Anonymous Llc Nevada Withholding

Description

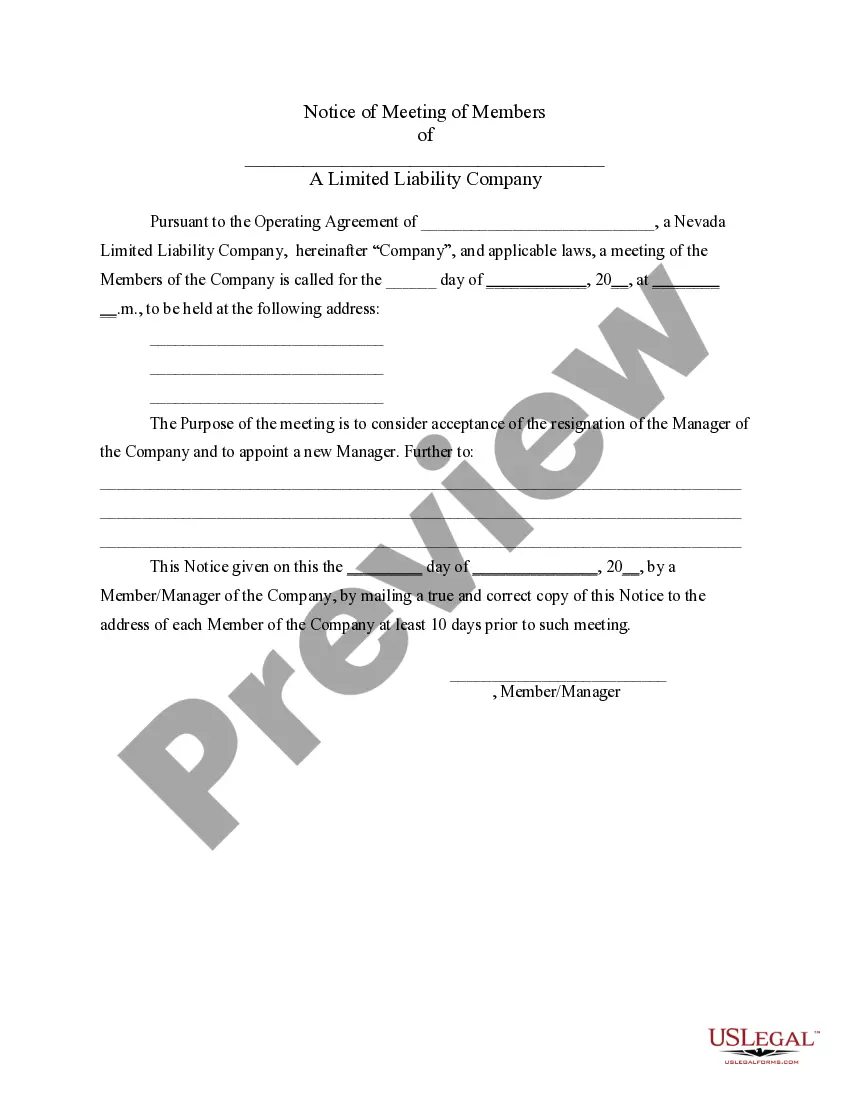

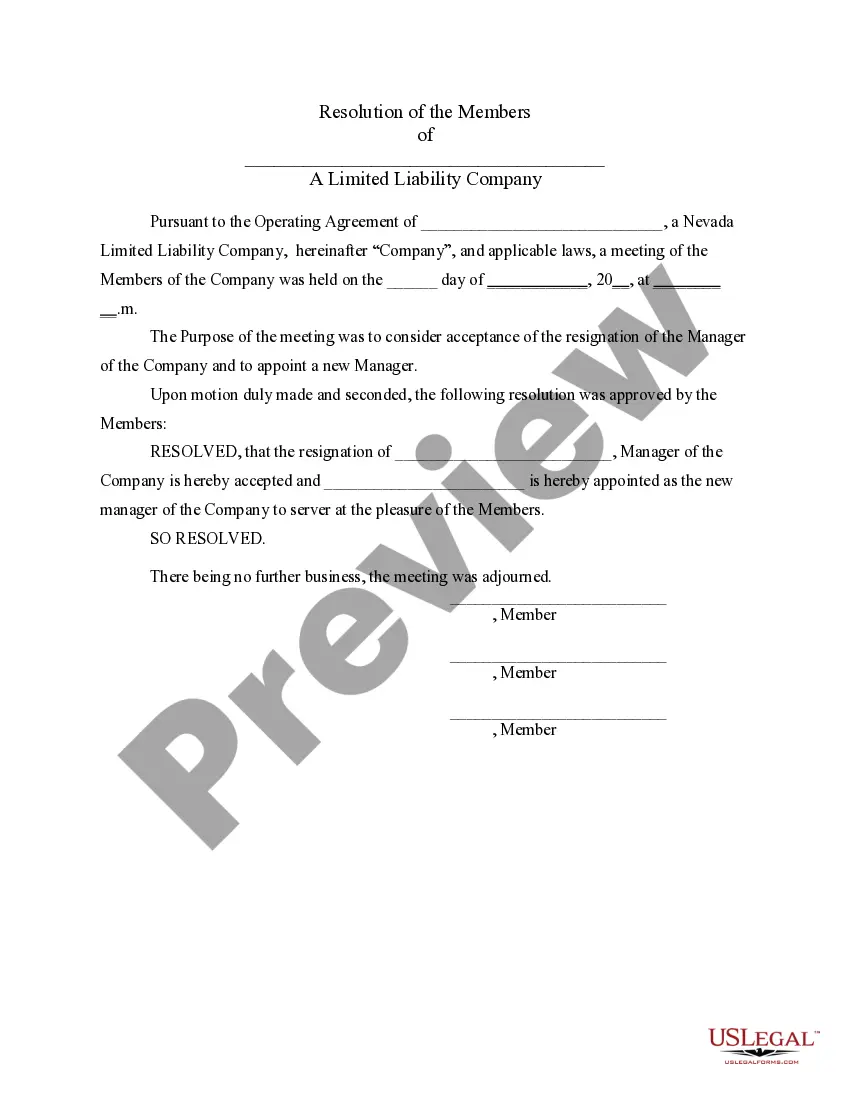

How to fill out Nevada LLC Notices, Resolutions And Other Operations Forms Package?

It’s obvious that you can’t become a legal expert immediately, nor can you grasp how to quickly prepare Anonymous Llc Nevada Withholding without having a specialized background. Putting together legal forms is a long process requiring a particular training and skills. So why not leave the creation of the Anonymous Llc Nevada Withholding to the pros?

With US Legal Forms, one of the most comprehensive legal document libraries, you can access anything from court papers to templates for internal corporate communication. We understand how crucial compliance and adherence to federal and state laws and regulations are. That’s why, on our website, all templates are location specific and up to date.

Here’s how you can get started with our platform and obtain the form you need in mere minutes:

- Find the form you need by using the search bar at the top of the page.

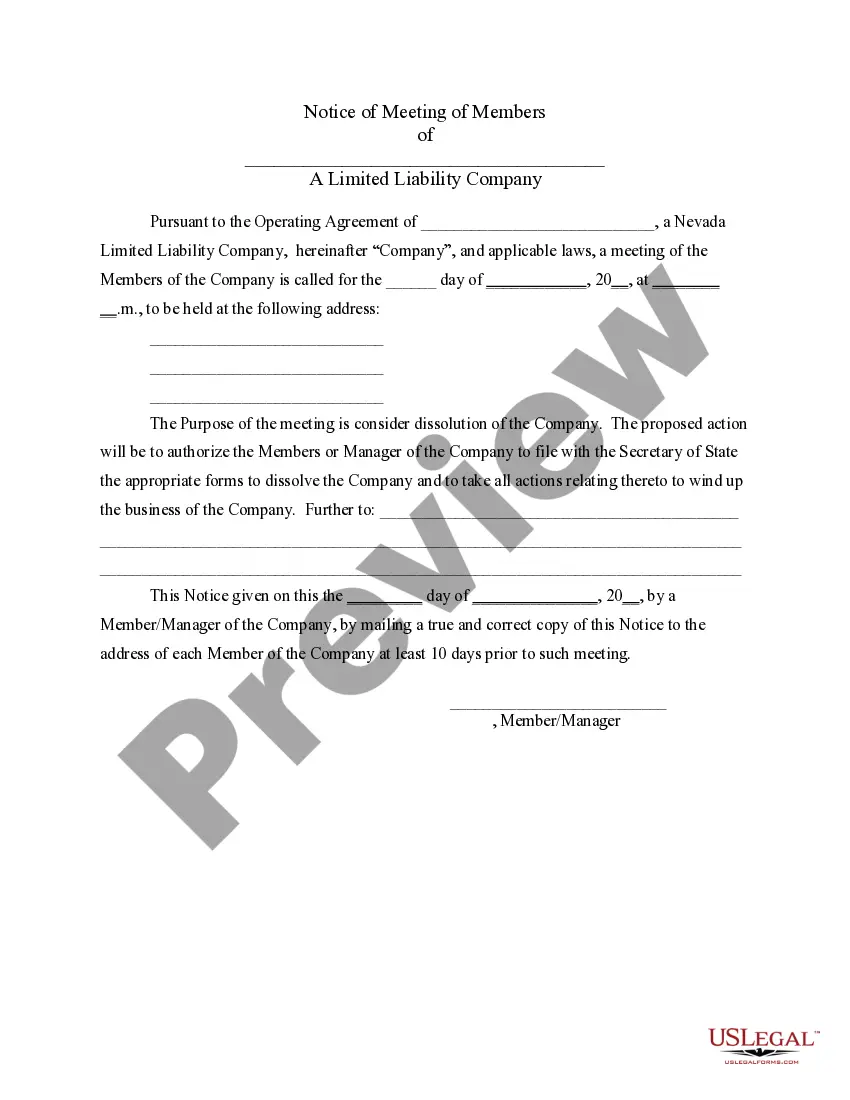

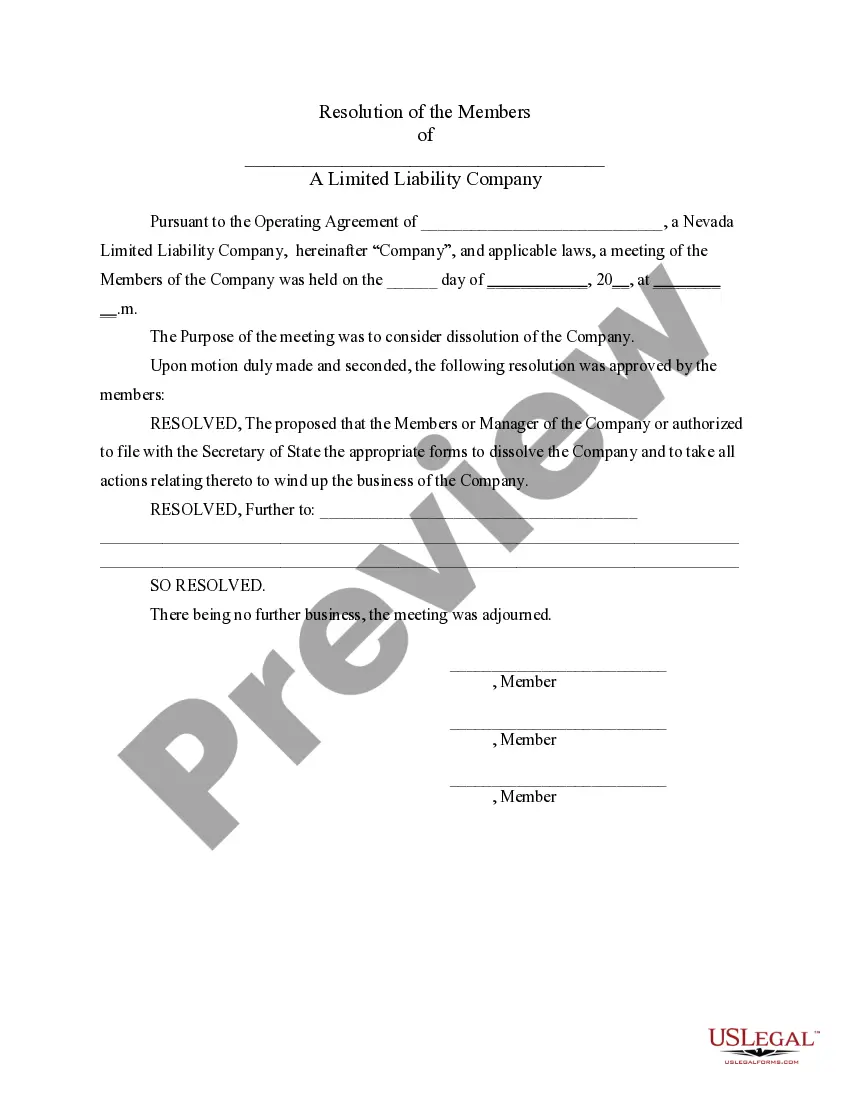

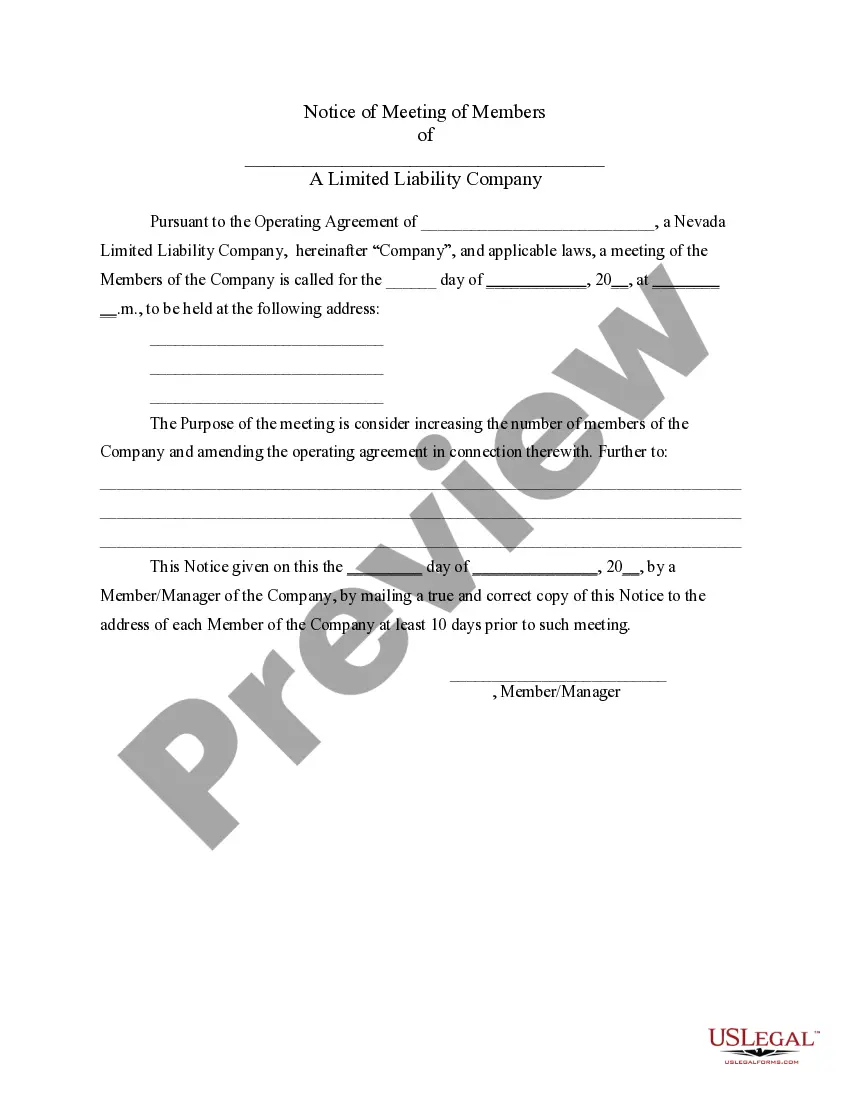

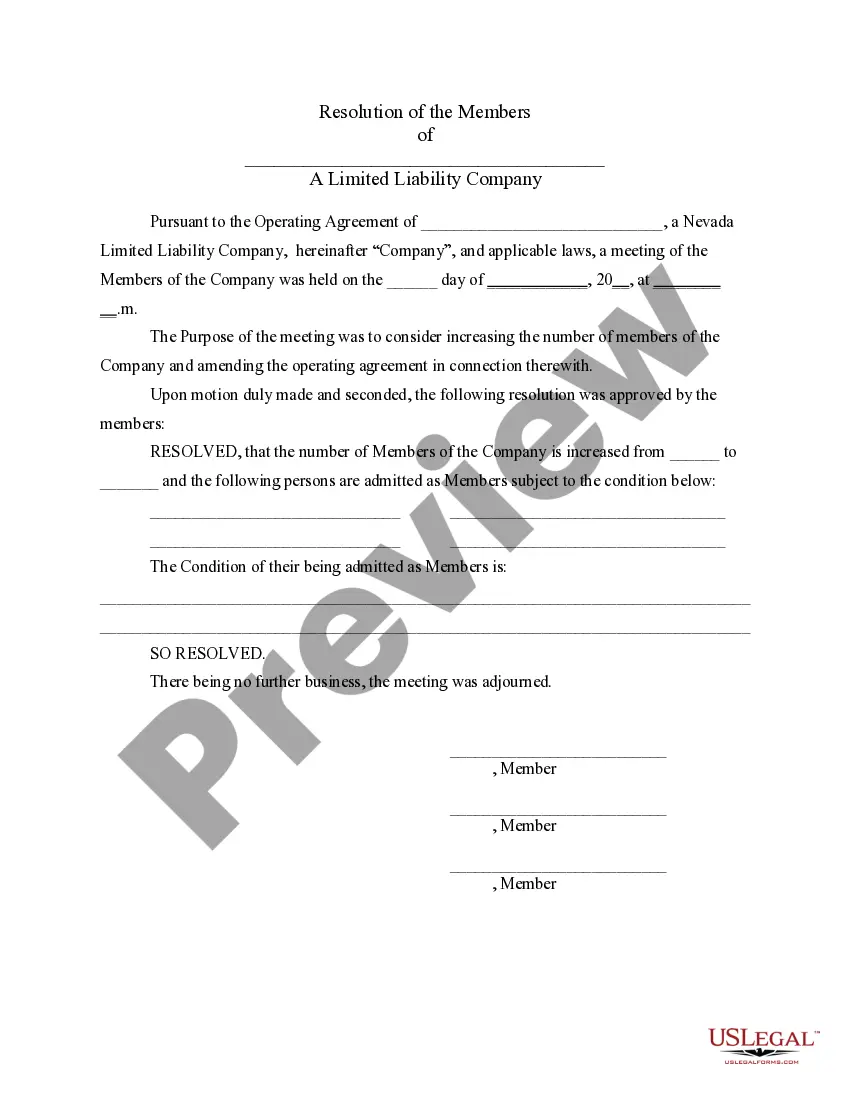

- Preview it (if this option available) and read the supporting description to figure out whether Anonymous Llc Nevada Withholding is what you’re looking for.

- Begin your search over if you need a different template.

- Register for a free account and select a subscription plan to purchase the template.

- Choose Buy now. Once the payment is complete, you can get the Anonymous Llc Nevada Withholding, fill it out, print it, and send or mail it to the designated people or entities.

You can re-access your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your paperwork-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

If you're looking to form an anonymous LLC, New Mexico is probably your best bet. It's the only state that lets you keep your name off the public record, which means you get a ton of privacy and protection for your assets. Plus, the filing fees in New Mexico are very reasonable, making it a popular choice.

Risks of an LLC Loss of Limited Liability. Although an LLC enjoys limited liability, poor practices could result in an LLC losing its liability shield. ... Difficulty Obtaining Investors. ... Pass-Through Taxation.

Hiding ownership is accomplished by creating a separate company and placing the assets into the new company. The new company can be used to open bank accounts or to make purchases. In some countries, it is almost impossible to link a company back to its owner.

To file an Anonymous LLC in Nevada, the owner must submit the business's Articles of Organization to the state. This includes information such as: The name of the company. The duration of the business.

Some of the disadvantages are slightly higher filing and business license fees than other states, and the commerce tax for business with over $4 million of Nevada gross revenue.