Nevada Surety Bond Cost

Description

How to fill out Nevada Surety Bond Form - Individual?

It’s well known that you cannot transform into a legal expert overnight, nor can you quickly learn how to prepare Nevada Surety Bond Cost without a specialized education.

Creating legal documents is a lengthy process that demands specific training and expertise. Therefore, why not entrust the creation of the Nevada Surety Bond Cost to the experts.

With US Legal Forms, one of the most extensive legal template collections, you can find everything from courtroom documents to templates for internal company communications. We recognize the significance of compliance with federal and state regulations.

You can access your forms again from the My documents section at any time. If you’re already a client, you can simply Log In, and find and download the template from the same section.

Regardless of the reason for your documents—whether financial and legal, or personal—our platform is here to assist you. Give US Legal Forms a try today!

- Locate the form you require using the search feature at the top of the site.

- Preview it (if this option is available) and review the accompanying description to determine if Nevada Surety Bond Cost is what you need.

- Initiate your search again if you require another template.

- Create a free account and choose a subscription plan to acquire the template.

- Select Buy now. Once the transaction is finalized, you can download the Nevada Surety Bond Cost, complete it, print it, and send it by mail to the intended recipients or organizations.

Form popularity

FAQ

To buy a surety bond in Nevada, start by researching licensed surety bond providers. Gather necessary documents, which typically include financial statements and proof of identity. Once you have selected a provider, you can request a quote that will detail the Nevada surety bond cost. After agreeing to the terms, complete the application process, and your bond will be issued.

To obtain a surety bond in Nevada, you should first identify the type of bond you need. Contact a qualified surety company, fill out an application, and provide any necessary documentation. Your financial history will play a role in determining the Nevada surety bond cost. Using resources like US Legal Forms can simplify this process, making it easier to obtain the bond you need.

The Nevada surety bond cost often hinges on the bond type and your financial standing. Generally, the premium is calculated as a percentage of the bond amount, and this can range from a few hundred dollars for smaller amounts. Knowing the specifics of your bond can help you better anticipate costs and prepare accordingly. For additional assistance, consider utilizing US Legal Forms to navigate the details.

Yes, many surety bonds in Nevada are set at $10,000, but the exact amount can depend on the specific bond type. Different licenses or contracts may require different bond amounts to ensure compliance. It's important to understand what your particular situation demands and how it affects your Nevada surety bond cost. US Legal Forms can help clarify these requirements and guide you through the process.

To get a Nevada surety bond, you need to find a licensed surety company. Once you select a provider, you will complete an application that includes your personal information and the type of bond you require. The surety company will assess your financial status and provide you with a quote, which includes the Nevada surety bond cost. You can streamline the process by using platforms like US Legal Forms.

Surety bonds generally cost 1-15% of the required bond amount. Surety bond costs vary significantly depending on the bond amount you need and your rate (which is the percentage of the full bond amount you must pay).

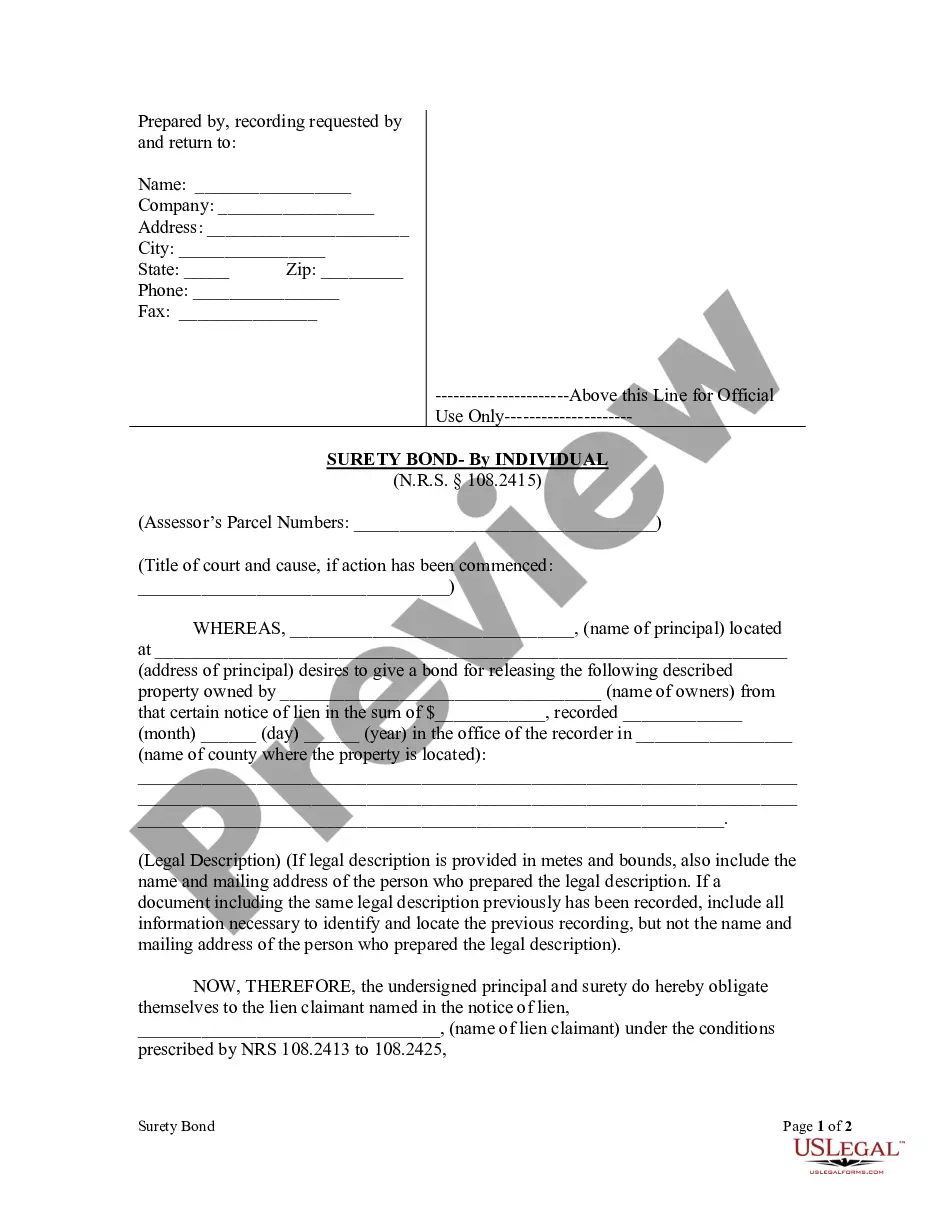

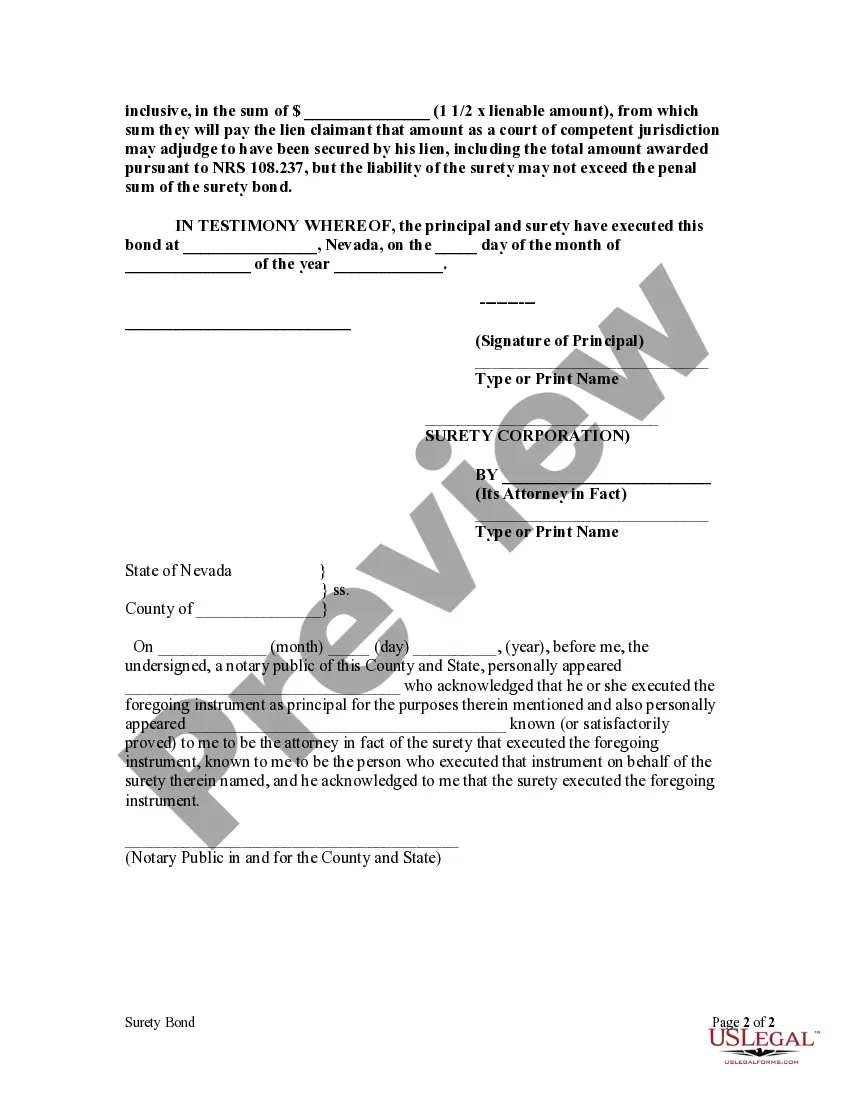

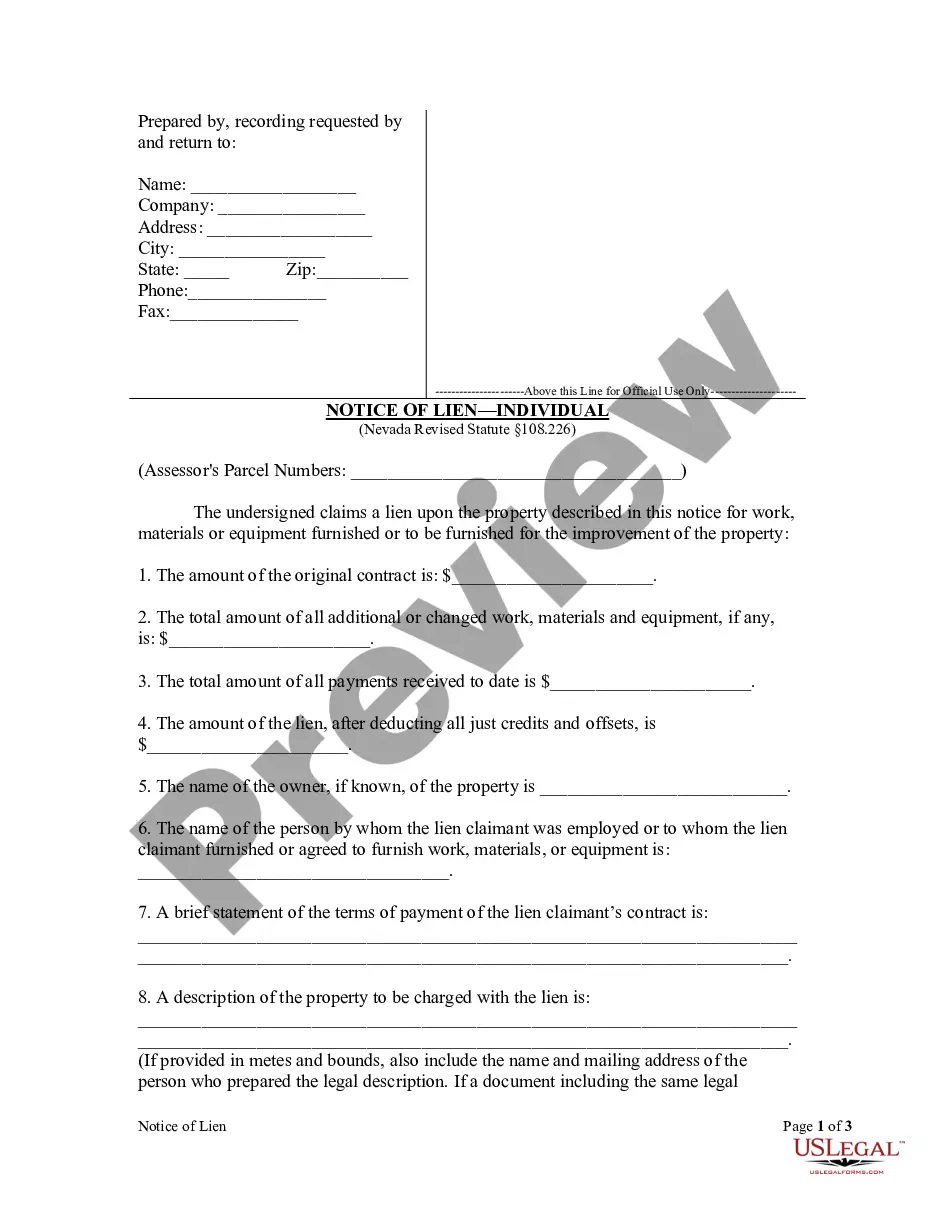

Anatomy of a Surety Bond Form Bond Number. The surety company assigns this unique identifying number to the bond. ... Principal. The principal is the person or business required to obtain the bond. ... Surety Company. ... Bond Penalty (Penal Sum) ... Obligation. ... Obligee. ... Effective Term. ... State.

Surety bond premiums (the amount you pay) are often calculated as a percentage of the total bond amount, usually between 0.5% and 5% of the bond amount for applicants with good credit, and between 5% up to as much as 20% of the bond amount for applicants with poor credit.

Nevada law requires all notaries to have a $10,000 notary surety bond for the duration of their commission. The Nevada notary bond protects the people of Nevada from any mistakes you might make while performing your notarial duties.