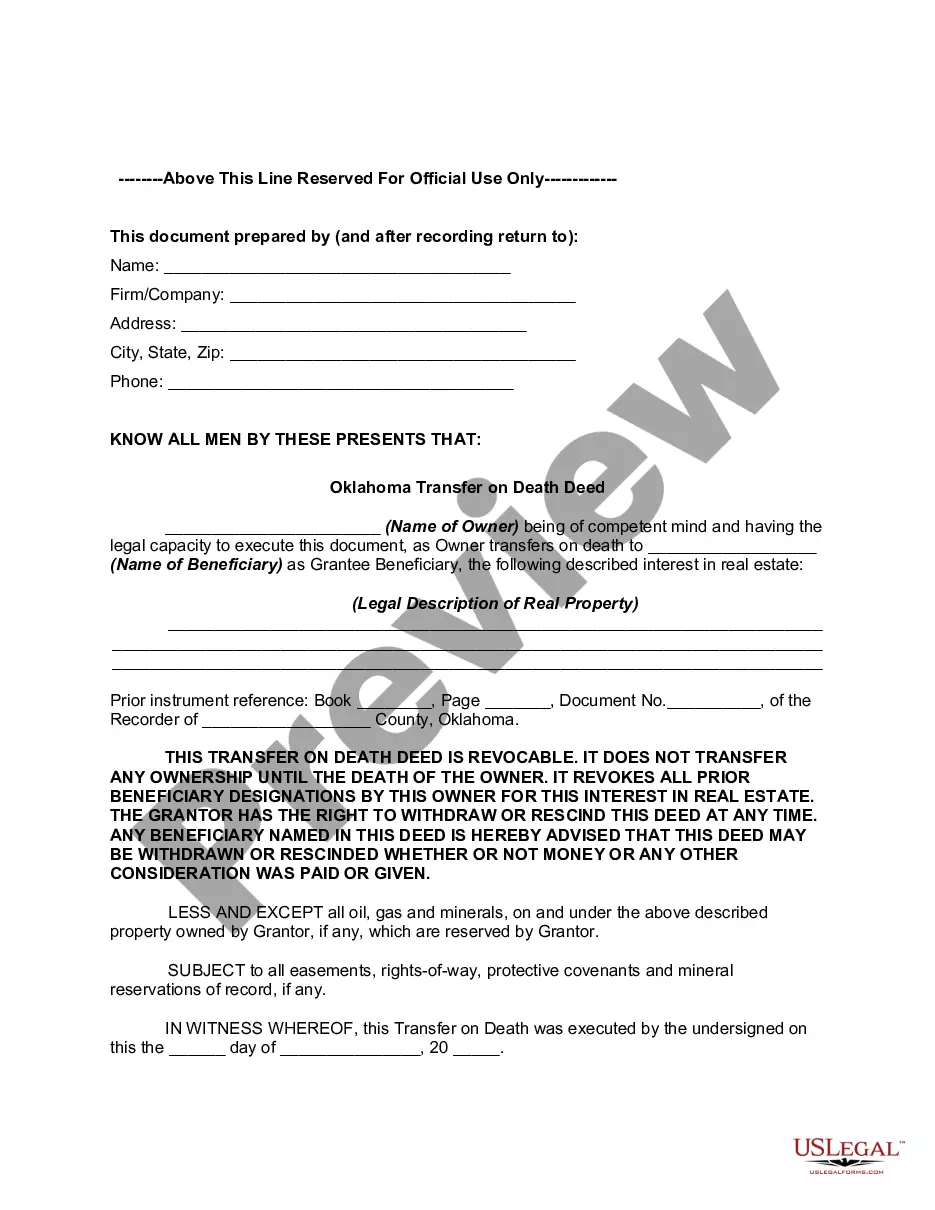

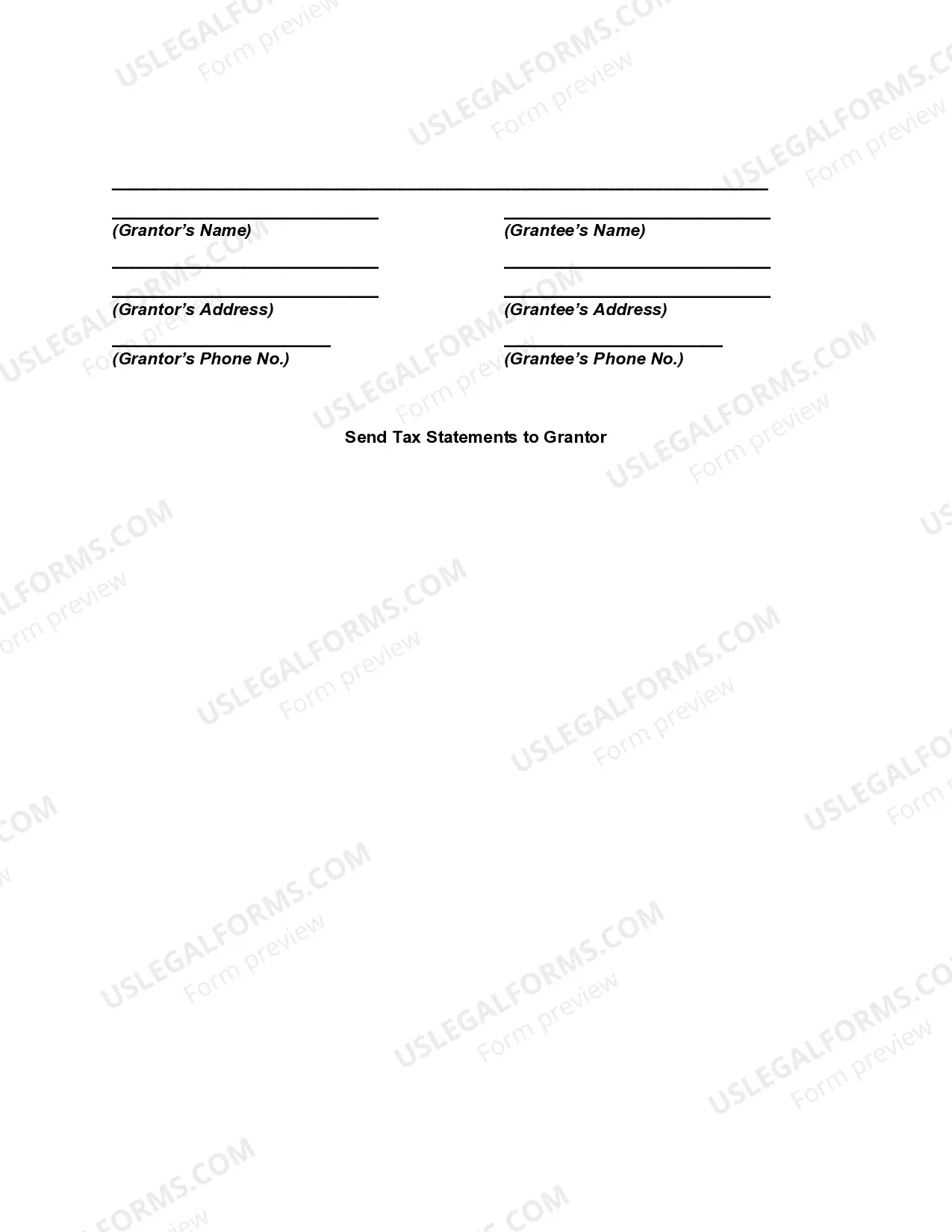

Oklahoma Transfer on Death Deed

Oklahoma Statutes

TITLE 58 PROBATE PROCEDURE

CHAPTER 21 NONTESTAMENTARY TRANSFER OF PROPERTY ACT

§ 58-1251. Short title.

Sections 1 through 8 of this act shall be known and may be cited as the "Nontestamentary Transfer of Property Act".

Laws 2008, c. 78, § 1, eff. Nov. 1, 2008.

§ 58-1252. Transfer-on-death deed � Notice to beneficiary � Acceptance of transfer-on-death deed. **Update Notice: This section has been amended by Chapter 372 of 2011

A. An interest in real estate may be titled in transfer-on-death form by recording a deed, signed by the record owner of the interest, designating a grantee beneficiary or beneficiaries of the interest. The deed shall transfer ownership of the interest upon the death of the owner. A transfer-on-death deed need not be supported by consideration.

B. The signature, consent or agreement of or notice to a grantee beneficiary or beneficiaries of a transfer-on-death deed shall not be required for any purpose during the lifetime of the record owner.

C. To accept real estate pursuant to a transfer-on-death deed, a designated grantee beneficiary shall execute a notarized affidavit affirming:

1. Verification of the record owner's death;

2. Whether the record owner and the designated beneficiary were married at the time of the record owner's death; and

3. A legal description of the real estate.

If the grantee beneficiary was not the record owner's spouse, he or she shall attach a copy of the record owner's death certificate and an estate tax release to the beneficiary affidavit. The beneficiary shall record the affidavit and related documents with the office of the county clerk where the real estate is located.

Laws 2008, c. 78, § 2, eff. Nov. 1, 2008; Laws 2010, c. 205, § 1, eff. Nov. 1, 2010.

§ 58-1253. Transfer-on-death, form.

An interest in real estate is titled in transfer-on-death form by executing, acknowledging and recording in the office of the county clerk in the county where the real estate is located, prior to the death of the owner, a deed in substantially the following form:

_________ (name of owner) being of competent mind and having

the legal capacity to execute this document, as owner

transfers on death to ________ (name of beneficiary) as

grantee beneficiary, the following described interest in real

estate: (here insert description of the interest in real

estate). THIS TRANSFER-ON-DEATH DEED IS REVOCABLE. IT DOES NOT

TRANSFER ANY OWNERSHIP UNTIL THE DEATH OF THE OWNER. IT

REVOKES ALL PRIOR BENEFICIARY DESIGNATIONS BY THIS OWNER FOR

THIS INTEREST IN REAL ESTATE. THE GRANTOR HAS THE RIGHT TO

WITHDRAW OR RESCIND THIS DEED AT ANY TIME. ANY BENEFICIARY

NAMED IN THIS DEED IS HEREBY ADVISED THAT THIS DEED MAY BE

WITHDRAWN OR RESCINDED WHETHER OR NOT MONEY OR ANY OTHER

CONSIDERATION WAS PAID OR GIVEN.

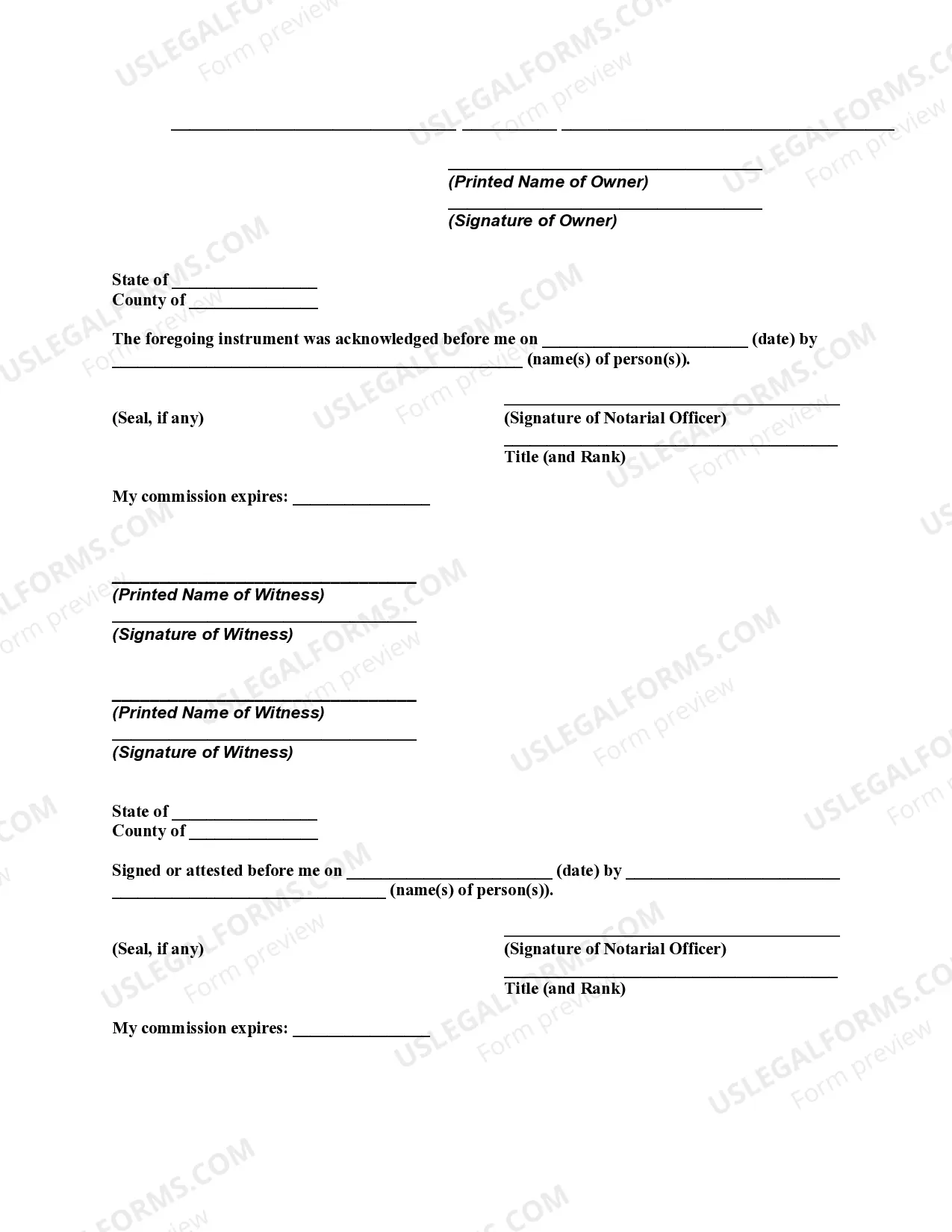

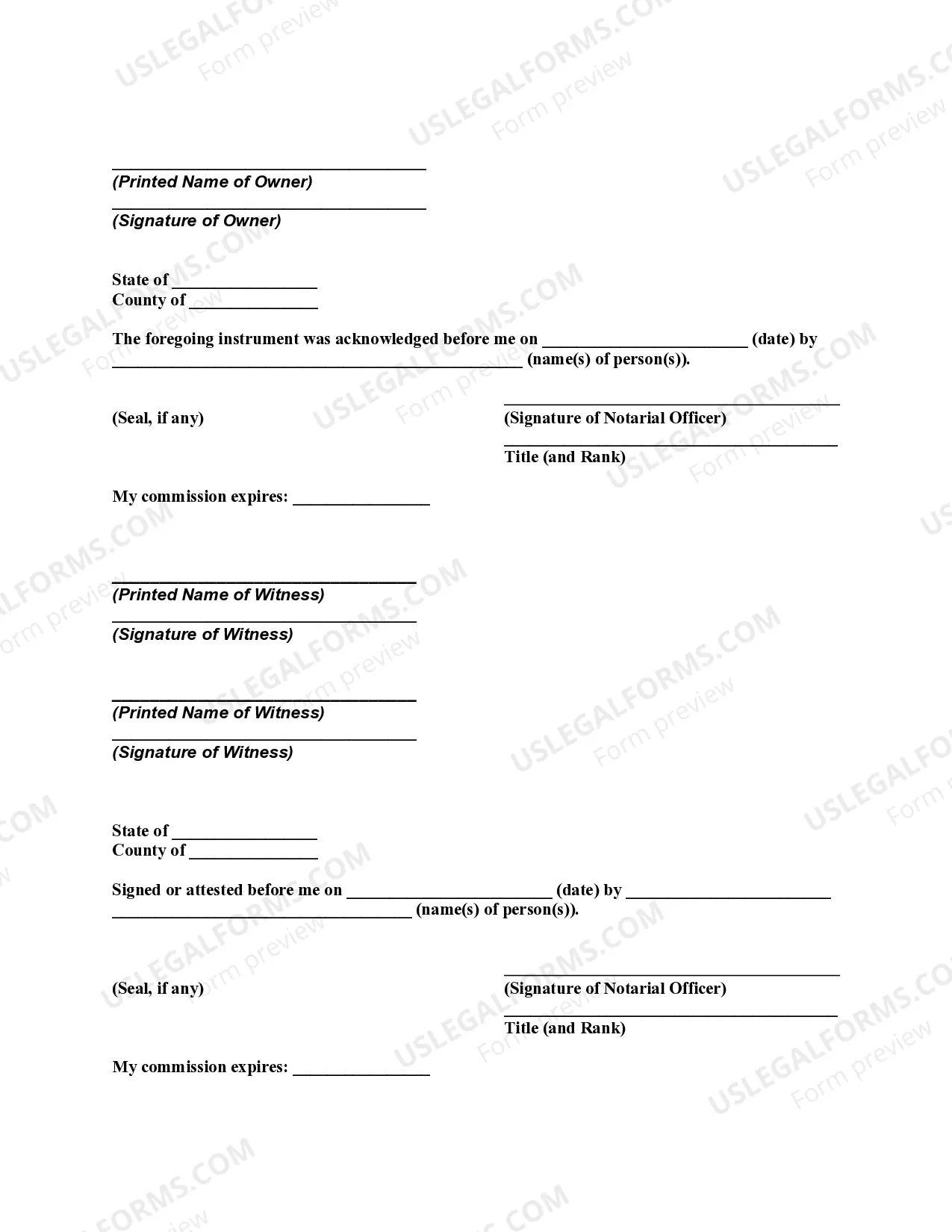

THE STATE OF OKLAHOMA

COUNTY OF __________

Before me, on this day personally appeared _________,

________, and ______, the owner of the land described in this

deed, and the witnesses, respectively, whose names are

subscribed below in their respective capacities, and the

owner of the land declared to me and to the witnesses in my

presence that the deed is a revocable transfer-on-death of

the real estate described therein, and the witnesses declared

in the presence of the owner of the real estate and in my

presence that the owner of the land declared to them that the

deed is a revocable transfer-on-death of the real estate

described therein and that the owner of the land wanted each

of them to sign it as a witness, and that each witness did

sign the same as witness in the presence of the owner of the

land and in my presence.

______________________

(name of owner)

______________________

(witness)

______________________

(witness)

Subscribed and acknowledged before me by ___________, the

owner of the land, and __________ and ___________, witnesses,

this ___ day of _________ (month), _______ (year).

____________________________

(signature of notary public)

(Seal)

My commission expires ______ (date).

Instead of the words "transfer-on-death" the abbreviation

"TOD" may be used.

Laws 2008, c. 78, § 3, eff. Nov. 1, 2008.

§ 58-1254. Revocation or change of grantee beneficiary � Effect of will � Disclaimer. **Update Notice: This section has been amended by Chapter 372 of 2011

A. A designation of the grantee beneficiary may be revoked at any time prior to the death of the record owner by executing, acknowledging and recording in the office of the county clerk in. the county where the real estate is located an instrument revoking the designation. The signature, consent or agreement of or notice to the grantee beneficiary or beneficiaries to the revocation is not required.

B. A designation of the grantee beneficiary may be changed at any time prior to the death of the record owner, by executing, acknowledging and recording a subsequent transfer-on-death deed in accordance with the Nontestamentary Transfer of Property Act. The signature, consent or agreement of or notice to the grantee beneficiary or beneficiaries is not required. A subsequent transfer-on-death beneficiary designation revokes all prior designations of grantee beneficiary or beneficiaries by the record owner for the interest in real estate.

C. A transfer-on-death deed executed, acknowledged and recorded in accordance with the Nontestamentary Transfer of Property Act may not be revoked by the provisions of a will.

D. A transfer-on-death deed executed, acknowledged and recorded in accordance with the Nontestamentary Transfer of Property Act may be disclaimed in whole or in part or with reference to specific parts by the grantee beneficiary or beneficiaries. The disclaimer must occur within nine (9) months after the death of the landowner. The disclaimer shall be filed with the office of the county clerk in which the transfer-on-death deed was recorded. If a grantee beneficiary exerts dominion over the real estate within the nine-month period, the disclaimer is waived. Dominion may be evidenced by acts including, but not limited to, possession or the execution of any conveyance, assignment, contract, mortgage, security pledge, executory contract for sale, option to purchase, lease, license, easement or right-of-way. A guardian, executor, administrator or other personal representative of a minor or legally incompetent beneficiary may execute and file a disclaimer on behalf of the beneficiary within the time and in the manner in which the beneficiary could disclaim, if the guardian, executor, administrator or other personal representative deems it in the best interests of and not detrimental to the best interests of the beneficiary.

Laws 2008, c. 78, § 4, eff. Nov. 1, 2008.

§ 58-1255. Vesting of interest � Affidavit � Grantee interest subject to encumbrances � Lapse of transfer. **Update Notice: This section has been amended by Chapter 372 of 2011

A. Title to the interest in real estate recorded in transfer-on-death form shall vest in the designated grantee beneficiary or beneficiaries on the death of the record owner. The death of the record owner shall be evidenced by the recording of an affidavit in the office of the county clerk of the county where the real estate is located. The affidavit shall be executed by the grantee beneficiary or beneficiaries. The affidavit shall state the fact of the death of the record owner, state whether or not the record owner and the designated grantee were husband and wife, and provide the legal description of the real estate. The affidavit shall be notarized. If the record owner and designated grantee were not husband and wife, a copy of the death certificate of the record owner and an estate tax release shall be attached to the affidavit.

B. Grantee beneficiaries of a transfer-on-death deed take the interest of the record owner in the real estate at death subject to all conveyances, assignments, contracts, mortgages, liens and security pledges made by the record owner or to which the record owner was subject during the lifetime of the record owner including, but not limited to, any executory contract of sale, option to purchase, lease, license, easement, mortgage, deed of trust or lien, and to any interest conveyed by the record owner that is less than all of the record owner's interest in the property.

C. If a grantee beneficiary dies prior to the death of the record owner and an alternative grantee beneficiary has not been designated on the deed, the transfer shall lapse.

Laws 2008, c. 78, § 5, eff. Nov. 1, 2008.

§ 58-1256. Effect of deed on joint tenancy � "Joint owner" defined.

A. A record joint owner of an interest in real estate may use the procedures in the Nontestamentary Transfer of Property Act to title the interest in transfer-on-death form. However, title to the interest shall vest in the designated grantee beneficiary or beneficiaries only if the record joint owner is the last to die of all of the record joint owners of the interest. A deed in transfer-on-death form shall not sever a joint tenancy.

B. As used in this section, "joint owner" means a person who owns an interest in real estate as a joint tenant with right of survivorship.

Laws 2008, c. 78, § 6, eff. Nov. 1, 2008.

§ 58-1257. Record owner considered absolute owner.

A record owner who executes a transfer-on-death deed remains the legal and equitable owner until the death of the owner and during the lifetime of the owner is considered an absolute owner as regards creditors and purchasers.

Laws 2008, c. 78, § 7, eff. Nov. 1, 2008.

§ 58-1258. Transfer-on-death deed not considered testamentary disposition.

A deed in transfer-on-death form, executed in conformity with the Nontestamentary Transfer of Property Act, shall not be considered a testamentary disposition and shall not be invalidated due to nonconformity with other provisions in Title 58 or Title 84 of the Oklahoma Statutes.

Laws 2008, c. 78, § 8, eff. Nov. 1, 2008.