Nevada Lien Release Withholding Tax

Description

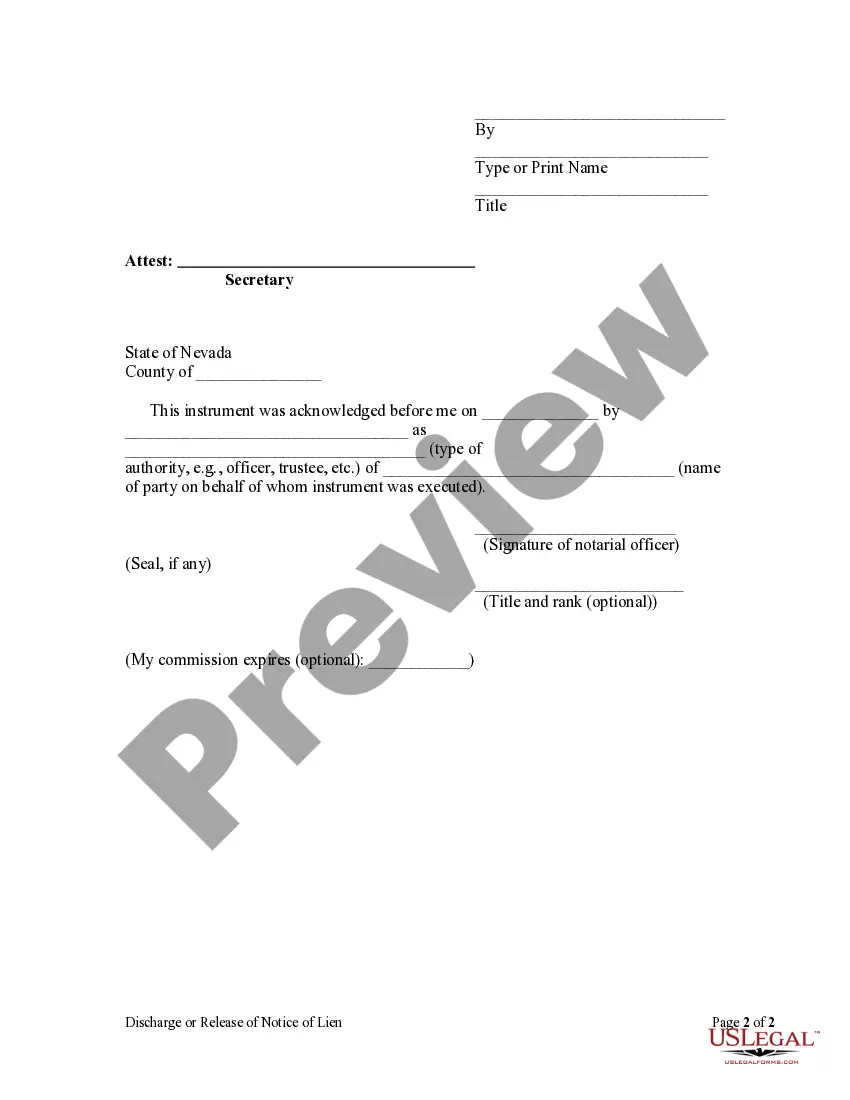

How to fill out Nevada Discharge Or Release Of Lien - Corporation?

It’s obvious that you can’t become a law expert immediately, nor can you figure out how to quickly prepare Nevada Lien Release Withholding Tax without the need of a specialized background. Putting together legal documents is a time-consuming venture requiring a particular training and skills. So why not leave the creation of the Nevada Lien Release Withholding Tax to the professionals?

With US Legal Forms, one of the most comprehensive legal document libraries, you can find anything from court paperwork to templates for in-office communication. We know how crucial compliance and adherence to federal and state laws are. That’s why, on our platform, all forms are location specific and up to date.

Here’s start off with our platform and get the document you need in mere minutes:

- Find the document you need by using the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to figure out whether Nevada Lien Release Withholding Tax is what you’re looking for.

- Start your search over if you need any other form.

- Set up a free account and select a subscription plan to purchase the form.

- Pick Buy now. Once the transaction is complete, you can download the Nevada Lien Release Withholding Tax, complete it, print it, and send or send it by post to the necessary people or organizations.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your documents-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

No, of the 12 states that provide statutory lien waiver forms, only 3 states require them to be notarized. Nevada's lien waivers don't require notarization to be valid, In fact, an argument could be made that notarizing a Nevada lien waiver, could actually invalidate it.

The ELT lienholder can electronically request a lien release (title will be processed without the lienholder) or request a printed title with the lienholder listed (fees apply for printing). You cannot apply for a duplicate ELT title using a paper form.

Nevada has specific regulated statutory lien waiver forms that must be used. To waive lien rights in Nevada, the waiver must use the statutory form and have it signed by the claimant. Both conditional and unconditional lien waivers are allowed, but conditional is viewed as the safer option.

You may submit the title at a DMV office or mail it to us to have the lienholder removed and obtain a "clear" title. It does not matter whether the title was issued in a different state as long as the vehicle is registered in Nevada.