This is an official form from the New York State Unified Court, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by New York statutes and law.

Nys Surrogate Court Forms Receipt And Release With Waiver

Description

How to fill out New York Surrogate's Court Information?

The Nys Surrogate Court Forms Receipt And Release With Waiver displayed on this page is a reusable official template crafted by skilled attorneys in compliance with federal and local regulations.

For over 25 years, US Legal Forms has supplied individuals, organizations, and lawyers with more than 85,000 validated, state-specific documents for any business and personal circumstance. It’s the fastest, most straightforward, and most dependable method to acquire the paperwork you require, as the service ensures the utmost level of data security and anti-malware safeguards.

Subscribe to US Legal Forms to have validated legal templates for all of life’s scenarios readily available.

- Search for the document you require and examine it.

- Browse the file you searched and preview it or verify the form description to ensure it meets your requirements. If it doesn’t, utilize the search feature to find the correct one. Click Buy Now once you have identified the template you need.

- Select and Log In.

- Choose the pricing option that fits you and create an account. Use PayPal or a credit card to complete a swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Acquire the editable template.

- Choose the format you prefer for your Nys Surrogate Court Forms Receipt And Release With Waiver (PDF, DOCX, RTF) and download the example to your device.

- Complete and sign the document.

- Print the template to fill it out by hand. Alternatively, utilize an online multifunctional PDF editor to swiftly and accurately complete and sign your form with a valid signature.

- Download your documents again.

- Reutilize the same document whenever necessary. Access the My documents tab in your profile to redownload any previously obtained forms.

Form popularity

FAQ

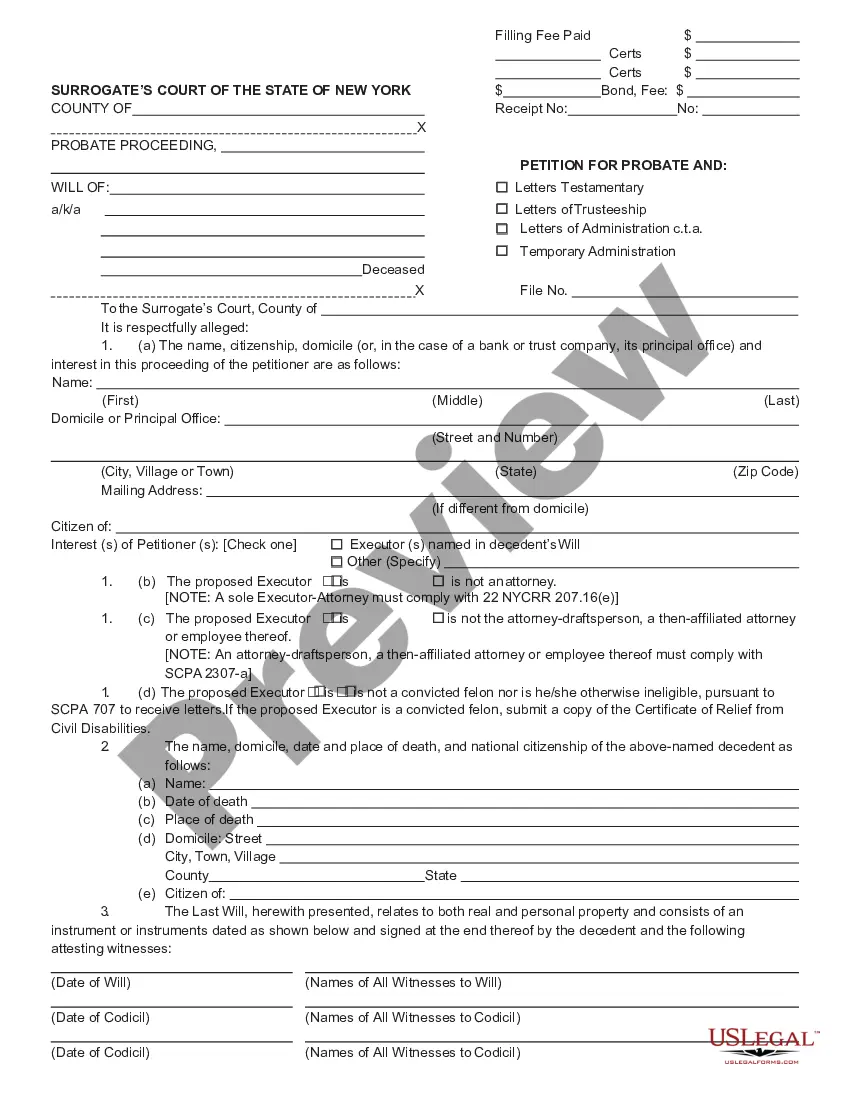

In New York, a waiver of process consent to probate allows interested parties to bypass the formal notification requirements in probate proceedings. This type of waiver can expedite the process, reducing delays in estate administration. For those looking to manage their legal obligations effectively, leveraging NYS surrogate court forms receipt and release with waiver can be a practical solution.

A waiver of process consent to probate in New York enables individuals to waive the right to receive formal service of process in probate matters. This means they agree to the probate proceedings without needing to be formally notified. This can streamline the process, making it easier for families to navigate estate matters using NYS surrogate court forms receipt and release with waiver.

A waiver of consent to probate is a legal document that allows an interested party to forgo receiving notifications about probate proceedings. This waiver signifies that the party agrees to the probate process without contesting the validity of the will. It's essential to understand this document's implications, especially when dealing with NYS surrogate court forms receipt and release with waiver.

To obtain a waiver of documentation of consent in New York, you must provide a clear statement indicating that you are relinquishing your right to receive paperwork regarding probate proceedings. This waiver must be signed by all interested parties, ensuring that there is no dispute about consent. Utilizing NYS surrogate court forms receipt and release with waiver can simplify this process and ensure compliance with state laws.

Surrogate courts and probate courts often serve similar functions, but they are not identical. A surrogate court specifically handles matters related to the administration of estates, including the management of wills and the appointment of guardians for minors. In contrast, a probate court typically oversees the validation of wills and the distribution of assets. Understanding the distinction is crucial when dealing with NYS surrogate court forms receipt and release with waiver.

A waiver of consent means that an individual relinquishes their right to receive formal notification regarding the probate proceedings. This allows the process to move forward without delays caused by notifying all interested parties. Utilizing Nys surrogate court forms receipt and release with waiver can help you navigate this aspect of probate smoothly and effectively.

A waiver of process consent to probate form is a specific document that individuals sign to acknowledge their consent to the probate process. This form eliminates the need for the court to provide formal notice, making the process quicker and more efficient. By using Nys surrogate court forms receipt and release with waiver, you can easily obtain the necessary documentation to facilitate this step.

A waiver of process consent to probate is a legal document that allows individuals to consent to the probate process without requiring formal notice. This waiver can simplify the proceedings, as it indicates that the person agrees to the terms and conditions of the probate. When using Nys surrogate court forms receipt and release with waiver, you can ensure compliance with New York's legal requirements.

To remove an executor from a petition in New York, you must file a motion with the surrogate court. You should provide valid reasons for the removal, such as misconduct or incapacity. Utilizing Nys surrogate court forms receipt and release with waiver can streamline this process and help you document your request clearly.

Section 207.4 of the New York Court Rules addresses the requirements for filing certain court documents, including the use of Nys surrogate court forms receipt and release with waiver. This section outlines the necessary steps for ensuring that all filings meet legal standards and are processed efficiently. Understanding this section is crucial for anyone navigating the probate process in New York.