New York Small Estate Forms

Description

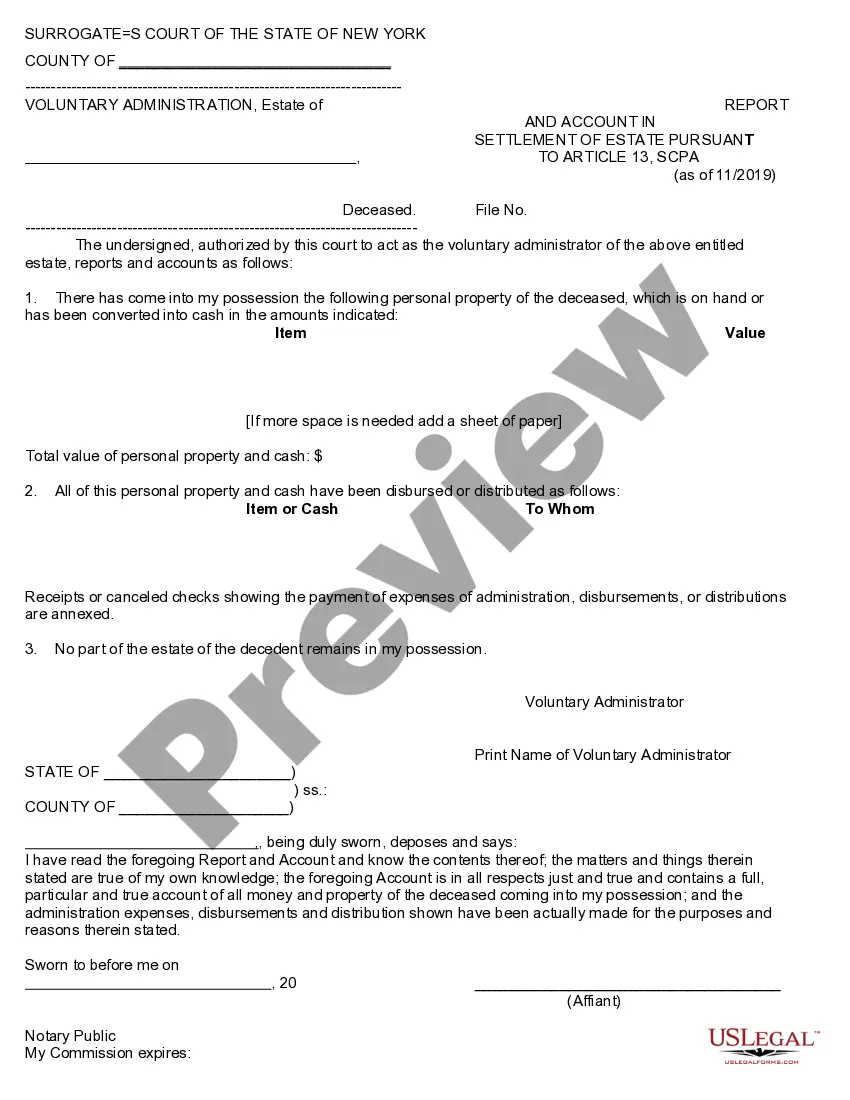

How to fill out Report And Account To Settle Small Estate In New York?

When you need to fill out New York Small Estate Forms that adhere to your local state's laws and regulations, there may be various choices to select from.

There's no need to scrutinize every form to verify it meets all the legal requirements if you are a US Legal Forms subscriber.

It is a reliable service that can assist you in acquiring a reusable and updated template on any topic.

Navigating expertly crafted official documents becomes simple with US Legal Forms. Furthermore, Premium users can also benefit from the robust integrated tools for online PDF editing and signing. Try it out today!

- US Legal Forms is the most extensive online catalog with a collection of over 85k ready-to-use documents for business and personal legal situations.

- All templates are verified to comply with each state's regulations.

- Thus, when downloading New York Small Estate Forms from our website, you can be assured that you possess a valid and current document.

- Obtaining the necessary sample from our platform is extremely straightforward.

- If you already have an account, simply Log In to the system, ensure your subscription is valid, and save the selected file.

- In the future, you can access the My documents tab in your profile and have access to the New York Small Estate Forms at any time.

- If it's your first interaction with our website, please adhere to the instructions below.

Form popularity

FAQ

Yes, there are generally time limits for settling an estate in New York, typically varying based on the complexity of the estate. While smaller estates can often be settled more quickly using New York small estate forms, larger estates may take longer. It is important to act promptly to ensure that assets are distributed correctly and that you comply with legal requirements. Always check current guidelines to stay informed about specific deadlines.

You do not necessarily need a lawyer to settle an estate in New York, especially if it qualifies as a small estate. Many individuals successfully handle these matters on their own, particularly when using New York small estate forms which provide clear guidelines. However, consulting a lawyer can be beneficial for complex situations or when there are disputes among heirs. Ultimately, the choice depends on your comfort level and the estate's complexity.

Yes, New York does provide a small estate affidavit for settling estates that meet certain criteria. Typically, if the total value of the estate is below a specific threshold, you may use this form to expedite the process. This form simplifies the handling of small estates by allowing heirs to collect debts and assets without formal probate. Using New York small estate forms can help you navigate the settlement efficiently.

Filling out a small estate form in New York is straightforward but requires attention to detail. Start by gathering necessary information, including the details of the deceased and a list of their assets. Carefully complete the form, ensuring all sections are filled accurately. Should you need assistance, platforms like USLegalForms offer easy access to New York small estate forms and additional guidance to make this process seamless.

In New York, an estate must be worth more than $50,000 in personal property to necessitate probate. This threshold means that if your estate doesn't exceed this amount, you may use simpler procedures instead. Understanding this limit can save you time and resources. For estates below this value, New York small estate forms are a useful option to consider.

Avoiding probate in New York can be achieved by utilizing various estate planning strategies. One effective method is to establish revocable living trusts, which allow assets to pass directly to beneficiaries. Additionally, naming beneficiaries on accounts and holding assets jointly can also bypass probate. Using New York small estate forms is another efficient way to handle smaller estates without the need for court involvement.

The minimum estate value for probate in New York is $50,000 for personal assets. This means if your estate exceeds this amount, you will likely need to go through the probate process. Always consider the composition of your estate, as real property may not contribute to this threshold. If your estate falls below this value, New York small estate forms could help streamline the process.

In New York, the minimum amount that triggers the need for probate is $50,000 for personal property. If the estate consists mainly of real estate, there is no minimum value that requires probate. It is important to understand these thresholds to determine if you need to proceed with probate. Utilizing New York small estate forms may provide an alternative solution if your estate is below this limit.

In New York, a small estate affidavit generally does not require filing with the court. Instead, this form allows you to transfer property without going through the probate process. However, you must present the affidavit to institutions holding the assets, such as banks or other financial entities. To ensure you are following the correct steps, using New York small estate forms can be very helpful.

A 1310 form in New York is a specific document used when applying for the release of assets under the small estate provisions. This form allows heirs to claim property without going through probate. Properly completing the New York small estate forms, including the 1310, can simplify asset transfer and ensure compliance with state laws.