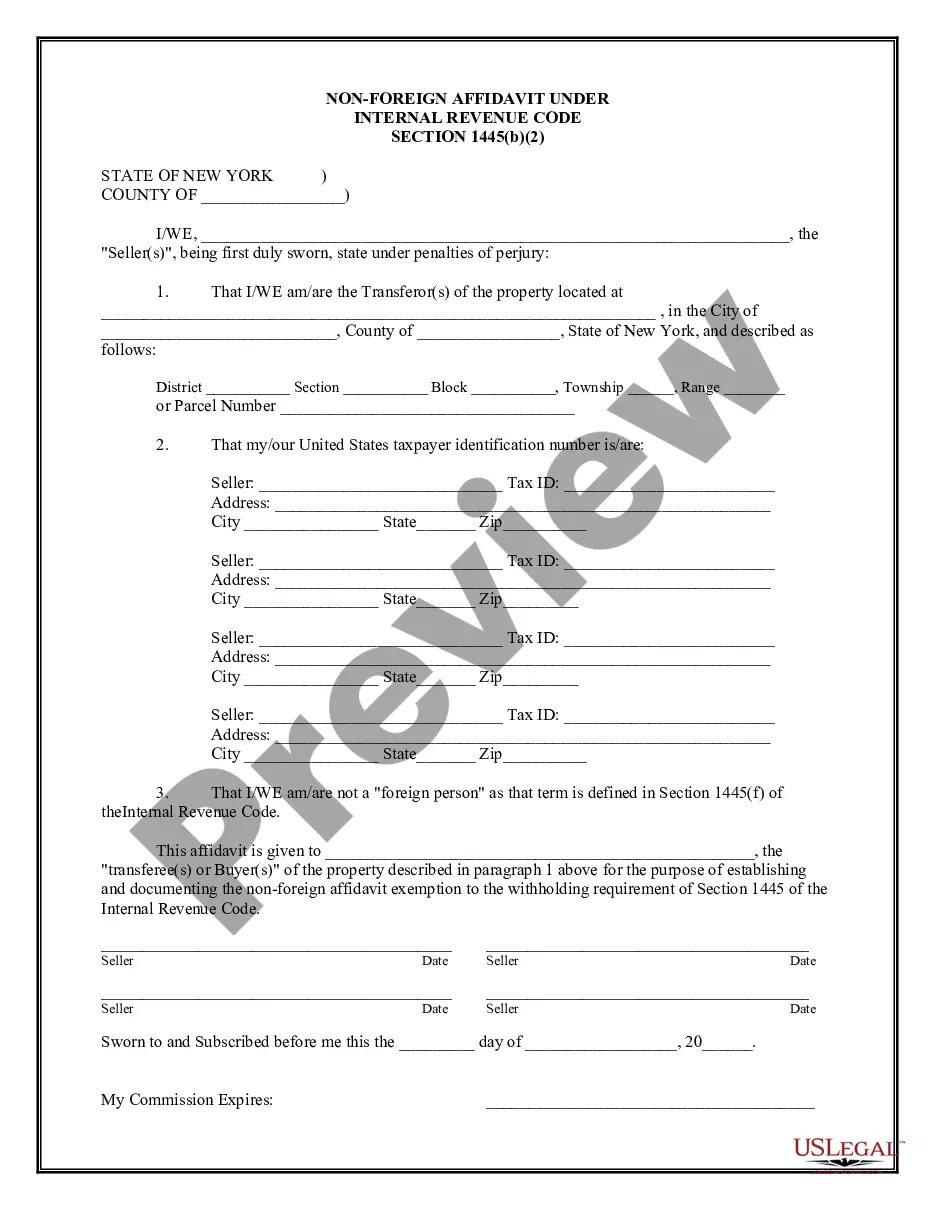

Firpta Affidavit Ny Withholding Exemption

Description

How to fill out New York Non-Foreign Affidavit Under IRC 1445?

It’s well-known that you cannot become a legal expert instantly, nor can you easily learn how to swiftly prepare Firpta Affidavit Ny Withholding Exemption without possessing a specific skill set.

Compiling legal documents is a lengthy undertaking that demands a certain level of education and expertise. Therefore, why not entrust the creation of the Firpta Affidavit Ny Withholding Exemption to the professionals.

With US Legal Forms, one of the most extensive legal template repositories, you can find everything from court papers to templates for internal corporate correspondence. We understand the significance of compliance and adherence to federal and state legislation and regulations.

Create a free account and select a subscription plan to purchase the document.

Click Buy now. Once the payment is completed, you can access the Firpta Affidavit Ny Withholding Exemption, fill it out, print it, and send or deliver it to the necessary parties or organizations.

- That’s why, on our platform, all forms are location-specific and current.

- Start by visiting our website and obtain the document you need in just a few minutes.

- Use the search bar at the top of the page to locate the document you require.

- Preview it (if this option is available) and read the accompanying description to determine if Firpta Affidavit Ny Withholding Exemption is what you are looking for.

- If you need a different template, begin your search again.

Form popularity

FAQ

Exceptions to FIRPTA withholding exist and can benefit both buyers and sellers. For example, the Firpta affidavit ny withholding exemption allows sellers under certain conditions to avoid withholding. Additionally, other exceptions apply to specific transactions such as sales involving tax-exempt organizations or certain transfers of property.

Certain payments related to the sale of property are not subject to FIRPTA withholding. For instance, if the seller qualifies for the Firpta affidavit ny withholding exemption, payments under the specified thresholds may be exempt. Additionally, specific types of payments, such as those related to certain tax-exempt entities, may also fall outside the withholding requirements.

Certain individuals and entities can be exempt from FIRPTA withholding. Typically, foreign sellers who are selling property for under the $300,000 threshold, or those who provide a valid Firpta affidavit ny withholding exemption, are not subject to withholding. Additionally, certain tax-exempt organizations may also qualify for exemptions.

To qualify for the Firpta affidavit ny withholding exemption, you must meet two key conditions. First, the property must be sold for less than $300,000, and second, the buyer must intend to use it as their residence. Meeting these criteria allows you to avoid the standard FIRPTA withholding requirements.

When answering questions about exemptions from withholding, it’s crucial to provide accurate information regarding your residency and any applicable exemptions. You’ll need to refer to the FIRPTA affidavit NY withholding exemption to support your claims. If you find this process challenging, consider using tools available through US Legal Forms to guide you in providing the correct answers.

To fill out the form for claiming your withholding exemptions, start by gathering all relevant financial information. You’ll need to indicate your residency status and provide details outlined in the FIRPTA affidavit NY withholding exemption. Platforms like US Legal Forms can offer templates and instructions, making it easier for you to complete the form accurately.

When claiming withholding exemptions, you should consider your individual tax situation and any applicable laws. It’s essential to accurately assess your residency status and consult the FIRPTA affidavit NY withholding exemption guidelines. For personalized assistance, US Legal Forms can provide the necessary resources to help you determine what to claim.

Yes, a FIRPTA affidavit may be required if you seek to claim an exemption from withholding. This document verifies your eligibility and provides necessary details to the IRS and state authorities. To ensure compliance and avoid potential issues, you can find helpful resources and templates on platforms like US Legal Forms for completing your FIRPTA affidavit NY withholding exemption.

Filling out the necessary forms to claim withholding exemptions requires careful attention to detail. You will need to provide relevant information about your residency status and any applicable exemptions. Utilizing a FIRPTA affidavit NY withholding exemption can simplify this process, and platforms like US Legal Forms offer templates to guide you through the steps.

To be exempt from FIRPTA withholding, you must meet specific criteria that demonstrate your eligibility. This often involves submitting a FIRPTA affidavit NY withholding exemption to affirm your status as a non-resident or satisfying other conditions set forth by the IRS. Consulting with tax professionals or using platforms like US Legal Forms can streamline this process and ensure you complete the necessary documentation correctly.