New York Trustee Withholding Tax

Description

Form popularity

FAQ

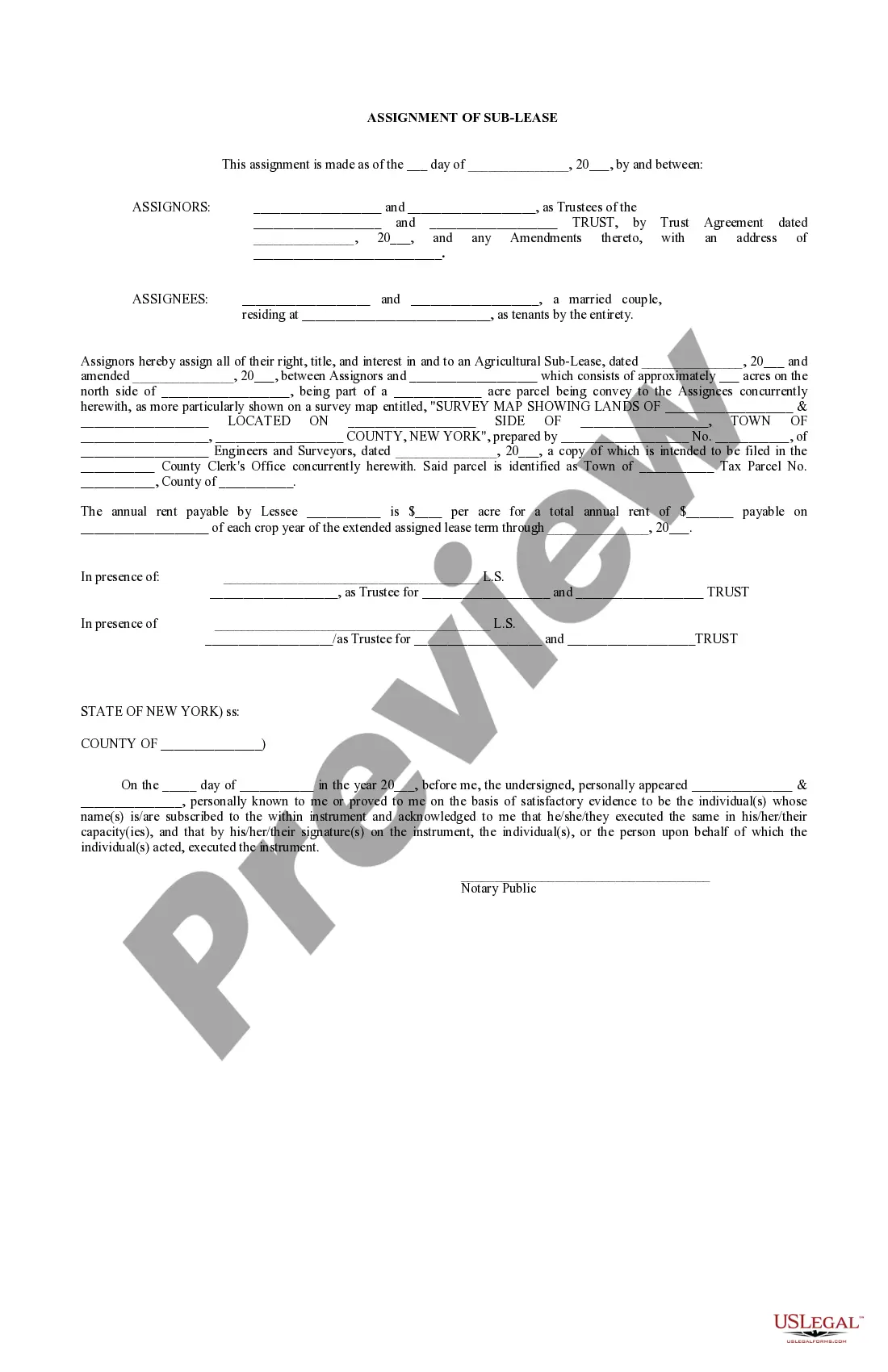

Trustees are subject to tax regulations depending on the type of trust and the income it generates. In many cases, the income distributed to beneficiaries may be taxed at their personal tax rates, while the trust itself may have different tax liabilities. Understanding the nuances of New York trustee withholding tax can help trustees navigate their responsibilities, ensuring compliance and effective financial planning.

Exemptions from New York state income tax withholding typically apply to individuals whose taxable income does not meet the state's minimum threshold. Additionally, certain religious organizations or specific categories of income may qualify for exclusion. Working with resources like USLegalForms can clarify your exemption status and streamline any necessary documentation regarding New York trustee withholding tax.

Exemption from New York tax withholding generally pertains to individuals who do not owe taxes based on their income levels or specific types of income they receive. Common exemptions include non-profit organizations and certain government-related entities. To navigate these complexities, leveraging platforms like USLegalForms can simplify the application process for your exemptions and ensure compliance with New York trustee withholding tax rules.

Individuals not subject to New York trustee withholding tax include those whose income does not reach the minimum threshold for taxation. Additionally, certain organizations, such as non-profit entities, may also be excluded from withholding requirements. It is wise to evaluate your income sources and consult tax authorities or professionals for clarity regarding your specific situation.

A person is typically considered tax exempt if they meet specific conditions set forth by tax regulations. This can include individuals who receive certain types of income or those who fall under specific exemptions, such as non-profit organizations. Understanding New York trustee withholding tax can help highlight whether you fall into such categories, ensuring you are not subject to unnecessary withholdings.

To qualify for exemption from New York trustee withholding tax, you must meet specific criteria outlined by the IRS and New York State. Generally, individuals who do not have a tax liability or whose income falls below certain thresholds may be eligible. It is essential to review your financial situation and consult tax professionals to ensure compliance with the requirements. Engaging with trusted resources can help clarify your eligibility.

Yes, you can file an amended NYS PTET return using Form TR-560-X. This form allows you to correct any errors in your original PTET filing, ensuring accuracy and compliance. Given the complexities that might arise, consulting resources like US Legal Forms could provide you with valuable guidance in addressing matters related to New York trustee withholding tax.

To report PTET on your New York tax return, you will include it on your Form IT-201 as an addition. Ensure that you provide accurate figures and any relevant documentation to support your claim. For assistance in navigating this requirement, consider leveraging platforms like US Legal Forms that can guide you through specific details pertaining to the New York trustee withholding tax.

A trustee typically files taxes using Form 1041, the U.S. Income Tax Return for Estates and Trusts. This form reports income, deductions, and tax credits that apply to the estate or trust, which may include aspects of the New York trustee withholding tax. Trustees must ensure they maintain accurate records of all transactions to support their filings.

To file an amended New York State return, you will use Form IT-201-X, which is meant for adjustments to your personal income tax. Completing this form allows you to correct any errors from your original submission, including issues related to the New York trustee withholding tax. It's advisable to consult with tax professionals if you need assistance throughout this process to avoid complications.