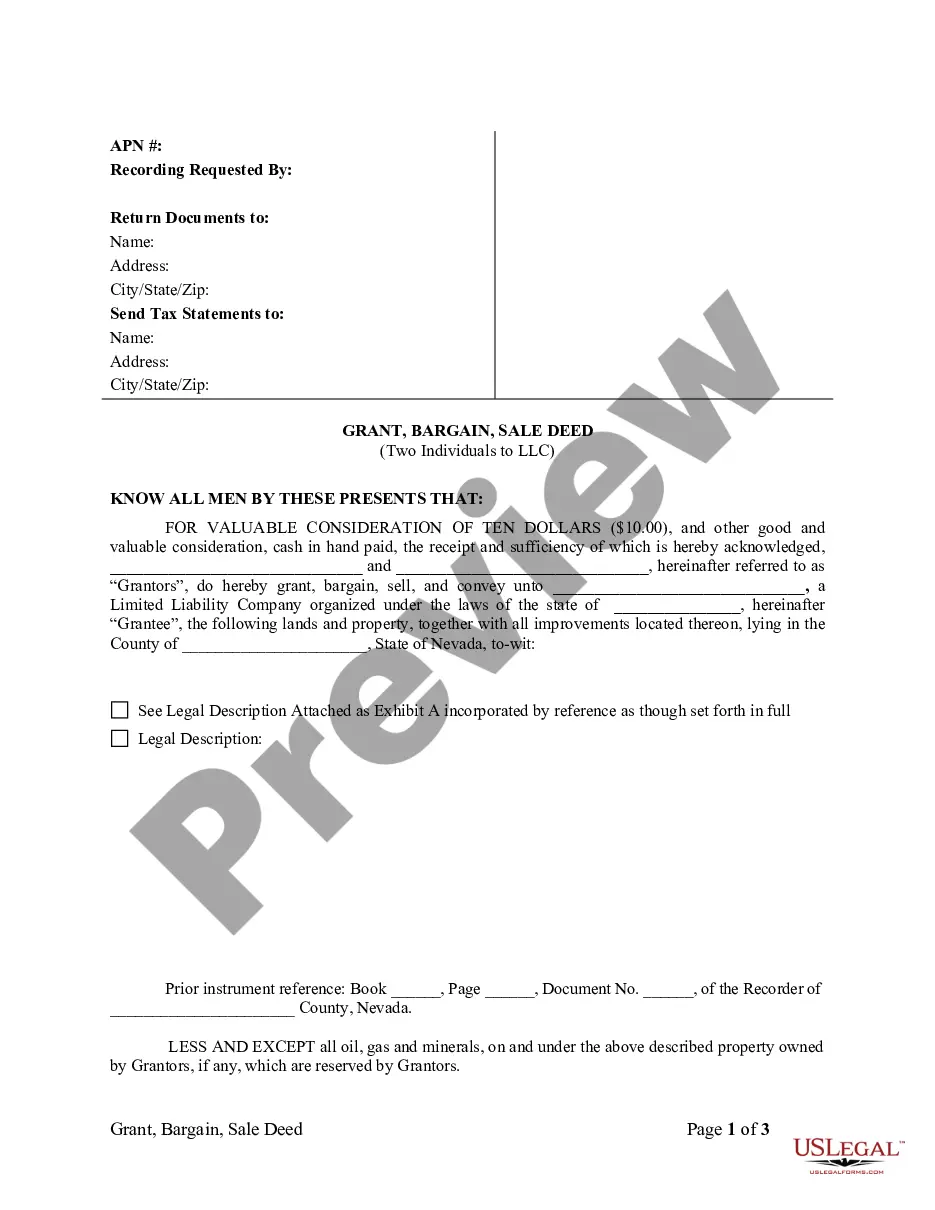

Nevada County Grant Deed Form

Description

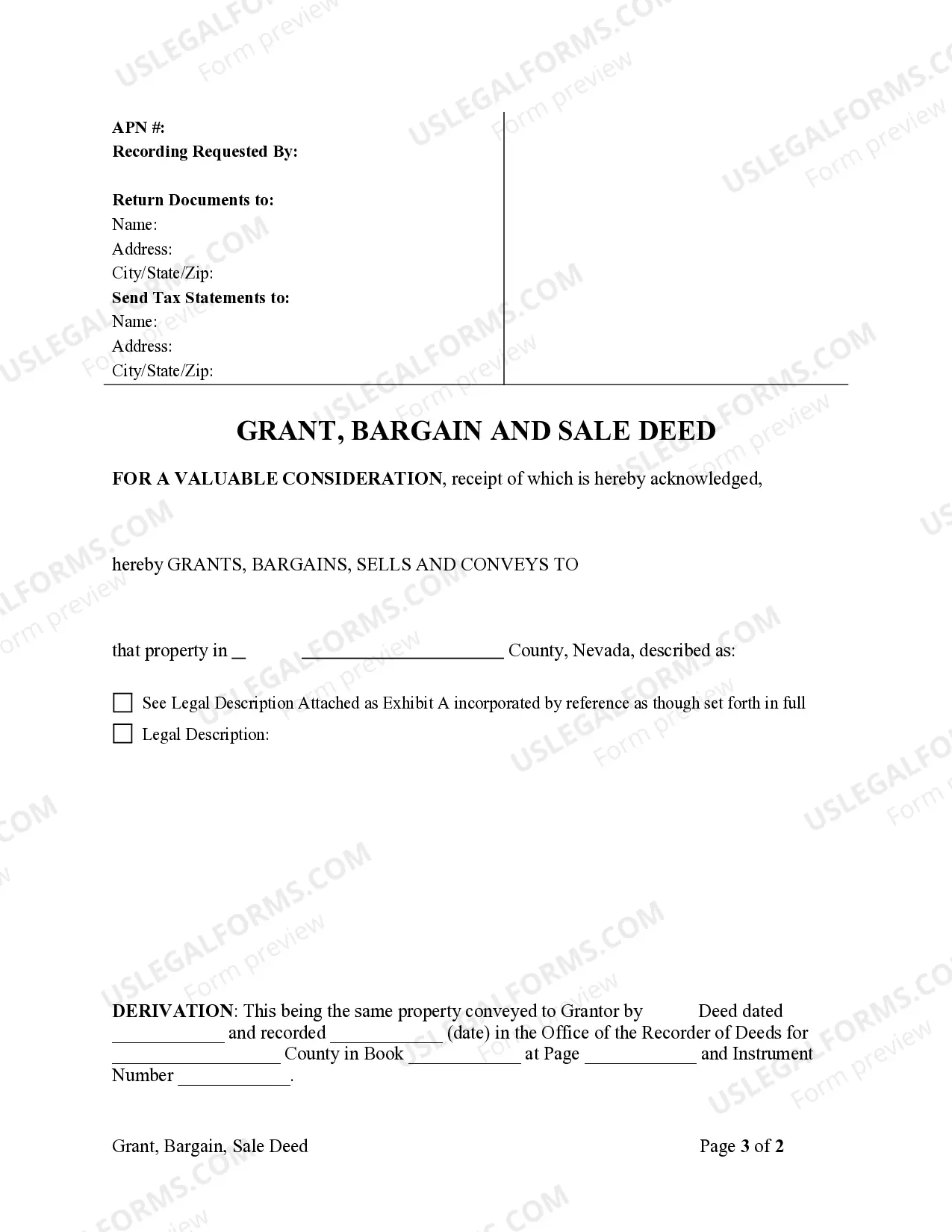

How to fill out Nevada Grant, Bargain And Sale Deed - Limited Liability Company To Limited Liability Company?

Well-crafted official documentation is one of the crucial safeguards for preventing problems and lawsuits, but acquiring it without the assistance of a lawyer may require time.

Whether you need to swiftly locate a current Nevada County Grant Deed Form or any other templates for employment, family, or business scenarios, US Legal Forms is always available to assist.

The procedure is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you just need to Log In to your account and click the Download button next to the desired document. Additionally, you can retrieve the Nevada County Grant Deed Form at any time, as all documents ever procured on the platform are kept accessible within the My documents section of your profile. Conserve time and funds on preparing official paperwork. Experiment with US Legal Forms today!

- Confirm that the form is applicable to your needs and locale by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar in the header of the page.

- Press Buy Now once you find the suitable template.

- Select the pricing plan, Log In to your account, or create a new one.

- Choose your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Select PDF or DOCX file format for your Nevada County Grant Deed Form.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

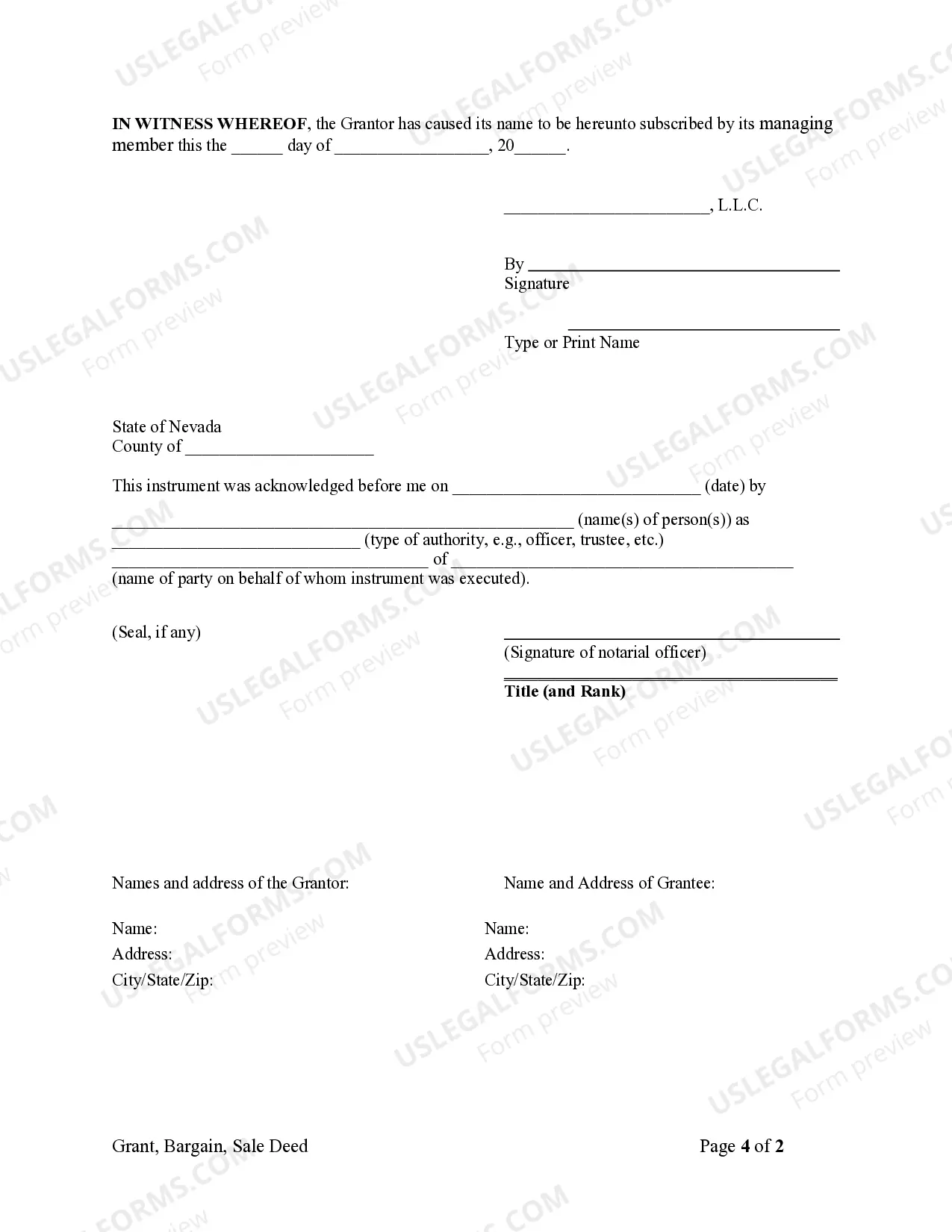

Filing a quitclaim deed in Nevada involves preparing the deed with the property information and the names of both the grantor and grantee. After completing the form, you must file it with the county recorder's office in the jurisdiction where the property is located. Using the proper Nevada county grant deed form simplifies this task, ensuring that all required information is included and accurate.

To transfer a property title in Nevada, you start by completing the necessary documentation, typically a grant deed or a quitclaim deed. Once filled out, you must record the document with the appropriate county recorder’s office. It's crucial to use the correct Nevada county grant deed form to ensure the transfer is legally sound and recognized by the state.

In California, the recording of a grant deed usually takes anywhere from a few days up to a couple of weeks, depending on the county's processing times. If you are moving from Nevada to California, remember that you will need a different set of forms. Ensure you prepare your documents accurately, and consider using the Nevada county grant deed form or its California equivalent to avoid delays.

To request records in Clark County, Nevada, you can visit the Clark County Recorder's Office website or their physical location. It’s best to have specific details about the document you are seeking, such as dates and types. If you need guidance, using the correct Nevada county grant deed form can streamline your request process effectively.

In Nevada, the recording of a deed typically occurs within a few days after closing. However, the exact time can vary depending on the county's workload and recording office hours. For a smooth process, you may want to ensure that you have the correct Nevada county grant deed form ready and complete. Using a reliable service can also help expedite this process.

A grant deed in Nevada is a legal document that transfers ownership of real property from one party to another while providing some assurances about the title. This type of deed usually guarantees that no one else has made a claim to the property after the grantor acquired it. If you need a straightforward Nevada county grant deed form, our platform can provide the necessary tools and resources to complete your transaction smoothly.

Yes, Nevada is considered a deed state, meaning that property ownership is typically transferred through deeds recorded with the county. The use of a deed is essential in formalizing the sale or transfer of property rights. If you are looking for a Nevada county grant deed form, be assured that it will help you properly document your property transfer in compliance with state laws.

The four primary types of deeds are warranty deeds, quitclaim deeds, grant deeds, and special purpose deeds. Each type serves different purposes related to property ownership and title transfer. Using a Nevada county grant deed form, for example, provides a guarantee that the grantor holds clear title to the property, offering assurance to the buyer.

A quitclaim deed is often used to transfer ownership rights in a property without any guarantees regarding the title. It is commonly applied in situations such as transferring property between family members or clearing up title issues. If you are considering using a Nevada county grant deed form, a quitclaim deed can typically simplify these processes, although it may lack the protective features of a warranty deed.

In Clark County, as in many other places, the seller usually pays the transfer tax. However, this responsibility can be altered through negotiations during the sale process. Both buyers and sellers should be transparent during these discussions to ensure clarity. Regardless of who pays, using the Nevada county grant deed form can clarify the financial obligations involved in the transaction.