Living Trust Without Lawyer

Description

How to fill out New York Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children?

Creating legal documentation from the ground up can frequently be somewhat daunting.

Certain situations may require extensive investigation and considerable financial investment.

If you’re seeking a simpler and more budget-friendly method of generating a Living Trust Without Lawyer or any other documentation without the hassle of navigating obstacles, US Legal Forms is always available to assist you.

Our online repository of more than 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal matters. With only a few clicks, you can swiftly obtain state- and county-specific forms meticulously prepared for you by our legal professionals.

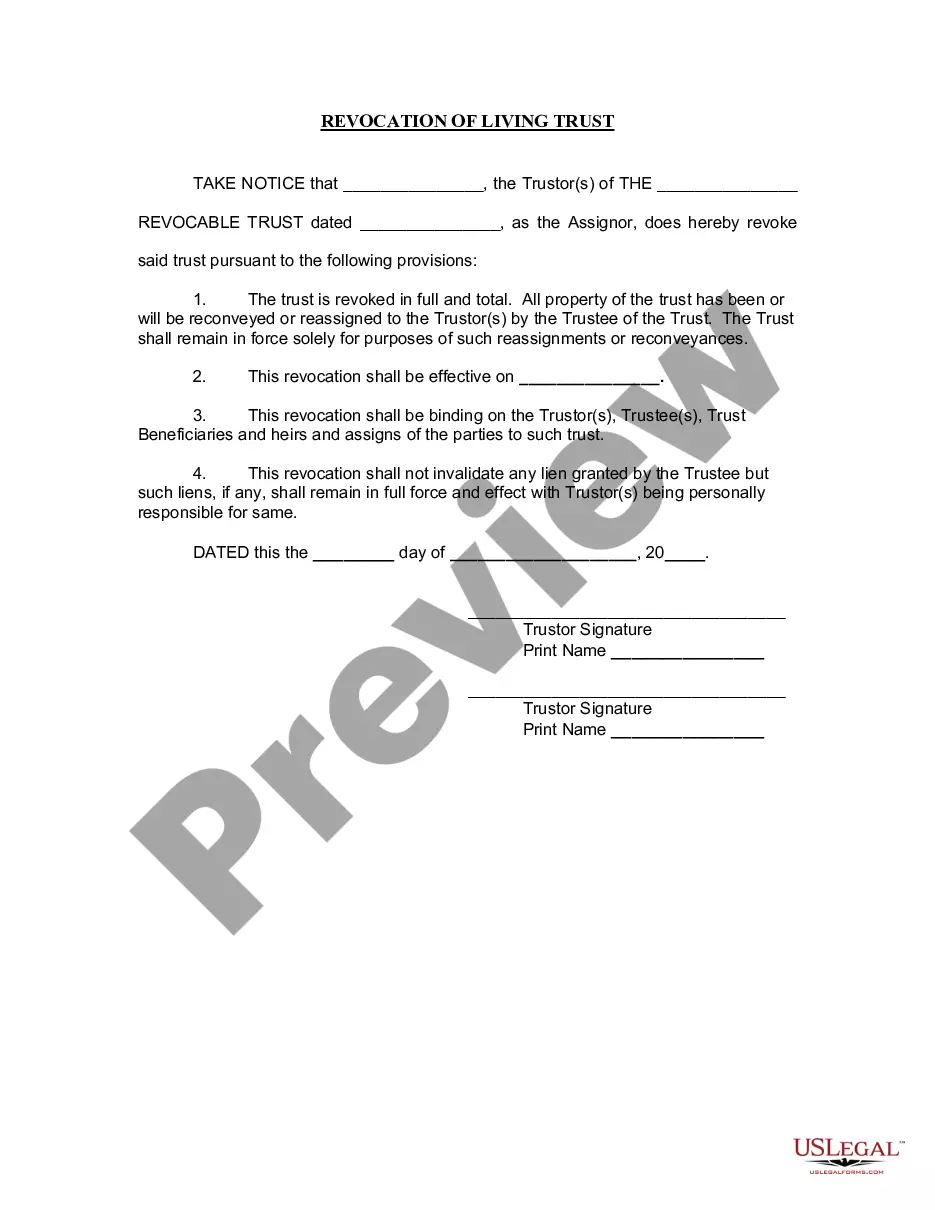

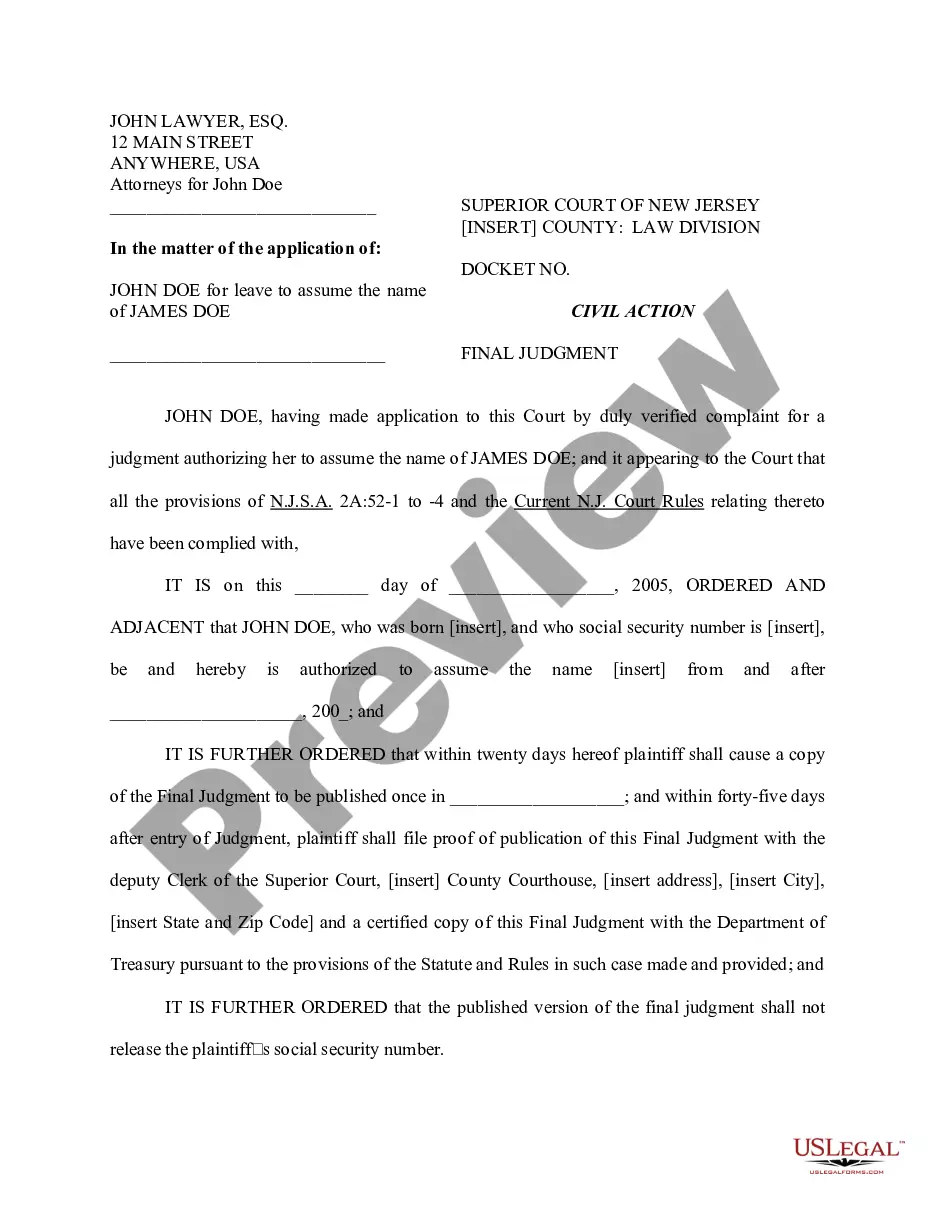

Examine the form preview and descriptions to confirm that you are on the correct form you need. Ensure the template you choose complies with your state and county’s laws and regulations. Select the appropriate subscription plan to acquire the Living Trust Without Lawyer. Download the document. Then complete, certify, and print it out. US Legal Forms has an impeccable reputation and over 25 years of expertise. Join us today and make the process of completing forms easy and efficient!

- Utilize our service whenever you require dependable and trustworthy solutions through which you can rapidly find and download the Living Trust Without Lawyer.

- If you’re already familiar with our services and have previously established an account with us, just Log In to your account, find the template, and download it promptly or re-download it anytime from the My documents section.

- Not registered yet? No problem. Setting it up and exploring the library takes minimal time.

- However, before proceeding directly to downloading the Living Trust Without Lawyer, adhere to these suggestions.

Form popularity

FAQ

The TRUSTEES do hereby agree that they shall hold and stand possessed of the said trust assets, properties and funds (which expression shall include all investments in cash or kind or in any nature whatsoever into and for which, the said property or a part or parts thereof may from time to time be converted, varied or ...

Special warranty deeds, also called limited warranty deeds, provide the majority of the warranties and covenants of a general warranty deed, but not the covenant of seisin, which is the warranty that the seller actually owns the land. Trustee deeds are given by trustees for property that is held in trust.

Small Tract Financing Act allows a deed of trust to be used on tracts of 40 acres or less. Mortgages can also be used. The trustee of a deed of trust can be a member of the bar, bank, trust company, savings & loan, or a title insurer or agent.

In Minnesota, the trustee's deed is a modified quitclaim deed, containing the granting language "convey and quitclaim." A quitclaim deed merely grants "all right, title, and interest of the grantor in the premises described" to the grantee, and contains no warranty of title (Minn. Stat. 707.07).

It contains the names of the current owner (the grantor) and the new owner (the grantee), the legal description of the property, and is signed by the grantor. Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located.

A Trust Certification gives a Trustee the ability to provide anyone who needs it (think: financial institutions or other third parties) important information about the Trust - like the date it was formed, the legal/formal name of the Trust, who the Trustee is (or Trustees are) and other information institutions may ...

Each Minnesota county has a county recorder's office that maintains the county's land records. Deeds and other documents that require recording are filed with the county recorder for the county where the property is located. Some counties call the office the recorder of titles.