Quit Claim Deed Form For Illinois

Description

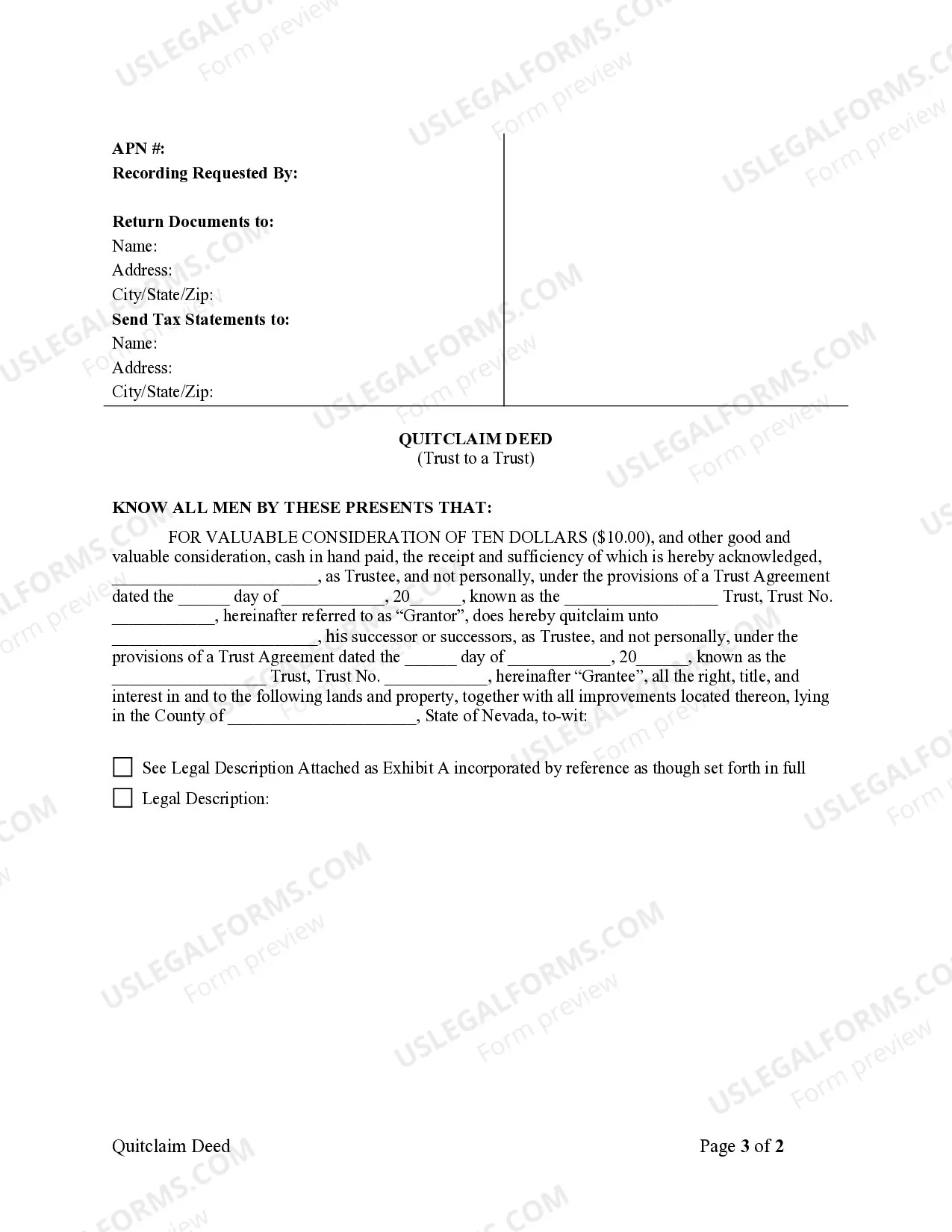

How to fill out Nevada Quitclaim Deed - Trust To A Trust?

- Visit the US Legal Forms website and log into your account if you're a returning user. Ensure that your subscription is current for uninterrupted access.

- If it's your first time, start by browsing the form library. Use the preview mode to confirm that you have selected the right quit claim deed form for Illinois.

- Should you need another template, utilize the search feature to find alternatives that suit your specific needs.

- Purchase the selected document by clicking the 'Buy Now' button and choosing a suitable subscription plan. You'll need to create an account if you haven't done so yet.

- Complete your payment using either a credit card or PayPal to finalize your subscription.

- Once the purchase is confirmed, download the quit claim deed form to your device and access it at any time from the 'My Forms' section in your profile.

In conclusion, US Legal Forms provides a simple way to obtain legal documents like the quit claim deed form for Illinois. With a vast library and expert assistance available, navigating property transactions becomes efficient and straightforward.

Ready to simplify your legal documentation? Visit US Legal Forms today and secure your quit claim deed form with ease!

Form popularity

FAQ

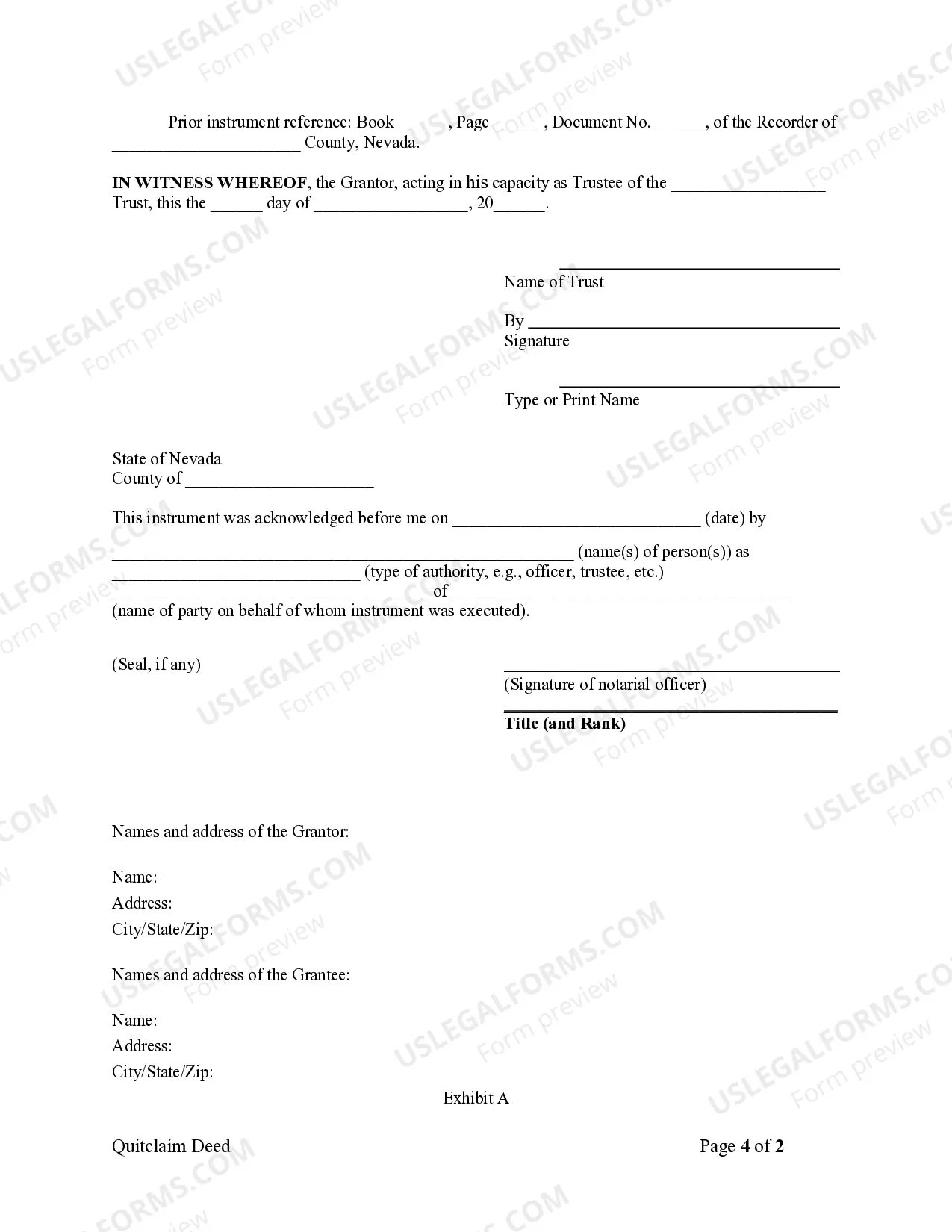

To file a quit claim deed in Illinois, start by obtaining the appropriate quit claim deed form for Illinois, which you can find on platforms like US Legal Forms. Next, fill out the form with accurate details about the property and the individuals involved in the transfer. After that, you must sign the form in the presence of a notary public, followed by filing it with the local county recorder's office. Following these steps ensures that your deed is legally recognized.

You do not necessarily need a lawyer to file a quit claim deed in Illinois; however, seeking legal advice can help you avoid complications. The quit claim deed form for Illinois is straightforward, and you can complete it yourself if you understand the requirements. It's important to ensure that all information is accurate to prevent any future disputes. Using a knowledgeable resource like US Legal Forms can guide you through the process effectively.

Yes, a quitclaim deed must be notarized in Illinois to be legally valid. This notarization adds an official layer of verification to your document. To make this process easier, consider using a quit claim deed form for Illinois from a service like USLegalForms, which can guide you through the necessary steps.

You might choose to do a quitclaim deed to yourself to clarify ownership or remove your property's title restrictions. This action can be particularly useful if you want to resolve title issues or prepare for a future transaction. Making use of a quit claim deed form for Illinois can help facilitate this process.

Certainly, you can prepare your own quitclaim deed without hiring a lawyer. Using a quit claim deed form for Illinois helps guide you through the necessary details, enabling you to complete the process confidently. Additionally, consider checking state regulations to ensure compliance.

Yes, you can file a quit claim deed yourself in many states, including Illinois. Utilizing a quit claim deed form for Illinois from a reliable service can simplify the process. Just make sure to properly fill out the document and follow the recording requirements specific to your county.

In California, any person who is familiar with the process can prepare a quit claim deed. Often, property owners choose to fill out the quit claim deed form for Illinois through platforms like USLegalForms, which provide easy-to-follow instructions and templates, ensuring that all legal guidelines are met.

You typically do not need an attorney to handle a quit claim deed in North Carolina. However, it can be beneficial to consult with a legal expert to ensure that you correctly complete the quit claim deed form for Illinois, or any other state, especially if there are complexities involved in your property transfer.

Quitclaims can be viewed with caution because they do not provide any guarantees about the title. When using a quit claim deed form for Illinois, the grantor is not responsible for any liens or encumbrances on the property. This lack of assurance means that if issues arise after the transfer, the grantee may face challenges that cannot be rectified easily.

An example of a quitclaim is when a property owner transfers their interest in a shared family property to a sibling without any warranty of title. In this situation, the quit claim deed form for Illinois legally documents the transfer of ownership, indicating that the grantor is giving up their rights to the property. This kind of transaction is often used in family matters or when property is given as a gift.