Child Support With 5050 Custody

Description

How to fill out Oklahoma Separation, Spousal Support, Child Custody And Support, And Property Settlement?

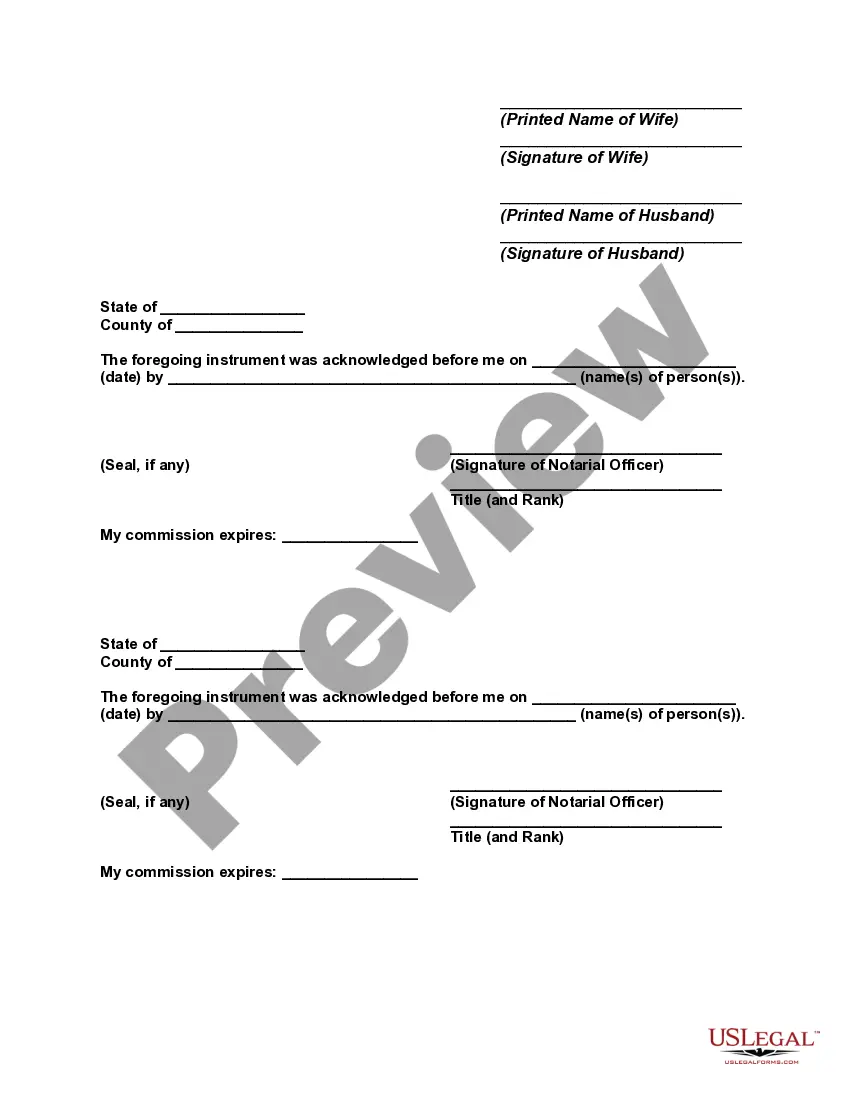

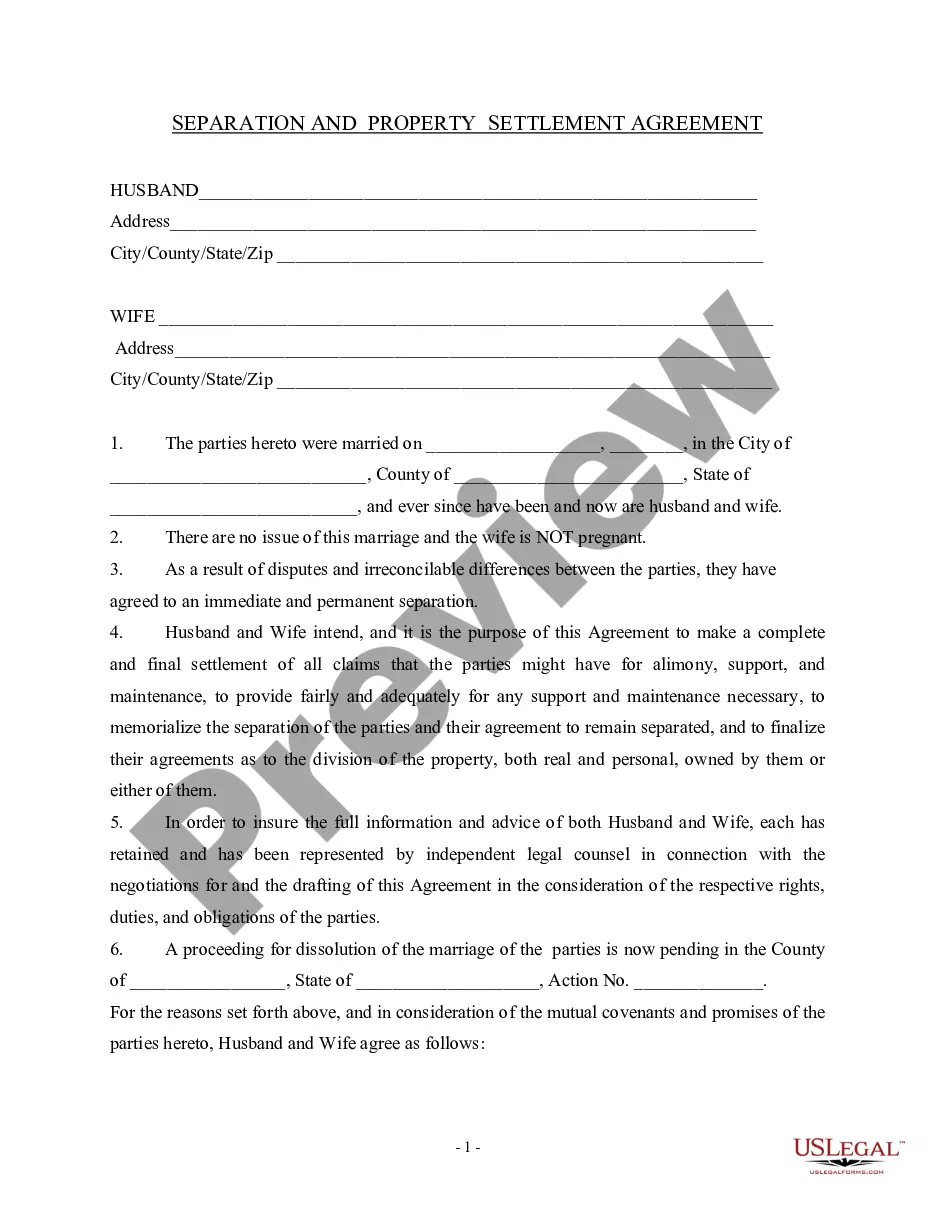

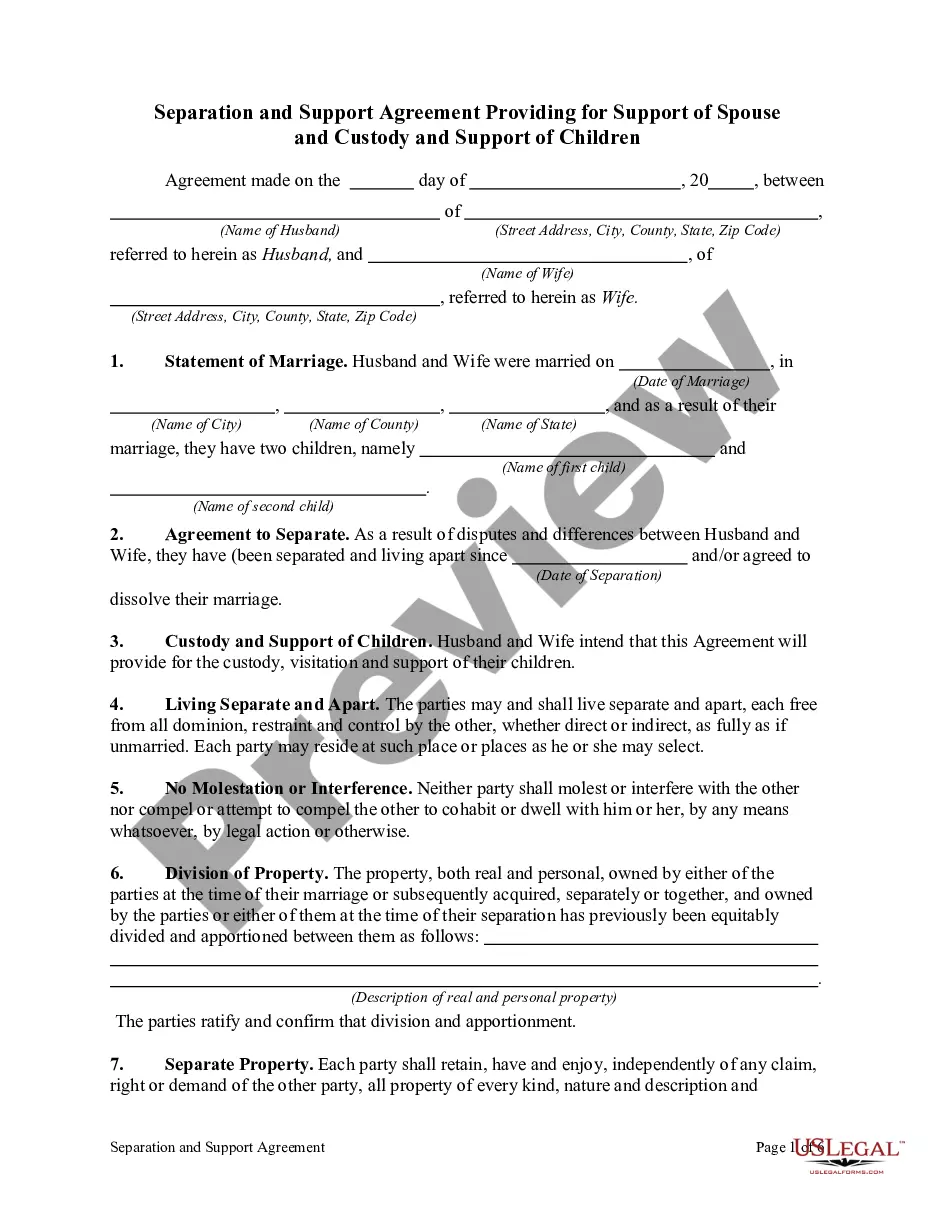

- If you are a returning user, log into your account to access the required form template. Verify that your subscription is active; renew it if it has expired.

- For first-time users, start by reviewing the Preview mode and form descriptions to ensure you select the best document that aligns with your needs and local laws.

- Should you require a different template, utilize the Search feature to locate the appropriate form. Ensure it meets your criteria before proceeding.

- Purchase the selected document by clicking on the Buy Now button. Choose your desired subscription plan and create an account for unlimited access to the document library.

- Complete your payment using a credit card or your PayPal account.

- After purchasing, download the template to your device for completion. You can always find it in the My Forms section of your profile.

US Legal Forms empowers users by providing access to a vast collection of legal documents tailored for your needs. With more than 85,000 fillable forms, you are sure to find what you need.

Start today and ensure your child support document is properly done with expert assistance available through US Legal Forms. Don’t wait—take charge of your legal needs now!

Form popularity

FAQ

To make shared custody easier, focus on clear communication and regular updates between parents. Creating a shared calendar can help both parties stay informed about schedules and important events. Using resources like USLegalForms can assist in drafting legal agreements that outline expectations. Prioritizing the children's needs will help navigate challenges effectively, encouraging a harmonious co-parenting environment.

Claiming your child on taxes with 50/50 custody typically hinges on the custodial agreement between parents. Generally, the parent with whom the child resides more than half the year claims the child as a dependent. However, if both parents agree, they may alternate claiming their child each year. It’s wise to consult with a tax professional to navigate child support with 50/50 custody and optimize your filing options.

The most common 50/50 custody split involves a week-on, week-off arrangement, allowing children to spend equal time with both parents. This setup encourages strong relationships with both caregivers while offering kids consistency and routine. Some families prefer a two-two-three schedule, where each parent has the children four days in a week. Regardless of the arrangement, focus on supporting child support with 50/50 custody to ensure well-being and stability.

The best co-parenting schedule for 50/50 custody often includes alternating weeks or a two-week rotation, providing stability for children. Many parents find that scheduling regular exchanges simplifies logistics and minimizes disruptions. Flexibility is essential, so both parties should be willing to adjust the plan as needed. Utilizing resources like USLegalForms can help you create a comprehensive schedule tailored to your family's needs.

To share 50/50 custody, both parents must agree on a parenting plan that supports equal time with each child. Start by discussing schedules that allow both parents to be actively involved in daily routines. Consider using tools or resources, like USLegalForms, to help create a plan that ensures a smooth transition and effective communication. Together, focus on the children's needs to foster a positive co-parenting relationship.

When parents are separated, claiming the child on taxes typically falls to the custodial parent. However, they can negotiate to allow the non-custodial parent to claim the deduction every other year or under certain circumstances. It’s vital to have these agreements documented to prevent disputes. Child support with 50/50 custody often requires added diligence in planning for tax implications.

The determination of who claims the child for tax purposes often hinges on the parenting arrangement established. If parents share custody, they may decide through mutual agreement or court order. Factors like financial support, residing patterns, and tax benefits influence this decision. Consulting tax professionals can provide additional clarity on child support with 50/50 custody.

In 50/50 custody arrangements, claiming the child can depend on the parents' agreement. Often, they alternate years or one parent claims the child while the other takes a deduction. Establishing clear communication is essential in these situations. Utilizing user-friendly tools like US Legal Forms can simplify these agreements, ensuring fairness and compliance.

The IRS identifies the custodial parent through the submission of tax returns that indicate the child's residency. The custodial parent usually resides with the child for more nights during the year. Taxpayers can also complete Form 8332 to release claim to the child’s exemption, clarifying which parent claims the child. Child support with 50/50 custody requires good record-keeping for smooth tax reporting.

When parents share child support with 50/50 custody, the tax benefits can depend on an agreement between them. Generally, only one parent can claim the child as a dependent on their tax return. This can be allocated based on the parenting plan or through mutual agreement. It’s important to document any arrangements clearly to ensure compliance with IRS rules.