Trust Filing Evidence For Tax Purposes

Description

How to fill out Nevada Certificate Of Trust By Individual?

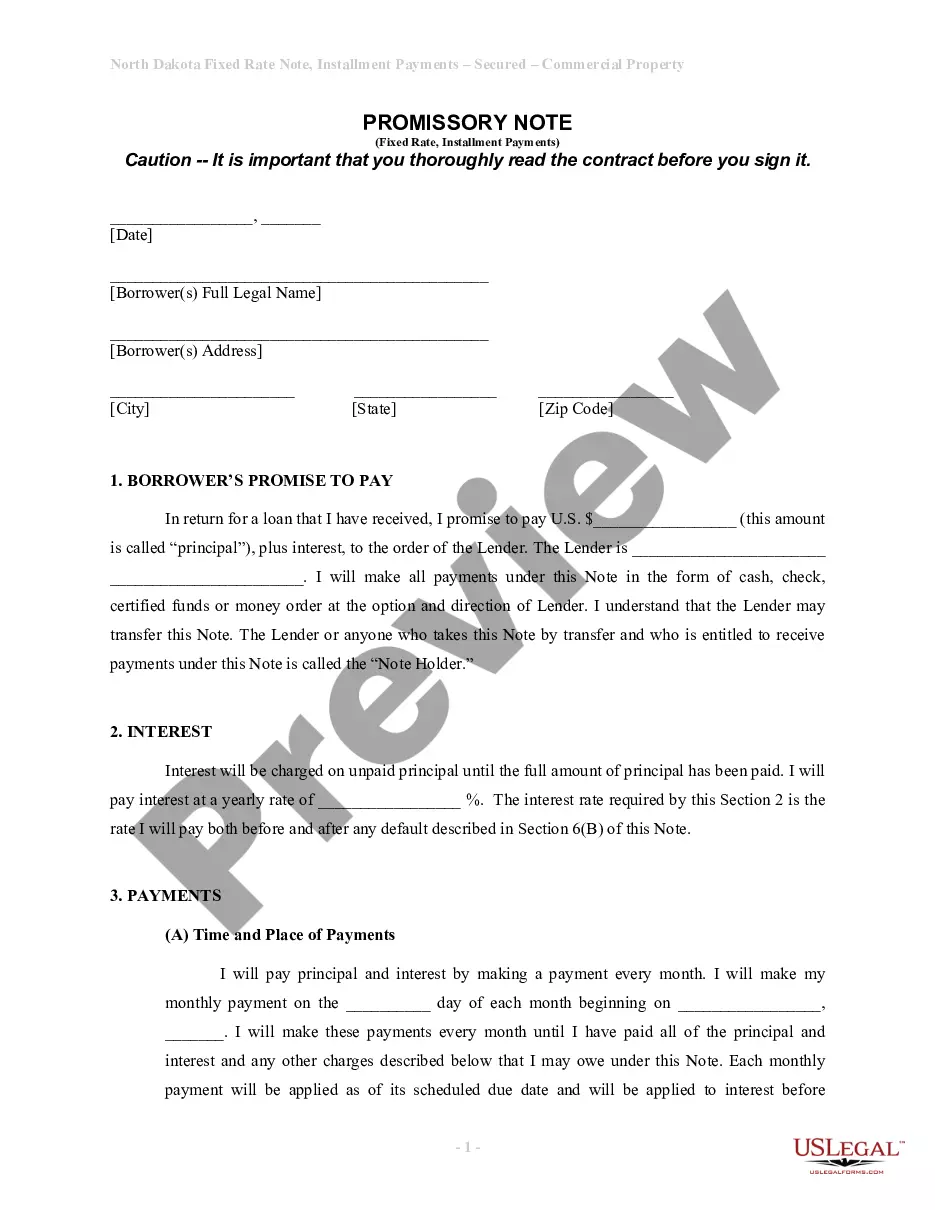

- Log in to your US Legal Forms account if you are a returning user to download the needed template directly. Ensure your subscription is active; renew if necessary.

- If you’re new to US Legal Forms, start by previewing the form and reading its description to ensure it meets your jurisdictional requirements.

- Utilize the Search tab to find alternate forms if your first choice isn't suitable. Verify its relevance to your needs before proceeding.

- Select the 'Buy Now' option for your chosen document and choose a subscription plan that fits your requirements. An account registration may be needed to access the full library.

- Complete your purchase by entering your payment details. You can use a credit card or PayPal for convenience.

- Download your form to your device and access it anytime from the 'My Forms' section in your profile for future reference.

In conclusion, US Legal Forms provides a robust collection of legal documents that empower users to file trust evidence efficiently. With over 85,000 editable forms and expert assistance available, you can ensure that your documents are precise and legally sound.

Explore the benefits of US Legal Forms today and make your legal paperwork hassle-free!

Form popularity

FAQ

To file taxes on behalf of a trust, you need to use Form 1041, which is specifically designed for trusts. You should gather all necessary documentation that serves as trust filing evidence for tax purposes, including income generated by the trust, distributions made to beneficiaries, and any deductions the trust may qualify for. After completing the form with accurate information, submit it to the IRS by the deadline. If you find the process overwhelming, consider using US Legal Forms to access resources and templates that simplify trust management and tax filing.

Yes, if a trust generates income, beneficiaries often receive a Schedule K-1, which details their share of the income and any distributions. While a trust itself may not receive a 1099, the trustee is responsible for reporting all income and necessary distributions accurately. Thus, maintaining proper trust filing evidence for tax purposes is essential to ensure you meet all IRS requirements.

To report trustee income, first determine how income is distributed to beneficiaries or retained in the trust. Trustees need to report their income on Form 1041 for the trust, reflecting any distributions made. Providing clear trust filing evidence for tax purposes helps simplify the process and ensures that all income is reported correctly.

The IRS form used for reporting trust income is Form 1041, which is specifically designed for estates and trusts. This form allows you to report income, deductions, and tax liabilities for the trust. It is vital to provide complete and accurate trust filing evidence for tax purposes to ensure proper submission and avoid any complications with the IRS.

A common tax loophole for trusts involves the use of irrevocable trusts, which can help in avoiding estate taxes and benefiting from lower income tax rates. These trusts can strategically manage income and distributions, effectively reducing the taxable income of the grantor. Understanding the specific regulations around trust filing evidence for tax purposes is crucial to maximize these benefits without attracting unwanted scrutiny.

To report trust income on your tax return, first determine whether the trust is a grantor or non-grantor trust. If it’s a grantor trust, you will report the income on your personal tax return using Form 1040. For non-grantor trusts, you must file Form 1041, U.S. Income Tax Return for Estates and Trusts. Accurate trust filing evidence for tax purposes is essential to ensure compliance and avoid penalties.

Yes, trusts can receive 1099 forms, especially if they earn income through investments or make distributions to beneficiaries. This reporting helps ensure transparency and accuracy in financial dealings. Keeping track of 1099s is a key part of maintaining trust filing evidence for tax purposes.

Typically, trusts need to file Form 1041 along with any necessary supporting schedules and forms, such as Schedule A, B, or D, depending on income sources. These forms help detail the trust's income and distributions, which are vital for trust filing evidence for tax purposes. Ensuring accurate filings can prevent issues with the IRS.

For a trust to file a tax return, it must generate income exceeding the specified threshold set by the IRS. This includes all taxable income that is not attributable to the beneficiaries. Meeting these criteria helps ensure that the trust fulfills its obligations for trust filing evidence for tax purposes.

Trusts must meet specific tax reporting requirements, which include filing Form 1041, U.S. Income Tax Return for Estates and Trusts. Additionally, they may need to provide Schedule K-1s to beneficiaries reporting their share of income. Understanding these requirements ensures proper trust filing evidence for tax purposes.