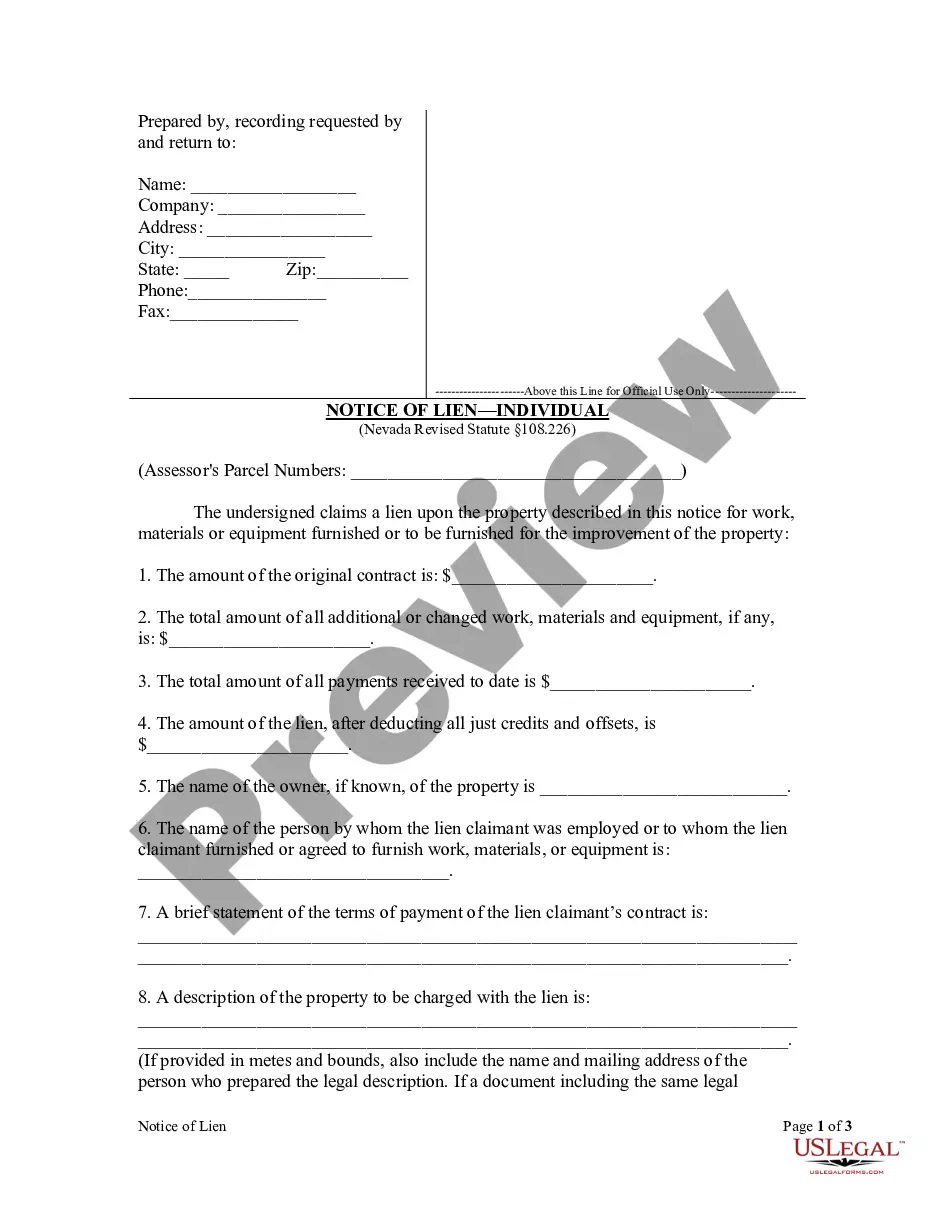

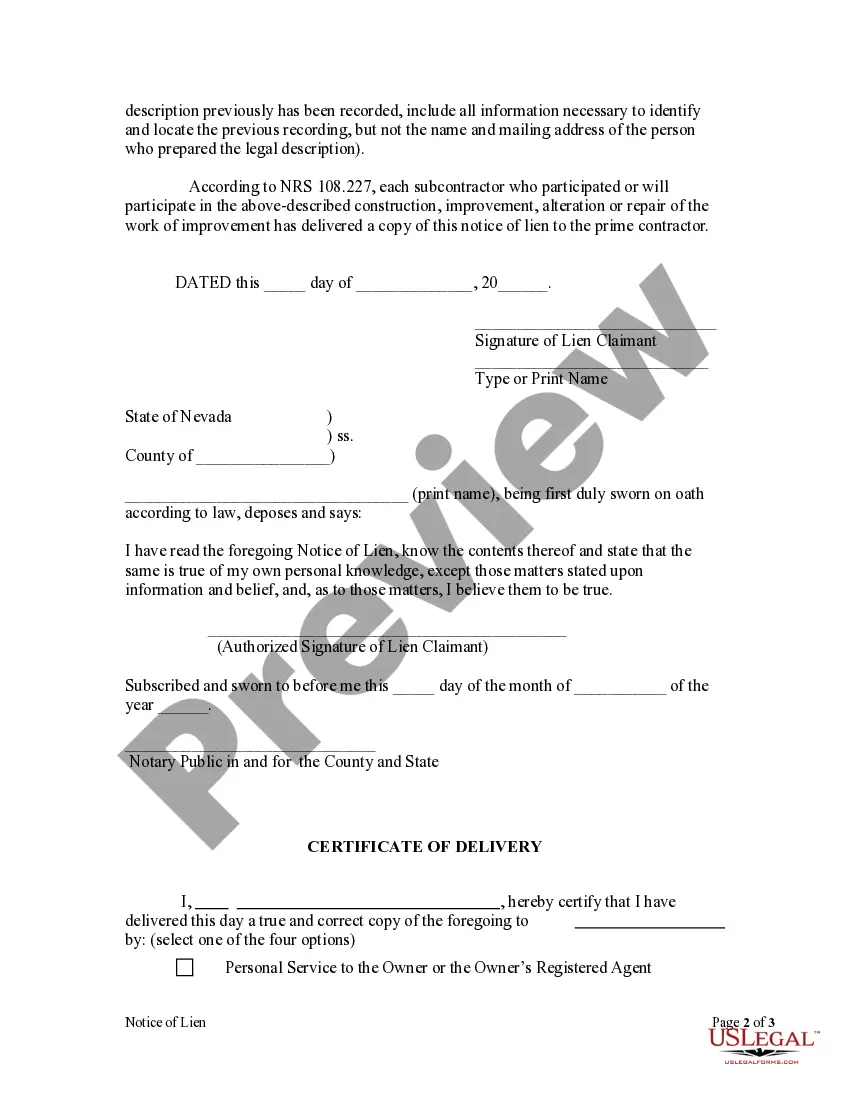

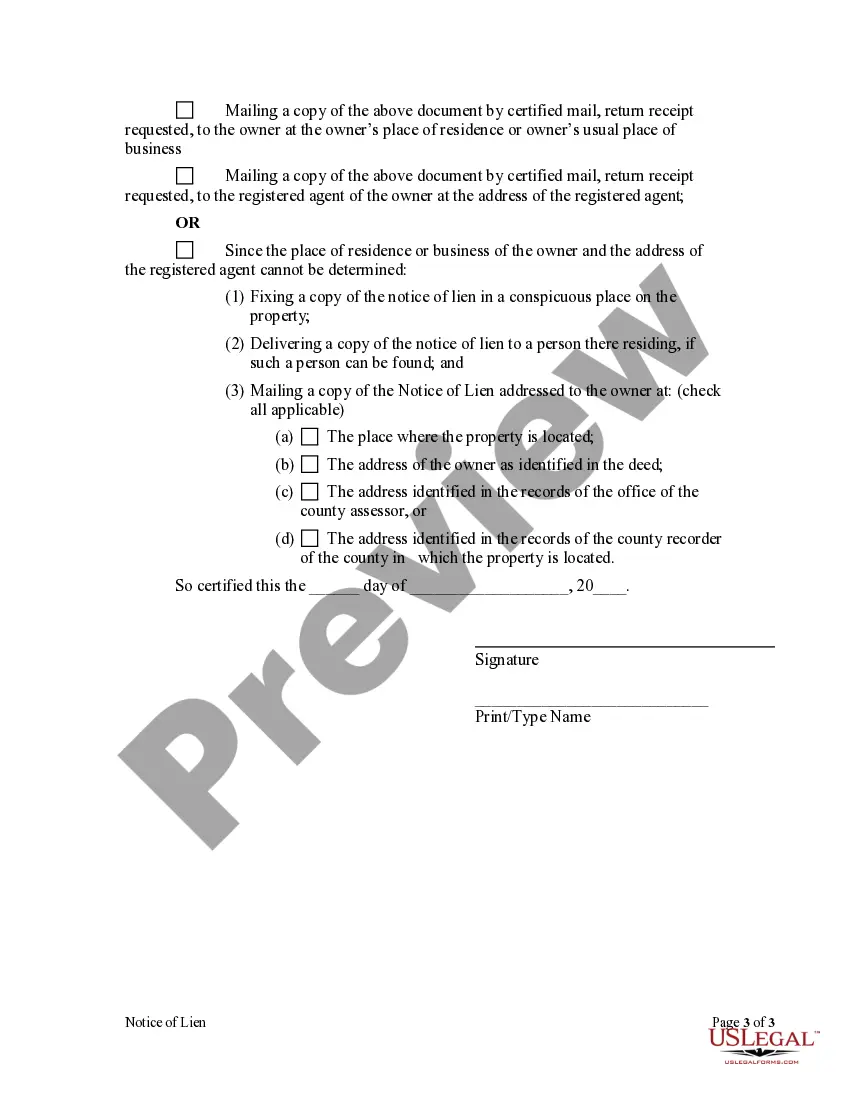

This notice, properly filed, serves to put all parties with an interest in a piece of property that has been improved on notice that the lien claimant has a claim for the value of labor or materials expended in the improvement.

Lien Notice Property For Debt

Description

Form popularity

FAQ

A lien can be placed on your property without your knowledge through court actions, unpaid debts, or judgments against you. Creditors may file a lien with local authorities after obtaining a judgment in their favor. This can happen without prior notice depending on the circumstances of the debt. To stay informed and protect your interests, regularly check property records in your area and consider using tools provided by US Legal Forms to stay updated on any lien notice property for debt affecting you.

To fill out a notice of lien, you must first gather the necessary information, including the name of the debtor, the amount owed, and a description of the property. Ensure that you accurately complete each section of the form, as inaccuracies can lead to legal complications or delays. Once filled out, you should sign and date the document before filing it with the appropriate local government office. Utilizing the US Legal Forms platform can help simplify this process, offering templates and guidance for your lien notice property for debt.

A letter of lien is a formal document that notifies a property owner of the existence of a lien against their property. This letter is often issued by a lender or creditor to assert their legal claim on the property due to unpaid debts. Understanding this letter can clarify your rights and obligations, especially regarding lien notice property for debt.

The most important lien is arguably the mortgage lien. This lien represents a significant financial commitment and affects the homeowner's ability to sell or refinance the property. Failing to address this lien can have serious consequences, including foreclosure. Exploring lien notice property for debt can provide critical insights into managing mortgage obligations.

The most common lien on personal property is a security interest lien, often utilized in securing personal loans. Lenders may place a lien on assets like vehicles or equipment to guarantee repayment. If the borrower defaults, the lender has the right to seize the asset. It's wise to consider how lien notice property for debt impacts personal asset ownership.

The property lien with the highest priority is typically a tax lien. This lien arises when property taxes go unpaid, and it takes precedence over other types of liens. The government can enforce this lien to recover owed taxes, which can result in property loss. Being aware of lien notice property for debt can help you manage your financial obligations effectively.