Open Trust Account Bank

Description

How to fill out Nevada Financial Account Transfer To Living Trust?

- Log into your US Legal Forms account if you're a returning user. Ensure your subscription is active; if it’s expired, renew it based on your plan.

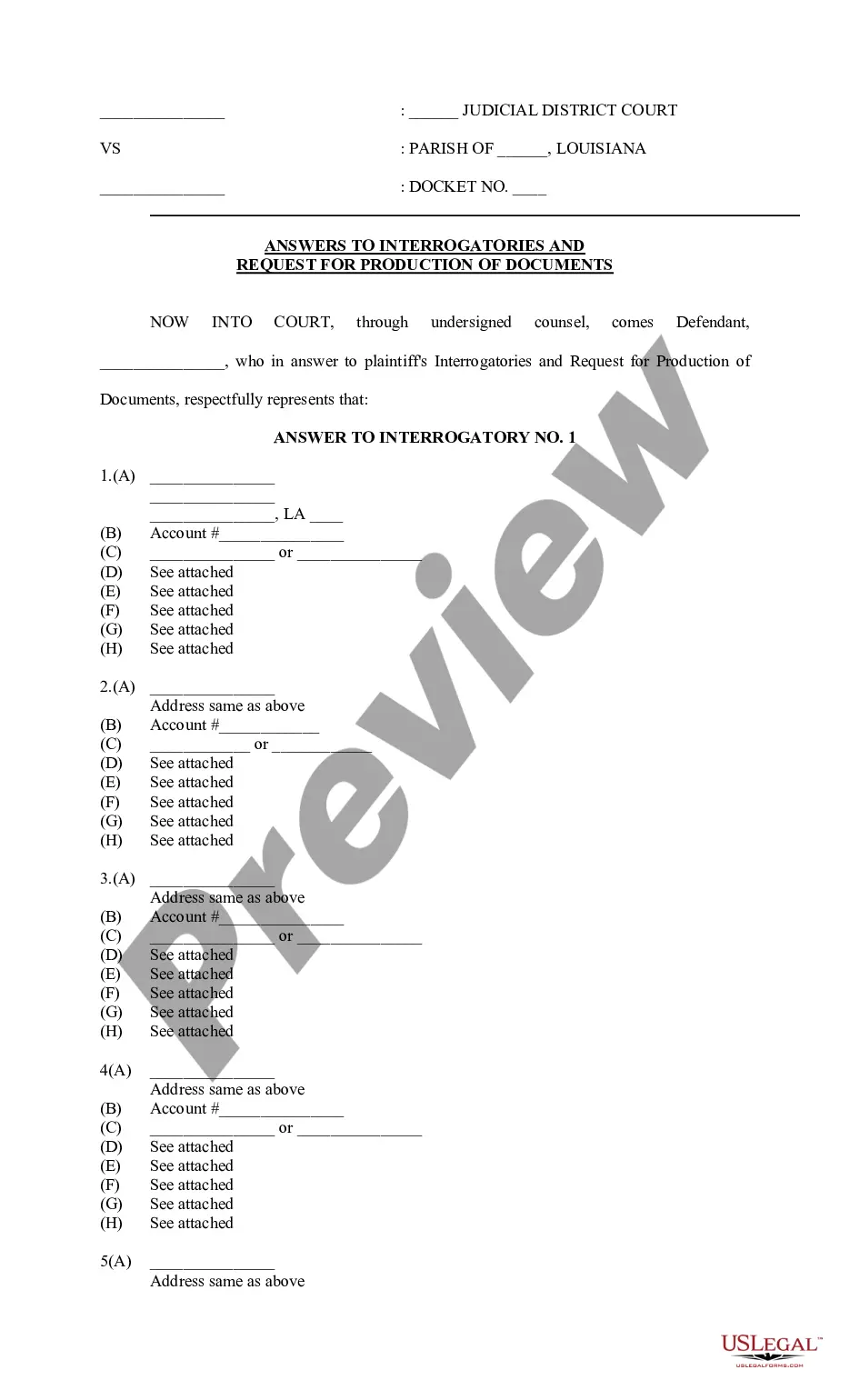

- For first-time users, explore the Preview mode to verify that you've selected the correct template that fits your needs and complies with jurisdictional requirements.

- Use the Search tab if you need a different template. Upon finding the right form, you can proceed to the next step.

- Click on the Buy Now button to select your preferred subscription plan. Create an account to unlock full access to the library.

- Complete your purchase using a credit card or PayPal, thus gaining access to numerous legal forms.

- Download your chosen form to your device for completion. You can also find it anytime in the My Forms section of your profile.

Using US Legal Forms for opening a trust account streamlines the process, providing users with more than 85,000 fillable and editable forms, ensuring you find exactly what you need. Additionally, expert assistance is available for those requiring help with form completion.

Start your journey towards opening a trust account today with the help of US Legal Forms—your one-stop destination for legal documentation.

Form popularity

FAQ

The best place to open a trust account often depends on your location and specific requirements. Look for banks that specialize in trust services, as they typically offer better expertise and tailored solutions. Online banks might also provide competitive rates and lower fees. Consider visiting the uslegalforms platform to explore options that match your needs when deciding where to open a trust account.

Generally, it takes between one and several business days to open a bank account for a trust. The time frame depends on the bank's procedures and the completeness of your documents. Ensure that you have all necessary paperwork ready to minimize delays. If you use the uslegalforms platform, you can streamline the preparation of your documents, making the process faster.

The best bank to open a trust account depends on your specific needs, including fees, services, and customer support. Some national banks and local credit unions offer beneficial terms for trust accounts. Research and compare banks to find one that provides favorable interest rates and convenient online access. Additionally, you may want to consider submissions on the uslegalforms platform for guidance on choosing the right bank.

To open a trust bank account, you will need to gather the necessary documents, such as the trust agreement and tax identification number. Next, visit a bank or a credit union that offers trust accounts. When you arrive, fill out the application forms and provide the required documents. Finally, fund the account to complete the process and start managing your assets effectively.

Yes, you can open a bank account specifically for a trust. When you do this, the bank will require documentation that proves the existence of the trust. Typically, this includes the trust agreement and a tax identification number for the trust. To make the process smoother, consider using USLegalForms, which can help you gather the necessary documents and navigate the requirements to open a trust account bank.

An example of a trust account at a bank could be a minor's trust account, where a parent or guardian manages funds until the child reaches a certain age. When you open a trust account bank for this purpose, it ensures that the funds are secure and managed in accordance with the trust's rules until the child can access their inheritance.

Opening a trust bank account involves several steps. First, identify a bank that provides such accounts and gather the required documents, including the trust agreement and tax identification number. Then, visit the bank, submit your documents, and follow their procedures to set up the account under the trust's name, allowing for organized asset management.

A trust account is specifically designated for holding and managing assets on behalf of a trust. When you set up this account, you are establishing a legal framework that aligns with the trust's objectives and ensures proper distribution of assets. It is different from a personal checking or savings account, as its purpose revolves around the trust’s terms.

A trust account is a financial account held by a bank or financial institution for a trust. When you open a trust account bank, you essentially separate the assets in this account from personal assets, ensuring they are managed according to the terms of the trust. This arrangement protects the assets for the beneficiaries and provides clarity on their usage.

A common example of a trust bank account is a revocable living trust account where the grantor retains control during their lifetime. When you open a trust account bank for this purpose, it allows for the seamless transfer of assets upon the grantor’s death, simplifying the estate planning process for your beneficiaries.