Employee Law State Withholding Allowance Certificate

Description

How to fill out New York Guidelines For Written Notice Of Rates Of Pay And Regular Payday?

Creating legal documents from the ground up can occasionally feel somewhat daunting.

Certain cases may require numerous hours of investigation and significant sums of money.

If you are seeking a simpler and more cost-effective method for generating the Employee Law State Withholding Allowance Certificate or any other documents without unnecessary complications, US Legal Forms is always accessible.

Our online repository of over 85,000 current legal documents covers nearly every element of your financial, legal, and personal matters. With just a few clicks, you can quickly obtain state- and county-specific forms expertly prepared by our legal professionals.

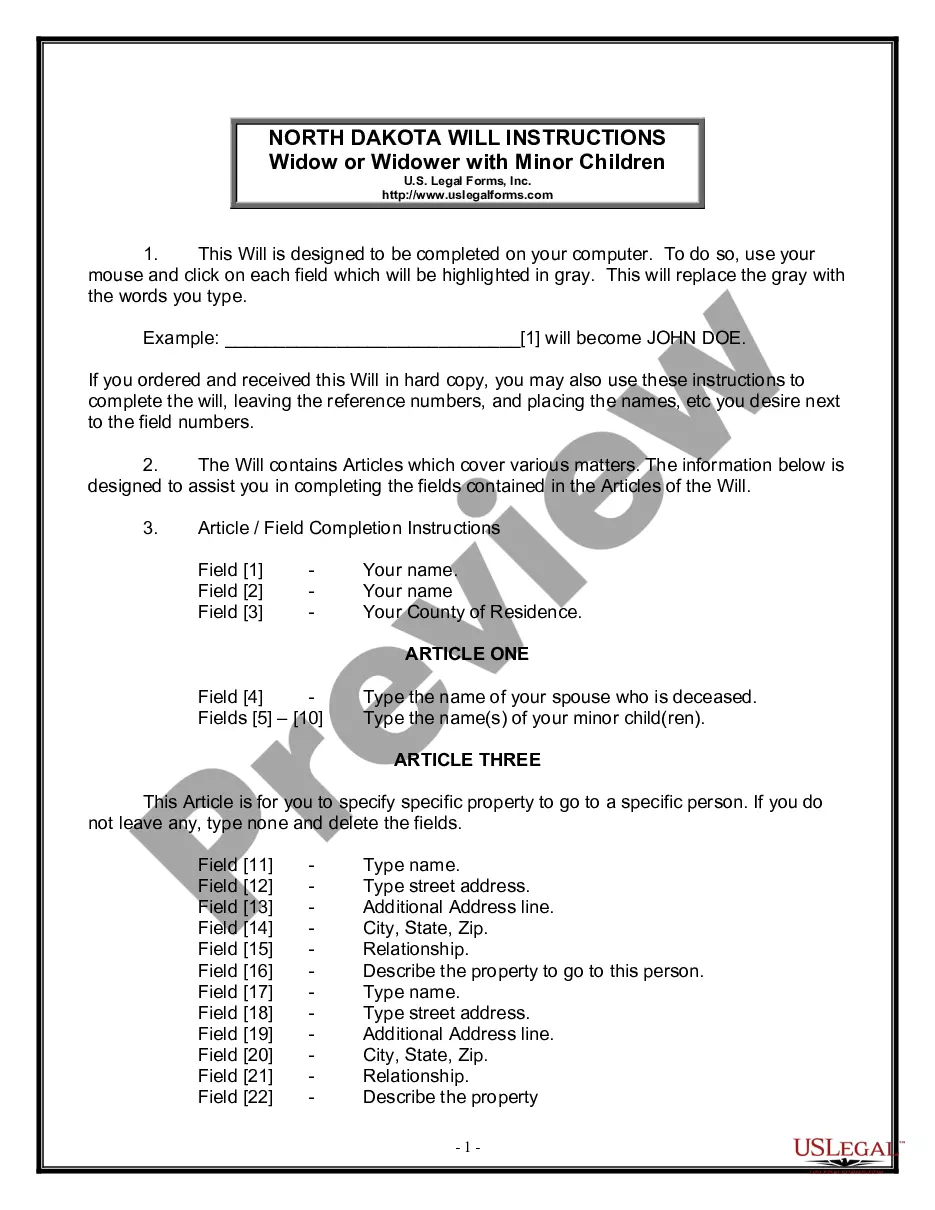

Examine the form preview and descriptions to make certain that you have selected the correct form. Verify that the chosen form meets the criteria of your state and county. Select the appropriate subscription option to acquire the Employee Law State Withholding Allowance Certificate. Download the document, then complete, certify, and print it. US Legal Forms has an excellent reputation and over 25 years of experience. Join us today and transform document completion into a straightforward and efficient process!

- Utilize our website whenever you need a dependable and trustworthy service to swiftly locate and download the Employee Law State Withholding Allowance Certificate.

- If you’re familiar with our services and have created an account previously, simply Log In, choose the template, and download it or access it anytime later in the My documents section.

- Not yet registered? No worries. Setting it up takes just minutes, allowing you to explore the library.

- Before downloading the Employee Law State Withholding Allowance Certificate, consider these suggestions.

Form popularity

FAQ

A sale of business contract is a legal agreement that finalizes the transfer of a business from one party to another. It defines the terms of the agreement, details essential information pertaining to the business being sold, and is the major record for the business transaction.

The following are ways to protect yourself when acquiring a business. Do Your Due Diligence. Do not cut corners on this step in the process. ... Get an Indemnity Agreement. ... Buy the Company's Assets Instead of Its Shares. ... Get a Non-Compete Agreement. ... Get a Buy-Sell Protection Plan.

Either the seller or the buyer can prepare a purchase agreement. Like any contract, it can be a standard document that one party uses in the normal course of business or it can be the end result of back-and-forth negotiations.

A business purchase agreement is a written contract between two (2) parties wherein one party agrees to buy the other party's company for a specific price. By drafting the legal document, each party warrants and agrees to a set of binding conditions that are enforceable in ance with state law.

A purchase and sale agreement, also called a sales and purchase agreement or a purchase and sales contract, is a legally binding document that parties in a transaction use to stipulate the terms and conditions that will guide the sale and transfer of goods or property.

Documents Required to Sell a Business Depending on the type of business you are selling, you may need an Entity Sale Agreement or an Asset Sales Agreement. Furthermore, if you are financing part of the purchase price, you may need a Security Agreement for Asset Sale, a UCC Financing Statement and a Promissory Note.

A Business Purchase Agreement, also referred to as a Business Transfer Agreement or an Offer of Business Agreement, is an agreement entered into between a seller and purchaser for rights to the business. Therefore, the purchaser is essentially taking over the company from the seller.

Parts of a Business Sale Agreement Parties. The names and locations of the buyer and seller will be clearly stated in the first paragraph or two of the contract. ... Assets. The agreement will detail the specific assets being transferred. ... Liabilities. ... Terms. ... Disclosures. ... Disputes. ... Notifications. ... Signatures.