What Does Protective Asset Protection Cover

Description

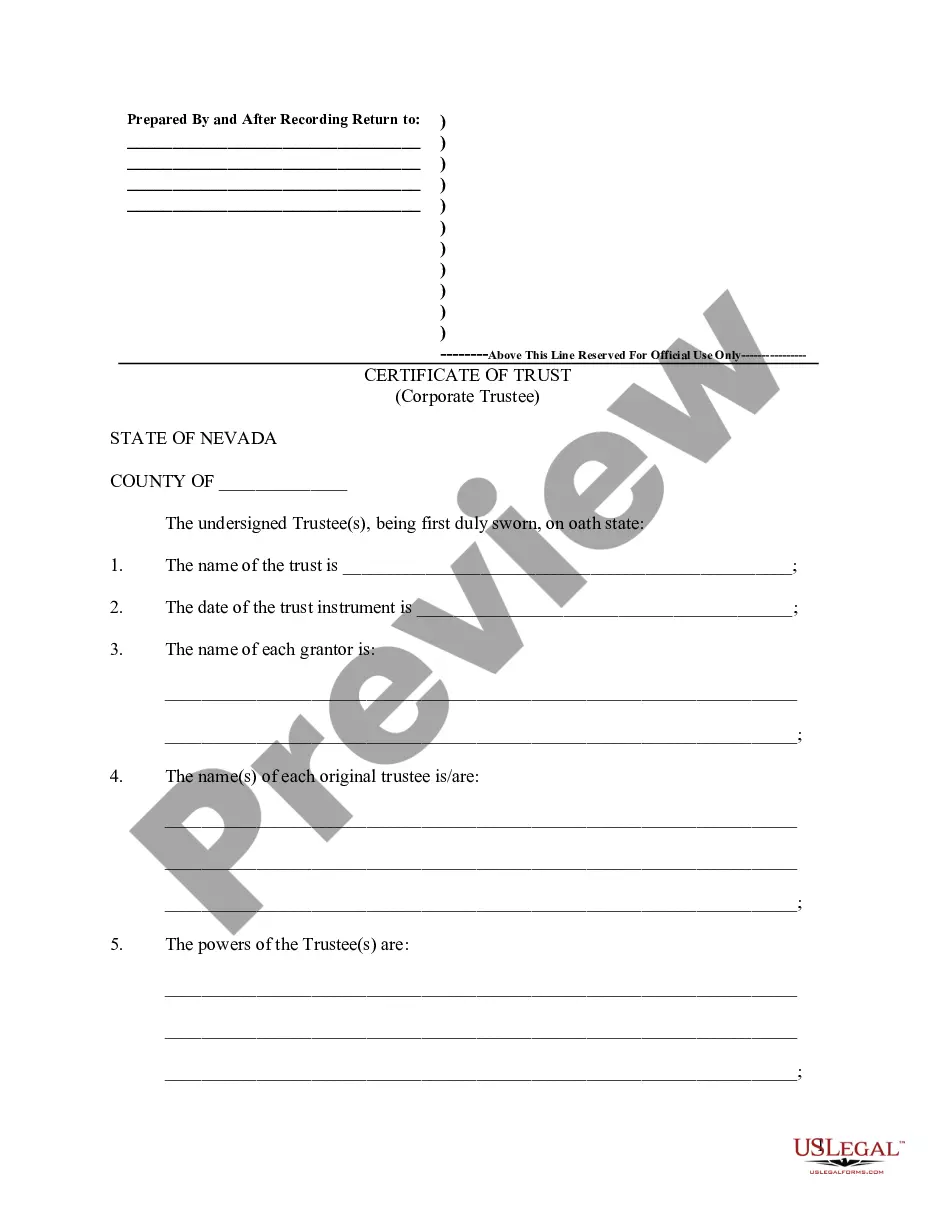

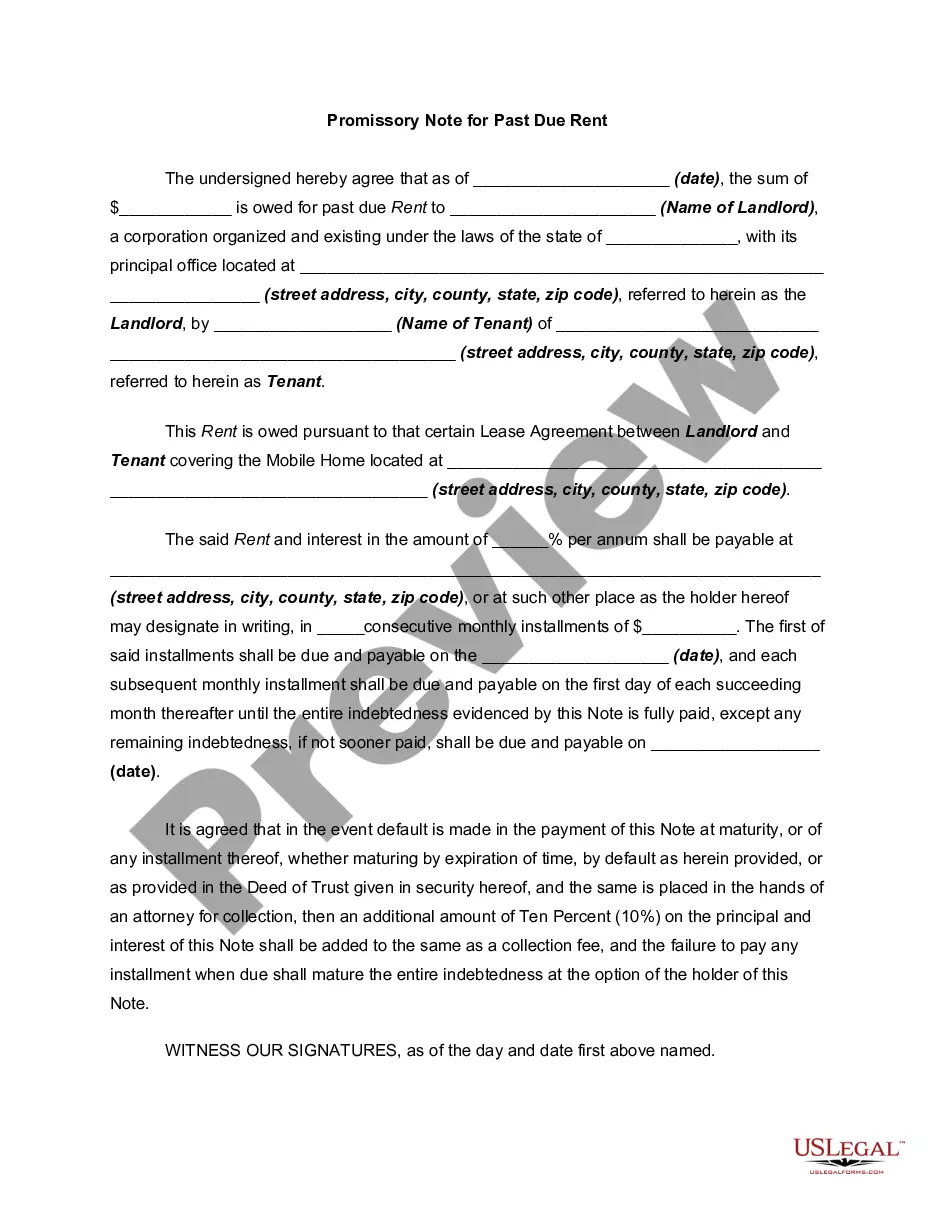

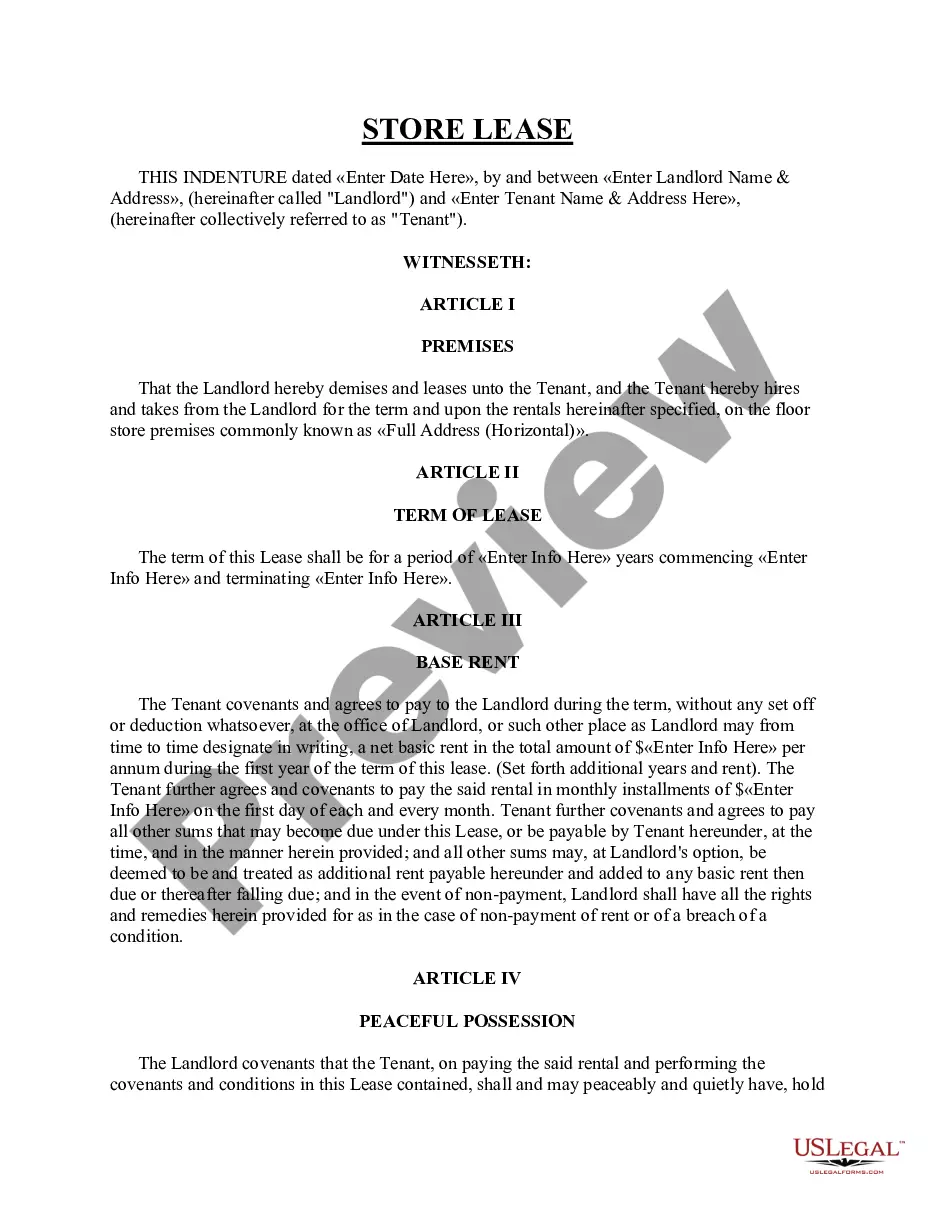

How to fill out Nevada Asset Protection Trust?

- Start by visiting the US Legal Forms website and create an account if you haven’t already.

- Browse through the extensive collection of over 85,000 legal forms or use the Search tab to find the specific document you need.

- Review the form description and check the Preview mode to ensure it meets your requirements and adheres to local regulations.

- Select the correct form and click on the Buy Now button to choose your preferred subscription plan.

- Complete your purchase by entering your payment information, either through credit card or PayPal.

- Once your payment is processed, download the form directly to your device and access it anytime through the My Forms menu in your profile.

In conclusion, US Legal Forms simplifies the legal document acquisition process by offering more than just a variety of forms; it also provides access to premium experts for assistance, ensuring your documents are complete and legally sound. Protect your assets with confidence by exploring our offerings today!

Visit US Legal Forms now to get started!

Form popularity

FAQ

A vehicle protection plan generally includes coverage for mechanical failures, parts replacement, and sometimes damages caused by accidents or wear and tear. It acts as a safety net for your vehicle, ensuring you don't face unexpected expenses. Recognizing what does protective asset protection cover will help you choose the right plan that fits your needs.

An asset protection vehicle is a car or other asset specifically designated to safeguard your investments from loss or liability. This concept helps to separate personal assets from business liabilities, providing an additional layer of security. Understanding what an asset protection vehicle entails allows you to make better financial decisions and protect your wealth.

Protective asset protection on a car typically covers scenarios like mechanical breakdowns, theft, and other unforeseen damages. This coverage allows you to feel secure knowing that your vehicle is protected from unexpected expenses. Familiarizing yourself with what does protective asset protection cover ensures that you can fully enjoy your vehicle without worry.

Yes, AUL covers windshield replacement as part of their protective asset protection offerings. This feature ensures that when your vehicle sustains damage to its windshield, you can easily get it repaired or replaced without the extra financial burden. Knowing what does protective asset protection cover can enhance your driving experience by minimizing unexpected costs.

Asset protection insurance covers various risks associated with your assets. Primarily, it helps you secure personal property against legal claims, theft, or loss. By offering financial support in these situations, it ensures your hard-earned investments remain safe. Understanding what does protective asset protection cover helps you make informed decisions.

It's essential to grasp what does protective asset protection cover, particularly regarding components in an extended warranty. Components such as batteries, tires, and brake pads often do not receive coverage since they are considered maintenance items. Additionally, electronic components that were not factory-installed may also be excluded. Understanding these limitations can help you determine the best protective asset strategy.

When evaluating what does protective asset protection cover for cars, there are specific exclusions to keep in mind. Extended car warranties usually do not cover items like regular maintenance, cosmetic damages, or any vehicle components that were not covered under the original manufacturer's warranty. Moreover, issues resulting from an accident or improper handling are typically excluded. Staying informed helps ensure you have realistic expectations of your coverage.

Understanding what does protective asset protection cover includes knowing exclusions under extended warranties. Commonly excluded items are routine maintenance, such as oil changes and tire rotations, as these are seen as regular upkeep. Additionally, damage caused by accidents, neglect, or misuse typically falls outside of warranty protection. Being aware of these details can help you make informed decisions regarding your benefits.

When considering what does protective asset protection cover, it's important to know that some conditions are typically excluded. For instance, pre-existing conditions, cosmetic damages, and wear and tear are generally not covered. Additionally, items that have been modified or repaired by unauthorized personnel may fall outside warranty coverage. Therefore, understanding your specific warranty terms is crucial.

Generally, car warranties do not cover routine maintenance and wear-and-tear items, such as brake pads or tires. Additionally, they often exclude damage resulting from accidents or improper usage. By understanding what items are typically not covered in a car warranty, you can plan your expenses better and ensure you have the right protections in place.