LLC (Limited Liability Company) is a popular business structure that provides an effective mix of the liability protection of a corporation and the simplicity of a partnership. It is a legal entity that separates personal assets from business liabilities, ensuring that the owner's personal property remains protected in case of debts or legal disputes. An LLC is a flexible form of business that can be formed by one or more individuals, known as members. These members can be individuals, corporations, or other entities. To establish an LLC, you must file the necessary paperwork with the state in which you intend to operate and pay the associated fees. The primary advantage of forming an LLC is the limited liability protection it offers. This means that the personal assets of the members, such as homes, cars, or personal bank accounts, are generally not at risk if the business incurs debts or faces legal liabilities. The member's liability is typically limited to the amount they've invested in the company. Another advantage is the flexibility in management and taxation options. Members can choose to manage the LLC themselves or appoint managers to handle day-to-day operations. Regarding taxation, an LLC has the flexibility to choose between being taxed as a partnership, a corporation, or even as a sole proprietorship (if it has a single member). This flexibility allows members to select the most advantageous tax structure for their specific situation. In certain states, there are variations of the traditional LLC structure available to suit different business purposes. Here are a few of the most common types: 1. Series LLC: This type allows for the creation of separate divisions within the LLC, known as series. Each series can have its own assets, liabilities, and members, providing an additional layer of separation. This structure is primarily used by businesses with multiple divisions or real estate investments. 2. Professional LLC (LLC): Professionals in fields such as law, accounting, architecture, or medicine often form PLL Cs. These are LCS specially designed for licensed professionals and typically require adherence to specific regulations and requirements mandated by state licensing boards. 3. Series LLC nested within an LLC: This structure combines the benefits of a Series LLC with the specialization of an LLC. It allows professionals to have separate divisions for different areas of their practice while maintaining limited liability protection. 4. Low-profit LLC (L3C): This unique form of LLC is primarily used by socially oriented businesses, such as nonprofits and for-profit entities, to pursue both financial and charitable objectives. L3Cs must prove that they primarily promote social welfare and meet specific requirements to maintain their status. It's important to consult with a legal or tax professional to fully understand the advantages, disadvantages, and legal requirements associated with forming and operating different types of LCS for business purposes. Each state may have its own regulations regarding LLC formation and management, so it's crucial to do thorough research and seek proper guidance.

Llc For Business Purpose

Description

How to fill out Llc For Business Purpose?

Using legal templates that comply with federal and state regulations is essential, and the internet offers a lot of options to choose from. But what’s the point in wasting time searching for the correctly drafted Llc For Business Purpose sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the largest online legal catalog with over 85,000 fillable templates drafted by lawyers for any business and life case. They are easy to browse with all files arranged by state and purpose of use. Our professionals keep up with legislative changes, so you can always be confident your paperwork is up to date and compliant when acquiring a Llc For Business Purpose from our website.

Obtaining a Llc For Business Purpose is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the preferred format. If you are new to our website, follow the instructions below:

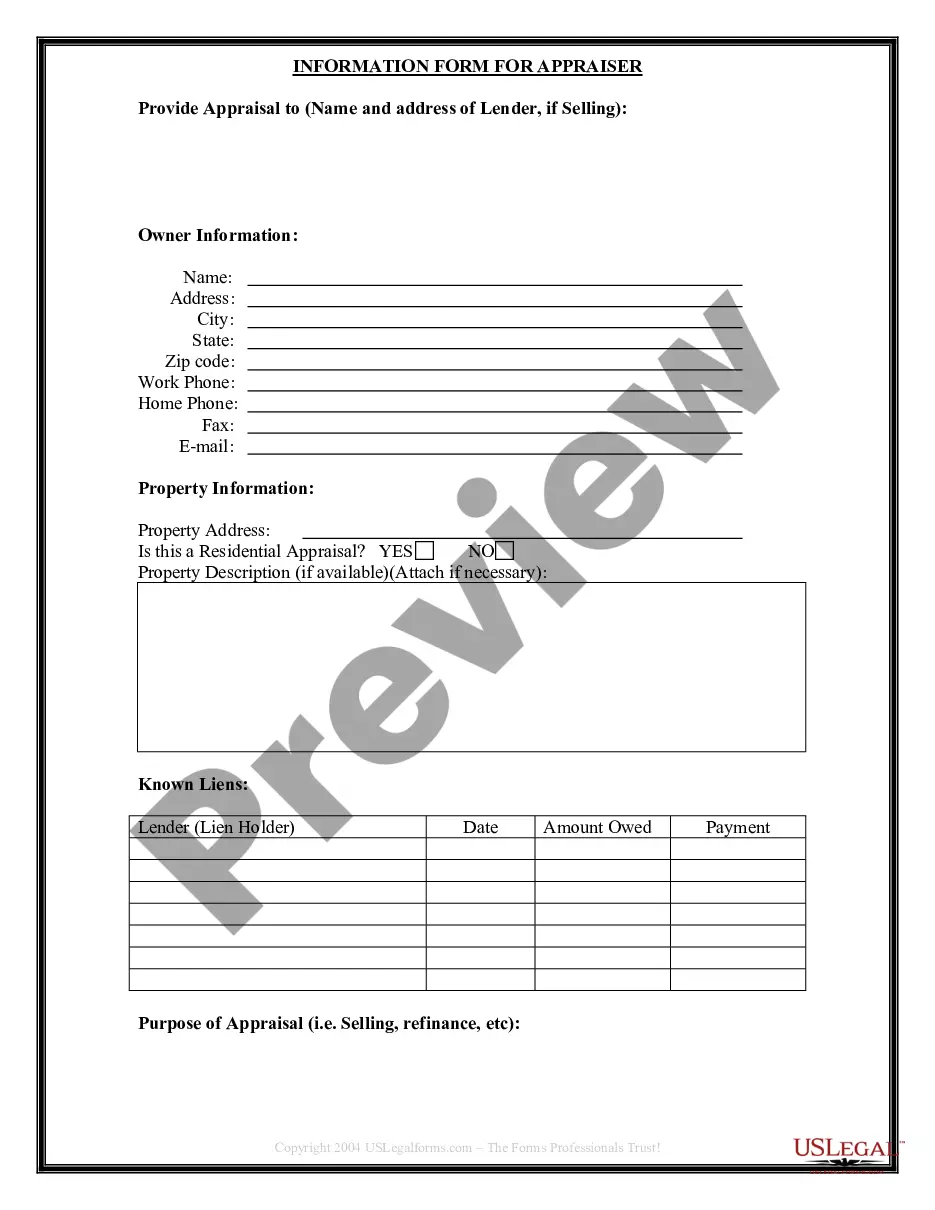

- Analyze the template using the Preview feature or through the text description to ensure it fits your needs.

- Browse for another sample using the search function at the top of the page if necessary.

- Click Buy Now when you’ve found the suitable form and choose a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Llc For Business Purpose and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and complete previously obtained forms, open the My Forms tab in your profile. Take advantage of the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

Here are 30 business purpose examples that you can use as inspiration for your own: 'To create an interconnected world of mutually supporting businesses who believe in the values of cooperation and sustainability. ' 'To empower people to educate themselves with content that's accurate, informative and enjoyable.

With an LLC, only the assets owned in the name of the LLC are subject to the claims of business creditors, including lawsuits against the business. The personal assets of the LLC members cannot be claimed to satisfy business debts. For most people, this is the most important reason to form an LLC.

Here's an example of what a general LLC purpose statement might look like: ?The purpose of this limited liability company is to engage in any lawful activity for which limited liability companies may be organized in this state.?

You can write a business purpose for an LLC with the following steps: First, start by researching your industry. ... Then, consider why you started the company. ... Then, consider how the business will operate. ... Finally, write your statement in a way that is concise and clear.

Disadvantages of creating an LLC Cost: An LLC usually costs more to form and maintain than a sole proprietorship or general partnership. States charge an initial formation fee. ... Transferable ownership. Ownership in an LLC is often harder to transfer than with a corporation.