New York Extended Forecast

Description

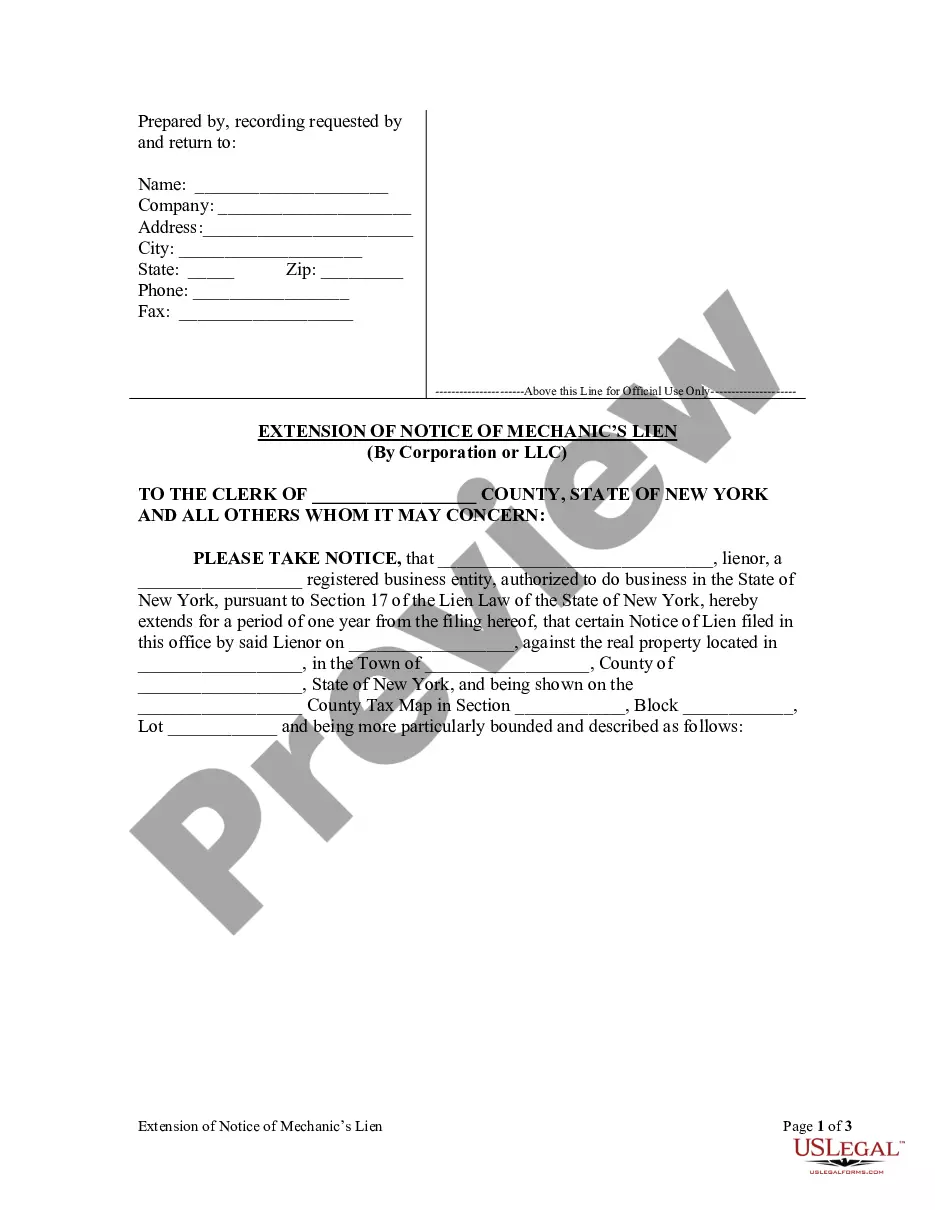

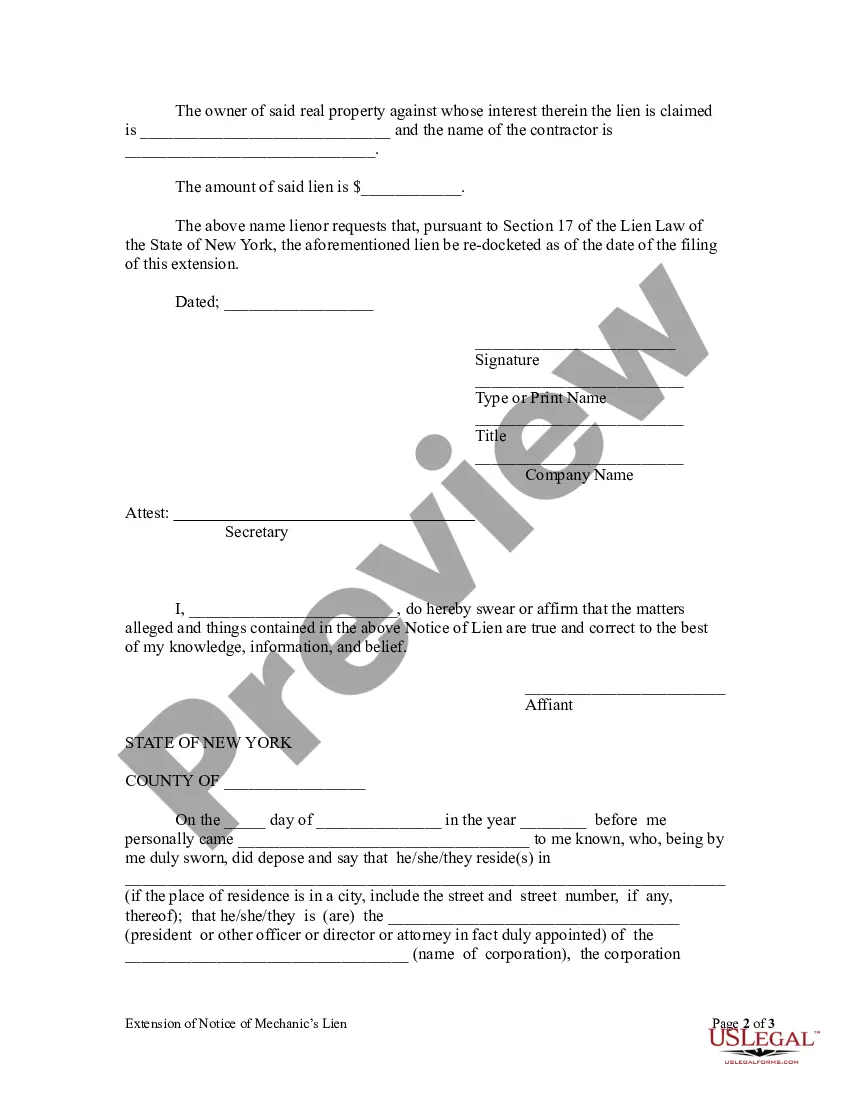

How to fill out New York Extension Of Notice Of Mechanic's Lien - Corporation?

It’s well-known that one cannot transform into a legal expert instantly, nor can one swiftly learn how to compile the New York Extended Forecast without having a specialized education. Assembling legal documents is a lengthy endeavor that necessitates specific training and expertise. So why not entrust the development of the New York Extended Forecast to the professionals.

With US Legal Forms, which boasts one of the most comprehensive legal document libraries, you can discover everything from court forms to templates for internal business communication. We recognize how vital compliance and adherence to federal and state regulations are. That’s why, on our platform, all templates are location-specific and current.

Let’s begin with our website and obtain the form you need in just minutes.

You can revisit your forms from the My documents tab at any time. If you’re an existing customer, you can simply Log In, and find and download the template from the same tab.

Regardless of the purpose of your forms—whether financial, legal, or personal—our website has you covered. Try US Legal Forms today!

- Locate the document you require using the search bar at the top of the page.

- Preview it (if this option is available) and read the accompanying description to determine if the New York Extended Forecast is what you’re looking for.

- Restart your search if you need a different template.

- Sign up for a free account and select a subscription option to acquire the template.

- Click Buy now. Once the payment is processed, you can obtain the New York Extended Forecast, complete it, print it, and send or mail it to the appropriate individuals or organizations.

Form popularity

FAQ

In New York, once the initial extension has been granted, you cannot file for another extension after the October 15 deadline. It is crucial to ensure all necessary documents are submitted before this date to avoid penalties. If you find yourself needing more time, it is best to prepare your taxes as thoroughly as possible before the deadline. The USLegalForms platform can help you stay organized and ready for your New York extended forecast.

To file for an extension on your taxes in New York, you should complete and submit the IT-370 form. You can file this form electronically or by mailing it to the appropriate address. Make sure to file before the tax deadline to obtain the extension. For a seamless process, the USLegalForms platform provides tools and templates to assist you in filing your New York extended forecast.

An extension for filing an estate tax return in New York is not automatic and requires specific forms to be submitted. Executors must file the appropriate form to request an extension for the estate tax return. It is crucial to adhere to the guidelines provided by the state to avoid penalties. The USLegalForms platform can help you navigate these requirements for your New York extended forecast.

In New York, a tax extension is indeed automatic as long as you file the appropriate form on time. This allows you the necessary time to gather your documents and complete your tax return without facing immediate penalties. However, remember that this extension applies only to the filing deadline, not to the payment of any taxes owed. For assistance, consider using the USLegalForms platform to ensure your New York extended forecast is handled properly.

You can file the New York State IT-370 form electronically or by mail. If you choose to file by mail, send the completed form to the address specified in the instructions provided with the form. Ensure that you file on time to benefit from the New York extended forecast. The USLegalForms platform offers templates and guidance to help you file correctly and efficiently.

Yes, when you file a New York tax extension, it is considered automatic. This means that as long as you submit the necessary form, you can extend your filing deadline for your state taxes. However, be aware that this does not extend the payment deadline for any taxes owed. For a smooth experience, the USLegalForms platform can guide you through the process of filing your New York extended forecast.

In New York, an automatic extension is granted to individuals who file for it. This extension allows you additional time to file your tax returns without incurring penalties. However, it is important to remember that while you can extend your filing deadline, any taxes owed are still due by the original due date. For a reliable process, consider using the USLegalForms platform to navigate your New York extended forecast.