Foreclosure Of A Dream Live

Description

How to fill out New York Referee's Deed In Foreclosure?

- If you are a returning user, log in to your account at US Legal Forms and check your subscription status to ensure it is active.

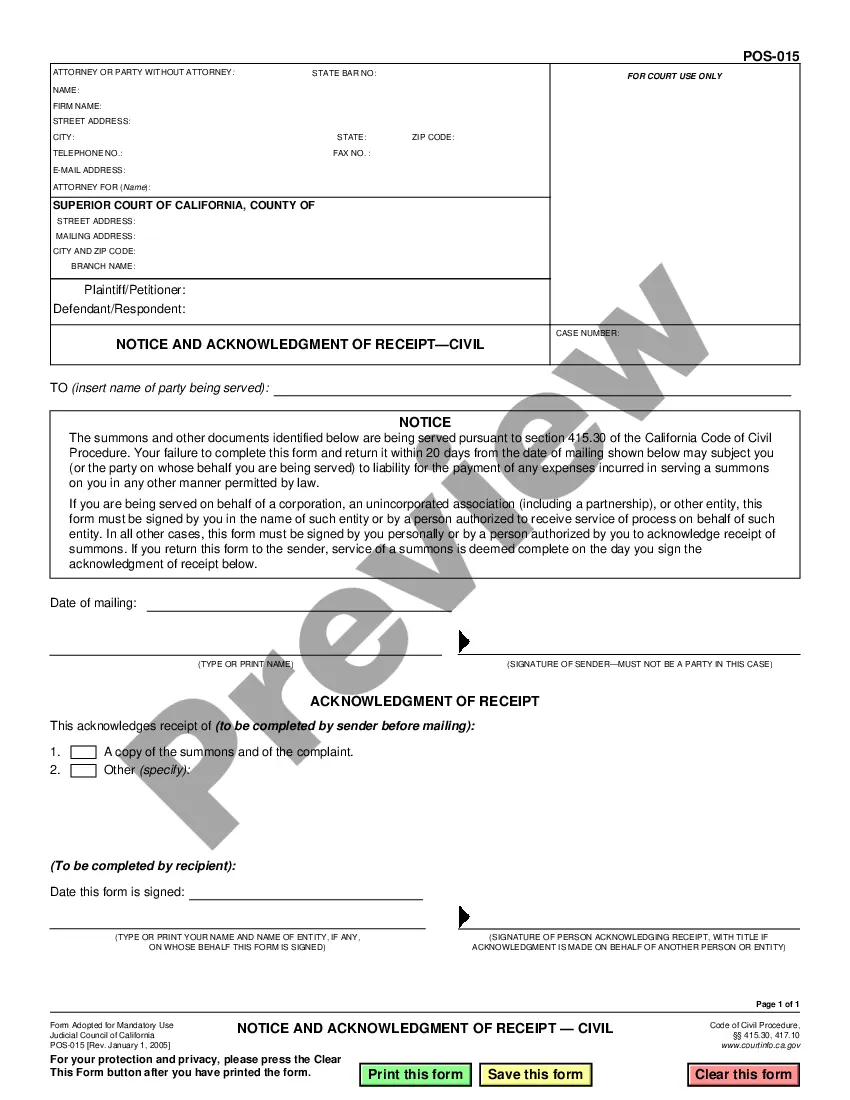

- Review the available templates related to foreclosure in the Preview mode to identify the form that best suits your needs and aligns with your local regulations.

- If you find discrepancies or need different forms, utilize the Search tab to refine your results until you locate the right document.

- Proceed to purchase the necessary form by selecting the 'Buy Now' button and choosing the subscription plan that works for you. Be sure to create an account to gain access to the full library.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Finally, download the form to your device. You can revisit your personalized list under 'My Forms' at any time for future access.

By utilizing the robust features of US Legal Forms, you ensure that your legal documents for foreclosure are handled efficiently, paving the way for a smoother resolution.

Start your process today and regain control over your legal journey with US Legal Forms!

Form popularity

FAQ

To get financing for a foreclosure home, begin by researching lenders who specialize in foreclosures. Collect all necessary financial documents and improve your credit score if needed. Consider using platforms like US Legal Forms to explore financing options and understand the process better. They can provide valuable resources to guide you through the foreclosure of a dream live.

Financing a pre-foreclosure home is possible, but it requires careful consideration. You may need to negotiate with the current owner or work with a real estate agent familiar with pre-foreclosure properties. By securing proper financing, you can be one step closer to experiencing the foreclosure of a dream live.

The foreclosure of a dream refers to the loss of homeownership and the associated hopes and aspirations attached to it. For many, losing a home is a significant emotional experience that can affect their future plans. However, understanding this process can help those affected find new paths to homeownership. Engaging with the foreclosure of a dream live could lead to new opportunities for renewal and happiness.

Buying a foreclosed property can be a smart investment, but it comes with risks. Foreclosed homes may have hidden damages or be in less desirable neighborhoods. However, understanding what to expect and how to navigate the process can lead to excellent opportunities. The foreclosure of a dream live can transform how you approach home buying.

A live foreclosure auction is an event where properties that are under foreclosure are sold to the public. These auctions usually happen on the courthouse steps or a designated auction site. Participants can bid on homes that may offer a chance for ownership at lower prices. Engaging in the foreclosure of a dream live offers a unique pathway to homeownership for many.

Live auctions for houses involve bidders gathering at a location to bid on properties in real-time. An auctioneer facilitates the process, and participants raise their hands or paddle numbers to place bids. Knowing how these auctions work helps you prepare and compete effectively. Exploring the foreclosure of a dream live at these auctions can result in significant savings.

At a foreclosure auction, properties are sold to the highest bidder. This process typically occurs after the homeowner has defaulted on their mortgage payments. Buyers can discover great deals, but they should research the property beforehand to understand any potential issues. The foreclosure of a dream live can lead to new opportunities for buyers looking to invest.

Renting an apartment with a foreclosure on your credit report is possible, but it may present some hurdles. Many landlords value income and references more than credit scores. You can improve your chances by being upfront about your past and demonstrating that you are financially responsible despite the foreclosure of a dream live.

Finding a rental after foreclosure requires careful research. Start by searching online platforms that cater to various housing needs. Networking with real estate agents or local community groups can also provide leads. Ensure your application emphasizes your stable income and positive references to mitigate concerns about the foreclosure of a dream live.

Renting after a foreclosure can be challenging but not impossible. Many landlords have different criteria, so some may overlook a foreclosure if you can prove your financial stability. Focus on building a strong rental application, as overcoming the stigma associated with the foreclosure of a dream live requires a proactive approach.