Ohio Surviving Spouse Form Mn

Description

How to fill out Ohio Affidavit Of Surviving Spouse Or Joint Survivor?

Drafting legal paperwork from scratch can sometimes be intimidating. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for a more straightforward and more cost-effective way of creating Ohio Surviving Spouse Form Mn or any other forms without jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual collection of more than 85,000 up-to-date legal documents addresses virtually every aspect of your financial, legal, and personal affairs. With just a few clicks, you can instantly get state- and county-specific forms diligently prepared for you by our legal specialists.

Use our platform whenever you need a trusted and reliable services through which you can quickly find and download the Ohio Surviving Spouse Form Mn. If you’re not new to our website and have previously set up an account with us, simply log in to your account, select the template and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No problem. It takes minutes to set it up and explore the catalog. But before jumping directly to downloading Ohio Surviving Spouse Form Mn, follow these tips:

- Review the form preview and descriptions to ensure that you are on the the form you are searching for.

- Make sure the template you choose complies with the requirements of your state and county.

- Pick the best-suited subscription option to buy the Ohio Surviving Spouse Form Mn.

- Download the file. Then complete, sign, and print it out.

US Legal Forms has a good reputation and over 25 years of experience. Join us now and turn form completion into something easy and streamlined!

Form popularity

FAQ

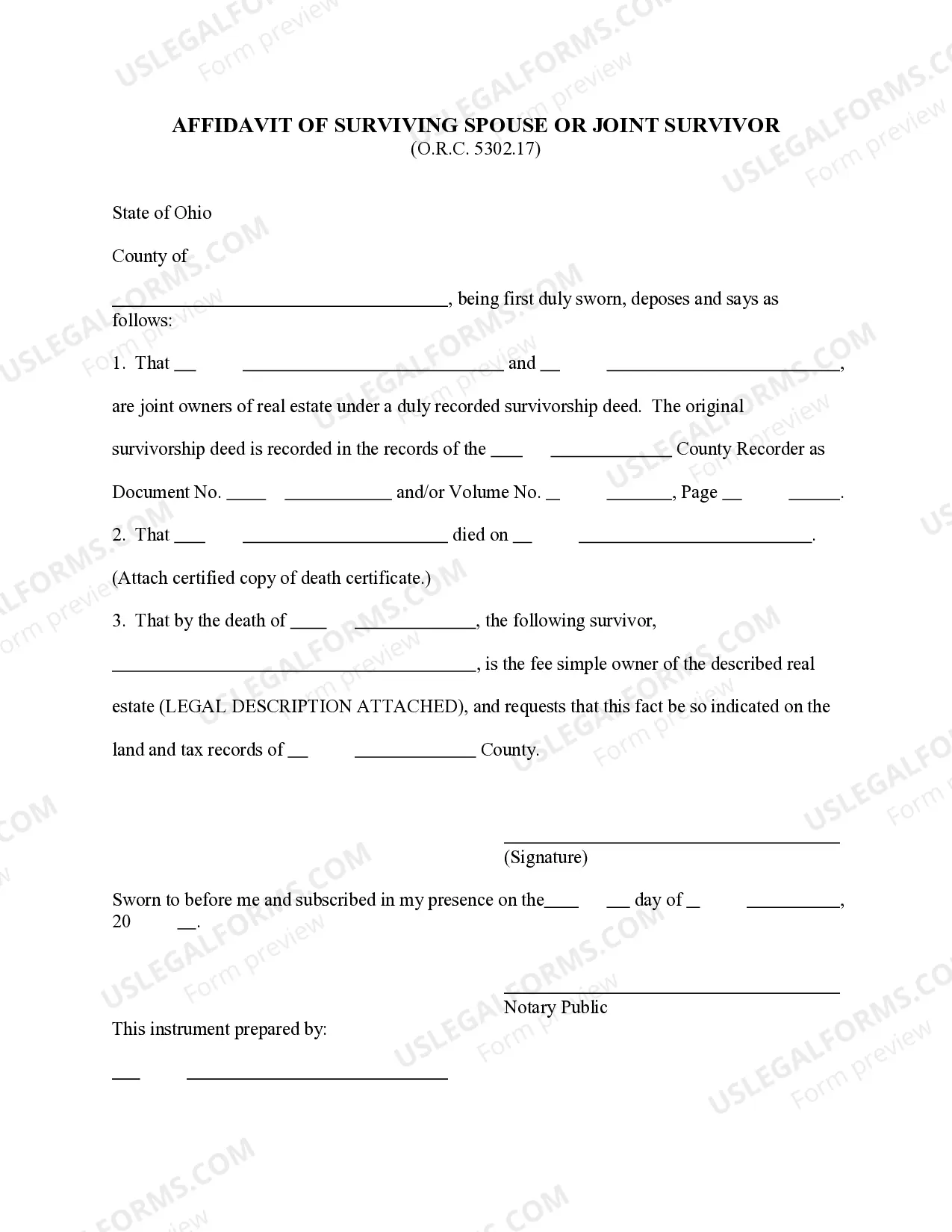

The Rights of a Surviving Spouse in Ohio If a person dies leaving a surviving spouse without any minor children, a surviving spouse and minor children, or minor children and no surviving spouse, these parties are entitled to receive $40,000 as an allowance for support.

Ing to Ohio's intestate laws, property is distributed as follows: If there is a surviving spouse, the entire estate will go to him or her unless there are children who are not the natural children of the surviving spouse, then the estate gets distributed differently.

Ing to Ohio's intestate laws, property is distributed as follows: If there is a surviving spouse, the entire estate will go to him or her unless there are children who are not the natural children of the surviving spouse, then the estate gets distributed differently.

For a Surviving Spouse, Most of the Estate Will Not Pass Through Probate. As a married couple, most of the property and assets you have are jointly owned. That means that when one of you dies, the other simply becomes the sole owner of the assets. This does not require any legal action or court involvement.

Ohio Probate: Eight Things to Do When Your Loved One Dies in Ohio Locate the decedent's Last Will and Testament. ... Find a local attorney who is familiar with Probate and Estate administration. ... Secure the decedent's assets. ... Review real property records. ... Review and keep the mail. ... Keep track of expenses.