Life Estate Deed Oklahoma With Mortgage

Description

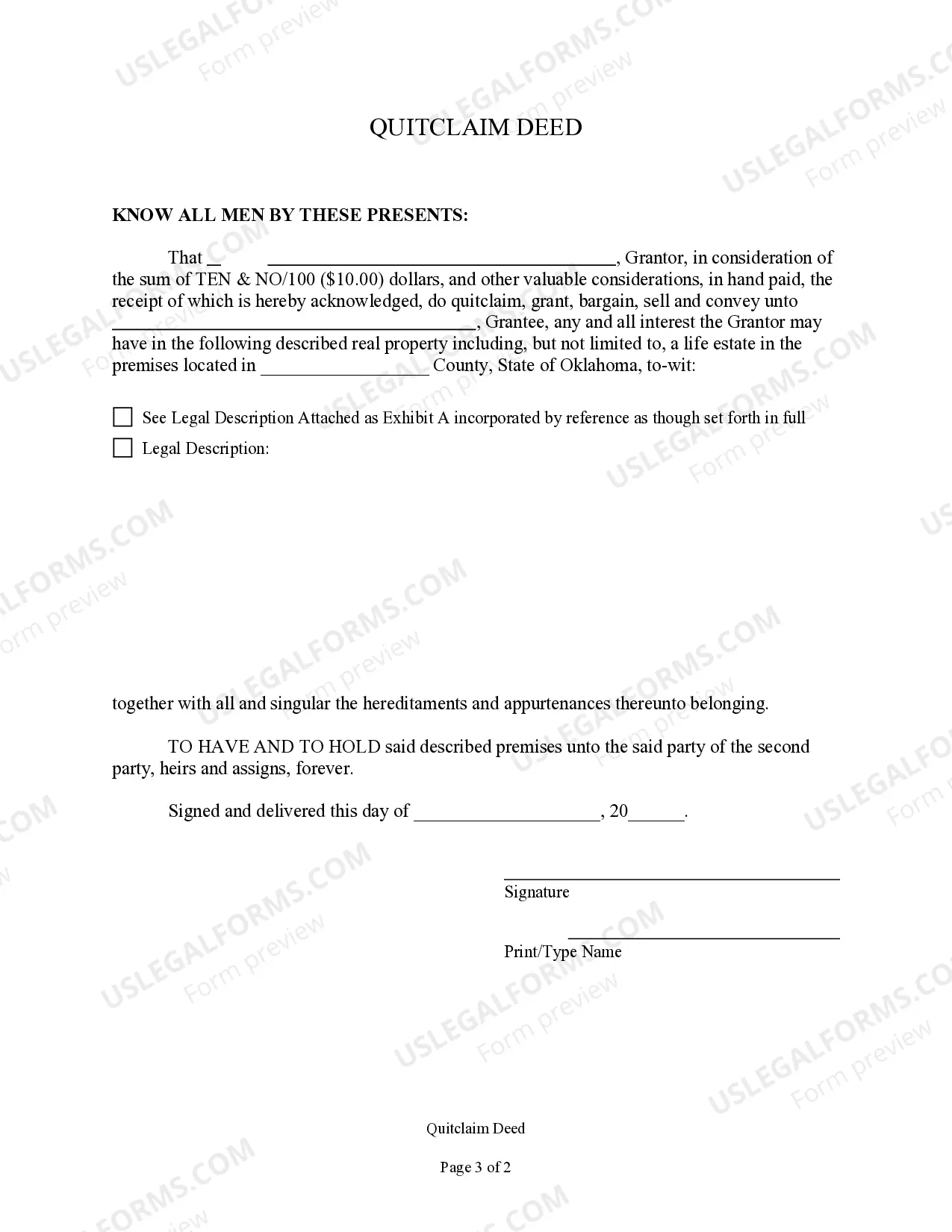

How to fill out Oklahoma Quitclaim Deed Releasing Life Estate?

What is the most trustworthy service to obtain the Life Estate Deed Oklahoma With Mortgage and other up-to-date iterations of legal documentation.

US Legal Forms is the answer! It offers the largest assortment of legal forms for any situation.

If you haven't created an account with us yet, here are the steps to do so: Form compliance review. Prior to obtaining any template, you should confirm whether it meets your usage requirements and complies with your state or county's laws. Examine the form description and utilize the Preview if available. Alternative form search. If there are any discrepancies, use the search bar in the page header to find another template. Click Buy Now to choose the correct one. Account registration and subscription purchase. Select the best pricing plan, Log In or create an account, and complete your subscription payment via PayPal or credit card. Downloading the documents. Choose the format in which you wish to save the Life Estate Deed Oklahoma With Mortgage (PDF or DOCX) and click Download to retrieve it. US Legal Forms is an outstanding choice for anyone who needs to manage legal documentation. Premium members can enjoy even more benefits, as they have the option to fill out and sign previously saved documents electronically at any time using the built-in PDF editing tool. Give it a try today!

- Each template is properly drafted and confirmed for adherence to federal and local statutes.

- They are organized by area and state of application, making it effortless to find the one you require.

- Experienced users of the site only need to Log In, verify if their subscription is active, and click the Download button next to the Life Estate Deed Oklahoma With Mortgage to obtain it.

- Once saved, the template can be accessed for future use within the My documents section of your account.

Form popularity

FAQ

To avoid probate in Oklahoma, you can use several strategies, including establishing a living trust or utilizing a life estate deed. A life estate deed allows you to transfer property directly to beneficiaries upon your death, bypassing probate proceedings entirely. By leveraging a life estate deed Oklahoma with mortgage, you can ensure a smooth and efficient transfer of property, providing peace of mind for both you and your loved ones.

To transfer property on death in Oklahoma, you can use tools such as a will, a trust, or a life estate deed. A life estate deed allows you to designate the next owner while retaining your rights during your lifetime. This method can be particularly advantageous when addressing a life estate deed Oklahoma with mortgage, as it streamlines the transfer process and avoids the complexities of probate.

In Oklahoma, there is no legal requirement for a spouse to be on the deed for property ownership. However, including a spouse on the deed can provide certain benefits, such as shared ownership and rights to the property. When considering a life estate deed Oklahoma with mortgage, evaluating joint ownership options may be advisable, especially for estate planning.

The life estate law in Oklahoma allows property owners to transfer their property to another person while retaining the right to live there for the rest of their life. This arrangement provides a way to manage the passing of property without going through probate. Incorporating a life estate deed Oklahoma with mortgage can make the process straightforward, preserving your rights and facilitating easy transfer upon your death.

To transfer mineral rights after death in Oklahoma, it is essential to refer to the deceased's will or trust, which outlines the distribution of their assets. If no will exists, the state laws of intestacy will apply. A life estate deed Oklahoma with mortgage can simplify this transfer, as it allows for a clear delineation of rights at the time of ownership, ensuring that mineral rights are handled smoothly.

Yes, a ladybird deed is legal in Oklahoma. This type of deed allows property owners to retain control of their property during their lifetime while designating beneficiaries to receive the property upon their death. It can be beneficial when considering a life estate deed in Oklahoma with a mortgage, as it helps avoid probate and supports effective estate planning.

Getting around a life estate can be complex but manageable with strategic planning. Options include negotiating a buyout with the life tenant or creating a new agreement that aligns with your goals. Utilizing resources like USLegalForms can guide you through the necessary legal processes. Proper preparation ensures you make informed decisions regarding a life estate deed in Oklahoma with a mortgage.

In Canada, the life tenant of a life estate holds the property for their lifetime. They enjoy the rights to use and manage the property but cannot sell or transfer it without consent. Future ownership typically reverts to a designated remainderman after the life tenant's passing. Understanding how these rights work is essential for managing a life estate effectively.

Yes, you can be alive and possess an estate. A life estate deed in Oklahoma with mortgage allows you to retain ownership during your lifetime while specifying the future ownership. This type of arrangement provides clarity on property rights for both the current owner and future beneficiaries. It's a valuable tool in estate planning, ensuring smooth transitions.

To navigate around a life estate deed in Oklahoma with a mortgage, consider consulting a legal expert. Understanding the terms of the life estate is crucial, as it outlines the rights of each party involved. One option is to negotiate with the life tenant for a buyout or restructuring. Additionally, involving a professional can help clarify your options related to future transfers.