New York Loan Modification Agreement Form

Description

How to fill out New York Modification Agreement?

Whether you handle documents often or occasionally need to send a legal paper, it is essential to have a helpful resource where all the samples are relevant and current.

The first step you should take with a New York Loan Modification Agreement Form is to ensure it is the latest version since it determines its submission eligibility.

If you wish to simplify your quest for the newest sample documents, look for them on US Legal Forms.

To obtain a form without an account, follow these instructions: Use the search feature to locate the required form. View the New York Loan Modification Agreement Form preview and details to confirm it is precisely what you need. After verifying the form, click Buy Now. Choose a subscription plan that suits you. Create an account or Log In to your existing one. Utilize your credit card or PayPal details to finalize the transaction. Select the download file format and confirm. Eliminate confusion when handling legal documents; all your templates will be organized and validated with a US Legal Forms account.

- US Legal Forms is a repository of legal documents featuring nearly every sample you might seek.

- Search for the templates you require, assess their relevance promptly, and learn more about their applications.

- With US Legal Forms, you gain access to around 85,000 form templates across a wide range of fields.

- Retrieve the New York Loan Modification Agreement Form samples in just a few clicks and store them in your account at any time.

- Having an account with US Legal Forms will assist you in accessing all the samples you need with added ease and reduced effort.

- Simply click Log In in the website header and visit the My documents section to have all the forms you require at your fingertips.

- You will not need to spend time searching for the correct template or verifying its legitimacy.

Form popularity

FAQ

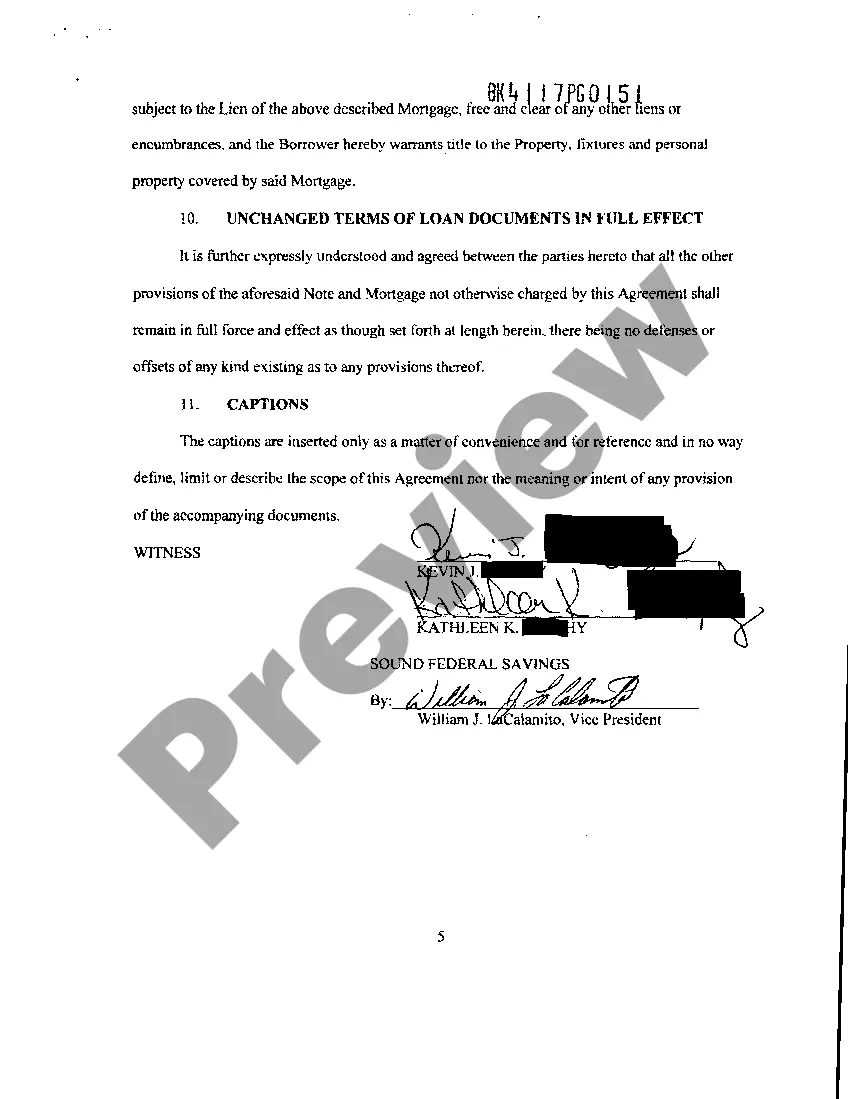

Fannie Mae will execute the mortgage loan modification agreement and return it to the servicer, regardless of whether the executed mortgage loan modification agreement needs to be recorded. Note: If the mortgage loan modification agreement needs to be recorded, the servicer must submit it for recordation.

Contact your servicerContact your lender or servicer and ask for a loan modification. If you're denied, you have 14 days after the denial date to ask for a review of your application, but only if you applied for the modification at least three months before the foreclosure sale of your home.

You can only get a loan modification through your current lender because they must approve the terms. Some of the things a modification may adjust include: Loan term changes: If you're having trouble making your monthly payments, you may be able to modify your loan and extend your term.

A Consolidation, Extension and Modification Agreement, or CEMA, loan is an option available to New Yorkers that can drastically reduce the cost to refinance a mortgage. CEMA loans allow borrowers to pay mortgage recording taxes on only the difference between their current principal balance and their new loan amount.

CEMA stands for Consolidation, Extension, & Modification Agreement and is an agreement between two lenders regarding an existing mortgage.