Articles Of Incorporation Locator Id Without Phone Number

Description

How to fill out New York Articles Of Incorporation Certificate - Nonprofit Corporation - Tax Exempt?

It’s clear that you cannot become a legal expert in a day, nor can you easily learn how to swiftly create Articles Of Incorporation Locator Id Without Phone Number without possessing a unique skill set.

Compiling legal documents is a lengthy process that necessitates specific training and expertise. So why not entrust the drafting of the Articles Of Incorporation Locator Id Without Phone Number to the experts.

With US Legal Forms, one of the most extensive libraries of legal templates, you can locate everything from court documents to formats for internal corporate correspondence.

You can regain access to your documents from the My documents section whenever you need. If you are a returning customer, you can simply Log In, and locate and download the template from the same section.

No matter the objective of your forms—be it financial, legal, or personal—our website has you covered. Try US Legal Forms now!

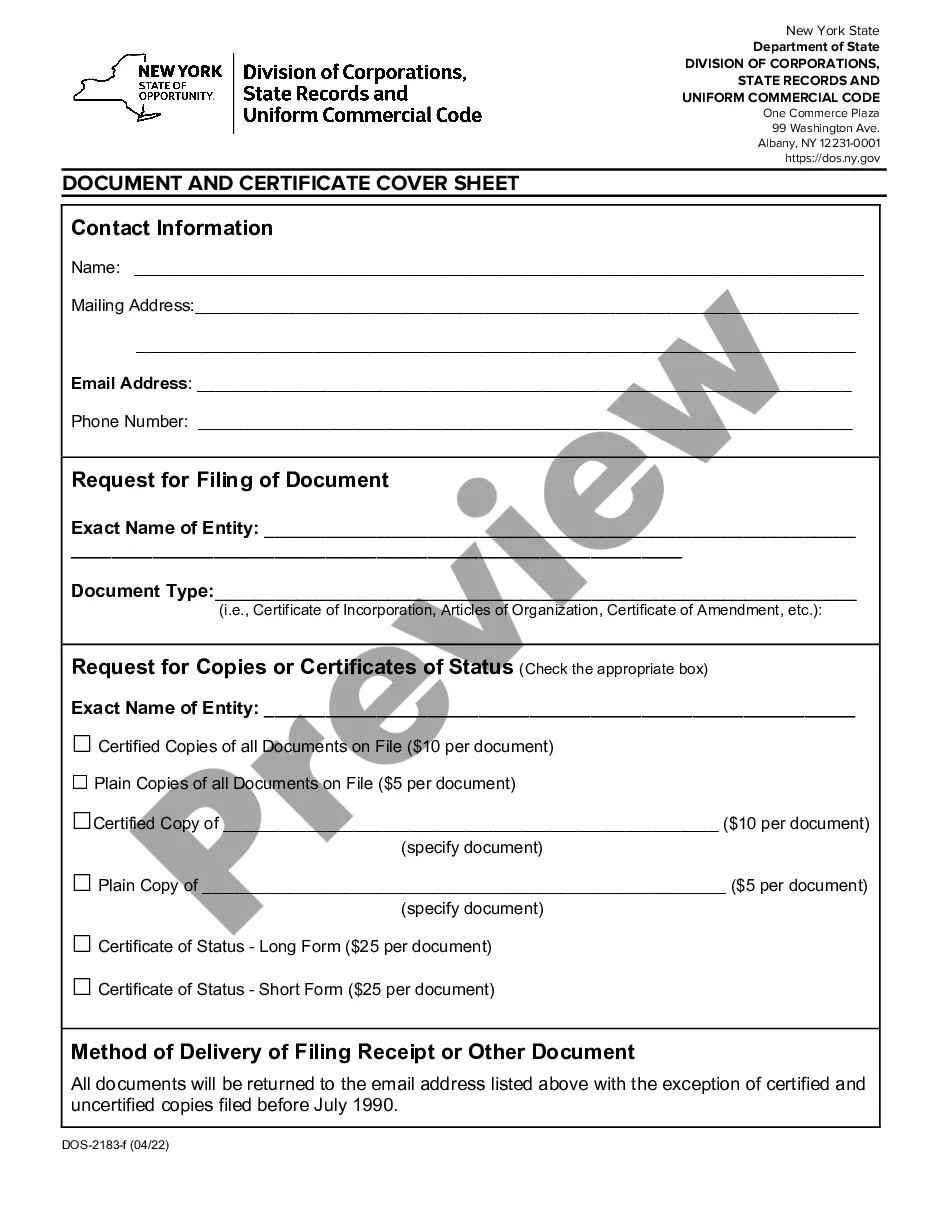

- Locate the template you need using the search bar at the top of the webpage.

- Preview it (if this feature is available) and review the accompanying description to verify if Articles Of Incorporation Locator Id Without Phone Number is what you are looking for.

- Initiate your search anew if you require a different template.

- Create a free account and choose a subscription plan to buy the template.

- Click Buy now. Once the payment is finished, you can download the Articles Of Incorporation Locator Id Without Phone Number, fill it out, print it, and send or mail it to the required parties or organizations.

Form popularity

FAQ

You can find the company's place of incorporation by checking the Articles of Incorporation filed with the relevant state authority. Most states make these records accessible through their Secretary of State websites. Using the Articles of incorporation locator id without phone number simplifies this search process.

Each province has different rules about the time limit of a lien. In Alberta, for example, your lien is valid for 180 days from the date the lien was placed. In Ontario, liens are only valid for 90 days from the date of last on site working.

RHODE ISLAND A lien executed against real property is deemed discharged after twenty years from the date of the judgment. R.I. Gen. Laws § 9-26-33.

Construction professionals, creditors and even family members can place a lien on your home as well if they obtain a judgment, although they would have to take the matter to court, provide evidence of unpaid debt and win a certificate of judgment from the court before being able to register the lien.

At the county clerk's office, you or the clerk can sift through all the public records for any liens on the property. The clerk will be available to answer any questions you may have, and they can help you identify any possible issues with the property.

How to file a mechanics lien in Rhode Island Prepare your Rhode Island Notice of Intention form. ... Serve the Rhode Island Notice of Intention as a preliminary notice. ... Record the Rhode Island Notice of Intention as a mechanics lien. ... File Notice of Lis Pendens and enforce the mechanics lien.

How long does a judgment lien last in Massachusetts? A judgment lien in Massachusetts will remain attached to the debtor's property (even if the property changes hands) for 20 years (for liens on real estate) or 30 days (for liens on personal property).

How does a creditor go about getting a judgment lien in Rhode Island? To attach the lien, the creditor must request execution of attachment within 48 hours after entry of the judgment, then file the execution with the town clerk or recorder of deeds in the Rhode Island town where the debtor's property is located.

If an individual fails to pay their debts, a creditor can obtain a judgement against them ? up to and including liens against the debtor's real property. The property then cannot be sold without dealing with the liens.

RHODE ISLAND A lien executed against real property is deemed discharged after twenty years from the date of the judgment. R.I. Gen. Laws § 9-26-33.