New York Professional Ny Withholding

Description

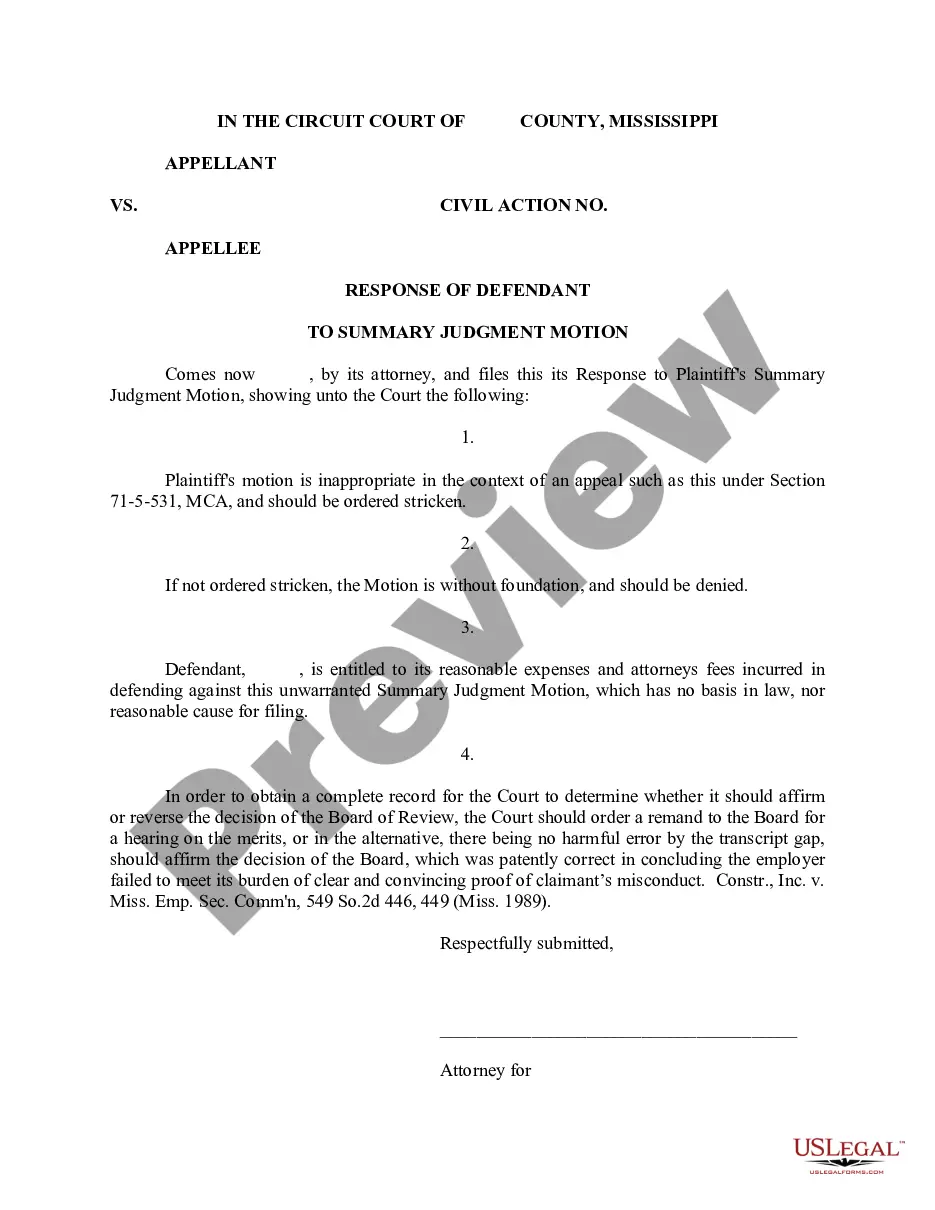

How to fill out Sample Bylaws For A New York Professional Service Corporation?

Finding a go-to place to access the most current and relevant legal samples is half the struggle of working with bureaucracy. Discovering the right legal documents requirements precision and attention to detail, which explains why it is very important to take samples of New York Professional Ny Withholding only from reputable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to worry about. You can access and see all the information regarding the document’s use and relevance for your situation and in your state or county.

Consider the listed steps to complete your New York Professional Ny Withholding:

- Make use of the catalog navigation or search field to find your template.

- Open the form’s description to see if it fits the requirements of your state and county.

- Open the form preview, if there is one, to make sure the template is definitely the one you are searching for.

- Go back to the search and look for the appropriate document if the New York Professional Ny Withholding does not match your needs.

- When you are positive regarding the form’s relevance, download it.

- If you are a registered user, click Log in to authenticate and access your selected forms in My Forms.

- If you do not have a profile yet, click Buy now to obtain the form.

- Choose the pricing plan that suits your preferences.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by picking a transaction method (bank card or PayPal).

- Choose the document format for downloading New York Professional Ny Withholding.

- When you have the form on your gadget, you can change it using the editor or print it and complete it manually.

Remove the hassle that comes with your legal documentation. Discover the extensive US Legal Forms library where you can find legal samples, check their relevance to your situation, and download them on the spot.

Form popularity

FAQ

California law requires withholding when a person (an individual, business entity, trust, or estate) sells California real property unless the seller qualifies for an exemption.

Your New York Withholding Identification Number will match your nine digit (XX-X) Federal Employment Identification Number (EIN). This information will auto-populate in the New York Withholding Identification Number field when you enter your EIN.

New York has a progressive income tax that ranges from 4 to 8.82 percent depending on an employee's earnings. A 9.62 percent withholding rate is applied to any additional commissions or bonuses.

All employers required to withhold tax from wages must file Form NYS-45, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, each calendar quarter. If you withhold less than $700 during a calendar quarter, remit taxes withheld with your quarterly return, Form NYS-45.

Register your business for income withholding and unemployment tax on the New York Department of Labor website. (Registering with the New York Department of Labor will automatically register you for the New York Department of Taxation and Finance as well.)