Amendment Living Trust With The Bank

Description

How to fill out Ohio Amendment To Living Trust?

- If you're an existing user, log in to your account and access your document library. Check your subscription status to ensure it’s current.

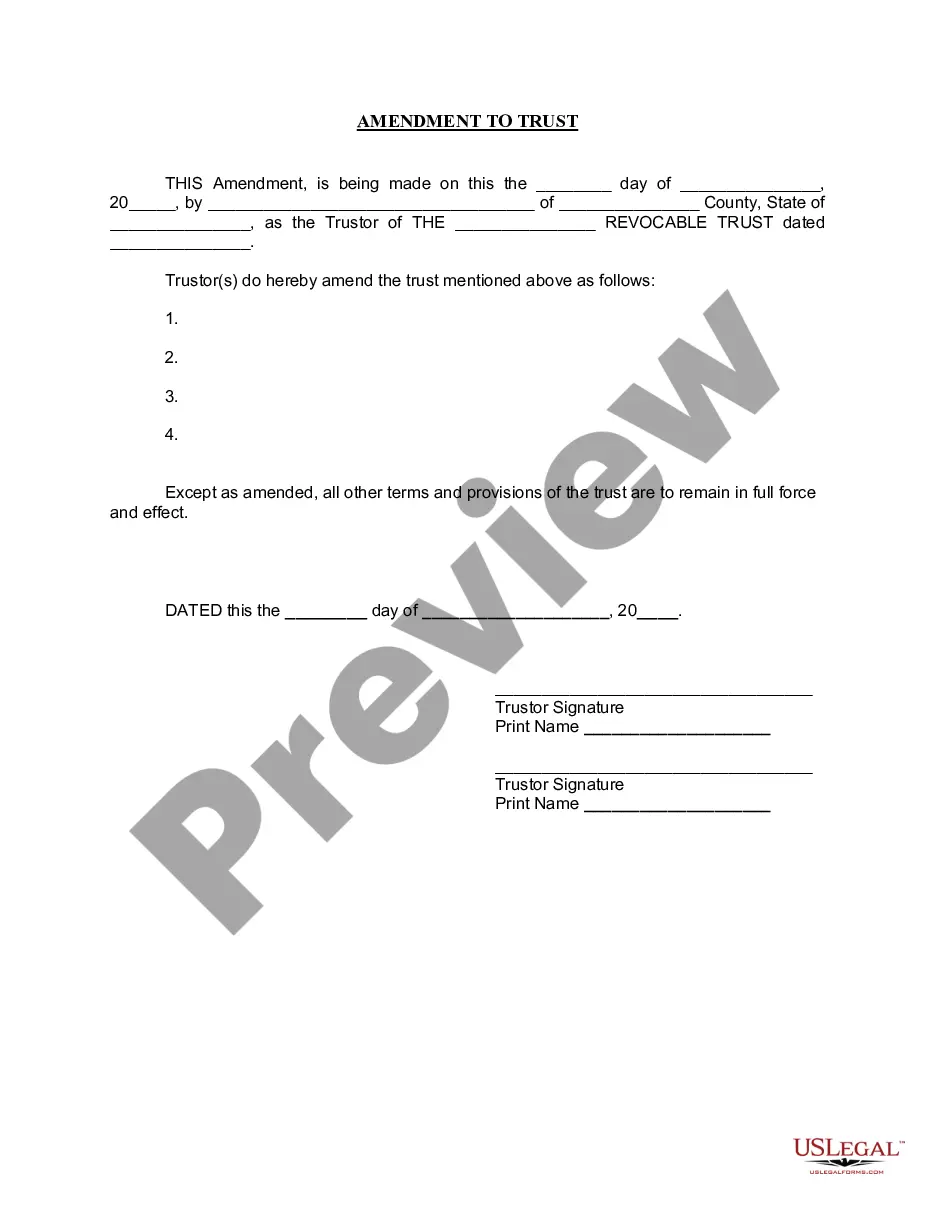

- For new users, start by reviewing the Preview mode of the desired living trust amendment template to ensure it aligns with your needs and local jurisdiction.

- If the template doesn’t fit your requirements, utilize the Search feature to find the correct form that suits your circumstances.

- Once you've found the appropriate document, select the Buy Now option, choose your subscription plan, and create an account to gain access to a wealth of forms.

- Complete your purchase using your credit card or PayPal, then download the form directly to your device.

- Access your saved document anytime through the My Forms section of your account.

By following these steps, amending your living trust with the bank can be a seamless process. US Legal Forms not only provides a robust collection of templates but also access to premium experts to ensure your documents are executed correctly.

Don’t hesitate—start your journey towards secure trust management today with US Legal Forms. Sign up now and streamline your legal documentation process!

Form popularity

FAQ

One of the biggest mistakes parents often make is not funding the trust adequately, which can lead to complications later. They may establish a trust, believing it will automatically distribute assets, but without proper funding, the trust will remain empty. To prevent this issue, regularly review and update your accounts held with the bank, making sure they're in line with your trust's provisions. An efficient way to manage your amendment living trust with the bank is to consult with professionals who can guide you through the funding process.

To amend a living trust, first, you need to create an amendment document that reflects your desired changes. After drafting this document, sign it in accordance with your state's legal requirements, which might include notarization. It's essential to inform your bank about the amendments, updating them ensures that your accounts align with the new terms. By following these steps, you can effectively manage your amendment living trust with the bank.

Amending a trust can be straightforward, especially if you follow the correct procedures. Typically, you will need to write a formal amendment document, which outlines the specific changes you want to make. Additionally, involving your bank can simplify the process, as they often provide guidance and resources that ensure a smooth transition. Remember, maintaining clarity in your amendment living trust with the bank will help avoid confusion down the line.

Placing your bank account in a living trust can avoid probate and ensure your assets are efficiently managed after your passing. However, you should weigh the benefits against the potential complexities of an amendment living trust with the bank. It's advisable to consult a legal or financial expert to determine the best course of action for your specific situation.

Certain bank accounts, like those intended for daily use or specific beneficiaries, may not need to be placed in a trust. Additionally, joint accounts or accounts with payable-on-death designations are typically excluded from trusts. Before deciding, it’s wise to review the pros and cons of an amendment living trust with the bank with a financial advisor.

The main downfall of having a trust is the complexity involved in its setup and maintenance. Trusts can require ongoing legal oversight and may have tax implications. Furthermore, creating an amendment living trust with the bank necessitates meticulous attention to ensure all assets are properly titled, which could become overwhelming without professional help.

While a family trust provides numerous benefits, one disadvantage is the potential for ongoing management and administrative costs. Moreover, families may face conflicts or disputes over trust management and asset distribution. If you are considering an amendment living trust with the bank, this can add another layer of complexity to the trust's administration.

Yes, putting bank accounts in a living trust can be beneficial, but it requires careful planning. An amendment living trust with the bank allows for smooth management and distribution of assets upon death. Still, it's essential to understand any restrictions that the financial institution may impose on such accounts.