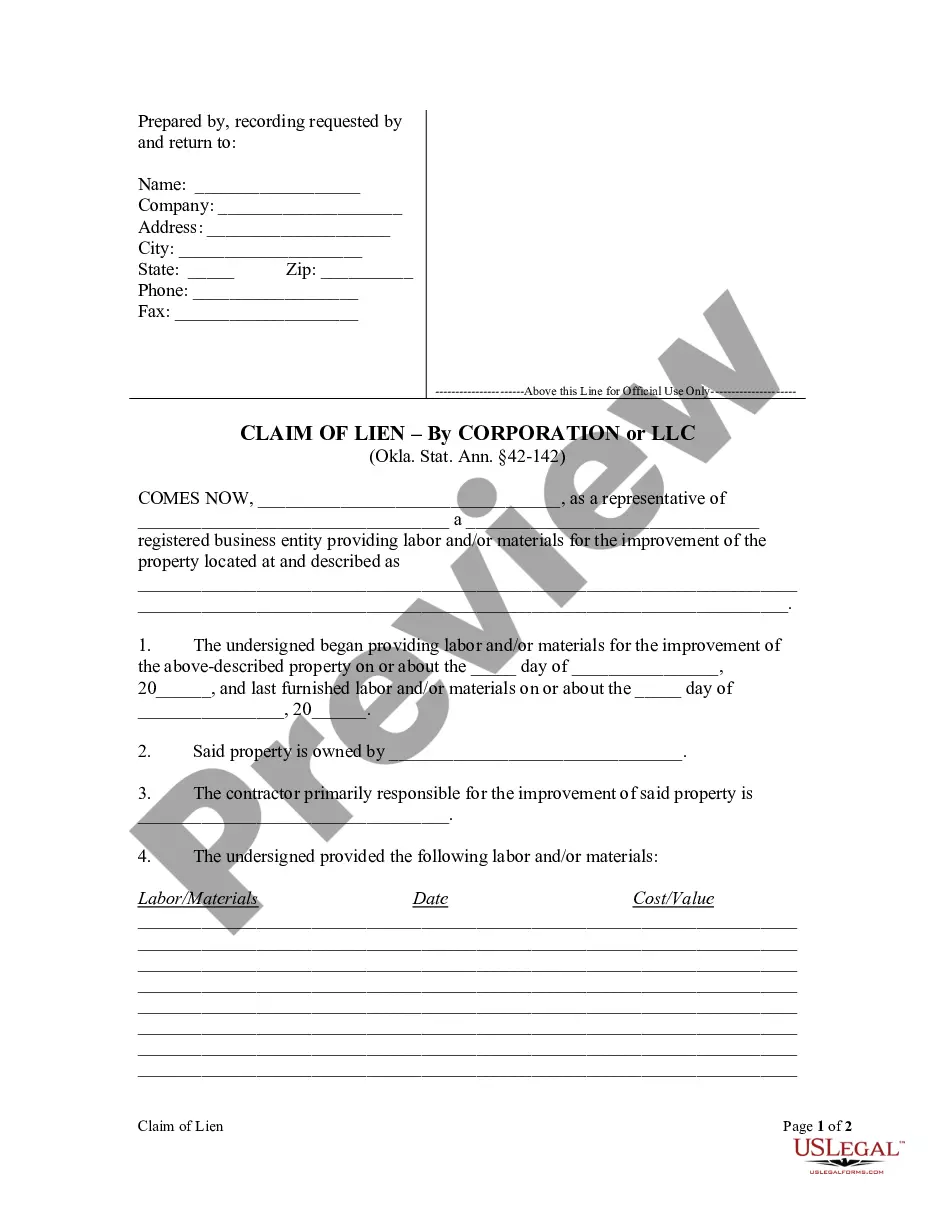

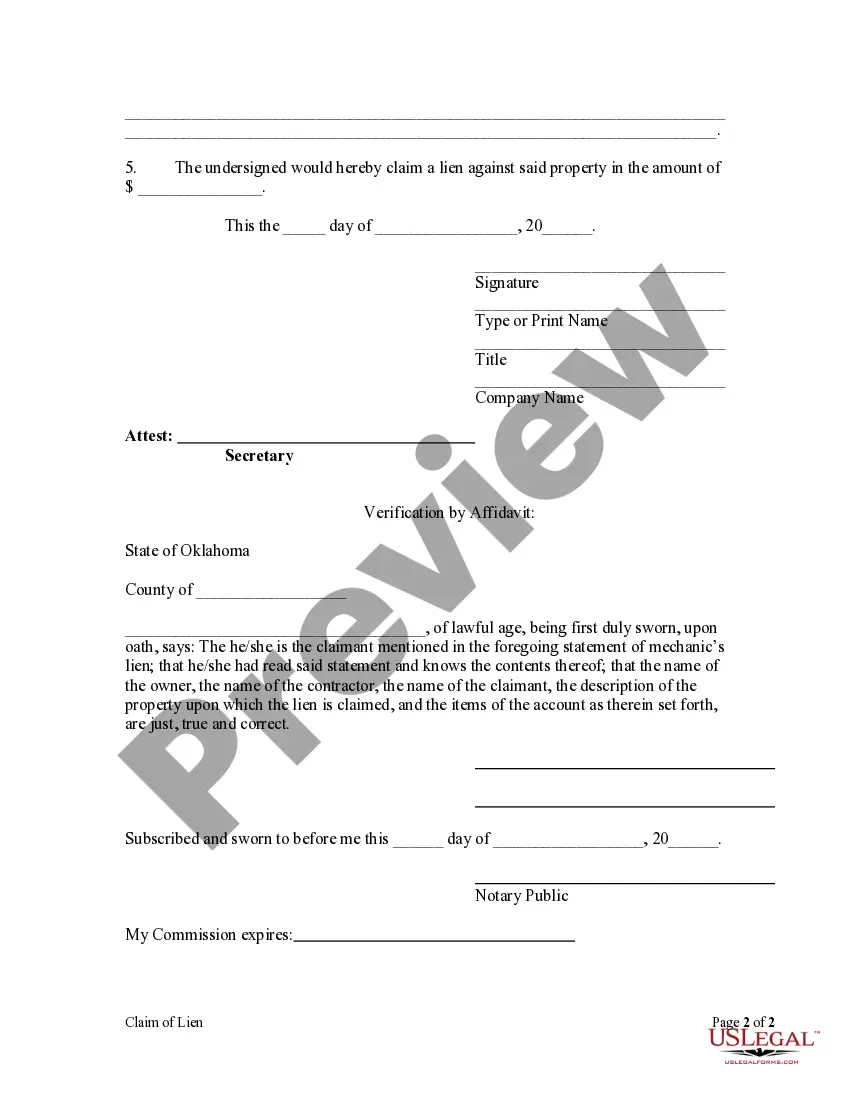

Any person who shall, under oral or written contract with the owner of any tract or piece of land, perform labor, furnish material or lease or rent equipment used on said land shall have a lien upon the whole of said tract or piece of land. Any person claiming a lien as aforesaid shall file in the office of the county clerk of the county in which the land is situated a statement setting forth the amount claimed and the items thereof as nearly as practicable, the names of the owner, the contractor, the claimant, and a legal description of the property subject to the lien, verified by affidavit. Such statement shall be filed within four (4) months after the date upon which material or equipment used on said land was last furnished or labor last performed under contract.

Ok Lien Oklahoma Form Instructions

Description

Form popularity

FAQ

To obtain a lien release in Oklahoma, you need to follow specific Ok lien Oklahoma form instructions. First, reach out to the lien holder who issued the lien and request a release. They must complete the necessary documentation to officially remove the lien. Once completed, you can file this release with your county clerk to clear the lien from your records.

In Oklahoma, you generally need to file your lien within 90 days after the work is completed or the materials are provided. However, it's crucial to follow the Ok lien Oklahoma form instructions carefully to avoid missing deadlines. Failing to file within this timeframe could jeopardize your legal claim. For more guidance, consider utilizing the US Legal Forms platform to access reliable resources.

To place a lien on someone in Oklahoma, you must complete the Ok lien Oklahoma form instructions accurately. First, gather the necessary information about the debtor and the property. Then, file the lien with the appropriate county clerk's office. This process ensures your claim is recognized legally, protecting your interests.

To obtain a lien release in Oklahoma, you must file a release form with the same office where the lien was recorded. Make sure to follow the detailed ‘Ok lien Oklahoma form instructions’ to avoid any errors. Once submitted, the county clerk will officially release the lien, clearing your property.

Yes, in certain situations, you can file a lien in Oklahoma without a formal contract. For instance, a lien can arise from unpaid services or materials provided. It's essential to understand your rights and follow the correct ‘Ok lien Oklahoma form instructions’ to ensure compliance with the law.

In Oklahoma, a lien typically lasts for five years from the filing date unless it is renewed. To ensure your lien remains valid, consider following the 'Ok lien Oklahoma form instructions' for the renewal process before it expires. Keeping track of your filing dates helps you maintain your rights under the lien.

To file a lien in Oklahoma, begin by obtaining the necessary forms, which you can find on the US Legal Forms platform. Fill out the ‘Ok lien Oklahoma form instructions’ thoroughly, providing all required details. Once completed, file the form with the appropriate county clerk’s office. Remember to keep copies for your records.

A lien entry form in Oklahoma is a document that officially records a lien against a property in the public records. This form includes details such as the creditor, debtor, and property description. For those unfamiliar with the process, reviewing the Ok lien oklahoma form instructions can help them navigate how to complete and file the lien entry form correctly.

A tax lien in Oklahoma is a legal claim against a property due to unpaid taxes. It secures the government's right to collect the owed amount, which can lead to property foreclosure if left unresolved. Understanding how tax liens work is vital, so referring to the Ok lien oklahoma form instructions can provide valuable insights on addressing tax-related issues.

Filing a lien in Oklahoma involves completing a lien form with detailed information about the debt and the property. After preparing the form, you must file it with the county clerk's office where the property is located. You can follow the Ok lien oklahoma form instructions to ensure you fill out everything correctly and understand the filing process.