New York Attorney New York Withholding

Description

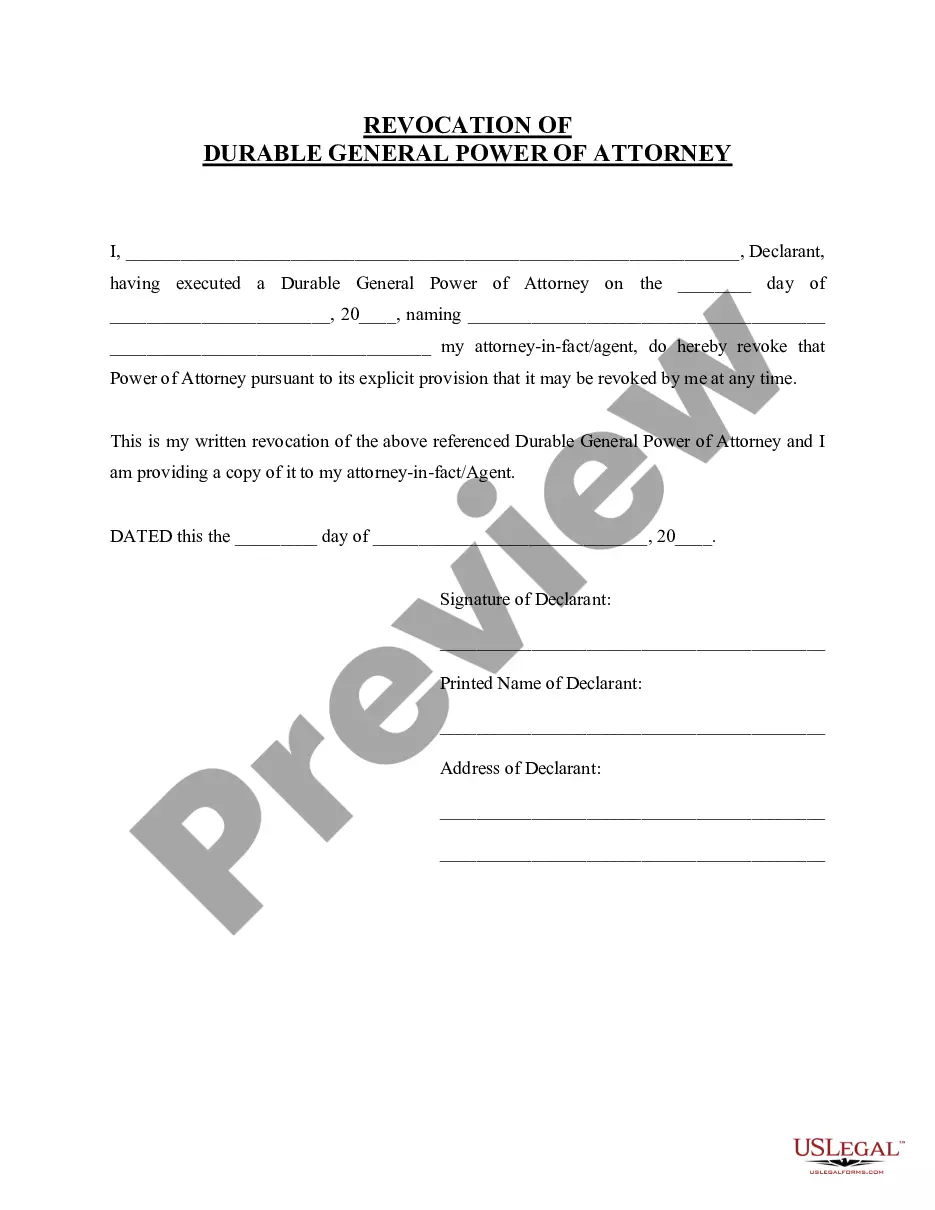

How to fill out New York Revocation Of Statutory Power Of Attorney?

It’s well known that you cannot instantly become a legal authority, nor can you understand how to swiftly prepare New York Attorney New York Withholding without having a specific expertise.

Compiling legal documents is a lengthy journey that demands distinct education and abilities. So why not let the professionals handle the drafting of the New York Attorney New York Withholding.

With US Legal Forms, one of the most comprehensive legal document repositories, you can find everything from judicial paperwork to templates for internal communication.

You can revisit your documents from the My documents section at any moment. If you’re a returning client, you can easily Log In and locate and download the template from the same section.

Regardless of your paperwork's purpose—be it financial, legal, or personal—our site has you taken care of. Experience US Legal Forms now!

- Locate the document you need using the search function at the top of the page.

- View it (if this option is available) and read the accompanying description to see if New York Attorney New York Withholding matches your needs.

- Restart your search if you require another template.

- Create a free account and select a subscription plan to buy the template.

- Select Buy now. After the payment is processed, you can obtain the New York Attorney New York Withholding, complete it, print it, and send or deliver it to the intended recipients or organizations.

Form popularity

FAQ

The state as a whole has a progressive income tax that ranges from 4. % to 10.9%, depending on an employee's income level. There is also a supplemental withholding rate of 11.70% for bonuses and commissions.

For NYS/NYC/Yonkers taxes: the IT-2104 Employee's Withholding Allowance Certificate form filed with the NY State Department of Taxation and Finance.

New York State payroll taxes for 2023 Calculating taxes in New York is a little trickier than in other states. The state as a whole has a progressive income tax that ranges from 4. % to 10.9%, depending on an employee's income level. There is also a supplemental withholding rate of 11.70% for bonuses and commissions.

Your New York Withholding Identification Number will match your nine digit (XX-X) Federal Employment Identification Number (EIN). This information will auto-populate in the New York Withholding Identification Number field when you enter your EIN.

New York has a progressive income tax that ranges from 4 to 8.82 percent depending on an employee's earnings. A 9.62 percent withholding rate is applied to any additional commissions or bonuses.