New York Small Business New York Withdrawal

Description

How to fill out New York Small Business Startup Package?

Whether for corporate objectives or personal issues, everyone must confront legal circumstances at some point in their lives.

Completing legal documents requires meticulous care, starting with choosing the correct form template.

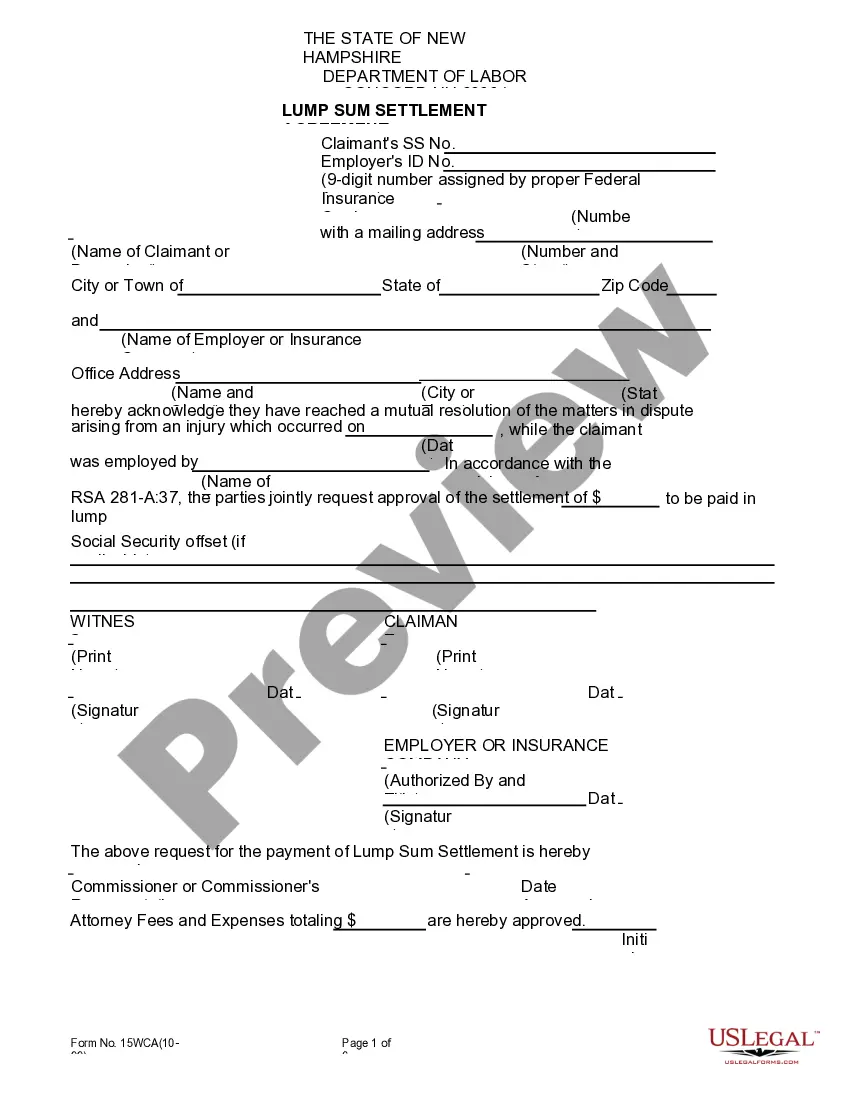

Complete the account sign-up form. Choose your payment method: utilize a credit card or PayPal account. Select the file format you prefer and download the New York Small Business New York Withdrawal. After it is saved, you can fill out the form with editing software or print it and complete it manually. With a vast US Legal Forms catalogue available, you don't need to waste time searching for the correct template online. Utilize the library’s user-friendly navigation to discover the suitable template for any situation.

- For instance, if you choose an incorrect version of a New York Small Business New York Withdrawal, it will be denied upon submission.

- Thus, it is crucial to have a trustworthy source of legal documents like US Legal Forms.

- If you need to acquire a New York Small Business New York Withdrawal template, follow these straightforward steps.

- Obtain the template you require by utilizing the search function or catalogue browsing.

- Review the description of the form to ensure it aligns with your situation, state, and locality.

- Click on the form’s preview to examine it.

- If it is the incorrect document, revert to the search feature to find the New York Small Business New York Withdrawal template you need.

- Acquire the template if it suits your requirements.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you do not have an account yet, you may secure the form by clicking Buy now.

- Select the appropriate pricing option.

Form popularity

FAQ

If you fail to file your New York biennial statement, you won't be charged any late fees and New York will not administratively dissolve your LLC. Instead, the New York Department of State will change your LLC's status to ?past due,? meaning you'll lose your good standing.

Complete the process by filing with the New York Department of State written consent from the Tax Department (Form TR-960, Consent to Dissolution of a Corporation); one Certificate of Dissolution; and. a check for $60 payable to the New York Department of State.

Closing/Dissolving a Business Notify government agencies that you are dissolving your business; Notify all lenders and creditors and settle any remaining debts; Collect all the money the business is owed (accounts receivables) or sell off any outstanding judgments, claims, and debts owed to the business;

Complete and file the Articles of Dissolution with the Department of State. The completed Articles of Dissolution, together with the statutory fee of $60, should be forwarded to: New York Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.