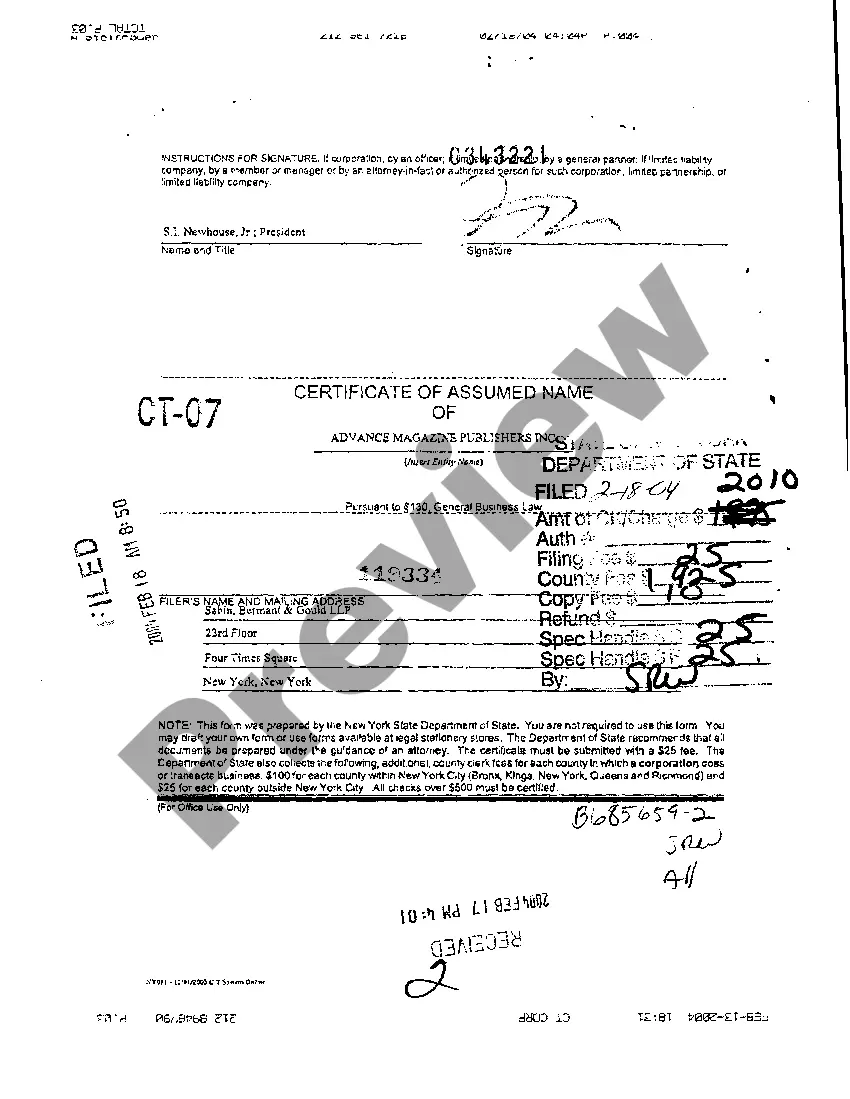

Certificate Of Assumed Name Nyc Without Llc

Description

How to fill out New York Sample Certificate Of Assumed Name?

Accessing legal templates that comply with federal and regional laws is crucial, and the internet offers a lot of options to choose from. But what’s the point in wasting time searching for the right Certificate Of Assumed Name Nyc Without Llc sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the most extensive online legal library with over 85,000 fillable templates drafted by attorneys for any professional and life situation. They are easy to browse with all papers organized by state and purpose of use. Our specialists keep up with legislative updates, so you can always be sure your form is up to date and compliant when acquiring a Certificate Of Assumed Name Nyc Without Llc from our website.

Obtaining a Certificate Of Assumed Name Nyc Without Llc is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, follow the guidelines below:

- Examine the template utilizing the Preview option or through the text description to make certain it meets your needs.

- Browse for another sample utilizing the search function at the top of the page if needed.

- Click Buy Now when you’ve found the right form and select a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Select the best format for your Certificate Of Assumed Name Nyc Without Llc and download it.

All templates you find through US Legal Forms are reusable. To re-download and fill out earlier purchased forms, open the My Forms tab in your profile. Benefit from the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

Convert your DBA to an LLC in 5 Steps Step 1: Verify your DBA name is available for an LLC. Make sure your DBA name is available to register as an LLC. ... Step 2: Determine what needs to happen next with your DBA. ... Step 3: Form an LLC. ... Step 4: Obtain an EIN. ... Step 5: Dissolve your DBA, if necessary.

LLCs, LLPs, corporations and foreign entities: Previously incorporated businesses must register their DBA through the New York Department of State by filing a Certificate of Assumed Name form. LLCs and LLPs get charged a $25 fee. Corporations must pay the state $25 for every non-NYC county.

This certificate is also called the "doing business as (DBA) certificate." Businesses must file the certificate with the New York State Department of State (NYSDOS). Without this certificate, a business must operate under its legal name, and use its legal name everywhere.

How much does a DBA filing cost in New York? For sole proprietors, the filing fee for a DBA in New York is $100. Certified copies of the business certificate are an additional $10 each. Sole proprietors file a DBA with the county clerk they plan on doing business with.

Step 1 ? New York business entity search. A DBA name must be unique and meet New York state requirements. ... Step 2 ? Filing a certificate of the assumed name New York. If your business is incorporated, you must file a DBA with the NYS Department of State. ... Step 3 ? Pay New York filing fees.