Fifty Dollar Check Example

Description

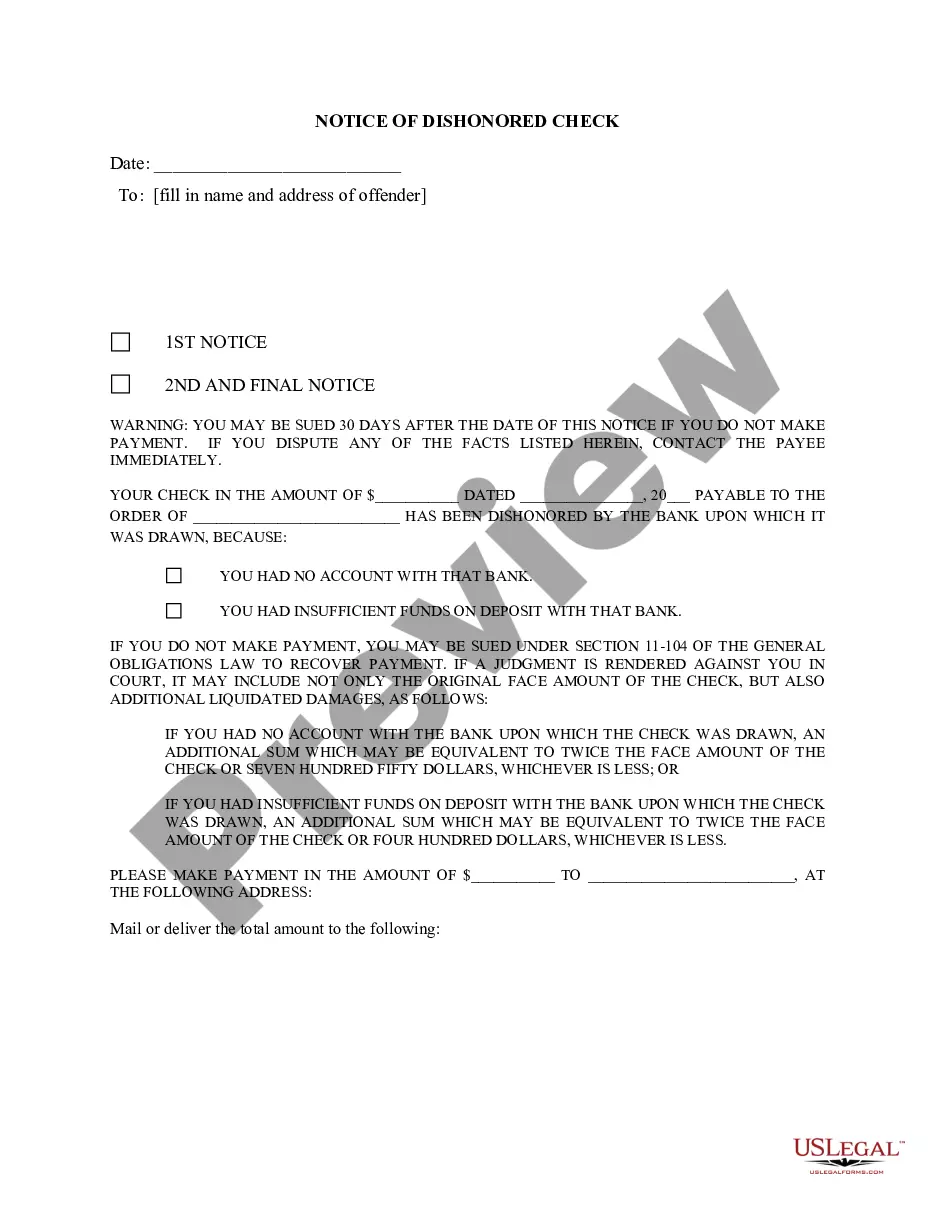

How to fill out New York English Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

Securing a reliable source for accessing the latest and most pertinent legal documents is a major part of navigating bureaucracy. Locating the appropriate legal templates requires care and meticulousness, which is why it is essential to source Fifty Dollar Check Example samples exclusively from trustworthy providers, such as US Legal Forms. Using an incorrect template will squander your time and delay your current situation. With US Legal Forms, you can have peace of mind. You can review and access all details about the document's applicability and relevance to your circumstances and in your region.

Follow these steps to complete your Fifty Dollar Check Example.

Eliminate the hassle associated with your legal documents. Explore the extensive US Legal Forms database where you can discover legal samples, evaluate their applicability to your case, and download them instantly.

- Utilize the directory navigation or search function to find your template.

- Review the document details to ensure it meets your state's and county's requirements.

- Check the form preview, if available, to confirm that the template is what you need.

- Return to the search to find the correct template if the Fifty Dollar Check Example does not suit your needs.

- If you are confident in the document's applicability, download it.

- As a registered user, click Log in to verify your identity and gain access to your chosen forms in My documents.

- If you do not yet have an account, click Buy now to purchase the template.

- Select the pricing option that fits your needs.

- Complete the registration process to finish your purchase.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading the Fifty Dollar Check Example.

- Once the document is on your device, you can alter it with the editor or print it to complete it by hand.

Form popularity

FAQ

If you misplaced your copy of the mortgage note, request another copy from your mortgage lender or servicer. Some lenders require you to make this request in writing. You could also try to retrieve a copy through your local recording office.

Promissory Note Vs. Mortgage. A promissory note is a document between the lender and the borrower in which the borrower promises to pay back the lender, it is a separate contract from the mortgage. The mortgage is a legal document that ties or "secures" a piece of real estate to an obligation to repay money.

A mortgage note is a legal document that sets out all the terms of the mortgage between a borrower and their lending institution. It includes terms such as: The total amount of the home loan. The down payment amount. Whether monthly or bimonthly payments are required.

Promissory notes, also known as mortgage notes, are written agreements in which a borrower promises to pay the lender a certain amount of money at a later date. Banks and borrowers typically agree to these notes during the mortgage process.

The mortgage note is signed by borrowers at the end of the home buying process stating your promise to repay the money you're borrowing from your mortgage lender. This document will list how much you'll pay each month, when you'll make these payments and your mortgage's interest rate.

Definition of 'Master Mortgage' The Master Mortgage is a document created when a property is purchased for the first time. It is filed in the public land records and its purpose is to keep track of the initial mortgage and of any liens that might be associated with the property.

How to Write a Mortgage Deed Step 1 ? Fill In the Effective Date. ... Step 2 ? Enter Borrower and Lender Details. ... Step 3 ? Write Loan Information. ... Step 4 ? Fill In Property Details. ... Step 5 ? Identify Assigned Rents. ... Step 6 ? Enter Acceleration Upon Default. ... Step 7 ? Choose the Power of Sale Option.

There is the DRE NMLS LO Endorsement issued by the Bureau of Real Estate, and there is the DFPI LO License issued by the Department of Business Oversight. The DRE NMLS LO Endorsement is used by loan originators working for DRE companies. The DFPI LO License is used by loan originators working for CFL or CRML companies.