Notice Lien Form Withdrawal

Description

Form popularity

FAQ

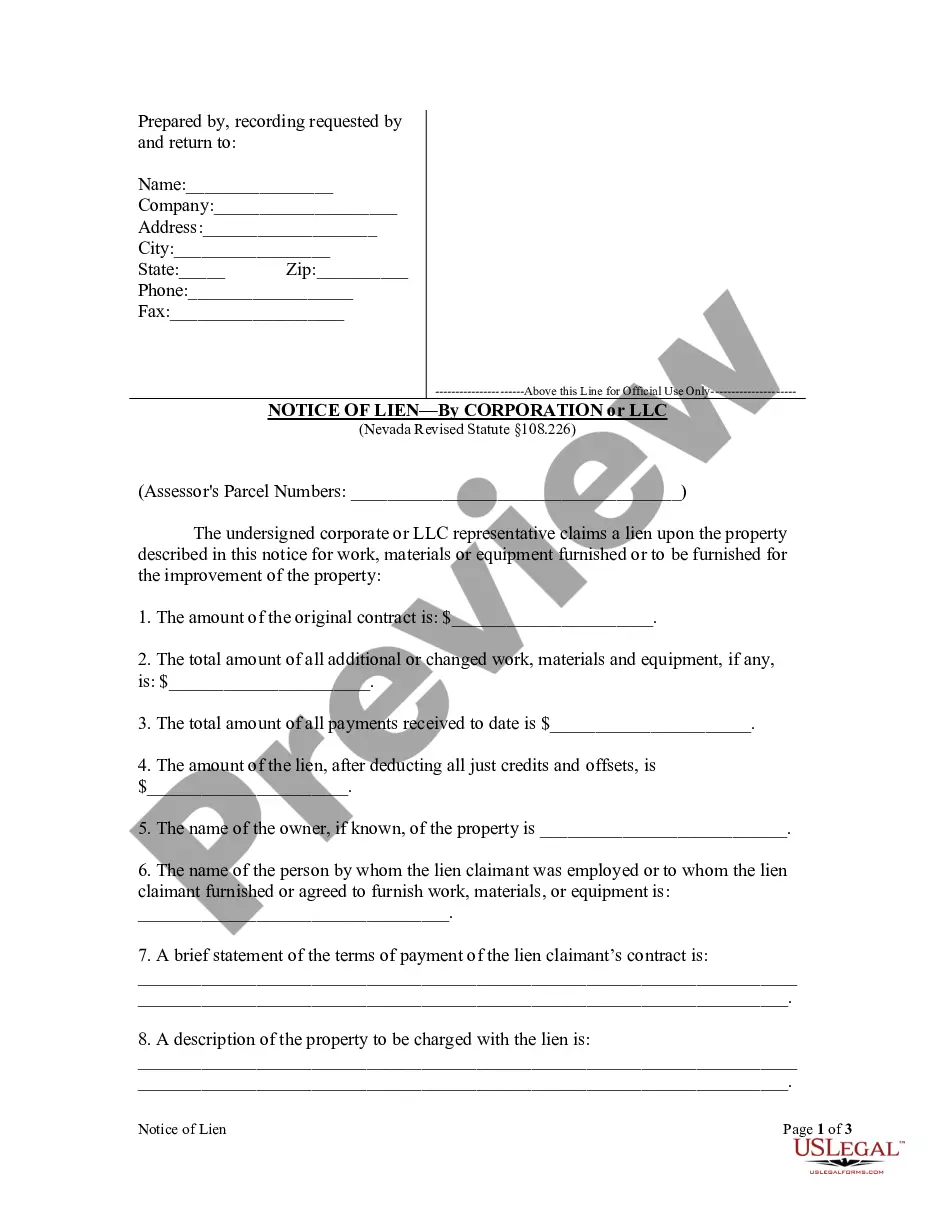

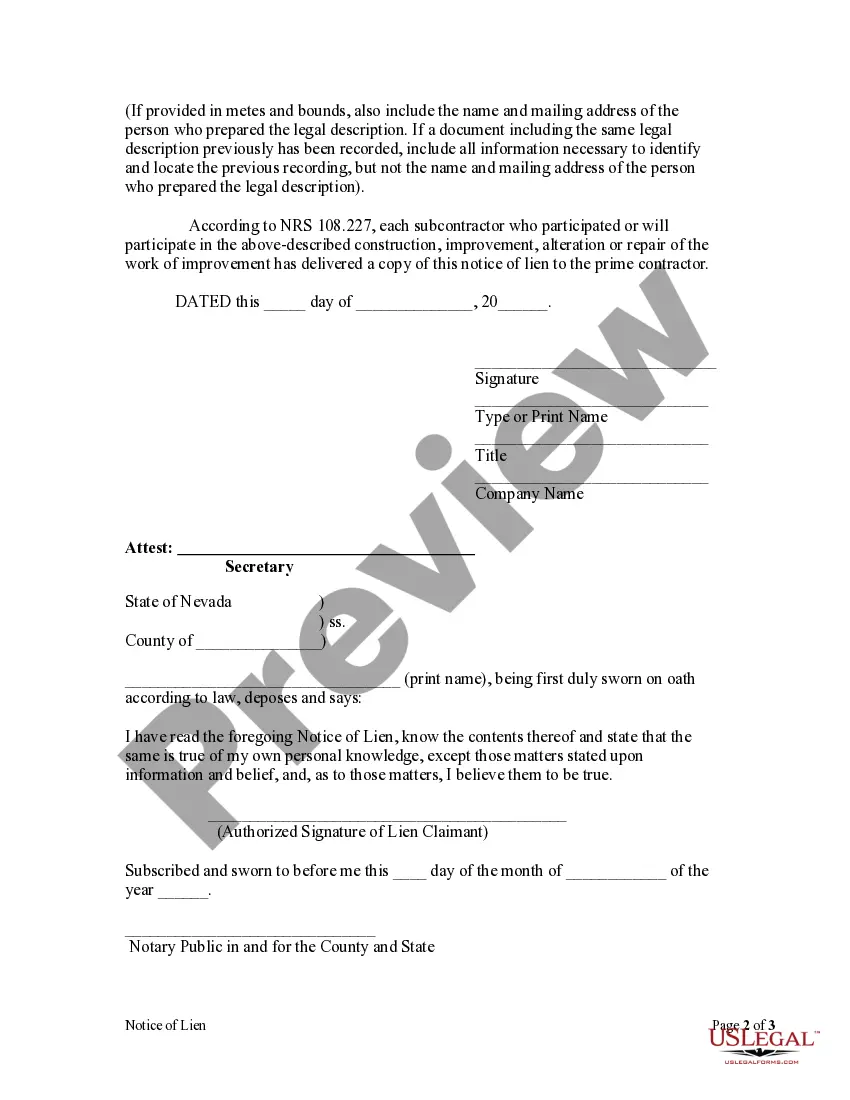

A lien is a legal right that a creditor holds against your property until a debt is satisfied. This mechanism ensures that creditors can recoup what they are owed if payments are not made. Understanding liens is critical, and utilizing tools like the Notice lien form withdrawal from uslegalforms can help you navigate the complexities of lien management.

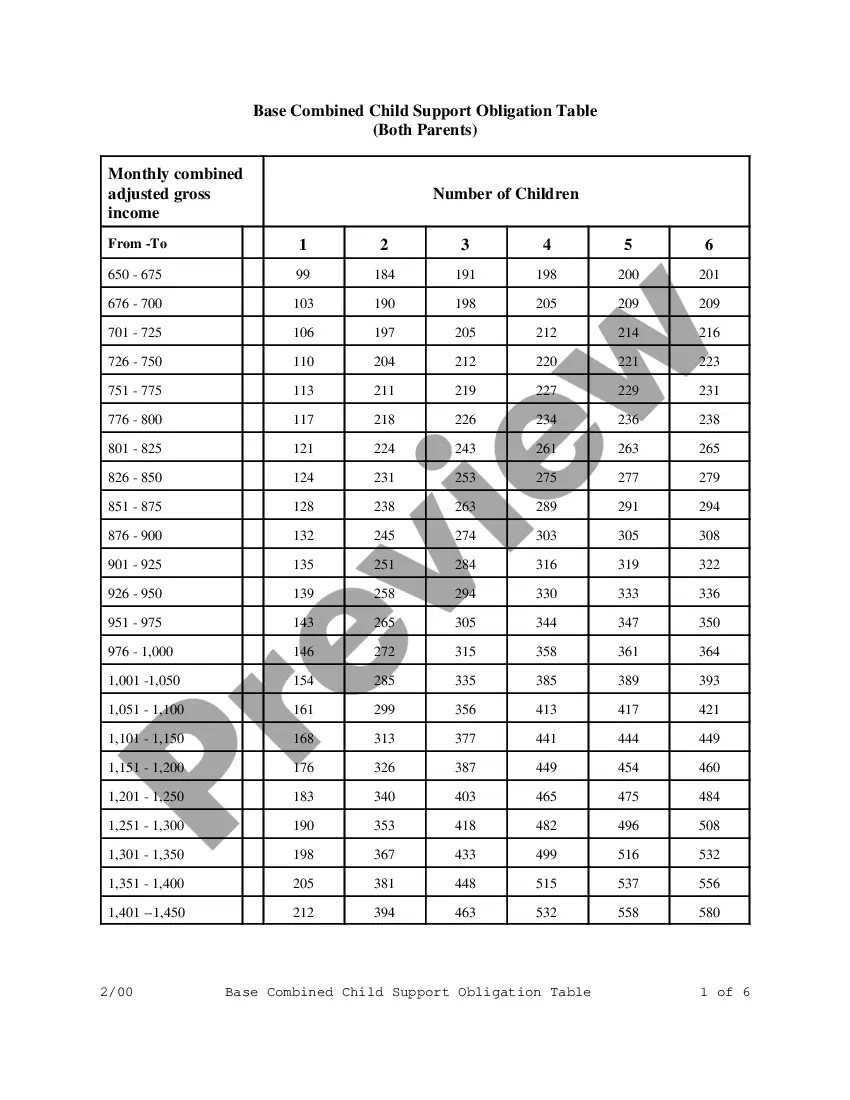

The lien amount refers to the total sum that is claimed by a lienholder against your property. This amount is determined by the debt owed and can affect your ability to sell or refinance your property. Using a Notice lien form withdrawal can help you address lien amount issues effectively, allowing you to resolve disputes promptly.

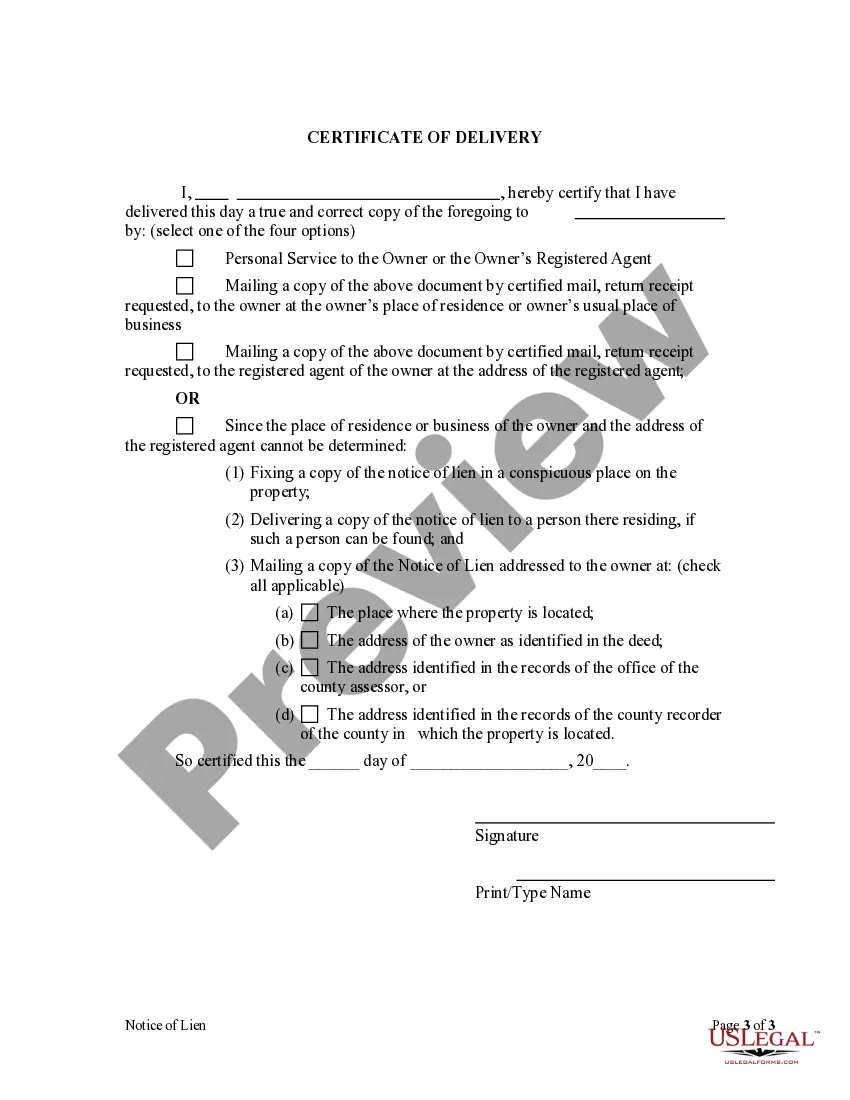

Removing a lien means that the legal hold no longer exists on your property or assets. This action permits the property owner to sell, refinance, or transfer ownership freely. The Notice lien form withdrawal from uslegalforms can streamline the removal process, ensuring that you handle it correctly and efficiently.

Releasing a lien means removing the legal claim that a creditor has on your property. This process allows you to regain full ownership and use of your property without restrictions. To effectively manage this process, consider utilizing a Notice lien form withdrawal provided by uslegalforms, which simplifies the necessary paperwork.

To request a lien removal, you need to submit the Notice lien form withdrawal to the IRS. This form indicates that you are officially seeking to clear the lien from your record. You may consider using the uslegalforms platform to easily access the necessary forms and guidance, ensuring a smooth and efficient request process.

The IRS withdrawal form is specifically designed to handle lien removals. When you complete a Notice lien form withdrawal, you initiate the official process to clear the lien from your records. This step is crucial for restoring your financial reputation and allowing for smoother transactions in the future.

The IRS form refers to various forms required by the Internal Revenue Service to manage tax-related tasks. Specifically, for lien withdrawal, you'll need to fill out the appropriate Notice lien form withdrawal. This form identifies your desire to withdraw a lien and ensures proper handling by the IRS.

Electronic withdrawal allows you to submit your request for lien removal digitally. This method is often faster and more convenient compared to traditional paper submissions. By using a Notice lien form withdrawal electronically, you can expedite the process and receive confirmation from the IRS efficiently.

The tax form for early withdrawal depends on the specific type of account you are withdrawing from. Generally, you may need to complete a Notice lien form withdrawal if the withdrawal affects your tax lien status. This ensures that the IRS acknowledges the changes in your tax liabilities.

A lien withdrawal is the process of removing a tax lien from your property or assets. Essentially, it indicates that you have settled your tax obligations and the IRS no longer has a claim over your property. Completing the Notice lien form withdrawal is essential to ensure that your records are updated and your credit score is improved.