Assumption Letter For Mortgage

Description

How to fill out Ohio Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

There's no longer a requirement to squander time searching for legal documents to fulfill your local state obligations. US Legal Forms has gathered all of them in a single location and streamlined their availability.

Our site features more than 85,000 templates for any business and personal legal situations categorized by state and usage area. All forms are properly drafted and verified for accuracy, so you can be confident in obtaining a current Assumption Letter for Mortgage.

If you are acquainted with our service and already possess an account, you need to confirm your subscription is active before accessing any templates. Log In to your account, select the document, and click Download. You can also revisit all obtained documents whenever necessary by opening the My documents section in your profile.

Choose the file format for your Assumption Letter for Mortgage and download it to your device. Print out your form to fill it in manually or upload the sample if you prefer to utilize an online editor. Creating formal documents under federal and state regulations is quick and effortless with our library. Try US Legal Forms now to keep your paperwork organized!

- If you've never interacted with our service before, the procedure will require a few additional steps to complete.

- Here's how new users can discover the Assumption Letter for Mortgage in our catalog.

- Carefully examine the page content to ensure it contains the sample you need.

- To do this, utilize the form description and preview options if available.

- Use the Search field above to find another sample if the previous one didn't suit you.

- Click Buy Now next to the template title when you identify the appropriate one.

- Select the most fitting pricing plan and create an account or sign in.

- Make the payment for your subscription with a credit card or through PayPal to continue.

Form popularity

FAQ

To assume a mortgage, you must first get approval from the lender. The lender will review your financial situation to ensure you can manage the mortgage payments. Additionally, obtaining an assumption letter for mortgage is essential, as it formalizes the transfer of responsibility from the original borrower to you. This letter acts as a legal document that secures your position as the new borrower.

Assumption documents refer to the paperwork involved in transferring mortgage responsibility from one borrower to another. These documents typically include the assumption application, the original mortgage agreement, and any disclosures required by the lender. It’s essential to have a clear and accurate assumption letter for mortgage as part of this documentation to facilitate the process without complications.

When assuming a mortgage, you generally need several key documents. Start with your financial information, including income verification and credit reports. Additionally, you'll need the original mortgage documents and a completed assumption application. Providing the lender with a well-prepared assumption letter for mortgage can also streamline the approval process.

While an assumption letter for mortgage can be beneficial, there are some potential downsides to consider. You may inherit a higher interest rate than the current market offers, which could lead to increased payments. Furthermore, if there are outstanding debts or fees associated with the original mortgage, you could be held responsible. It’s important to review all terms carefully before proceeding with the assumption.

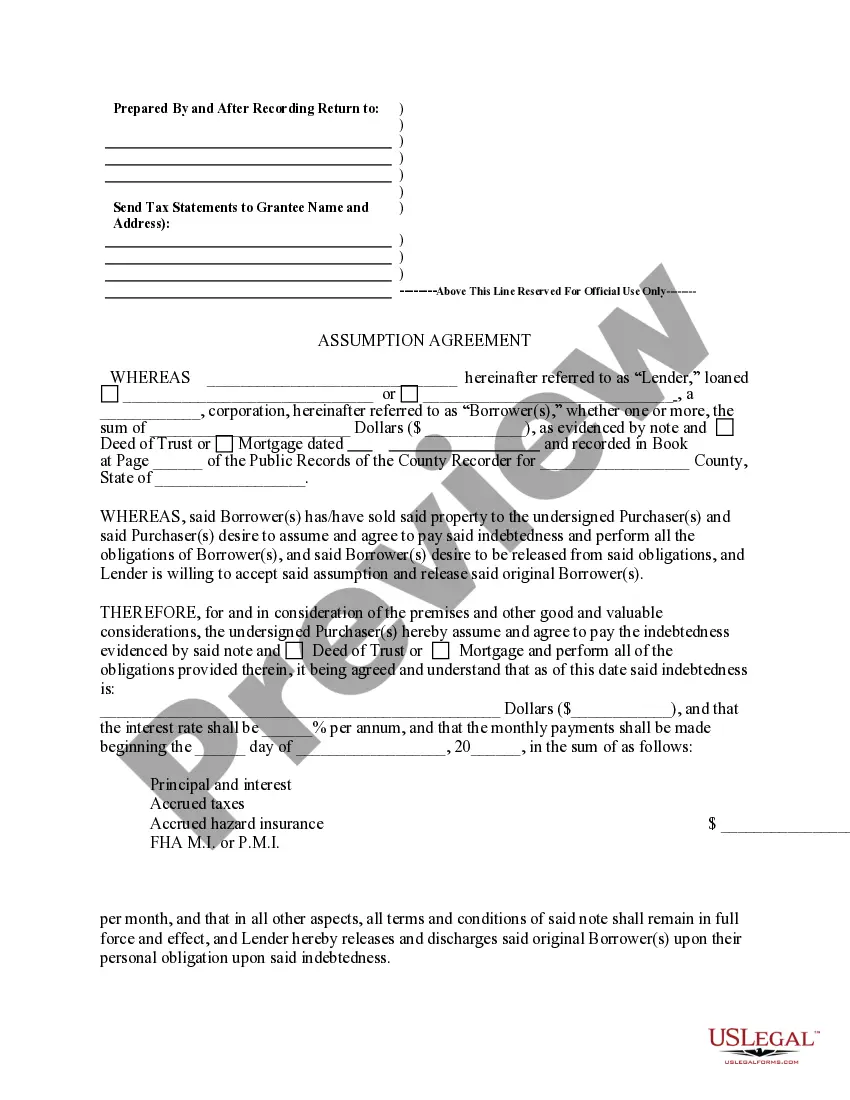

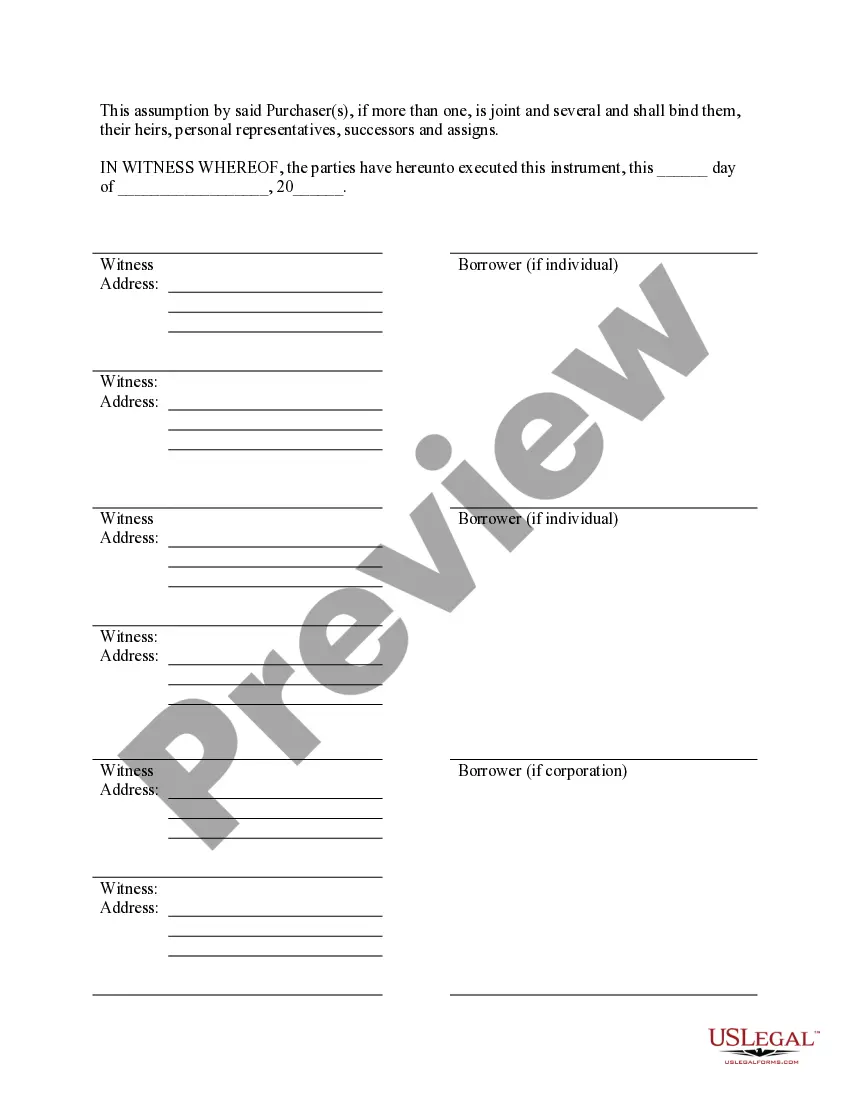

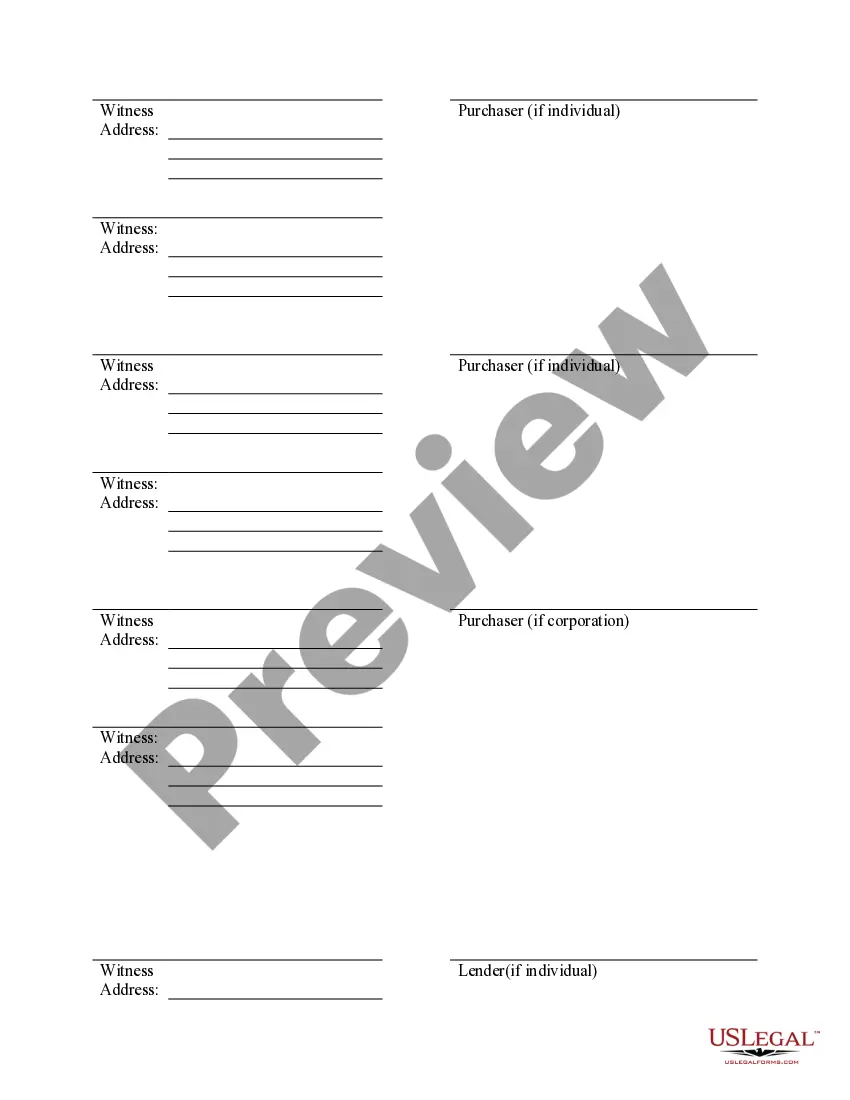

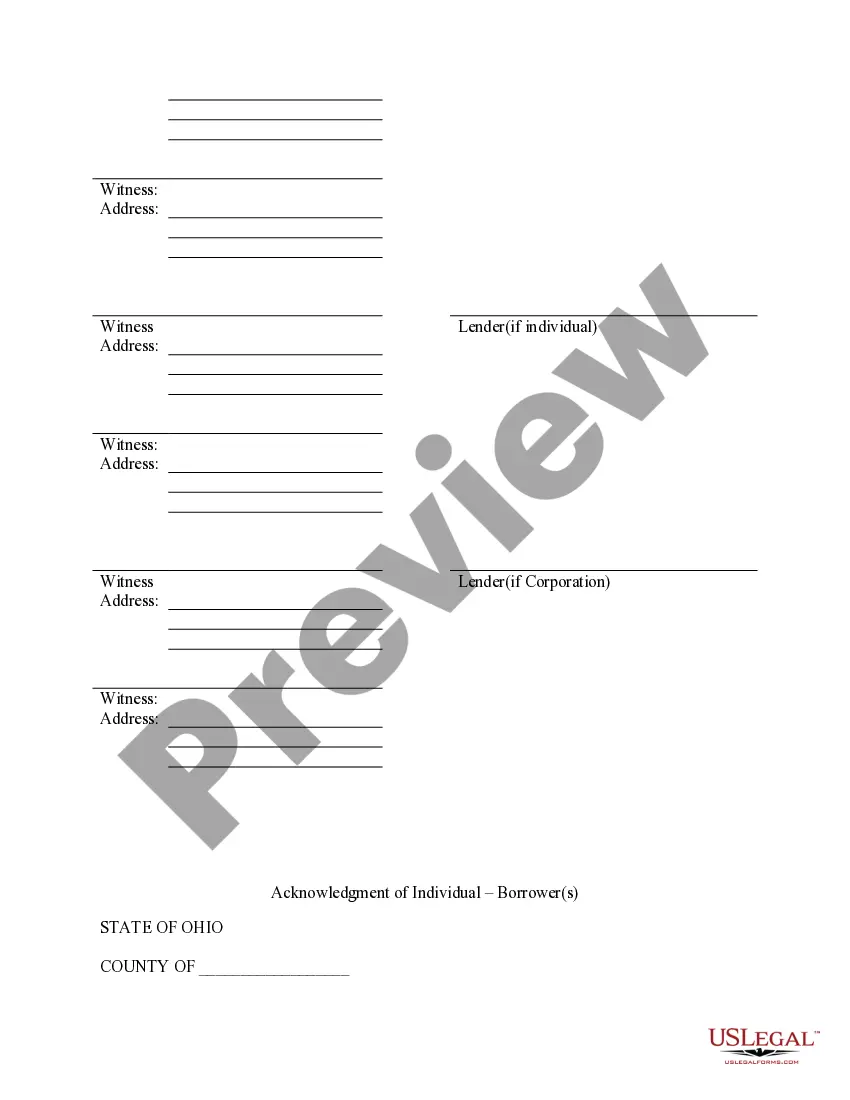

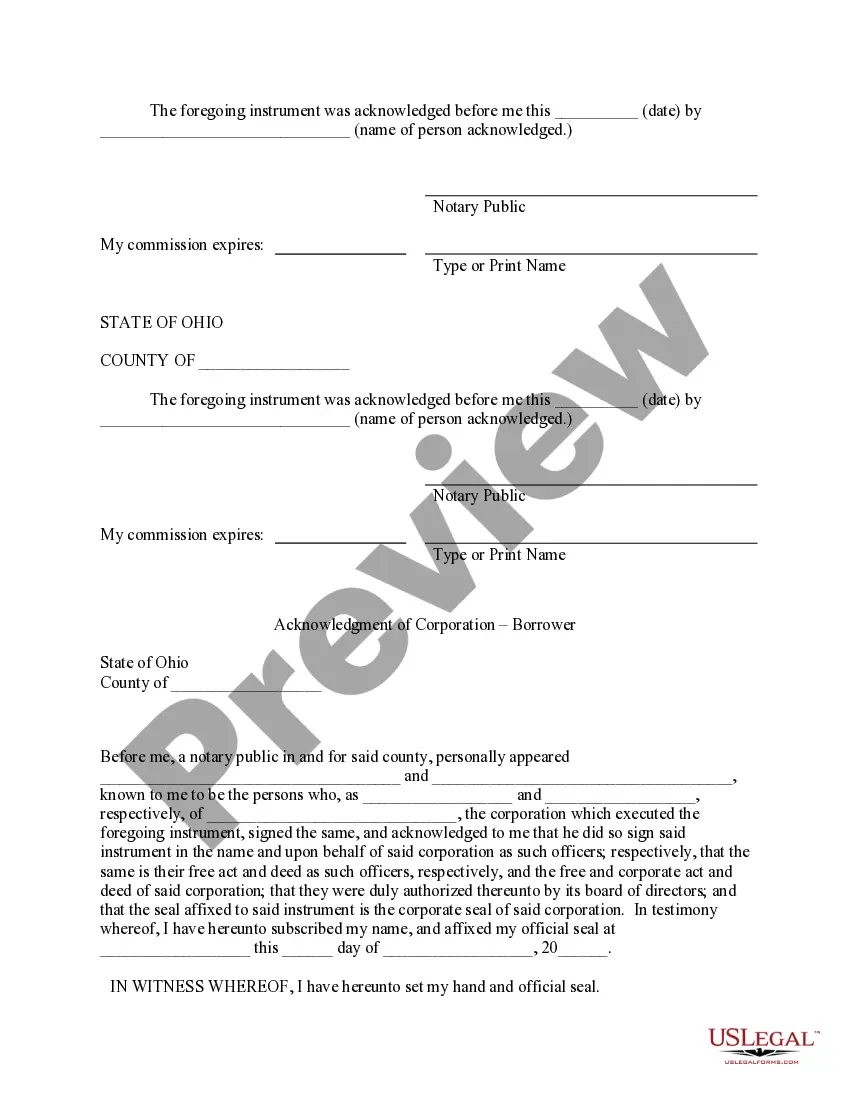

Filling out an assumption agreement involves several steps, starting with gathering the necessary information, including the mortgage details and personal information of both parties. Next, you need to clearly state the terms of the assumption and any conditions that must be met. Finally, both the buyer and the seller should sign the document to validate it. Using a trusted platform like USLegalForms can simplify this process, providing templates and guidance for creating a comprehensive assumption letter for mortgage.

An assumption letter for a mortgage is a document that allows a buyer to take over the seller's mortgage obligations. This letter outlines the terms of the mortgage and states that the buyer is responsible for the remaining payments. By creating this assumption letter for mortgage, both the seller and the lender confirm the buyer’s acceptance, ensuring everyone understands their roles in the transaction.

You can transfer a mortgage to another person if the terms of your mortgage say that it is assumable. If you have an assumable mortgage, the new borrower can pay a flat fee to take over the existing mortgage and become responsible for payment. But they'll still typically need to qualify for the loan with your lender.

To assume a mortgage, start by contacting the lender to make sure the mortgage is assumable, since many lenders prohibit buyers from taking over an existing mortgage. If the mortgage is assumable, you'll have to complete an application with information such as your income and the value of your assets.

A letter of assumption is essentially an agreement between a current homeowner and the prospective buyer that that prospective buyer will assume the payments of the current homeowner on the remainder of their mortgage.

The most important document in the loan assumption process is the deed of trust, which adds your name to the mortgage and absolves the original borrower of any obligations under the agreement, assuming a novation. All parties will be required to sign the final documents.