Living Trusts

Description

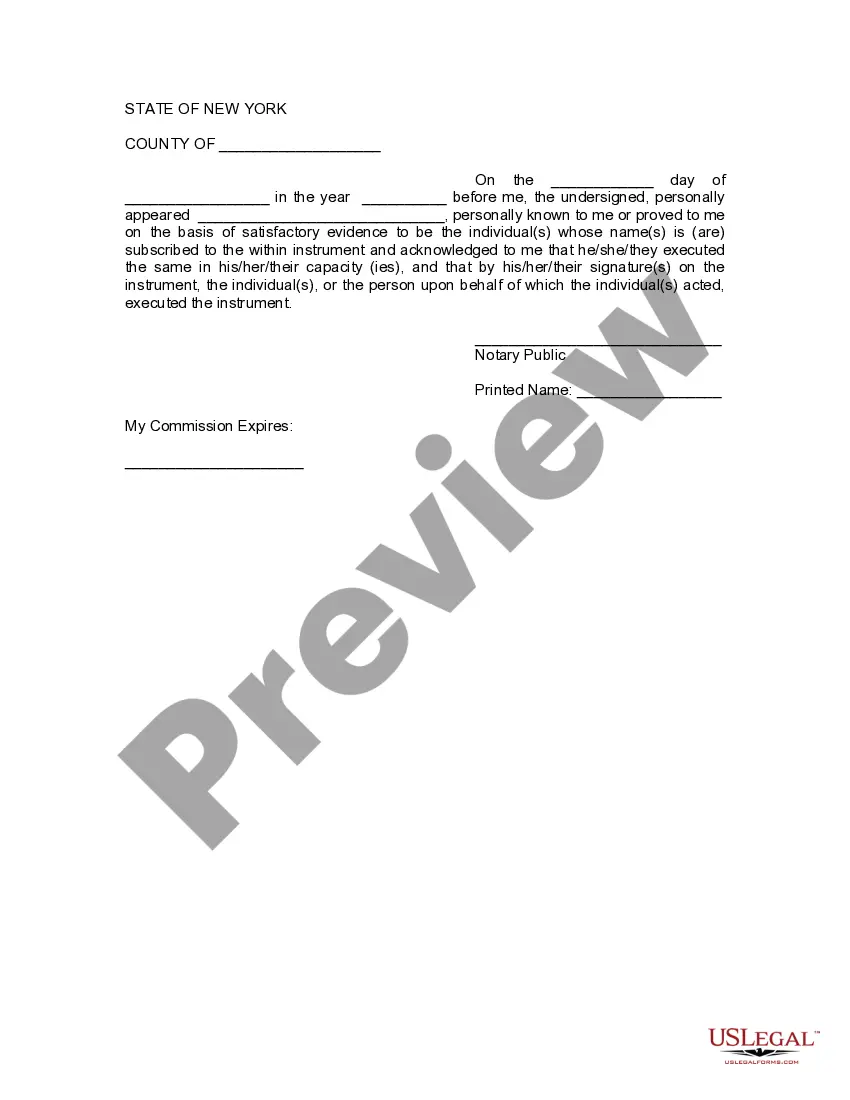

How to fill out New York Assignment To Living Trust?

- Log in to your US Legal Forms account if you are an existing user. Ensure your subscription is active to access all forms.

- Preview the available Living Trust forms and thoroughly review the descriptions to confirm they meet your local jurisdiction requirements.

- If needed, utilize the search feature to find the exact form that addresses your needs.

- Select the form you want, click 'Buy Now,' and choose a subscription plan that suits your needs. You will need to create an account if it's your first visit.

- Complete your purchase by entering your payment information through credit card or PayPal.

- Once the payment is processed, download your Living Trust document to your device and save it for completion. You can revisit it anytime via the 'My Forms' section in your account.

By following these straightforward steps, you'll gain access to US Legal Forms' extensive library, which features over 85,000 customizable legal documents.

Creating a Living Trust could not be easier. Don't hesitate to start your journey towards legal clarity—begin today with US Legal Forms!

Form popularity

FAQ

Filling out a living trust involves several key steps. First, gather all necessary documents, such as property titles, bank statements, and anything else you wish to include in the trust. Next, clearly outline your wishes regarding asset distribution, and choose a reliable trustee to manage the trust. Finally, you can utilize platforms like US Legal Forms, which provide user-friendly templates and guidance to ensure your living trusts are properly filled out and legally binding.

While living trusts offer many benefits, they do have some downsides. They typically require ongoing management, which can be burdensome. Additionally, living trusts do not exempt assets from estate taxes, and you may still need to go through probate for assets not placed into the trust. Considering these factors, it's wise to leverage tools like US Legal Forms to streamline the process.

One of the biggest mistakes parents make when establishing living trusts is failing to fund them properly. It's essential to transfer assets into the trust; otherwise, it remains ineffective. Moreover, not updating the trust to reflect changes in family circumstances can lead to confusion and unintended distributions.

Putting your house in a living trust can lead to higher upfront costs, such as attorney fees for creating the trust. Additionally, there is a possibility of losing some control over the property, as the trust technically owns it. It's also important to note that not all states recognize living trusts in the same way, which might complicate things when transferring ownership.

Suze Orman emphasizes that living trusts can be a powerful tool for estate planning, particularly for those with substantial assets or specific wishes for their inheritance. She highlights the importance of understanding how they work and ensuring that all your assets are transferred into the trust during your lifetime. While she advocates for living trusts, she also advises conducting comprehensive research to understand their implications. Resources like USLegalForms can provide you the necessary guidance and templates to set up your living trust correctly.

While many assets can be included in living trusts, certain items like retirement accounts or life insurance policies typically cannot be placed directly in a trust. Instead, you can name the trust as a beneficiary of these accounts, but it's crucial to ensure this is done correctly. Additionally, properties with certain liens may also have restrictions. Engaging with USLegalForms can help you navigate these complexities and ensure you account for all assets appropriately.

One downside of living trusts is that they may not cover all types of assets, which could lead to confusion for your heirs. Another consideration is that, unlike a will, a living trust does not hold up under challenges to its validity, so you may not have the same level of court protection. Lastly, if you don't fund the trust properly, your estate may still have to go through probate. USLegalForms can guide you in addressing these concerns effectively.

The main purpose of living trusts is to simplify the transfer of your assets after you pass away. They help you avoid the lengthy and often costly probate process, making it easier for your loved ones to access their inheritance. Additionally, living trusts allow you to maintain control over your assets while you are alive, offering both security and flexibility in managing your estate. By utilizing tools from USLegalForms, you can effectively set up a trust that meets your needs.