Ohio Promissory Note With Chattel Mortgage

Description

How to fill out Ohio Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Individuals typically link legal documents with something intricate that solely a specialist can handle.

In a sense, this is accurate, as creating an Ohio Promissory Note With Chattel Mortgage demands considerable knowledge of topic requirements, encompassing state and local statutes.

However, with US Legal Forms, matters have become more straightforward: pre-prepared legal documents for any life and business event specific to state regulations are compiled in a single online directory and are now accessible to all.

Complete your subscription through PayPal or with your credit card. Select the format for your document and click Download. You can print your document or upload it to an online editor for faster completion. All templates in our collection are reusable: once obtained, they are retained in your profile. You can access them whenever necessary via the My documents tab. Explore all the benefits of using the US Legal Forms platform. Subscribe now!

- US Legal Forms provides over 85k current forms categorized by state and purpose, making the search for Ohio Promissory Note With Chattel Mortgage or any other specific template take just minutes.

- Previously registered users with a valid membership must Log In to their account and click Download to retrieve the document.

- New users to the platform must first create an account and subscribe before they can save any paperwork documentation.

- Below is the step-by-step guide on how to obtain the Ohio Promissory Note With Chattel Mortgage.

- Carefully review the page content to ensure it aligns with your requirements.

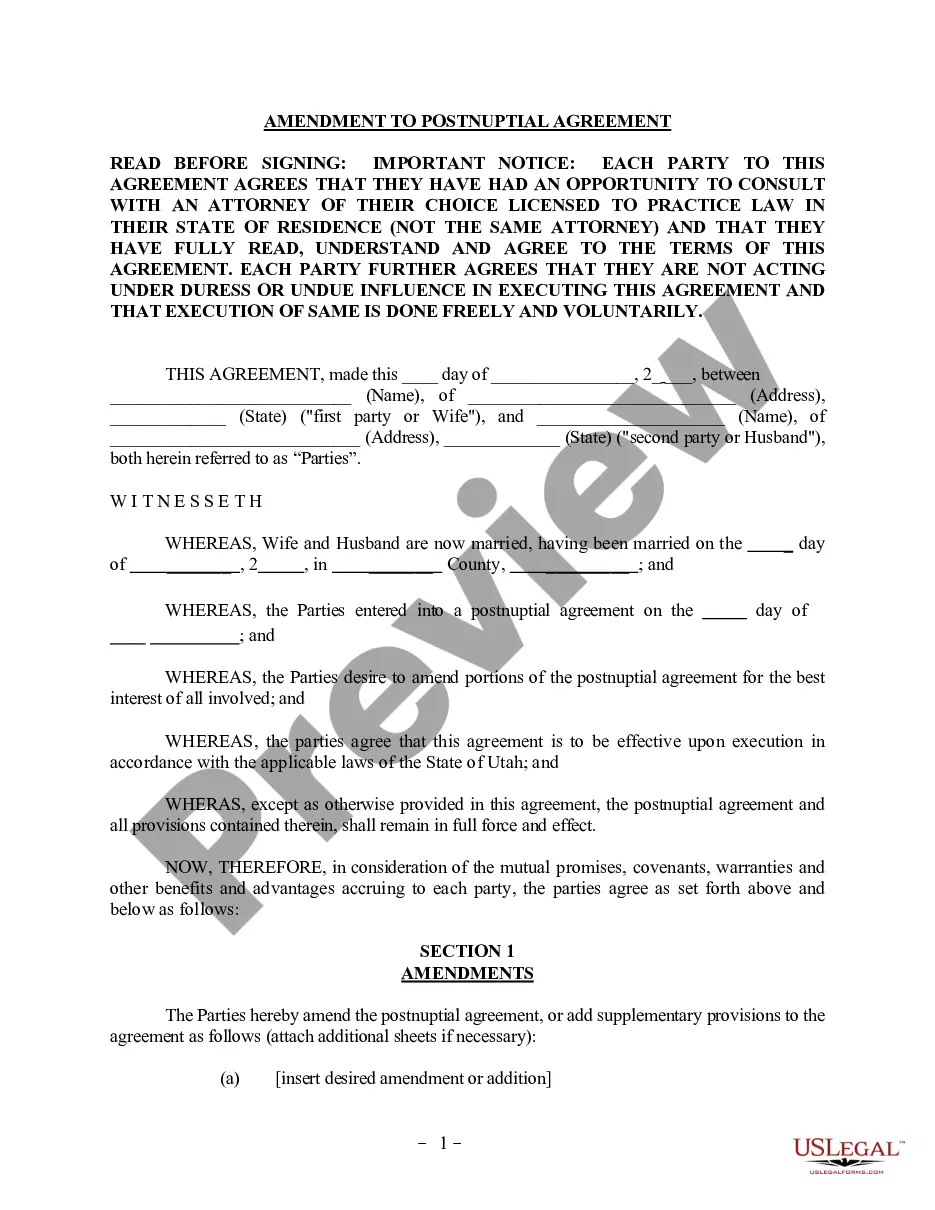

- Read the form description or confirm it through the Preview feature.

- If the last example does not meet your needs, find another template using the Search bar in the header.

- Click Buy Now once you identify the suitable Ohio Promissory Note With Chattel Mortgage.

- Choose a pricing plan that fits your needs and financial capabilities.

- Create an account or Log In to advance to the payment page.

Form popularity

FAQ

A promissory note is a key piece of a home loan application and mortgage agreement, ensuring that a borrower agrees to be indebted to a lender for loan repayment. Ultimately, it serves as a necessary piece of the legal puzzle that helps guarantee that sums are repaid in full and in a timely fashion.

There is no legal requirement for promissory notes to be witnessed or notarized in Ohio. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A promissory note is a key piece of a home loan application and mortgage agreement, ensuring that a borrower agrees to be indebted to a lender for loan repayment.

The requirements of how a promissory note must be signed are governed by state law and vary from state to state. Some states require that a promissory note by witnessed, others require that it be notarized and some do not require witnessing or a notary.