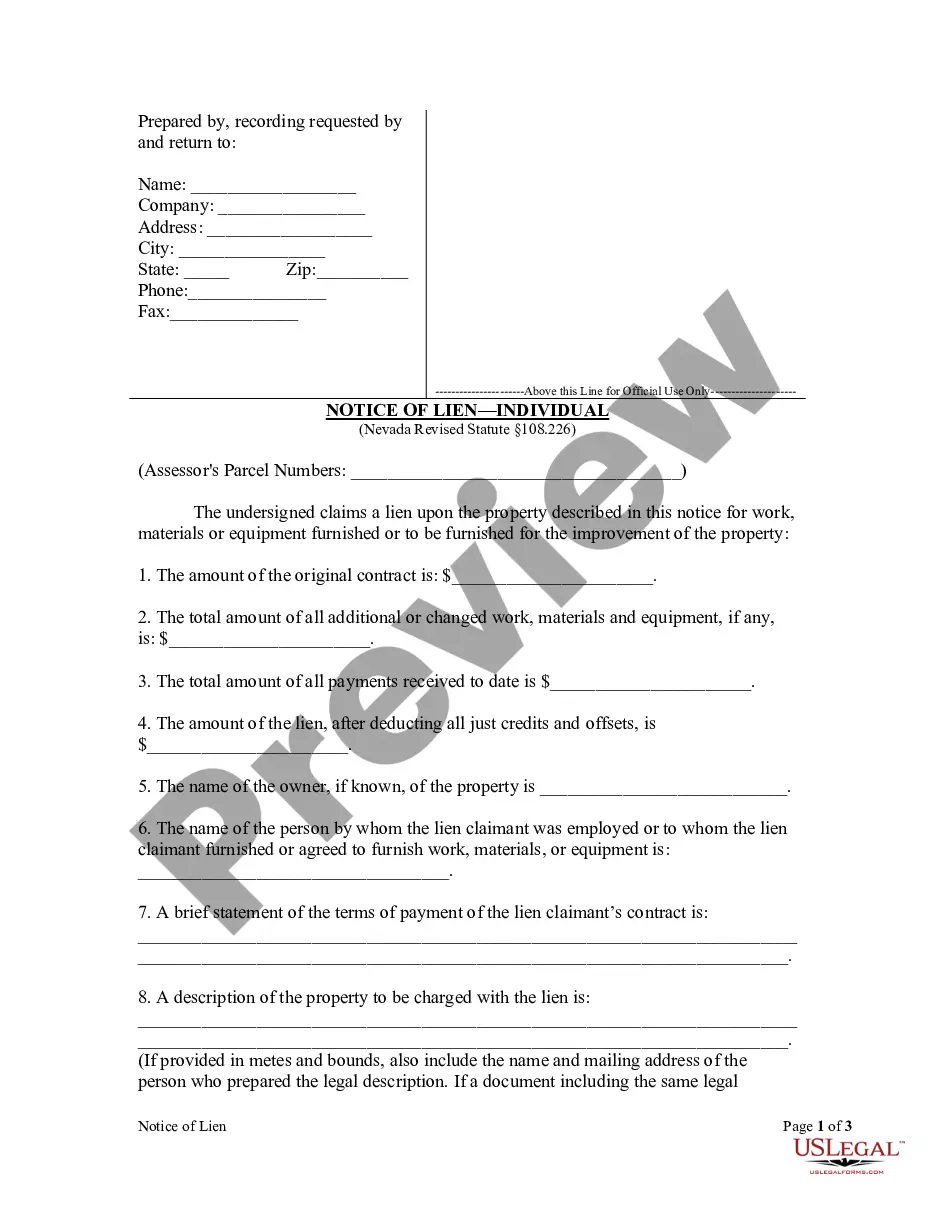

Notice of Lien - Individual

Note: This summary is not intended to be an all inclusive

discussion of Nevada's construction lien laws, but does include basic

and other provisions.

Who may file a lien?

Nevada law permits any person or corporation

who performs labor or furnishes material in excess of $500 value for most

types of construction projects to claim a lien on the property being improved

for the value of the labor or materials supplied. NRS 108.222.

How long does a party have to file a lien?

To claim a lien on improved property a

Notice of Lien form must be filed in the office of the county recorder

in the county where the property is being improved. The time limit

within which a Notice of Lien may be filed is, within ninety (90) days

after the completion of work, or within ninety (90) days of the last delivery

of materials by the claimant, or within ninety (90) days after the last

performance of labor by the lien claimant, whichever is later. NRS

108.226. In addition, a filed Notice of Lien must be served upon

the property owner within thirty (30) days of recording by personal delivery

or service at the owner's residence or place of business. NRS

108.227.

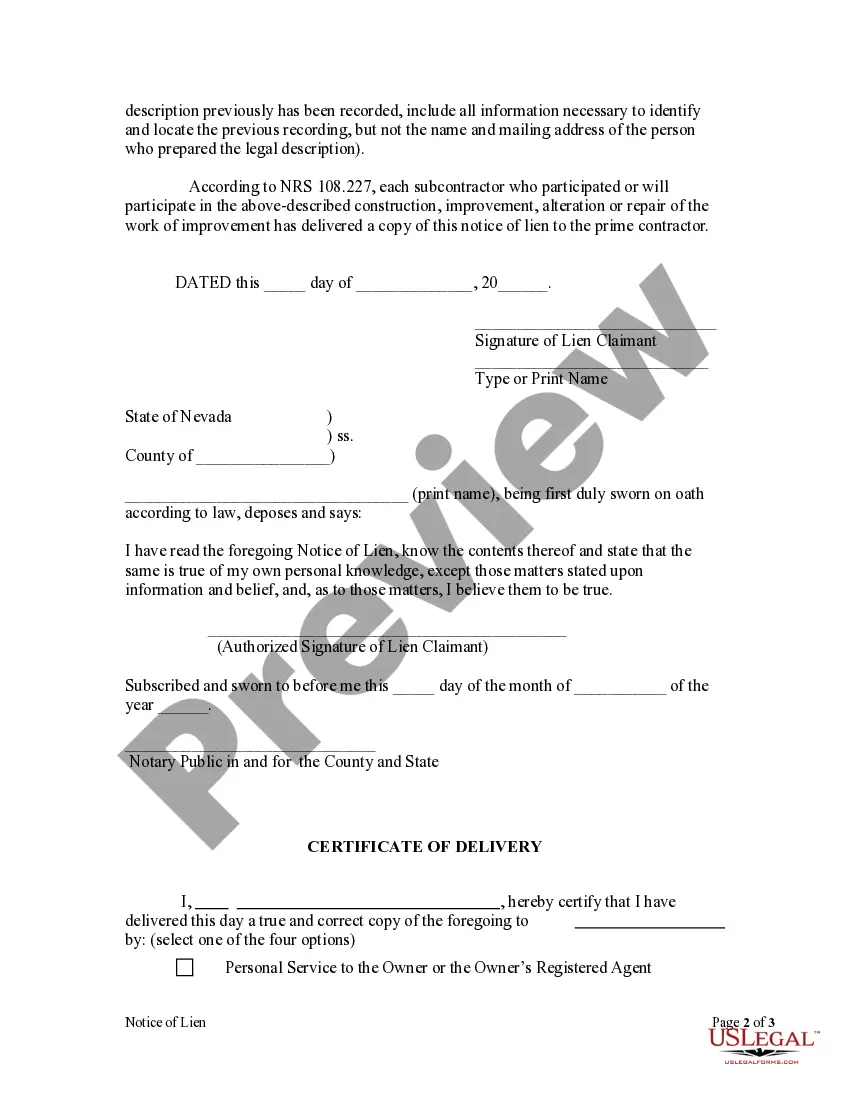

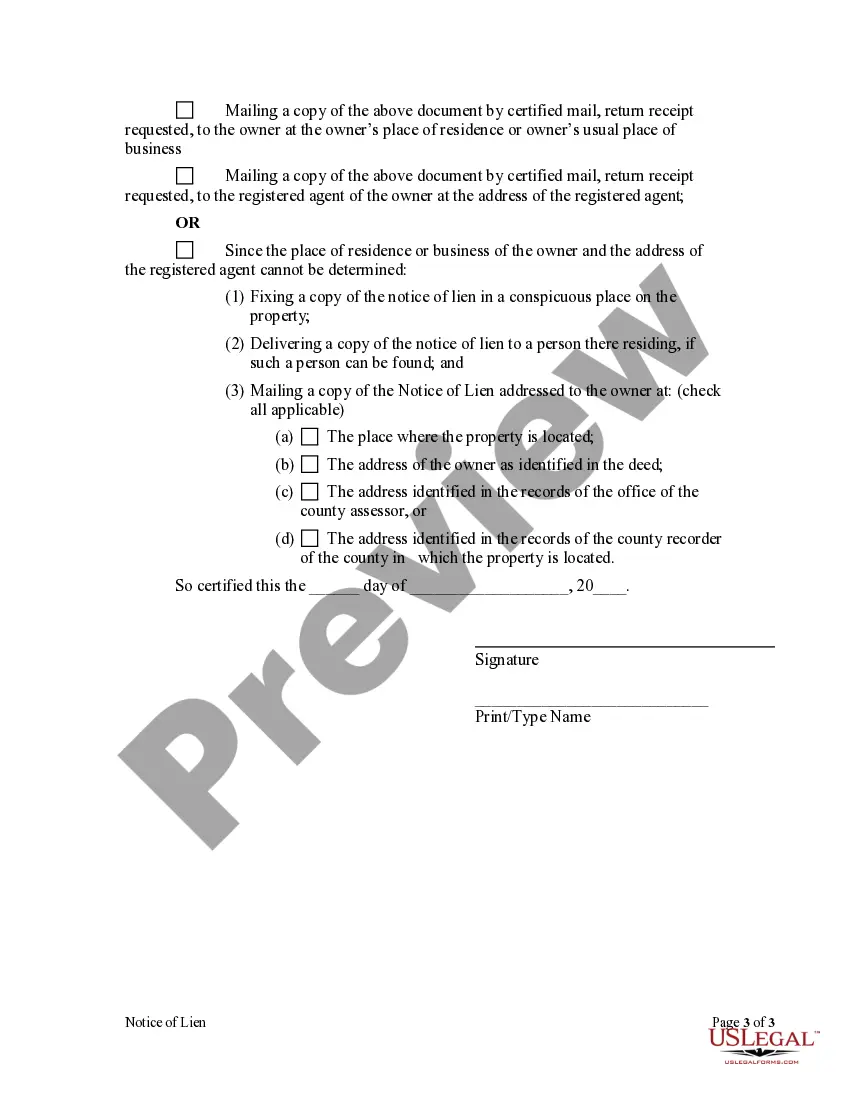

A lien claimant must wait thirty (30) days after

the filing of a Notice of Lien prior to bringing suit to enforce the lien.

NRS 108.244.

What is a Notice of Completion?

Nevada law permits a property owner to file with

the county recorder a Notice of Completion when improvements are complete

or work has ceased for more than thirty (30) days. This notice

serves to put parties who may have performed labor or provided materials

on notice that the time within which to file a lien notice has commenced

to run. The owner must provide a copy of the Notice of Completion

to the general contractor, or any party who requested a copy of the notice

prior to the notice being recorded, within ten (10) days of the notice

being recorded. NRS 108.228

How long is a lien effective?

A lien on improved property is only binding on

the property for six months from the date of filing, unless a suit is filed

during that six month period. Otherwise, a lien may be extended by

filing a written Notice of Extension with the county recorder. A

Notice of Extension may never extend the duration of a lien for longer

than one year from the date of filing of the original Notice of Lien.

NRS 108.233

What is a Notice of Non-Responsibility?

It is presumed by Nevada law that a person making

improvements to property does so for the benefit of the property owner

and that the party providing labor or materials should have a lien for

those improvements. However, if a property owner or person with an

interest in property learns that improvements are being made to which the

owner or interested party does not feel he should be held responsible,

he may file a Notice of Non-Responsibility with the county recorder within

three days of learning of the improvements. A Notice of Non-Responsibility

properly filed will prevent the recording of a valid lien. NRS 108.234.

How may a lien be released?

A properly filed lien may be released by the

posting of a surety bond in the amount of 150% of the lien amount.

Nevada statutes provide the form with which a property owner or other interested

party may obtain a surety bond. After obtaining the bond, a petiton

may be filed with the District Court requesting the release of the lien

pursuant to bond. NRS-108.2413-2417.

A lien may also be discharged by the owner or

another party in interest by payment in full of the lien amount.

Within ten days of the satisfaction of the lien, the lien holder shall file

a Notice of Discharge of Lien with the county recorder. Failure to

file a Notice of Discharge within ten days of satisfaction will result

in the lien holder becoming liable in a civil action to the property owner

in the amount of $100 plus attorney's fees or any actual damages suffered

by the owner as a result of the delay or refusal to release the lien.

NRS 108.2437.

What is a Notice of Materials Supplied or Work Performed?

Any subcontractor who provides material or labor

for the improvement of property may put the property owner on notice of

the value of the materials or labor provided by delivering to the property

owner a Notice of Materials Supplied or Work Performed within thirty-one

(31) days after the first delivery of materials or work performed.