Limited Liability Company With One Member

Description

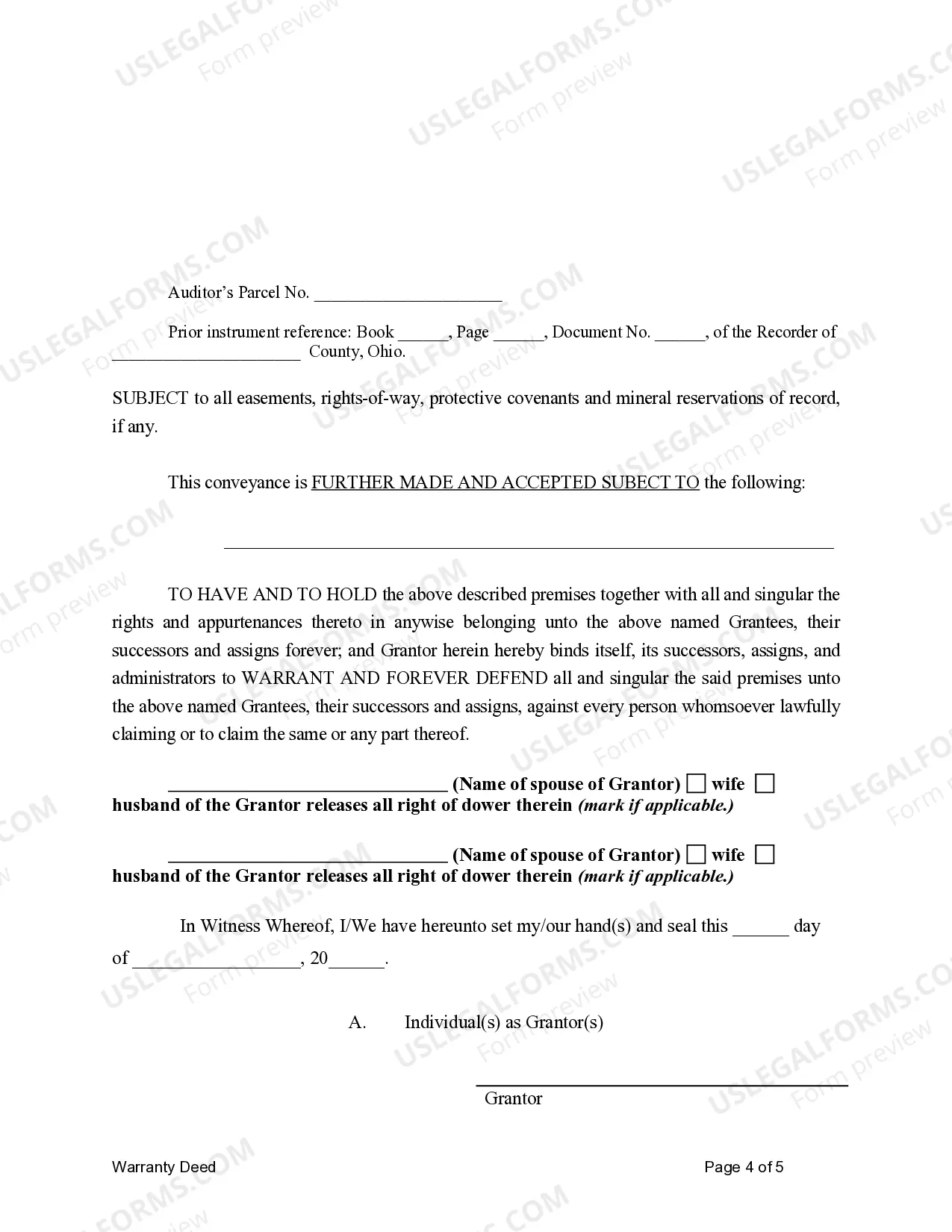

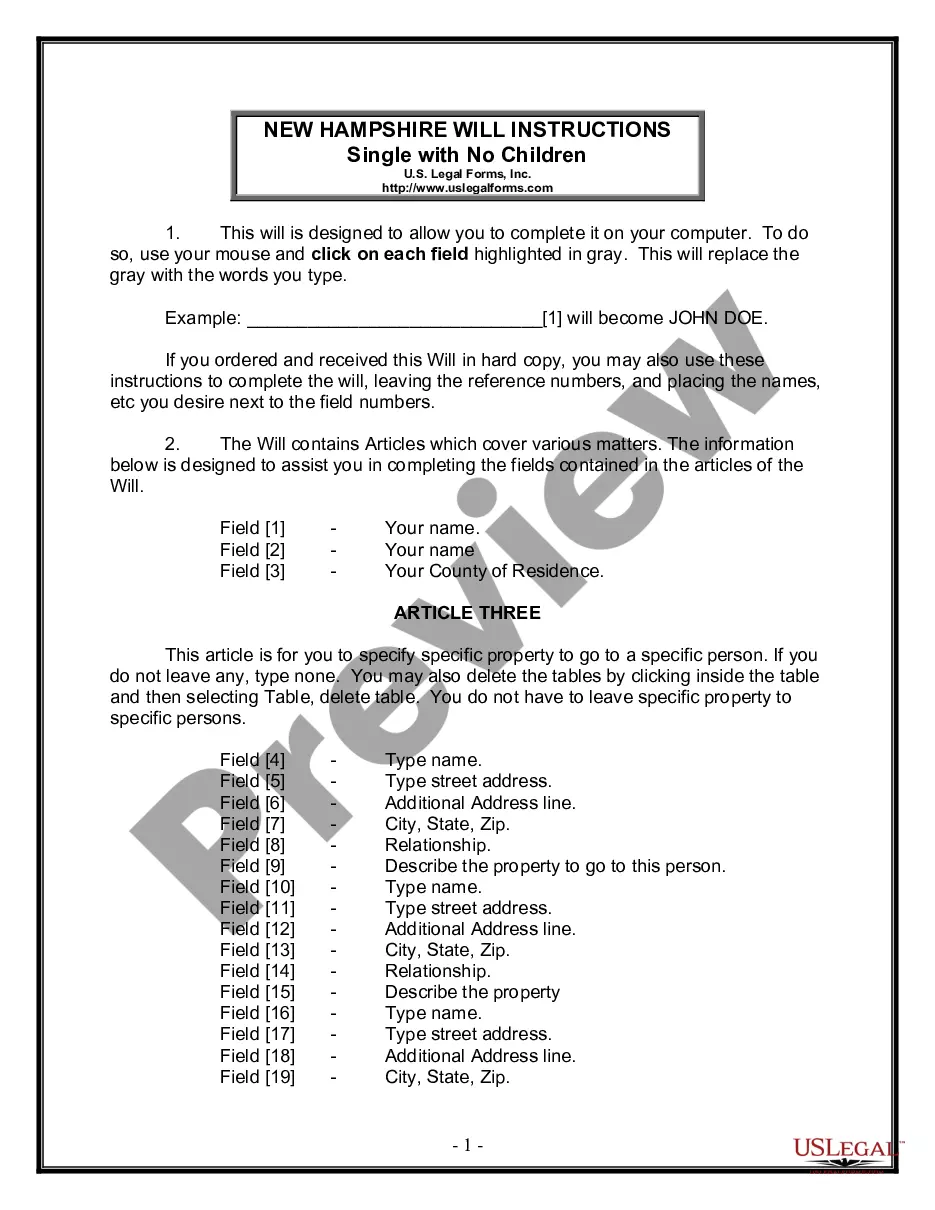

How to fill out Ohio Warranty Deed From Limited Partnership Or LLC Is The Grantor, Or Grantee?

- If you're an existing user, log in to your account to access the form template and click the Download button to save it.

- Verify your subscription to ensure access; renew it if it has expired.

- For first-time users, start by reviewing the form description and Preview mode to choose the template that fits your needs and complies with local legal requirements.

- Utilize the Search tab to find an alternative template if necessary, ensuring it aligns with your requirements.

- Select the Buy Now button to purchase your chosen document and pick your preferred subscription plan, registering an account if needed.

- Complete the transaction by entering your credit card details or using PayPal for your subscription.

- Download the form onto your device, and you can also find it anytime in the My Forms section of your profile.

US Legal Forms provides a robust collection of legal documents that outnumbers most competitors, making it easier and quicker for you to find what you need.

With over 85,000 forms available, you can count on their expertise and resources to help you create legally sound documents. Start your journey towards forming your LLC today!

Form popularity

FAQ

Forming a limited liability company with one member can be an excellent choice for many entrepreneurs. It offers personal liability protection while allowing complete ownership and control of the business. Additionally, a single-member LLC provides flexibility in taxation, either as a disregarded entity or as a corporation. Consider using platforms like US Legal Forms to understand better how this structure can benefit you.

Absolutely, a limited liability company with one member can have W-2 employees. This means you can hire individuals and classify them as employees on your payroll system. Just remember to handle payroll taxes correctly, as you'll be responsible for withholding and submitting them. This arrangement can help you grow your business effectively.

To add an employee to your limited liability company with one member, you need to register with the IRS for an Employer Identification Number (EIN). Once you have your EIN, you can complete the necessary employment paperwork and begin payroll. It's important to set up a system to manage taxes and benefits appropriately. US Legal Forms can provide resources to ensure you comply with the proper procedures.

Yes, a limited liability company with one member can hire employees. This structure allows you to grow your business while maintaining personal liability protection. When you hire, make sure you follow federal and state regulations to comply with employment laws. This way, your business can thrive with the right team in place.

Yes, you can hire contractors as a limited liability company with one member. This flexibility allows you to manage your workload without the need for full-time employees. Using contractors can also help you control costs while accessing specific skills as needed. Just ensure you comply with any applicable tax and reporting requirements.

member LLC often provides tax advantages compared to a sole proprietorship. It shields your personal assets from business liabilities while allowing for passthrough taxation. Additionally, this structure can offer more flexibility regarding different tax options, such as being taxed as an S Corporation. You might find assistance with these considerations through uslegalforms, which can guide you in making an informed decision.

The primary tax benefit of a limited liability company with one member is pass-through taxation. This means the business income is reported on your personal tax return, avoiding double taxation. Additionally, a single-member LLC can deduct business expenses directly, potentially lowering overall tax liability. Exploration of these benefits can be made easier using resources available on uslegalforms.

A limited liability company with one member can write off various business expenses on taxes. Common deductions include operational costs, home office expenses, business travel, and equipment purchases. By keeping accurate records and separating personal from business expenses, a single-member LLC can maximize tax benefits. Utilizing a platform like uslegalforms can simplify the process of managing these deductions.

Yes, a limited liability company with one member is allowed in the United States. This type of LLC is known as a single-member LLC. It provides the same limited liability protection as a multi-member LLC, meaning your personal assets are generally safe from business debts. Establishing a single-member LLC is a straightforward process and can be done through platforms like uslegalforms.

In a limited liability company with one member, the owner is generally not personally liable for business debts, preserving their personal assets. This structure protects members against financial loss arising from business operations. However, if the member engages in wrongdoings, they may be held personally accountable. It's vital to follow guidelines and seek professional assistance to maintain the liability protection inherent in an LLC.