Enhanced Life Estate For The Elderly

Description

How to fill out New York Enhanced Life Estate Or Lady Bird Warranty Deed From Individual To Two Individuals?

- Log in to your existing US Legal Forms account or create a new account if you're a first-time user.

- Search for the enhanced life estate form template specific to your state in the extensive library, ensuring it meets all local regulations.

- Preview the selected form to confirm it aligns with your needs, addressing any specific requirements.

- Select the appropriate subscription plan that suits your needs and click on the 'Buy Now' button to purchase the document.

- Complete the payment process using your credit card or PayPal for immediate access.

- Download the completed form to your device and store it for future reference in the 'My Forms' section of your profile.

By following these straightforward steps, you can efficiently create an enhanced life estate tailored to your requirements. Utilizing US Legal Forms ensures you have access to a vast library of legal documents and expert assistance at your fingertips.

Take control of your estate planning today by visiting US Legal Forms and start your journey towards securing your assets!

Form popularity

FAQ

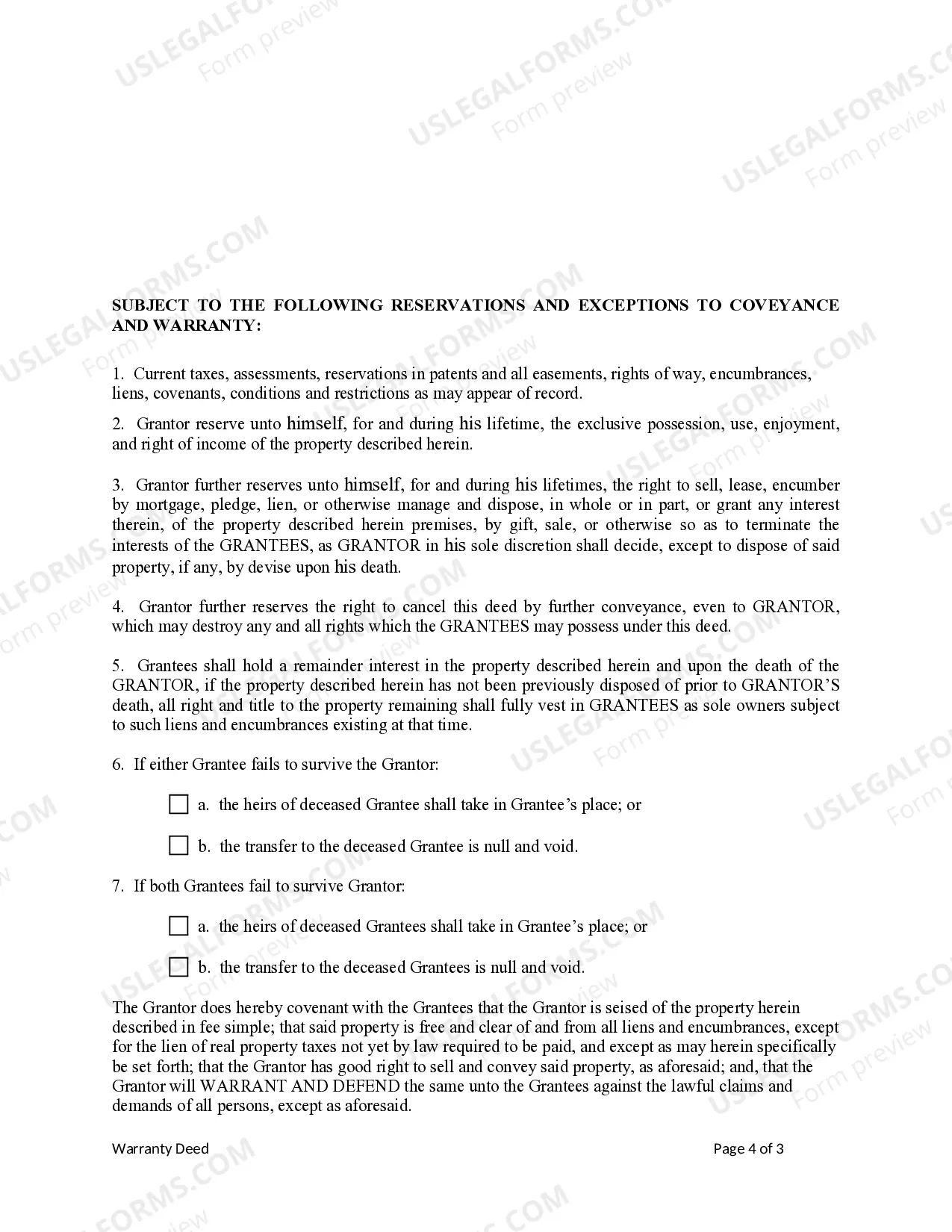

Life estates come with some drawbacks that elderly homeowners should consider before proceeding. One major disadvantage is the loss of control; once an enhanced life estate is established, the homeowner cannot sell or mortgage the property without the agreement of the beneficiary. Furthermore, any changes in circumstance may limit the homeowner's flexibility, as decisions about the property now involve others. It is essential to consult platforms like US Legal Forms for expert advice on navigating the complexities of an enhanced life estate for the elderly.

An enhanced life estate is a legal arrangement that allows an elderly person to retain the right to live in their home while designating a beneficiary to receive the property after their passing. This type of estate helps avoid probate, making the transfer of property smoother and more efficient. Additionally, it enables the homeowner to retain control over their property during their lifetime, providing peace of mind. The enhanced life estate for the elderly is particularly beneficial as it simplifies estate planning and ensures that assets are passed directly to loved ones.

Enhanced life estate deeds are recognized in a variety of states, notably Florida, Michigan, New Mexico, and Texas, among others. These states support the use of enhanced life estate deeds as part of their estate planning processes, particularly benefiting the elderly. By creating an enhanced life estate for the elderly, you can simplify the transfer of assets, making it easier for heirs while providing peace of mind. If you seek guidance, uslegalforms can help you navigate these state-specific requirements.

The primary difference between a life estate deed and an enhanced life estate deed lies in control and flexibility. A traditional life estate deed limits your ability to sell or encumber the property, while an enhanced life estate deed allows you full control during your lifetime. This makes the enhanced life estate for the elderly a more desirable option for those wishing to maintain greater flexibility in their estate planning. It's important to understand these differences so you can choose the best option for your situation.

In Florida, a life estate deed allows you to retain use of the property during your lifetime, but it restricts your ability to sell or mortgage it without the consent of the remainderman. Conversely, an enhanced life estate deed allows you to keep control over the property, including selling or mortgaging it without needing consent. This flexibility makes the enhanced life estate for the elderly a more advantageous choice for estate planning. Utilizing this option can greatly benefit seniors in Florida.

Ladybird deeds, a type of enhanced life estate deed for the elderly, are available in a limited number of states, including Florida, Texas, and Michigan. These deeds provide homeowners the ability to transfer property upon death while maintaining control during their lifetime. You should consider the benefits of a ladybird deed if you want to keep your options open while planning your estate. It is an excellent way to ensure a smooth transition of property.

Enhanced life estate deeds are recognized in several states across the U.S. States such as Florida, Michigan, Texas, and New Mexico have provisions for this type of deed. These states allow property owners to transfer ownership while retaining the right to use and live in the property during their lifetime. This feature makes the enhanced life estate an attractive option for the elderly looking to secure their estate.

Deciding between a lady bird deed and a trust depends on your financial situation and goals. A lady bird deed provides a simple way to transfer property outside of probate, which may be appealing for those wishing for ease and efficiency. However, trusts offer broader protection and can address various complex financial needs. USLegalForms can help you evaluate your options regarding enhanced life estate for the elderly.

A life estate allows a person to use and benefit from a property during their lifetime, but they cannot sell or transfer ownership without consent from the remainderman. In contrast, an enhanced life estate allows greater control; you retain the right to sell, lease, or improve the property without permission. This flexibility can be particularly beneficial for an enhanced life estate for the elderly.

Currently, many states allow enhanced life estate deeds, including Florida, Texas, and Michigan. Each of these states has specific rules governing their use, so it’s crucial to familiarize yourself with local laws. For the best information and assistance, consider using a resource like USLegalForms, which can help you navigate the complexities of enhanced life estates for the elderly.