Chapter 13 Bankruptcy Foreclosure

Description

How to fill out New York Southern District Bankruptcy Guide And Forms Package For Chapters 7 Or 13?

Whether you manage paperwork regularly or you occasionally need to submit a legal document, it is essential to find a resource where all the examples are pertinent and current.

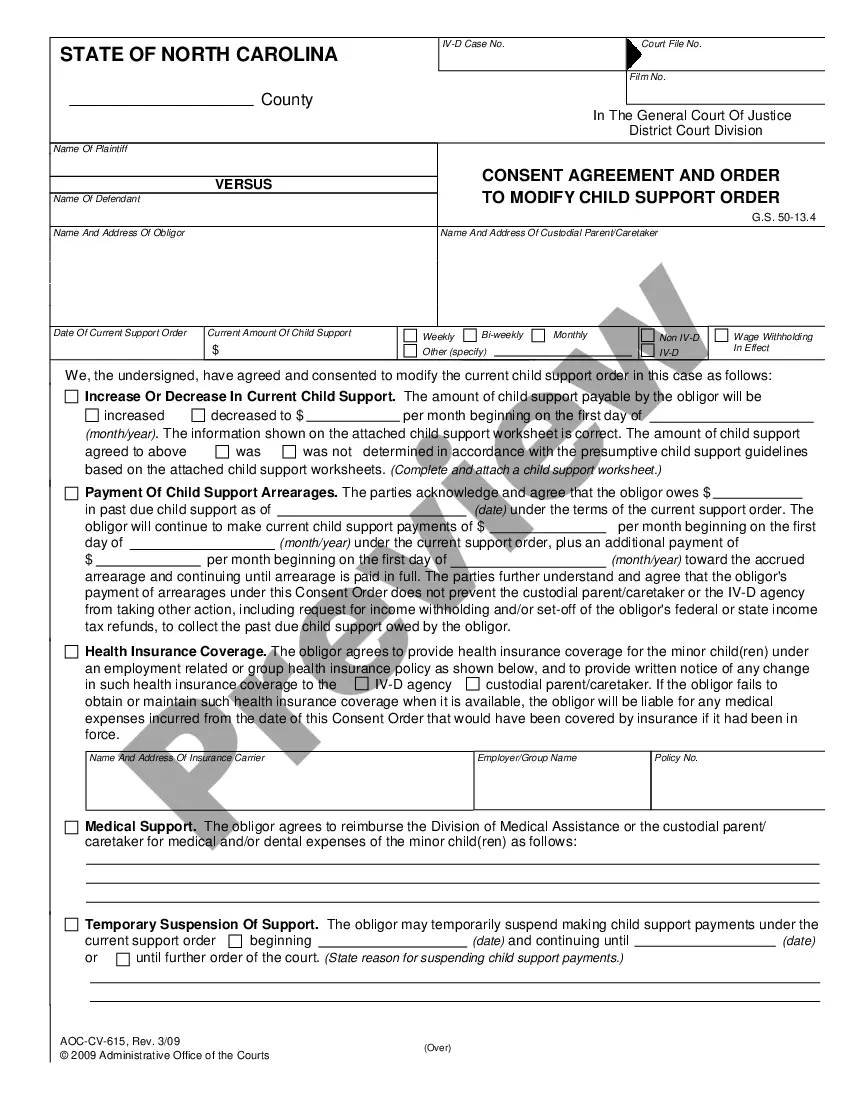

The initial step to take with a Chapter 13 Bankruptcy Foreclosure is to confirm that it genuinely is the most up-to-date edition, as this determines whether it can be submitted.

If you wish to streamline your search for the most recent document examples, look for them on US Legal Forms.

Use the search menu to locate the form you need. Examine the Chapter 13 Bankruptcy Foreclosure preview and description to verify it is precisely what you're looking for. After confirming the form, click Buy Now. Choose a subscription plan that suits you. Create an account or Log In to your existing one. Use your credit card details or PayPal account to finalize the purchase. Choose the document format for download and confirm it. Eliminate the stress associated with handling legal documents. All your templates will be organized and validated with an account at US Legal Forms.

- US Legal Forms is a repository of legal documents that includes nearly every type of sample you might seek.

- Look for the templates you need, verify their relevance instantly, and learn more about their usage.

- With US Legal Forms, you gain access to approximately 85,000 document templates across various fields.

- Find the Chapter 13 Bankruptcy Foreclosure samples in just a few clicks and save them anytime in your account.

- Having a US Legal Forms account enables you to access all the examples you need with greater ease and less hassle.

- You simply need to click Log In in the site header and access the My documents area containing all the forms you require at your fingertips; you won't have to spend time searching for the appropriate template or assessing its usefulness.

- To acquire a form without an account, follow these steps.

Form popularity

FAQ

The average monthly payment for Chapter 13 bankruptcy can vary widely based on your unique financial situation, including your income, debts, and state of residence. Generally, these payments are structured to be affordable, often ranging from $200 to $1,000 or more per month. This payment plan helps you catch up on missed mortgage payments, preventing foreclosure on your home while you regain financial stability. For tailored guidance, consider exploring resources like US Legal Forms to find affordable solutions for your Chapter 13 bankruptcy foreclosure needs.

No, filing Chapter 13 bankruptcy is designed to help you keep your house. This process allows you to repay your debts over time while providing protection from foreclosure. With a solid plan in place, you can work towards maintaining ownership of your home. USLegalForms can assist you in understanding your rights and navigating the complexities of Chapter 13 bankruptcy foreclosure.

Filing for Chapter 13 bankruptcy can be a strategic move to prevent foreclosure. It allows you to reorganize your debts and create a manageable repayment plan while keeping your home. By filing, you may halt foreclosure proceedings, giving you the chance to catch up on your mortgage payments. Consider exploring this option with the help of USLegalForms to guide you through the process.

Filing for Chapter 13 bankruptcy before foreclosure can provide you with immediate legal protections. By doing so, you can halt the foreclosure process and allow time to create a repayment plan. Choosing to file before foreclosure can be beneficial, as it gives you an opportunity to keep your home while managing your finances more effectively, especially with support from platforms like uslegalforms.

Chapter 13 bankruptcy has a solid success rate, often estimated around 30 to 50%. Many people effectively reorganize their debts under this plan, which enables them to catch up on missed mortgage payments. This success can lead to avoiding foreclosure and achieving financial stability through a manageable repayment plan.

When you file for Chapter 13 bankruptcy, an automatic stay goes into effect immediately. This stay halts all foreclosure proceedings against you. Therefore, as soon as you file, creditors must stop their actions, giving you valuable time to restructure your debts and save your home from foreclosure.

After a Chapter 13 bankruptcy discharge, the waiting period to qualify for a mortgage varies. You may have to wait two to four years, depending on the lender and circumstances. Understanding these timelines can help you plan ahead after experiencing challenges like Chapter 13 bankruptcy foreclosure.

If you fall behind on your mortgage during a Chapter 13 plan, you risk facing foreclosure. Your bankruptcy plan must address the mortgage arrears to prevent further action from your lender. It’s vital to seek advice from your bankruptcy attorney or use a resource like USLegalForms to keep communication open with your lender and manage payments effectively.

To file for Chapter 13 bankruptcy, you must have less than $2.75 million in secured and unsecured debts. This debt limit ensures that the Chapter 13 process is appropriate for your financial situation. If your debts exceed this limit, you may need to explore other bankruptcy options or solutions.

You cannot go to jail simply for failing to make payments under a Chapter 13 plan. However, if you intentionally misrepresent your financial situation to the court or engage in fraudulent behavior, there could be serious legal consequences. Engaging with trusted platforms like USLegalForms can help you navigate these challenges and maintain compliance during your Chapter 13 bankruptcy foreclosure journey.