Foreclosure Florida

Description

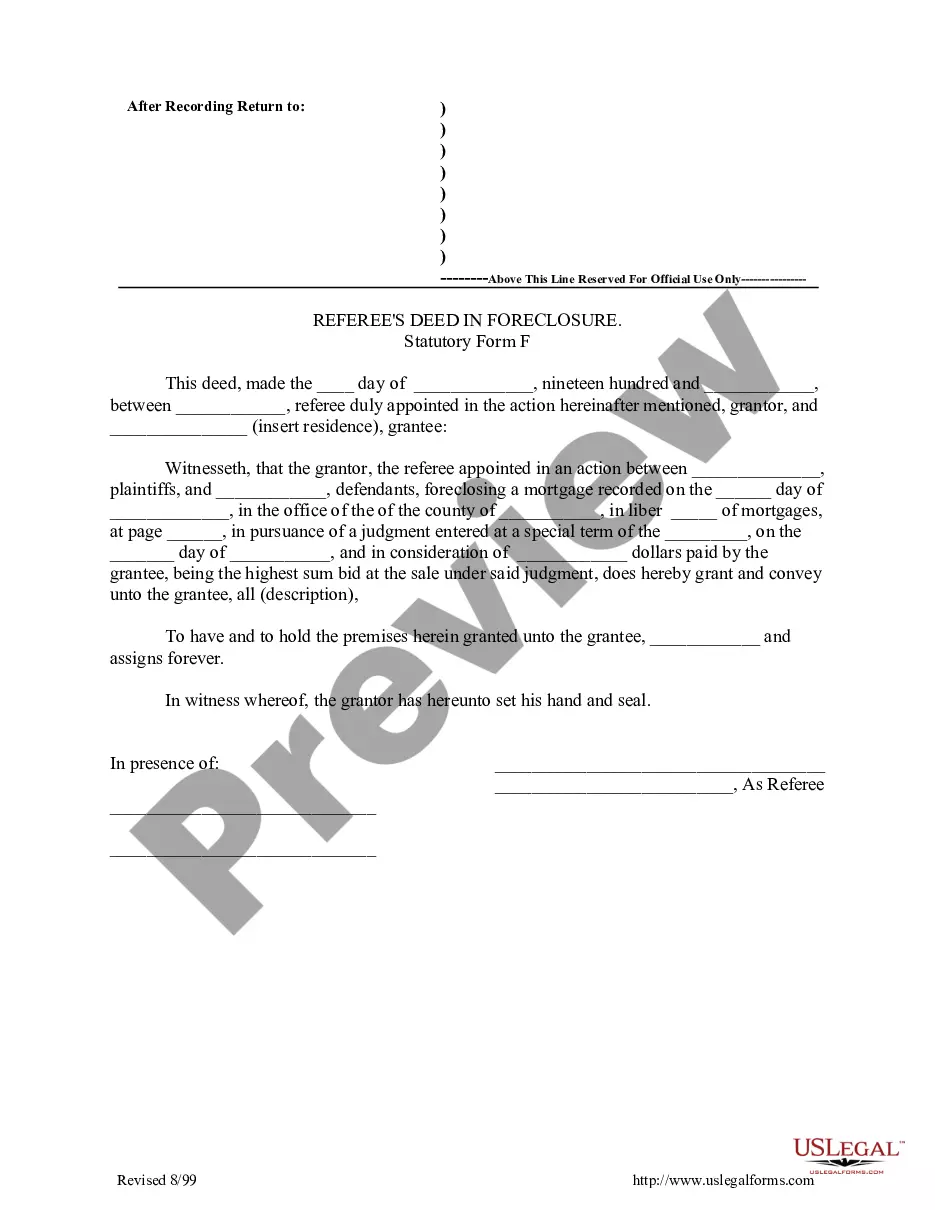

How to fill out New York Referee's Deed In Foreclosure?

- If you are an existing user, log in to your account and ensure your subscription is active. Download the necessary form by clicking the Download button.

- For first-time users, start by browsing the form description and Preview mode. Confirm that the selected document fits your local jurisdiction and needs.

- If the chosen form doesn’t meet your requirements, utilize the Search tab to find a suitable template.

- Once you identify the correct document, click the Buy Now button and select your preferred subscription plan. You will need to create an account to access further resources.

- Complete your purchase by entering your credit card information or using PayPal for the transaction.

- Finally, download your form and store it on your device. You can manage and access this template at any time through the My Forms section of your profile.

In conclusion, US Legal Forms simplifies the process of obtaining essential legal documents like foreclosure forms in Florida. With its extensive collection and user-friendly interface, you can ensure that your paperwork is handled correctly and efficiently.

Don’t hesitate to explore the resources available and start your document journey today!

Form popularity

FAQ

In Florida, foreclosure is a legal process initiated by the lender when a borrower fails to make mortgage payments. The lender files a lawsuit, and if the court rules in their favor, the home may be sold at auction. This process involves multiple steps, including notification and the opportunity for the homeowner to respond. Understanding these steps is crucial, and USLegalForms can help by providing necessary forms and information to manage your case related to foreclosure in Florida.

The timeline for foreclosure in Florida typically begins after you miss three payments, leading to a legal process that can range from several months to over a year. The exact timeline depends on the lender's actions and your efforts to resolve the situation. It’s essential to act quickly and seek counsel during this challenging time. USLegalForms offers resources that can assist you in navigating the foreclosure process effectively.

In Florida, generally, after missing three mortgage payments, the lender may begin foreclosure proceedings. They often wait until you are 90 days past due to ensure they follow proper protocols. During this grace period, it's critical to communicate with your lender and explore options for avoiding foreclosure. USLegalForms can provide valuable tools and documents to help you understand your rights and options in the process of foreclosure in Florida.

In Florida, you can miss several mortgage payments, but typically, lenders initiate foreclosure proceedings after you are 90 days late. This period allows them to assess your situation and possibly work with you on solutions. However, ignoring your payments for too long can lead to serious consequences. If you find yourself in this position, consider seeking guidance from USLegalForms as a resource for managing foreclosure in Florida.

While the duration of foreclosure can vary, the average timeframe in Florida is usually around 9 months to a year. This timeframe includes the legal proceedings, mediation, and the eventual sale of the property. It is crucial for homeowners to stay informed and engaged throughout the process; this can significantly impact the outcome. For those navigating these challenges, using platforms like US Legal Forms can provide helpful resources and guidance.

In Florida, the foreclosure process begins when a lender files a lawsuit against the homeowner for missed mortgage payments. Once the lawsuit is filed, a notice of foreclosure is served, and the homeowner has a chance to respond. If the court rules in favor of the lender, a foreclosure sale date is set. The property is then sold at auction, and the homeowner typically vacates the premises unless they resolve the issue beforehand.

The foreclosure process in Florida typically takes several months to complete. On average, it may take anywhere from 6 to 12 months, depending on various factors like court schedules and the specifics of each case. Homeowners should be aware that delays can occur, especially if the case goes to trial. Understanding the timeline can help you prepare better financially and legally.

The six phases of foreclosure in Florida include the pre-foreclosure phase, the mediation process, filing a foreclosure complaint, obtaining a judgment, the auction sale, and finally, the redemption period. Each phase presents its own challenges and opportunities for the homeowner. By understanding these phases, you can make informed decisions during the process. Consider using US Legal Forms to guide you through each stage of foreclosure.

The 120 day foreclosure rule in Florida mandates that a lender must wait a minimum of 120 days after a payment default before initiating a foreclosure lawsuit. This period allows homeowners time to resolve their financial issues, avoiding foreclosure whenever possible. Understanding this rule can empower you to take action sooner rather than later. Resources available on US Legal Forms can clarify your rights under this rule.

The foreclosure process in Florida typically lasts between 150 to 200 days, depending on various factors. This timeline can vary based on court schedules and homeowner responses. It’s crucial to be proactive during this process to understand your options. Using platforms like US Legal Forms can help you navigate the foreclosure landscape effectively.