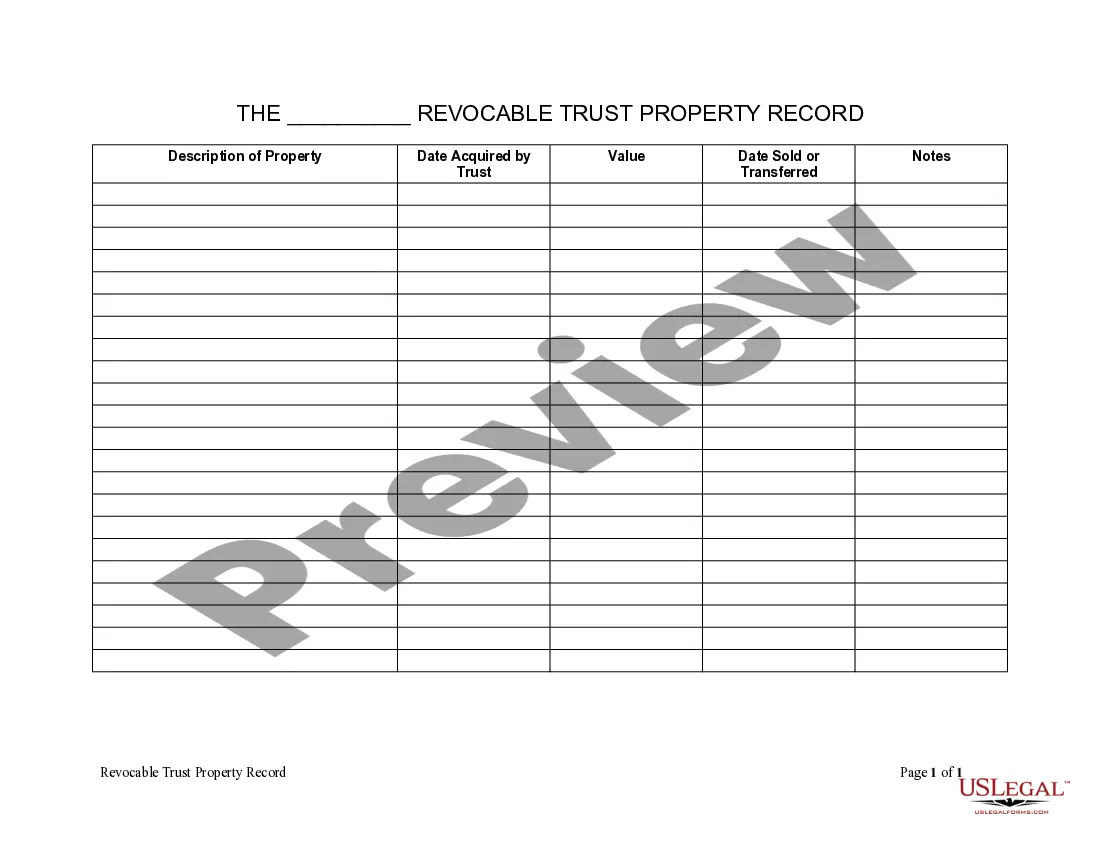

Living Trust Property With A Trust

Description

How to fill out New York Living Trust Property Record?

- If you're a returning user, log in to your account and locate the desired form template in your library. Ensure your subscription is active.

- For first-time users, start by exploring the Preview mode and reading the form description carefully to confirm it fits your needs and complies with your local jurisdiction.

- If you need a different template, utilize the Search tab to find the appropriate document. Once you identify the correct form, proceed to the next step.

- Purchase the document by clicking the Buy Now button and selecting a subscription plan that suits you. Remember, account registration is necessary to access the full library.

- Complete your transaction by entering your payment details via credit card or PayPal.

- Finally, download your completed form and save it to your device. You can also access it at any time in the My Forms section of your profile.

In conclusion, US Legal Forms makes it easy for individuals and attorneys to manage their legal documents efficiently. With an extensive library of over 85,000 templates and access to expert assistance, you can ensure that your living trust property documentation is accurate and legally sound.

Start your journey today by visiting US Legal Forms and take control of your legal needs!

Form popularity

FAQ

A common mistake parents make when setting up a trust fund is failing to properly fund the trust with their living trust property. If assets are not transferred into the trust, it cannot perform its intended function of avoiding probate. Therefore, ensuring that all relevant assets are included is crucial for the effectiveness of the trust.

While putting assets in a trust can offer various benefits, a downside might include the loss of control over those assets. Once assets are transferred, the trust becomes responsible for managing them, which might not align with the original owner's wishes. Additionally, maintaining the trust can require continuous effort and may include legal fees.

Determining whether your parents should put their assets in a living trust property with a trust depends on their financial situation and estate planning goals. Establishing a trust can streamline the transfer of assets and reduce potential taxes. It's advisable for them to consult with an estate planning attorney to evaluate their specific needs.

One disadvantage of a family trust is the complexity involved in managing the assets within the trust. Family relationships can sometimes complicate this management, leading to disputes. Additionally, like any trust, a family trust requires ongoing attention to ensure the assets remain properly funded and managed.

Many individuals choose to place their property in a living trust to avoid probate, which can be both time-consuming and costly. A living trust allows for smoother transitions of assets to beneficiaries upon death. Furthermore, it can offer privacy since details of the trust do not become public record.

The best way to leave a house to your children is often by placing it within a living trust property with a trust. This method helps avoid probate, simplifies the transfer process, and ensures that the property is managed according to your wishes. Consulting with a legal expert can help you set up a trust that meets your family's needs effectively.

While there are many benefits to placing a property in a trust, some disadvantages exist. For instance, once property is in a living trust property with a trust, it may limit your access to funds since you no longer legally own the property. Additionally, if the trust isn’t properly funded or maintained, it might not provide the intended protection or ease in asset distribution.

Yes, a trustee can buy property from the trust, but this action must be conducted with caution. It is crucial to ensure that the transaction is fair and in the best interest of all beneficiaries involved. By managing this process transparently, a trustee can uphold their fiduciary duty while effectively handling the living trust property with a trust.

Gifting a house and placing it in a living trust property with a trust both have their advantages. When you gift a house, you may incur gift tax implications, while putting it in a trust can provide a smoother transition of property upon your passing. Ultimately, your choice should depend on your goals for asset protection, tax implications, and control over the property.

Filling a living trust involves transferring your assets into the trust, which includes your living trust property with a trust. Start by listing all your assets and determining which ones you want to include. You will then need to complete the necessary paperwork, often through platforms like USLegalForms, which simplifies the process with clear guidelines and templates. Once you have filled the trust, you must ensure the trust owns those assets to make your plan effective.