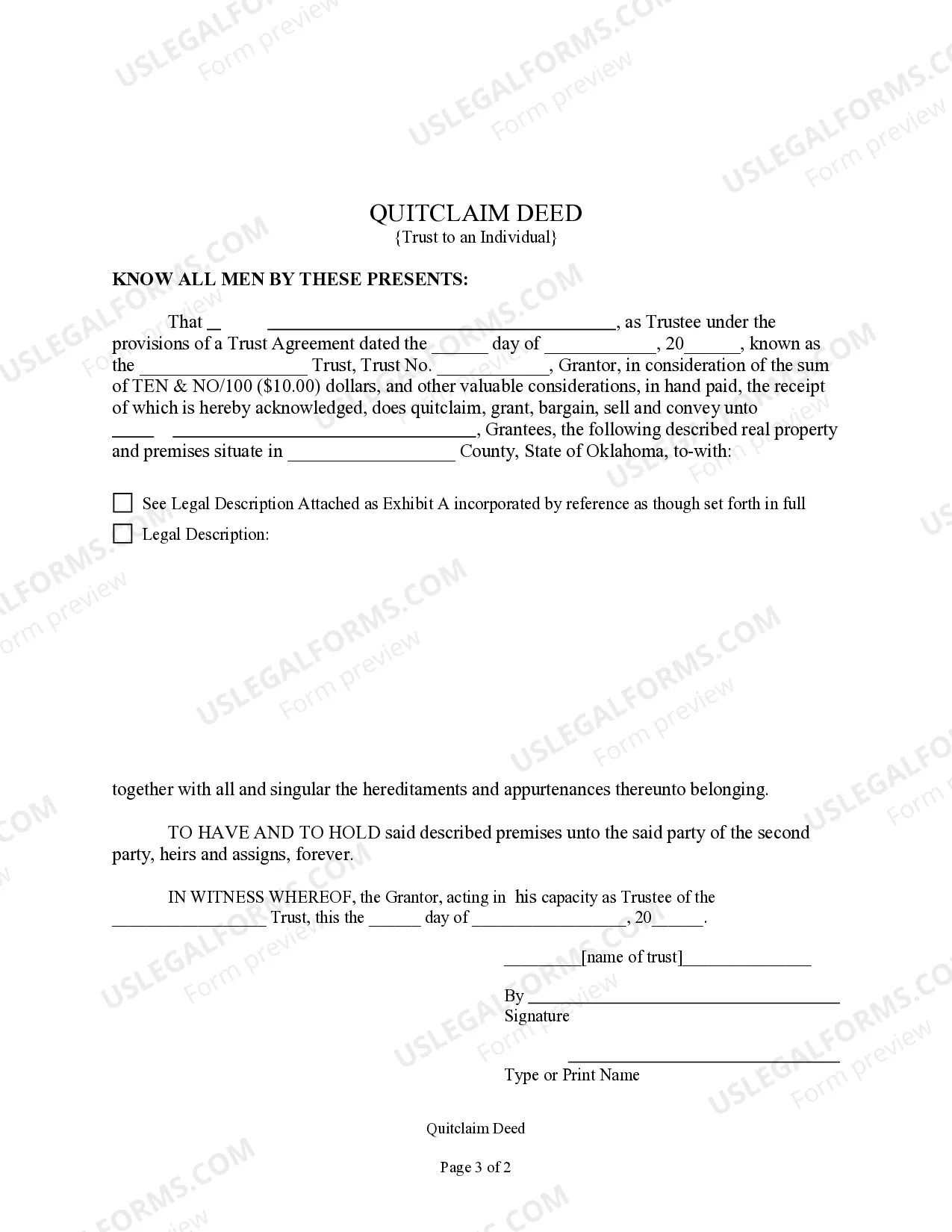

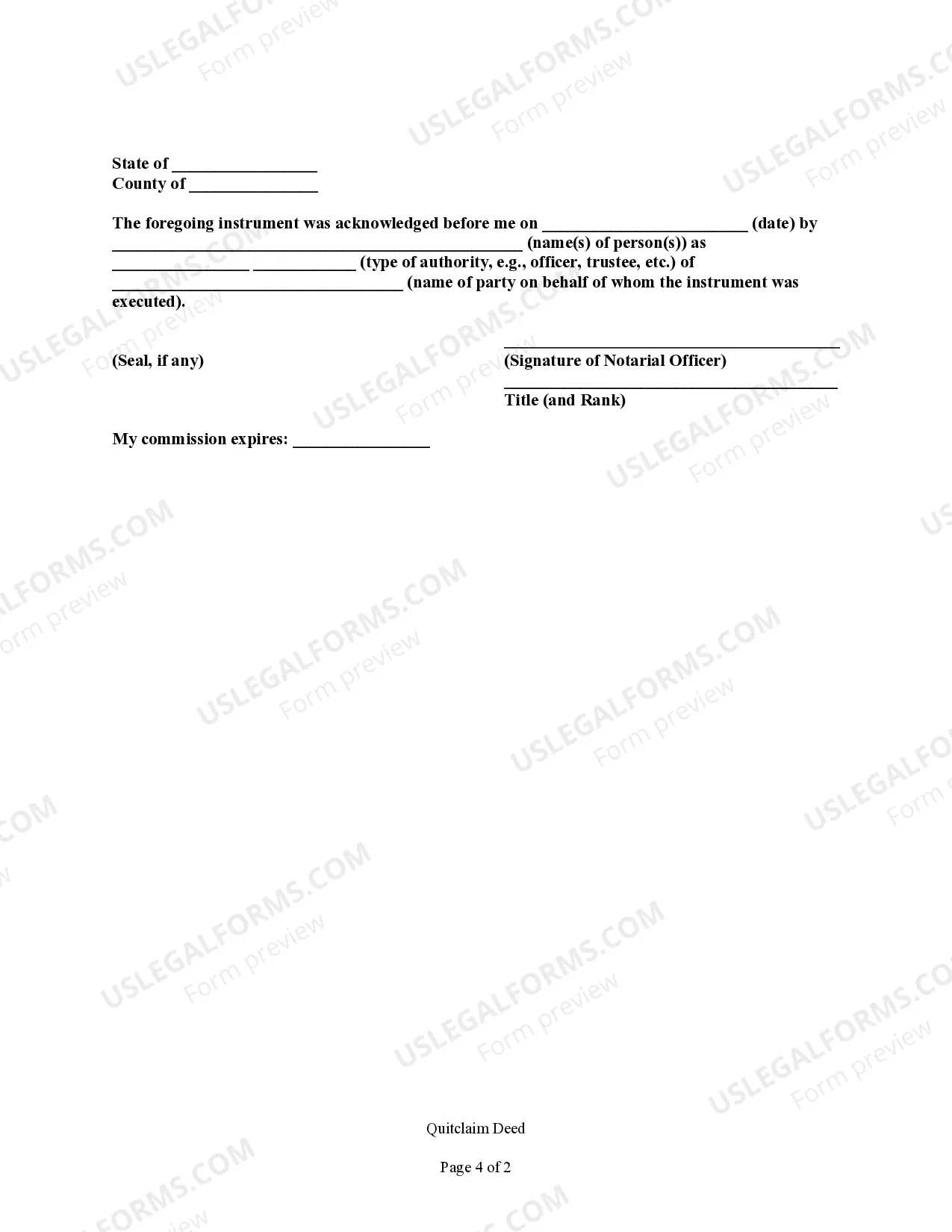

This form is a Quitclaim Deed where the grantor is a trust and the grantee is an individual. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

Deed Of Trust For Property Ownership

Description

How to fill out Deed Of Trust For Property Ownership?

Well-prepared official documents are a key assurance for preventing complications and lawsuits, although acquiring them without legal assistance may require time.

Whether you need to swiftly locate a current Deed Of Trust For Property Ownership or any other templates for employment, family, or business scenarios, US Legal Forms is always available to assist.

The procedure is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button adjacent to the selected file. Furthermore, you can retrieve the Deed Of Trust For Property Ownership at any time later, as all documents ever acquired on the platform are accessible within the My documents section of your profile. Save time and resources on preparing official documents. Experience US Legal Forms today!

- Ensure that the form aligns with your circumstances and locality by reviewing the description and preview.

- Search for an alternative sample (if necessary) using the Search bar located in the page header.

- Click on Buy Now once you identify the relevant template.

- Choose the pricing plan, Log Into your account, or create a new one.

- Select the payment option you prefer to purchase the subscription plan (using a credit card or PayPal).

- Choose PDF or DOCX format for your Deed Of Trust For Property Ownership.

- Click Download, then print the document to complete it or incorporate it into an online editor.

Form popularity

FAQ

To obtain a deed of trust for property ownership, start by contacting your lender or financial institution to discuss their requirements. They will guide you through the application process, including documentation needed for approval. You may also choose to work with legal services or platforms like UsLegalForms, which provide templates and resources for drafting trust deeds. Following the correct steps is essential for a smooth transaction and peace of mind.

After paying off your mortgage in Australia, you should receive a discharge of mortgage document from your lender. This document confirms that you have fulfilled your financial obligation. To obtain your title, you must apply to your local land registry office, submitting the discharge alongside any required forms. Once processed, you will receive your title, confirming your deed of trust for property ownership.

The negative side of a deed of trust for property ownership includes potential lack of control over the property if the borrower defaults. In cases of non-payment, the trustee has the authority to sell the property to recover debt. This situation can be distressing for homeowners, making it essential to assess your financial commitments thoroughly before entering a trust deed arrangement.

A trust deed is a legal document that outlines the terms under which a property is held in trust. It serves to protect both the lender and the borrower in real estate transactions by defining the rights and obligations of each party. Essentially, a deed of trust for property ownership is a mechanism that facilitates secure lending while ensuring that the property interest is legally documented. This clarity helps prevent misunderstandings and legal disputes.