This form is a Quitclaim Deed where the grantor is a trust and the grantee is an individual. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

Quitclaim Deed For Inherited Property

Description

How to fill out Oklahoma Quitclaim Deed - Trust To An Individual?

- If you are an existing user, log in to your account and choose the quitclaim deed template suitable for inherited property from your dashboard.

- Verify that your subscription is active. If it's expired, renew it based on your payment preferences.

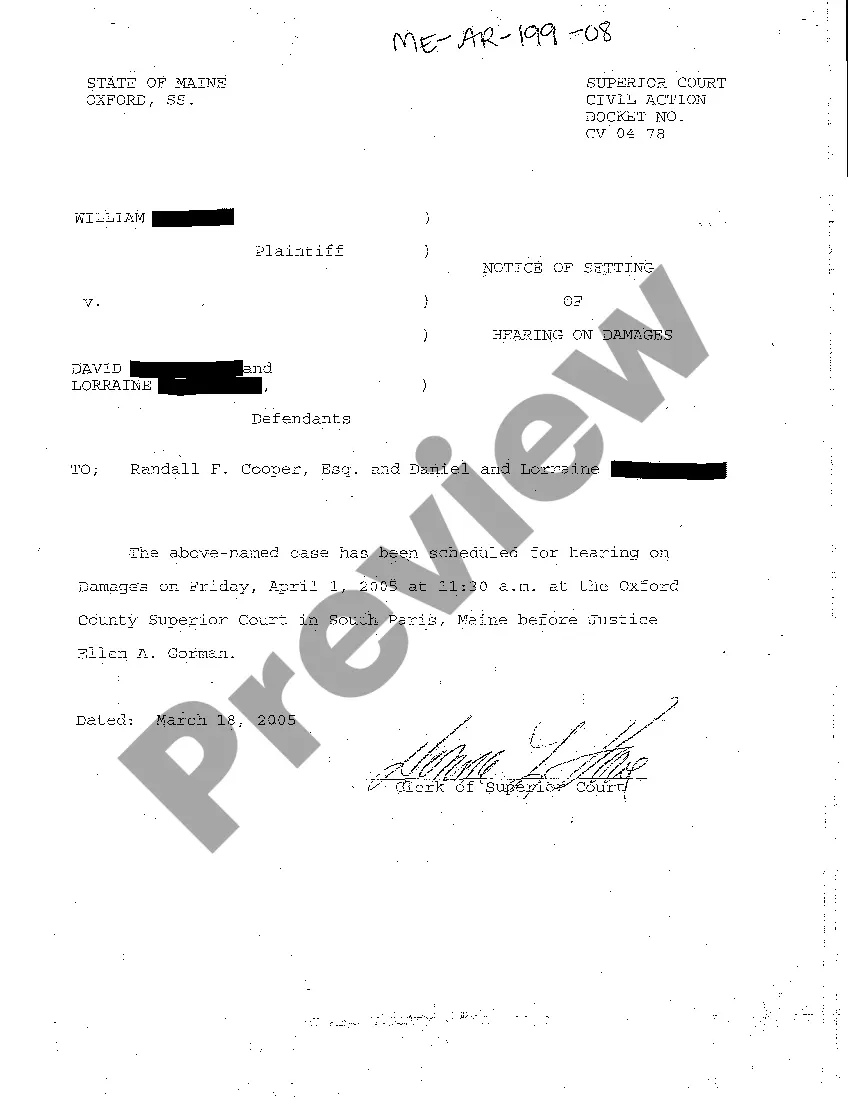

- In case you are a new user, begin by checking the preview and description of the quitclaim deed. Ensure it meets your state's legal requirements.

- If you need a different form, utilize the Search tab to find alternative templates that are more appropriate.

- Once you’ve found the correct template, click on the Buy Now button and select a subscription plan that fits your needs.

- Proceed with payment by entering your credit card details or linking your PayPal account.

- After the transaction, download the quitclaim deed form to your device. It will also be available anytime in the My Forms section.

US Legal Forms empowers users to create and process legal documents swiftly with an extensive selection that surpasses competitors, ensuring affordability and accessibility.

With over 85,000 fillable forms and expert help for precise completion, you can achieve legally sound results quickly. Start using US Legal Forms today to simplify your legal documentation!

Form popularity

FAQ

Individuals who benefit most from a quitclaim deed for inherited property are typically those looking for a quick and straightforward way to transfer title without extensive legal procedures. This can simplify the process for siblings or heirs who intend to consolidate ownership or sell the property jointly. Additionally, those who trust each other, such as family members, may find this method convenient. However, exercising caution is crucial to avoid future disputes or complications.

One major negative of a quitclaim deed for inherited property is that it does not provide any guarantee about the title's validity. This means if any liens exist, the new owner assumes those responsibilities without recourse. Additionally, since this deed transfers ownership without warranties, disputes can arise between family members over the property's value or use. Therefore, it's important to consider these risks before opting for a quitclaim deed for inherited property.

A quitclaim deed for inherited property is valid if executed before the owner's death. After the owner's death, the property will generally need to pass through probate to establish rightful ownership. Therefore, it's essential to initiate appropriate legal proceedings to validate the deed and ensure the property's title is clear.

Using a quitclaim deed for inherited property typically does not bypass probate. The property may still need to go through the probate process, depending on the state laws and the estate's circumstances. However, a quitclaim deed can simplify the transfer of ownership after probate concludes.

A quitclaim deed does not go through the probate process itself; instead, it serves as a method to transfer ownership directly. However, if the property was part of an estate requiring probate, you should first address the estate's legal matters. If you choose to use a quitclaim deed for inherited property, ensure you have a clear understanding of the probate process and consult with a legal expert or explore resources from UsLegalForms for guidance.

The primary disadvantage of a quitclaim deed for inherited property is the lack of legal protection it offers. Since there are no warranties, recipients may face unforeseen claims or issues with the property title that can lead to financial loss. Furthermore, this type of deed may not be suitable for complicated ownership situations, as it does not clarify ownership rights or liabilities.

Quitclaim deeds are often viewed with caution because they provide no warranty or guarantee of clear title. This means that if a problem arises with the property title after transfer, the new owner has no recourse against the previous owner. When dealing with inherited property, using a quitclaim deed for inherited property can be risky if you are unaware of the property's legal status.

The usual reason for using a quitclaim deed for inherited property is to facilitate a quick transfer of ownership without the need for extensive legal processes. This type of deed is often used among family members, making it ideal for estate planning and settling an inheritance. Additionally, it allows heirs to efficiently manage their property rights. When using platforms like USLegalForms, you can create an effective quitclaim deed that addresses your needs.

A quitclaim deed for inherited property can be seen as unfavorable because it offers no protection to the new owner regarding title issues. The grantor does not assure that they hold any rightful ownership, which might expose the buyer to potential disputes. Without a title search or title insurance, the new owner may face unexpected costs and legal challenges in the future. Understanding these risks is vital before proceeding with such a deed.

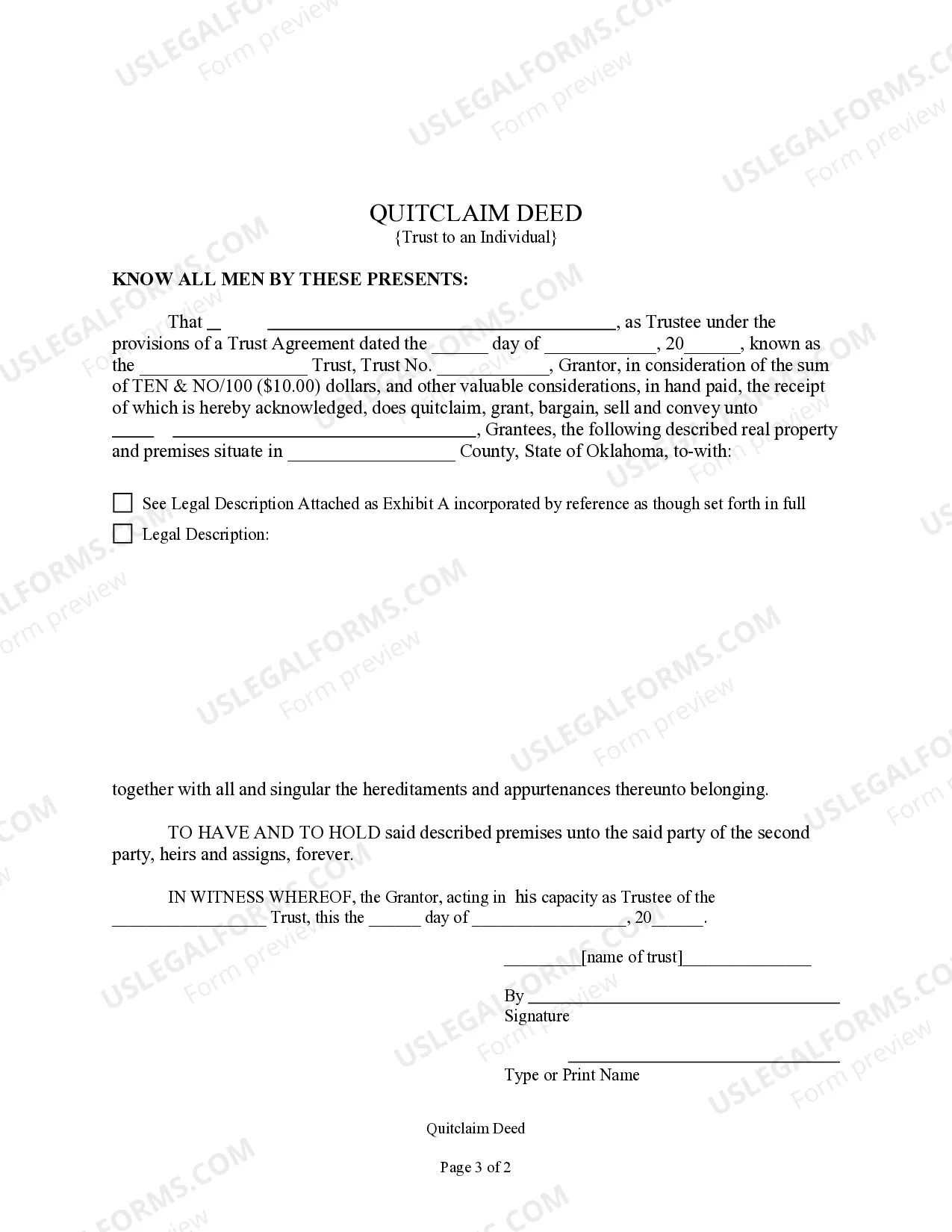

To change the deed on your inherited property, you will typically need to complete a quitclaim deed form. This form allows you to transfer the property title from the deceased owner to yourself or to other beneficiaries. After filling out the form, you must have it notarized and then file it with your local county recorder's office. Using a reliable platform like USLegalForms can guide you through this process smoothly.