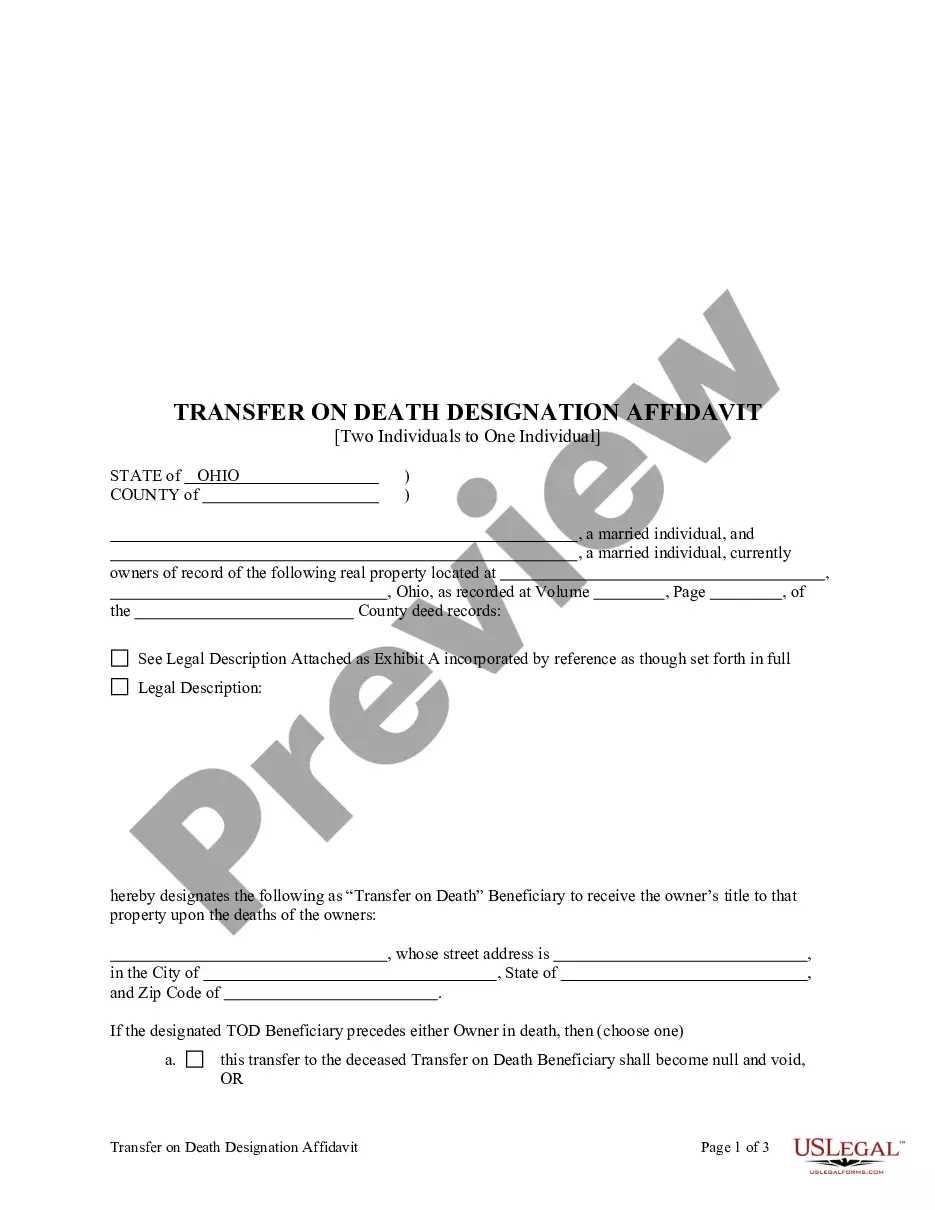

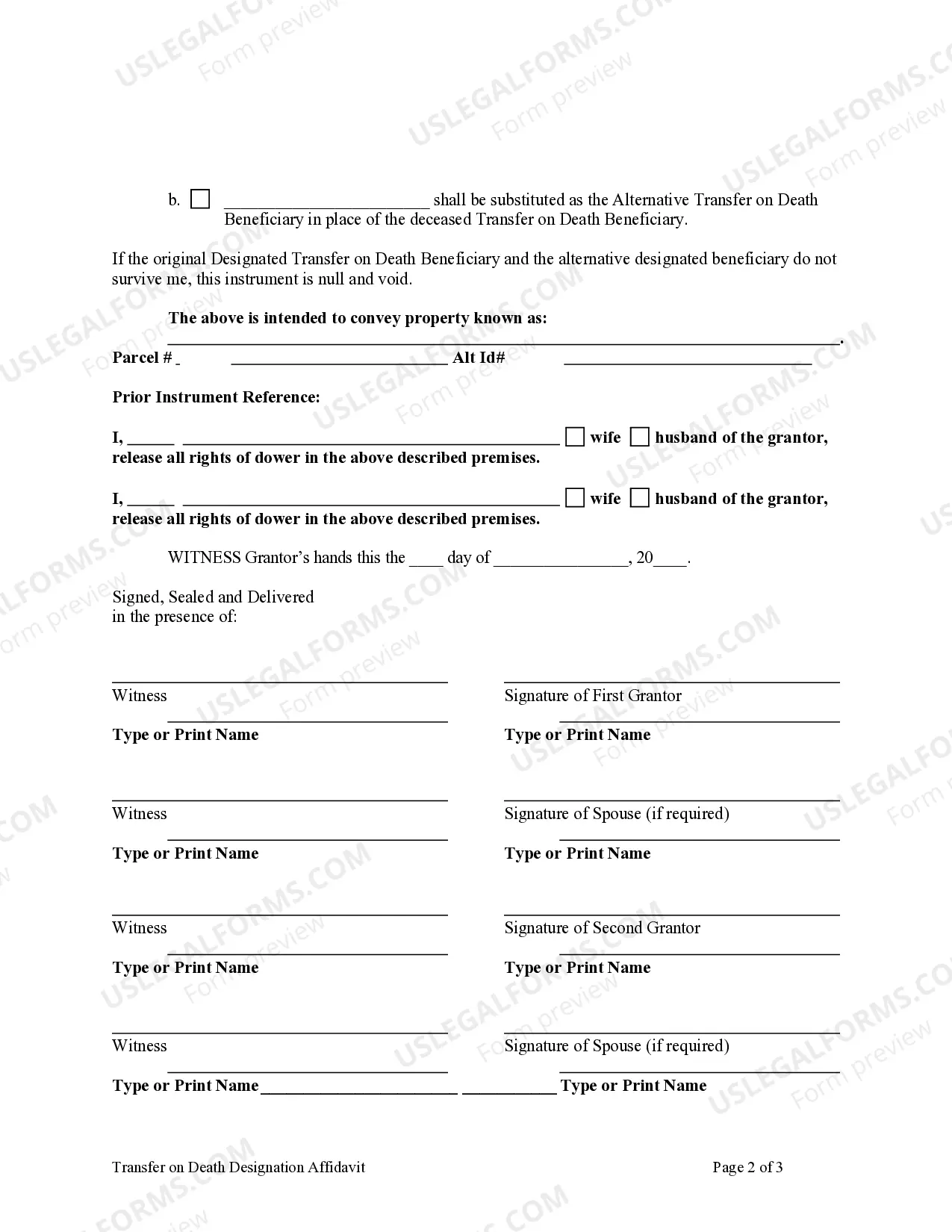

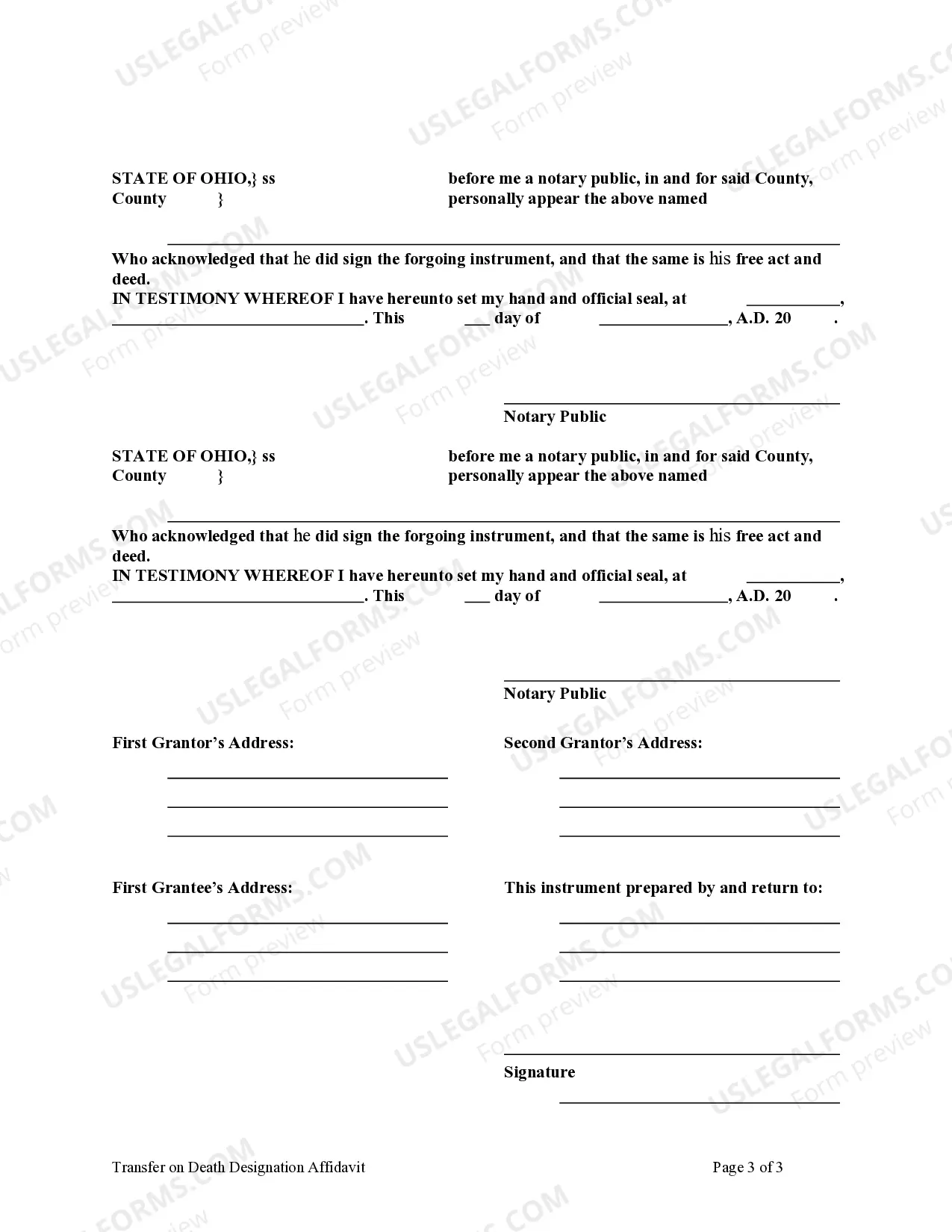

This affidavit is used to transfer the title of a parcel of land, attaching any existing covenants, upon the death of the Owners/Affiants to the designated beneficiary that survive the Owners/Affiants. It should be signed in front of a Notary Public. The form does NOT include provision for an alternate beneficiary in the event the designated beneficiary predeceases the owners. The designation of the beneficiary in an affidavit of transfer on death may be revoked or changed at any time, without the consent of that designated transfer on death beneficiary, by either owner of the interest by executing, in accordance with Chapter 5301 of the Ohio Revised Code and recording a transfer on death designation affidavit conveying the owner's entire, separate interest in the real property to one or more persons, including the Owner, with or without the designation of another transfer on death beneficiary.

Oh Transfer Tod With Chase Bank

Description

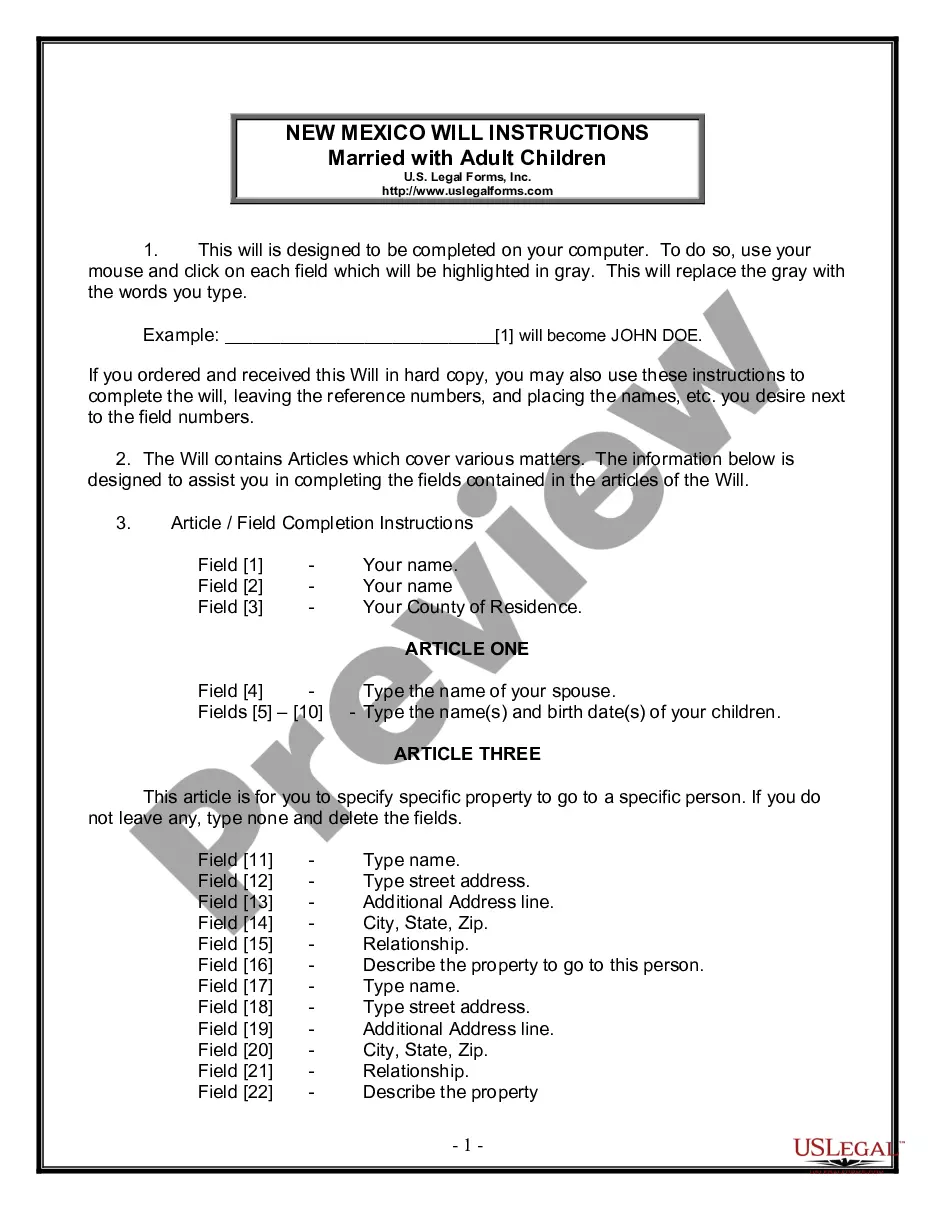

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Two Individuals To One Individual?

Locating a reliable source to obtain the most up-to-date and suitable legal templates is a significant part of navigating red tape.

Identifying the correct legal documents requires accuracy and meticulousness, which is why sourcing Oh Transfer Tod With Chase Bank solely from credible outlets, such as US Legal Forms, is crucial. An incorrect template can squander your time and delay your circumstances.

Eliminate the hassle associated with your legal documents. Explore the extensive US Legal Forms repository where you can find legal samples, evaluate their applicability to your circumstances, and download them immediately.

- Utilize the library navigation or search function to locate your document.

- Review the form's details to ensure it aligns with the stipulations of your state and locality.

- Access the form preview, if available, to confirm that the form is the one you seek.

- Continue your search and identify the appropriate template if the Oh Transfer Tod With Chase Bank does not satisfy your requirements.

- Once you are confident about the document’s applicability, download it.

- If you are an authorized user, click Log in to verify your identity and access your chosen forms in My documents.

- If you have yet to create an account, click Buy now to obtain the form.

- Select the pricing plan that suits your needs.

- Proceed to the registration to complete your purchase.

- Conclude your transaction by selecting a payment option (credit card or PayPal).

- Choose the format for downloading Oh Transfer Tod With Chase Bank.

- After obtaining the form on your device, you can edit it using the editor or print it and complete it by hand.

Form popularity

FAQ

Yes, you can put a Transfer on Death (TOD) designation on a bank account. This allows you to transfer assets directly to your chosen beneficiaries upon your passing. When you utilize the 'Oh transfer tod with Chase Bank' option, you streamline the process, ensuring your heirs receive their inheritance without unnecessary delays or complications. For guidance on setting this up, consider using US Legal Forms to navigate the paperwork with ease.

Adding a TOD to your bank account is straightforward. You can accomplish this by visiting your nearest Chase Bank or logging into your online banking account. Follow the procedures to fill out the designated form to add a beneficiary. This simple step allows for the Oh transfer tod with Chase Bank, ensuring your assets are transferred as you intend.

While both TOD accounts and traditional beneficiary designations serve to transfer assets, a TOD account specifically allows for assets to be transferred seamlessly without going through probate. However, in certain situations, a direct beneficiary can provide more immediate access to funds. Ultimately, which option is better depends on your personal circumstances and estate planning goals. Exploring the Oh transfer tod with Chase Bank may simplify your decision.

To put a TOD on your bank account, you can visit your Chase Bank branch or access your online banking account. The process typically involves filling out a simple form to designate a beneficiary. Ensure you have the necessary details, including the beneficiary's name and relationship. This setup facilitates the Oh transfer tod with Chase Bank when the time comes.

A Transfer on Death (TOD) account may not necessarily avoid inheritance tax, as this can depend on state laws and other factors. While it allows for a smooth transfer of assets outside of probate, your estate may still be subject to taxes. It’s wise to consult with a tax advisor or estate planner to understand the implications before utilizing the Oh transfer tod with Chase Bank.

Notifying Chase Bank of a death involves contacting their customer service or visiting a branch. You will need to provide documentation, such as the death certificate and proof of identity. After the notification, the bank can guide you through the process of accessing accounts held by the deceased. It is crucial to do this promptly when dealing with the Oh transfer tod with Chase Bank.

To set up a beneficiary for your Chase bank account, you can easily do this through online banking or by visiting a local branch. Just access the account services section, where you can add or change beneficiaries. Make sure to have the full name and information of your chosen individual. This ensures that you are prepared when considering the Oh transfer tod with Chase Bank.

One disadvantage of TOD accounts is that they can complicate estate planning, as they may not fit seamlessly into the overall strategy. Additionally, while they do allow for direct transfer, they do not provide protection against creditors. It’s also important to note that if you have a TOD setup, it may not transfer under your will, leading to potential disputes among heirs. Considering these aspects is vital if you plan to use the Oh transfer tod with Chase Bank.

To notify Chase Bank of a death, you should first gather essential documents such as the death certificate and any relevant account information. It's important to contact the bank’s customer service directly to report the death and provide the necessary details. They will guide you through the process for closing accounts or transferring assets, which may include the Oh transfer tod with Chase Bank to designated beneficiaries.

Making an ACH transfer with Chase Bank is easy and efficient. After logging into your account, head to the Transfers section, select the ACH transfer option, and input the necessary details for the transfer. You can enter the amount and choose the date of the transaction. By following these steps, you can complete an ACH transfer confidently, ensuring your funds move smoothly.