Ny Hiring Form For Employees

Description

How to fill out New York Employment Hiring Process Package?

Whether for commercial reasons or personal concerns, everyone must deal with legal circumstances at some stage in their life.

Filling out legal documents demands meticulous attention, starting with selecting the correct form sample. For instance, if you select an incorrect version of the Ny Hiring Form For Employees, it will be rejected when you submit it. Thus, it is vital to have a trustworthy source of legal documents like US Legal Forms.

With an extensive US Legal Forms catalog available, you never have to waste time searching for the correct template online. Use the library’s straightforward navigation to find the right template for any occasion.

- Locate the template you require using the search bar or catalog browsing.

- Review the form’s details to ensure it fits your scenario, state, and county.

- Click on the form’s preview to inspect it.

- If it is not the correct form, return to the search feature to find the Ny Hiring Form For Employees sample you need.

- Download the document if it fulfills your criteria.

- If you possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: utilize a credit card or PayPal account.

- Select the desired file format and download the Ny Hiring Form For Employees.

- After it is saved, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

New hires need to fill out several key documents to ensure a smooth start. These include the W-4 form for tax withholding and the I-9 form for verifying their eligibility to work in the U.S. Additionally, completing the NY hiring form for employees is crucial for compliance with local regulations. Make sure to provide clear instructions and support to help new hires complete these forms accurately.

New hire paperwork in NY typically consists of several forms that help you manage employee information and comply with state laws. This includes the W-4 form for tax purposes, the I-9 form for employment verification, and the NY hiring form for employees. Additionally, you may need to provide employee handbooks and benefits enrollment forms. Proper management of these documents streamlines the onboarding process.

When bringing on a new hire in NY, you need several important documents. These include the W-4 form for tax withholding, the I-9 form to verify employment eligibility, and any additional company-specific forms. Completing the NY hiring form for employees is also essential for proper record-keeping. This paperwork ensures both compliance and smooth onboarding.

To hire an employee in NY, begin by defining the job role and requirements. Next, you should post the job listing on various platforms, including your company website and job boards. Once you receive applications, screen candidates through interviews and background checks. Finally, ensure you complete the NY hiring form for employees to remain compliant with state regulations.

9 form. An 9 form is used to verify an employee's identity and eligibility to work within the United States.

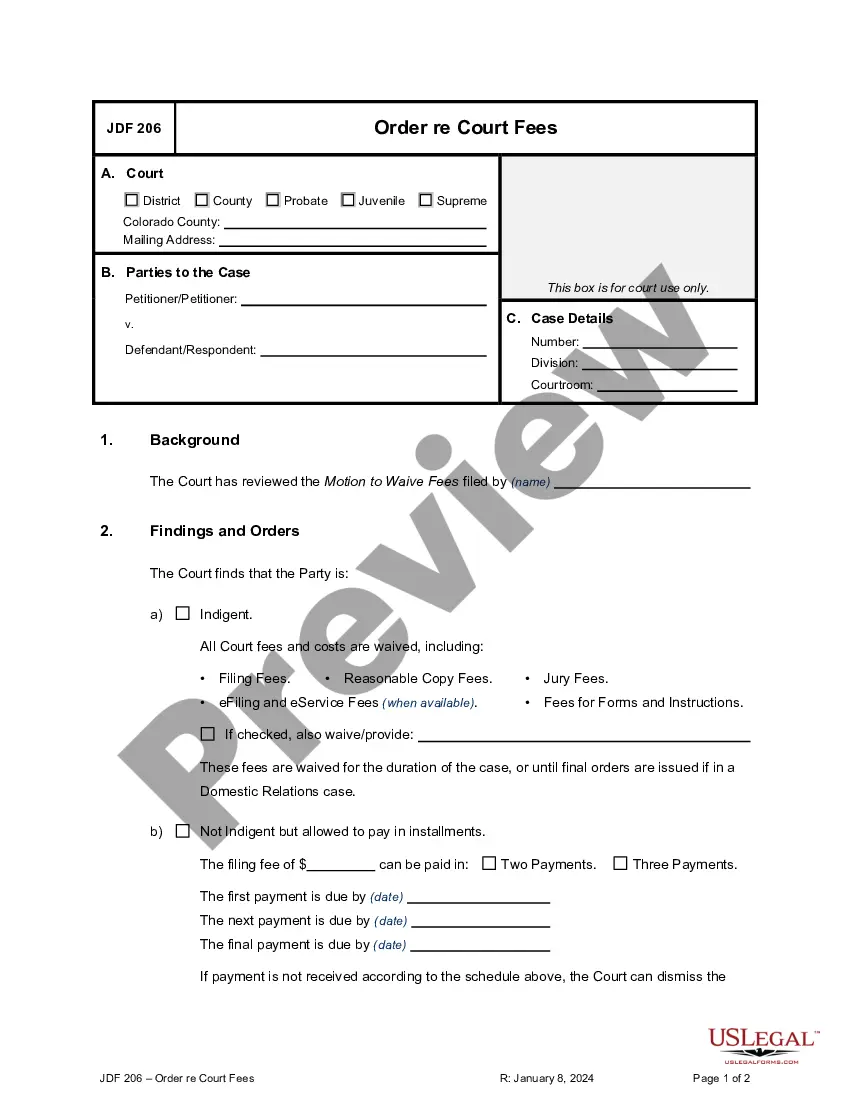

The Checklist to give you a quick snapshot on one page. I-9 Form for verifying an employee's eligibility to work in the United States. W-4 Form to set up federal income tax withholding. IT-2104 Form to set up New York State income tax withholding. Direct Deposit Form to set up direct deposit payments.

The most common types of employment forms to complete are: W-4 form (or W-9 for contractors) I-9 Employment Eligibility Verification form. State Tax Withholding form.

You must report newly hired or rehired employees who will be employed in New York State within 20 calendar days from the hiring date. The hiring date is the first day the employee: performs any services for which they will be paid wages, tips, commissions, or any other type of compensation, or.

Step 1: Take care of logistics. ... Step 2: Understand your hiring costs and tax liability. ... Step 3: Check New York state labor laws. ... Step 4: Fill out the New York new hire reporting form and distribute forms to the employee. ... Step 5: Set up your payroll system. ... Step 6: Display New York labor law posters and required notices.