggling, even for the most experienced experts. When you are looking for a Ok Mineral Real Forum and do not have the time to commit searching for the appropriate and updated version, the processes may be stress filled. A robust online form catalogue might be a gamechanger for everyone who wants to deal with these situations efficiently. US Legal Forms is a industry leader in web legal forms, with over 85,000 state-specific legal forms available anytime.

With US Legal Forms, you can:

- Access state- or county-specific legal and business forms. US Legal Forms covers any needs you might have, from individual to enterprise documents, in one spot.

- Make use of advanced resources to finish and handle your Ok Mineral Real Forum

- Access a resource base of articles, tutorials and handbooks and materials relevant to your situation and requirements

Save effort and time searching for the documents you will need, and make use of US Legal Forms’ advanced search and Preview tool to find Ok Mineral Real Forum and acquire it. In case you have a subscription, log in to the US Legal Forms profile, search for the form, and acquire it. Take a look at My Forms tab to view the documents you previously saved and to handle your folders as you see fit.

Should it be your first time with US Legal Forms, register a free account and obtain unlimited access to all benefits of the library. Listed below are the steps to take after downloading the form you need:

- Validate it is the right form by previewing it and reading its information.

- Be sure that the sample is acknowledged in your state or county.

- Choose Buy Now when you are ready.

- Select a monthly subscription plan.

- Pick the formatting you need, and Download, complete, sign, print and deliver your papers.

Enjoy the US Legal Forms online catalogue, supported with 25 years of experience and reliability. Enhance your daily papers managing in a smooth and intuitive process today.

Form popularity

FAQ

Effect of Property Taxes on Mineral Rights Oklahoma has no inheritance tax. Capital gains tax must be paid on any sale of mineral rights and income generated from royalty streams. However, if the mineral rights have not been severed from the property, the county may not charge taxes beyond property taxes.

Whether you have an offer on the table or not, you may have good reasons to sell your mineral rights: To pursue other opportunities. If you have a nonproducing property, you might have to wait years for anything to happen ? and nothing may ever happen, even after multiple leases.

People sell their mineral rights for a variety of reasons. Some need immediate cash, while others are seeking to improve the quality of their lives. Most want to sell while their minerals still have value and to avoid burdening their heirs with the learning curve and management duties.

On average, a single acre's mineral rights can range from as low as $200 to over $10,000+ on the high end. As you might expect, the prices will vary depending on the mineral in question, the number of wells currently drilled, the current production rate, the existence of pipeline infrastructure, and much more.

Determining Mineral Ownership: The Corporation Commission does not determine the ownership of minerals. This should be a matter of record in the courthouse of the county where the land is located. Tax Commission records may also help. You may need an attorney to research this for you.