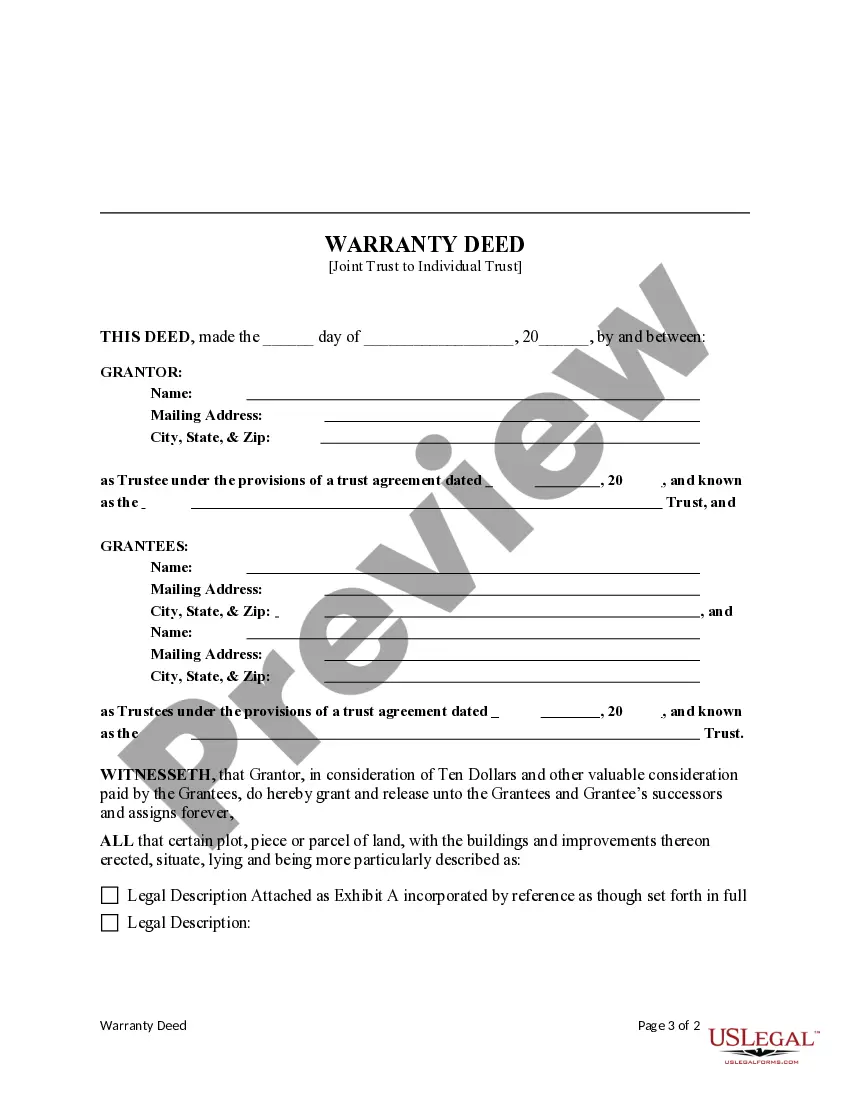

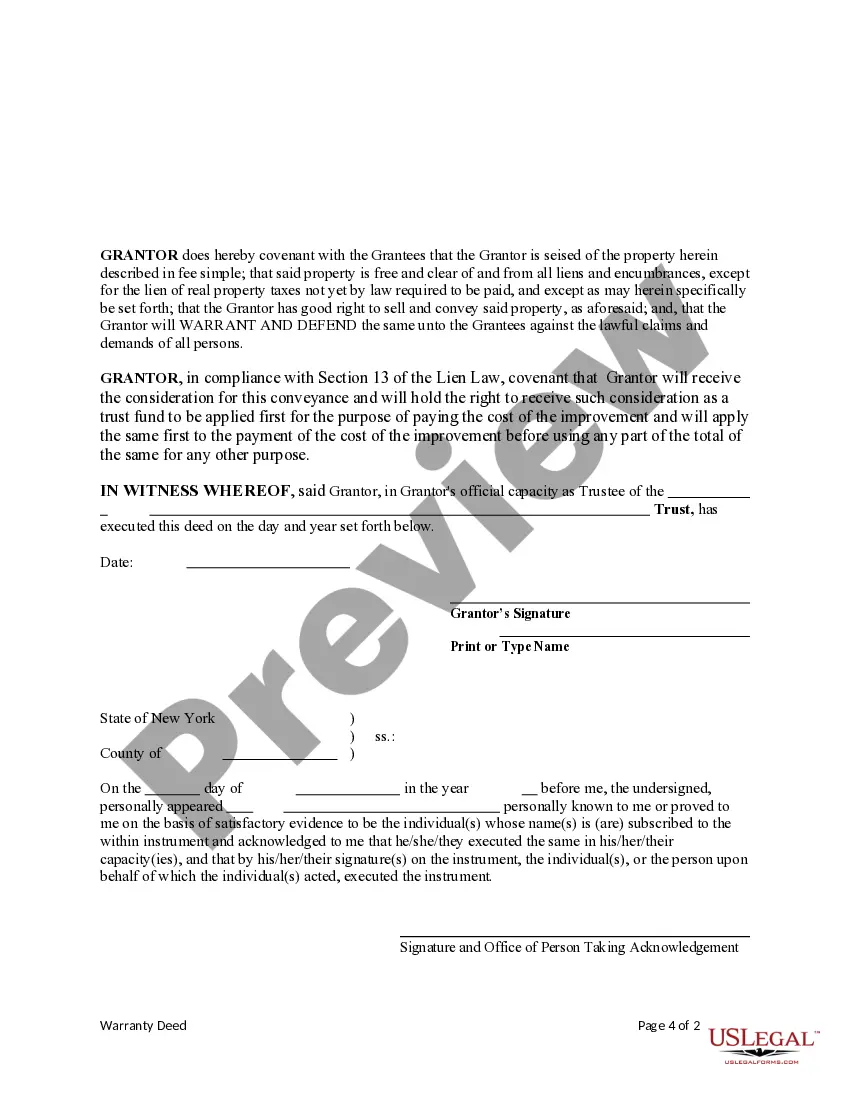

This form is a Warranty Deed where the Grantor is the Trustee of an individual trust and the Grantees are the trustees of a joint trust. Grantor conveys and warrants the described property to Trustees of the Grantee Trust. This deed complies with all state statutory laws.

From Individual Trust To Withdraw

Description

Form popularity

FAQ

One of the biggest mistakes parents make when setting up a trust fund is failing to clearly define their intentions for the trust. When parents do not outline specific guidelines, they risk confusion and mismanagement down the line. Additionally, ignoring the importance of choosing the right trustee can lead to significant issues when it comes time to withdraw from the trust. By addressing these factors, parents can create a structured plan that facilitates a smoother transition from individual trust to withdraw, ensuring their children's future needs are met.

Yes, you can remove yourself from a trust, but the process may vary depending on the type of trust you are involved with. Typically, if the trust is revocable, you have the authority to amend or dissolve it, thereby enabling you to withdraw yourself. However, if it is an irrevocable trust, the process is more complicated and may require consent from other trustees or beneficiaries. For detailed guidance, exploring options through US Legal Forms can simplify the steps involved when moving from an individual trust to withdraw.

Withdrawals from an individual trust can be taxable, depending on the circumstances. Taxation often applies if the trust generates income, which you then withdraw. It is crucial to understand the type of trust, as rules for distributions may vary. To navigate these complexities, consider using USLegalForms, which offers resources to help you better manage your trust withdrawals.

To dissolve a trust with the IRS, ensure all tax returns are filed, and tax obligations are settled. File a final Form 1041, reporting any income earned during the dissolution process. Completing these steps will facilitate your transition from individual trust to withdraw, making the dissolution process straightforward.

Trusts generally must file a tax return with the IRS if they have gross income over a specific threshold. The IRS requires Form 1041 to account for the trust's income, deductions, and distributions. This is a vital step in managing your trust effectively as you consider moving from individual trust to withdraw.

Closing a trust involves settling its financial obligations, distributing assets to beneficiaries, and filing required tax returns. Once these steps are completed, the trust is legally terminated, freeing you from ongoing responsibilities. This process is crucial for the transition from individual trust to withdraw, allowing for a clean closure.

When terminating a trust, you may face specific tax implications, including the need to report any capital gains from asset sales. Additionally, distributions to beneficiaries may trigger tax liabilities based on the trust's income. Understanding these consequences is essential as you consider your options from individual trust to withdraw, ensuring a smooth transition.

To remove yourself as a trustee, you should first check the trust agreement for specific instructions. If allowed, you may need to formally resign and, in some cases, obtain signatures from the co-trustee or beneficiaries. Once this is settled, you can effectively transition from individual trust to withdraw, ensuring proper management of the trust remains in place.

The IRS typically takes six to eight months to close an estate, depending on various factors such as outstanding tax obligations and the complexity of the estate. However, this timeframe can vary significantly based on the specific circumstances involved. Understanding this timeline is important as you navigate the transition from individual trust to withdraw.

Closing out a trust with the IRS involves several steps, including filing a final tax return using Form 1041. You must also notify the IRS of any distributions made to beneficiaries. Once all tax obligations are settled, the trust can be officially ended, allowing you to move seamlessly from individual trust to withdraw.