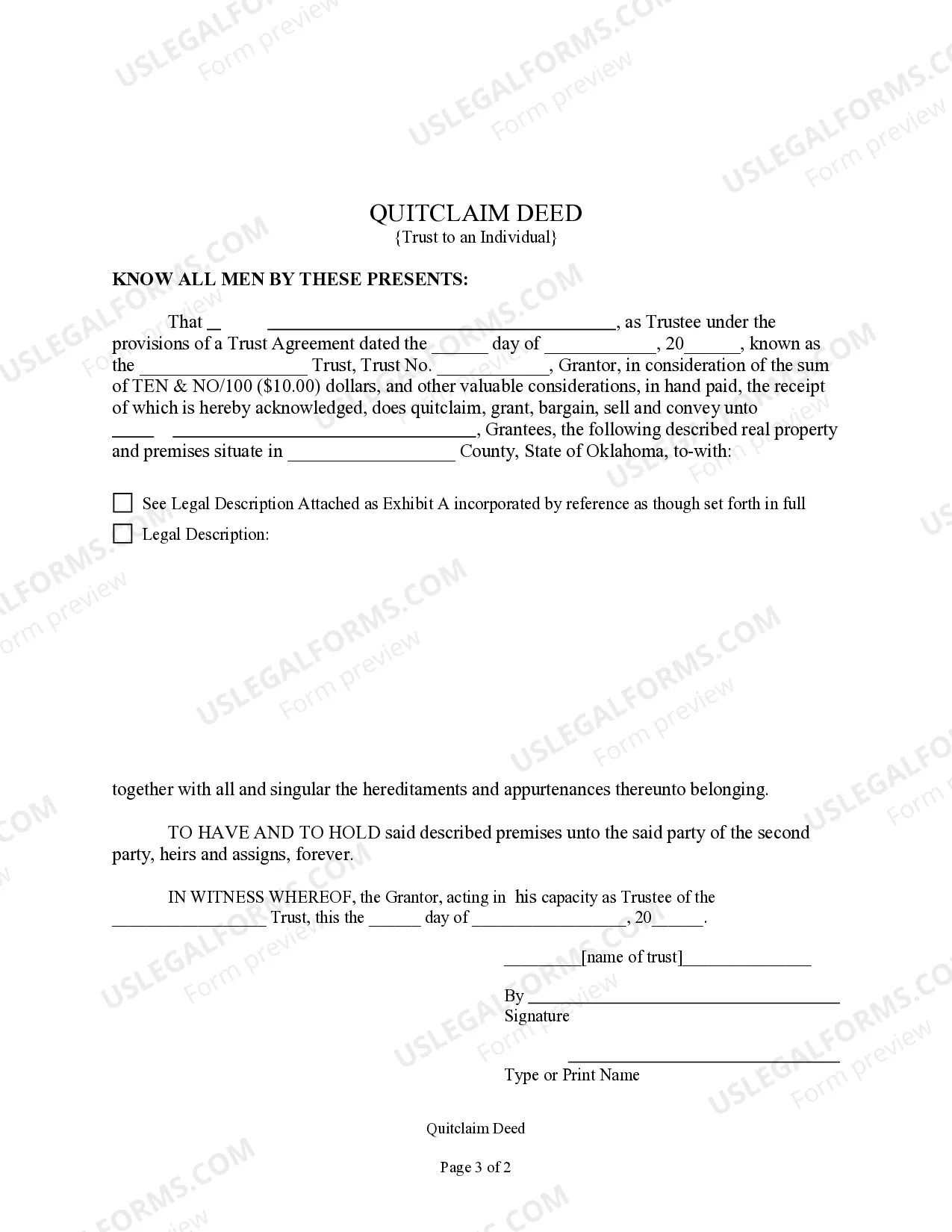

Quitclaim Deed For Property

Description

How to fill out Oklahoma Quitclaim Deed - Trust To An Individual?

- If you're a returning user, access your account on US Legal Forms and download the quitclaim deed template you need by clicking the Download button. Ensure your subscription is current; if it's expired, renew it as per your plan.

- For first-time users, start by checking the Preview mode and form description to confirm you've selected the correct quitclaim deed option that aligns with your jurisdiction's requirements.

- If you need further options, use the Search function to discover additional templates. Ensure the alternative fits your needs before proceeding to the next step.

- Purchase the descent document by clicking 'Buy Now' and selecting your desired subscription plan. You'll need to create an account for access to our extensive library.

- Complete your payment, entering your credit card information or opting to pay via PayPal for your subscription.

- Download your quitclaim deed form and save it on your device. You can access it anytime from the 'My Forms' section of your profile for future reference.

With US Legal Forms, you leverage a vast library of over 85,000 customizable legal forms, offering you more options than typical competitors. Our user-friendly platform ensures a smooth experience, whether you're a newcomer or returning to complete your legal documents.

In conclusion, obtaining a quitclaim deed for property is straightforward with US Legal Forms. Empower yourself with our extensive resources and expert assistance to ensure your legal documents are precise and valid. Start your journey today!

Form popularity

FAQ

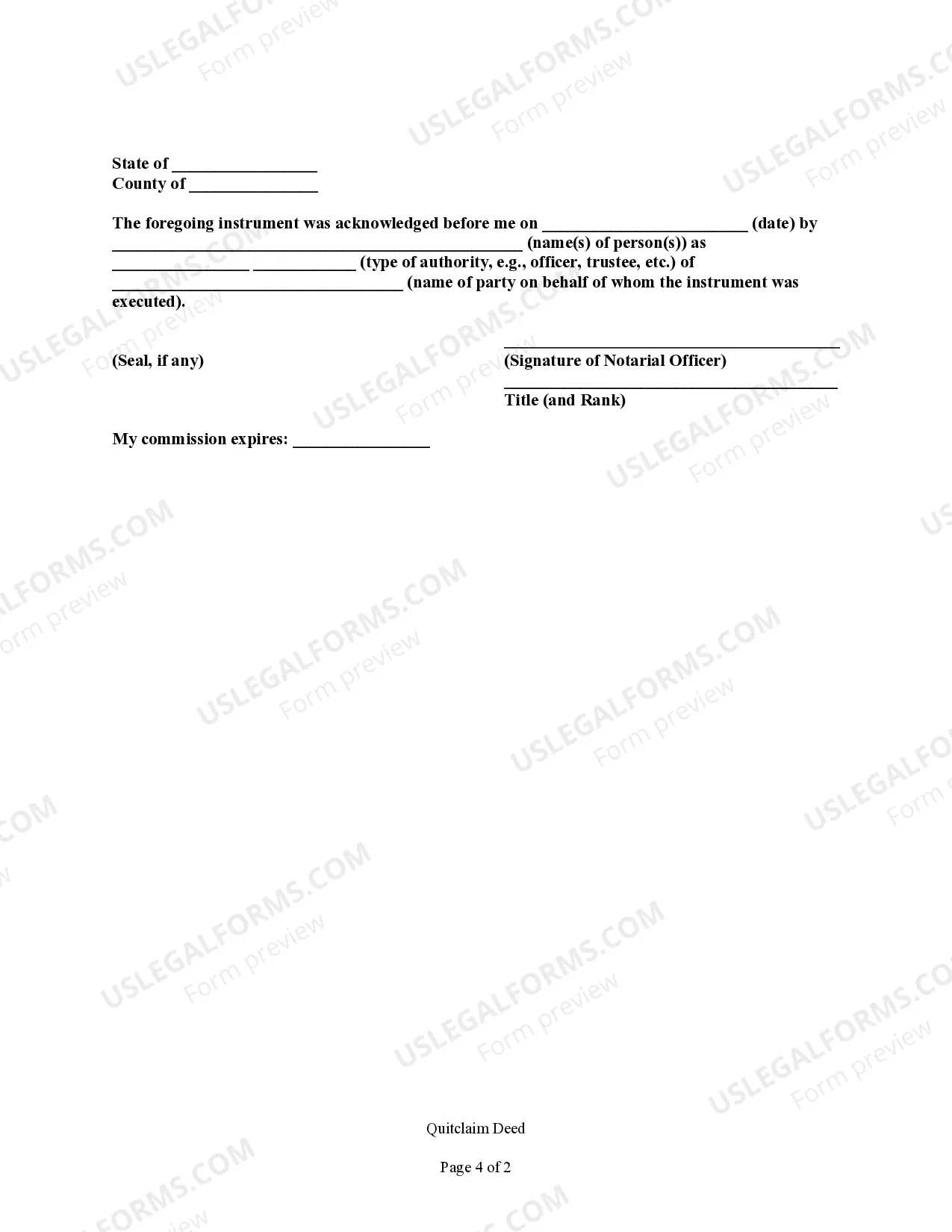

You can certainly handle your own quitclaim deed for property. The process requires that you correctly fill out the deed form, provide a precise legal description of the property, and ensure that both parties sign the document. However, since mistakes can lead to complications, using a service like US Legal Forms can simplify this task, guiding you through the requirements to make sure your quitclaim deed is legally sound.

Yes, you can prepare your own quitclaim deed for property in Michigan. The state does allow individuals to draft these documents, but you must ensure that the document meets all legal requirements. It's essential to include accurate property descriptions, signatures, and proper notarization. For added peace of mind, consider using US Legal Forms, which provides templates and guidance to help you create a valid quitclaim deed.

Yes, title companies often prepare quitclaim deeds for property transactions, especially during real estate closings. They ensure that the deed complies with legal standards and conduct necessary title searches to verify ownership. If you want peace of mind while preparing your quitclaim deed, consider working with a title company or using services like USLegalForms.

A quitclaim deed for property in California can be prepared by the property owner, real estate attorney, or anyone knowledgeable about the process. While you can do it independently, consulting a legal expert can help address specific concerns and ensure compliance with local laws. Also, consider using USLegalForms to access professional templates tailored for California.

Yes, you can prepare a quitclaim deed for property yourself, but it is important to understand the legal implications involved. Properly drafting the document ensures that you transfer your interest in the property clearly and legally. For those who prefer a simplified process, USLegalForms offers templates and guidance for creating a quitclaim deed with ease.

In California, a quitclaim deed for property can be prepared by the property owner, an attorney, or a qualified paralegal. While you may choose to prepare it yourself, seeking professional help ensures accuracy. Using platforms like USLegalForms can simplify the process and guide you through the necessary requirements for your quitclaim deed.

While it's beneficial in some cases, a quitclaim deed for property comes with notable disadvantages. One primary issue is the lack of warranties, meaning the recipient could inherit potential debts or claims tied to the property. Additionally, if the original owner has a cloudy title, the new owner may face legal challenges later. It's wise to consider these risks and consult with a legal expert if unsure about using a quitclaim deed.

The main purpose of a quitclaim deed for property is to transfer ownership rights without guaranteeing that the title is clear. It serves as a document that relinquishes any claim the grantor has to the property, making it a quick way to convey property interests. This method is particularly useful in certain situations such as transfers between family members or divorce settlements. However, it's essential to understand that a quitclaim deed does not protect against potential claims or liens on the property.

The primary disadvantage for a buyer receiving a quitclaim deed for property involves the lack of guarantees regarding the title. This means the buyer could face financial losses if there are hidden liens or titles issues. It's vital for buyers to conduct due diligence and possibly seek legal counsel before accepting such a deed to protect their interests.

A quitclaim deed for property may be considered unfavorable because it does not guarantee a clean title. This means that if there are hidden issues, such as debts or disputes regarding property rights, the new owner inherits these liabilities without recourse. Consequently, this uncertainty can lead to significant legal complications down the line.